Good Morning, The market continues to slowly move in the right direction. It’s hard to tell with the high level of volatility but if you look closely it’s there. We said two years ago that as we approached a 2% rate of inflation things would return to normal. No we’re no there yet! All I can say about that is that we are starting to get a little closer. As I said, we are moving in the right direction. Prices continue to fluctuate as each piece of news is evaluated for it’s influence of Fed policy. Will it convince them to increase rates further or will they stop their policy of increases and if they do how long will it be before they start to cut rates? It’s really quite simple. The higher the rates are the more confusion each piece of news will cause and as you all know the market doesn’t like confusion. They only folks that like confusion are the high speed algorithm traders. This is how they make their money. Each time the market sells off investors have to ask themselves if this is the fake out before the breakout. Add this additional confusion to the unwinding of Federal stimulus on top of the rate of inflation and you have the current market. I find if extremely uncomfortable! So far this environment has clearly favored the buy and holders, but one thing is for sure that hasn’t always been the case nor will it be into the future. Nevertheless, it is working now. So when will it not work? When will it not outperform? When all remnants of Federal stimulus are erased from this market. The stimulus may have saved us in the eyes of many, but it is directly responsible for the majority of the current volatility. It makes the market hard to read. It makes trends harder to follow. So the only thing some folks can do is buy and hold and take what the market gives you. That’s the safe thing to do right? We will agree to disagree and those of you who have been with this group for any extended period of time know it. How much would you have now had you not managed your account over the years? 100, 200, 300%$ less???? It pays to actively manage your accounts. As I have said and said and said we are so far ahead of where we would have been that we where able to easily weather this storm. To that , we will keep managing our accounts. This market is starting to come back to us, slow but sure. One more thing on this subject. To those who continue to call us market timers. If that’s what y0u think we are then you have no understanding of investment. I Seriously do not mean to insult you but you simply do not know the difference between timing the market and following the trend. If you think that we are timing the market because we have moved our money several times during this period of quantitative tightening then you are truly wasting your time here. We moved our funds in search of an extremely difficult to find trend. We underperformed during this time. We have discussed it openly on our Facebook page which is the proper venue for this type of thing. We admitted that we underperformed. We own it! There have been entire years when we have only adjusted our allocation once or twice and that will be the case again when the market returns to normal which as I said above it is slowly starting to do. Now I have one question to ask you? When did the buy and hold folks own their underperformance? My advice as always is to pray and seek God’s guidance and do what He tells you to do. He will tell you what to do if you ask. Don’t listen to this man or any other. Listen to Him and Him alone. Give Him all the praise for He and He alone is worthy!

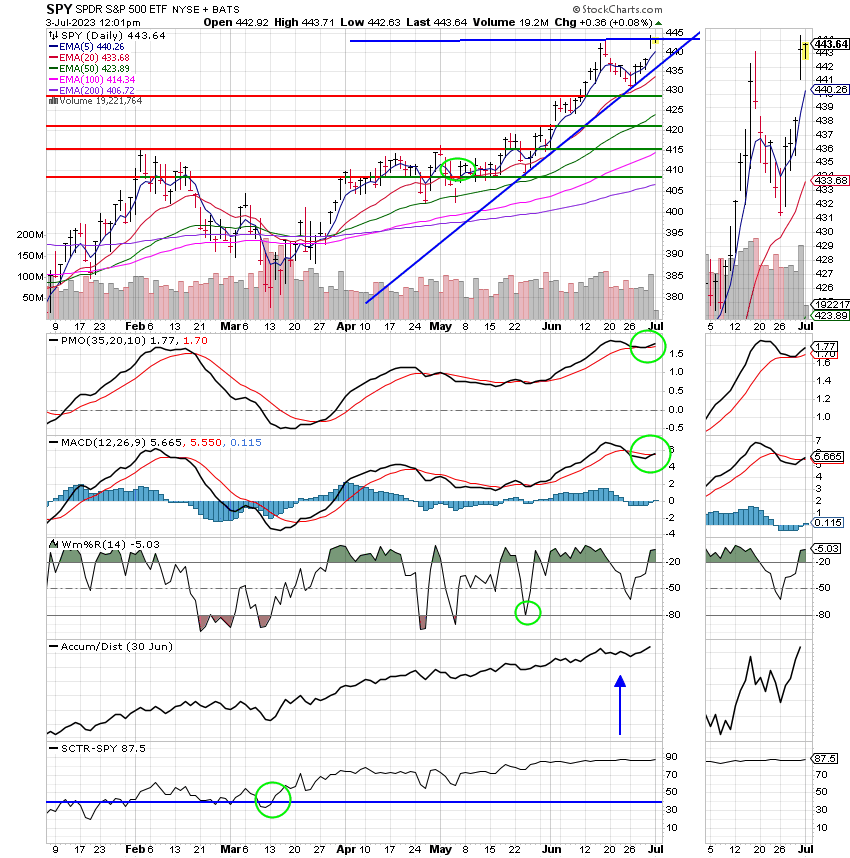

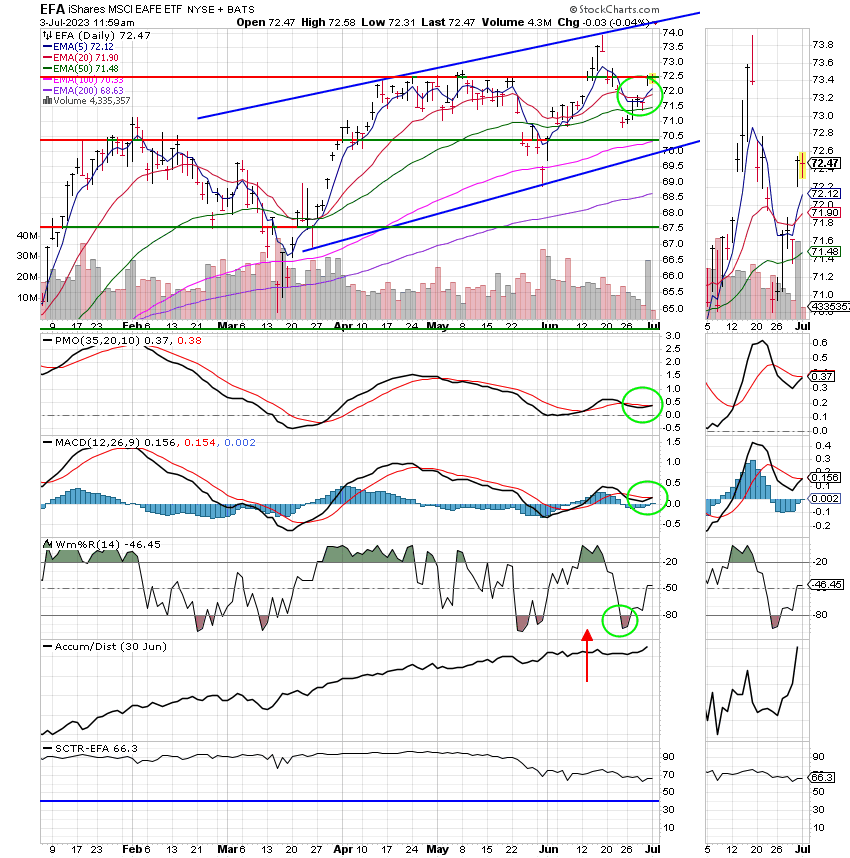

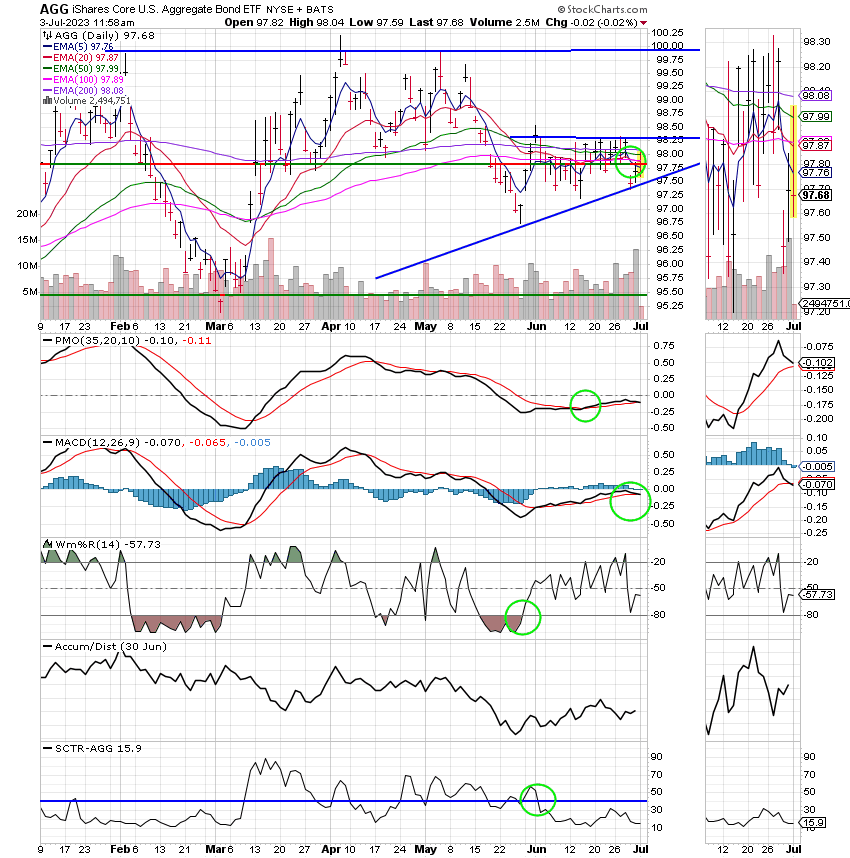

Today is only a half day of trading due to the fourth of July holiday. Thank God, that we still have freedom to celebrate! As you all know we issued an interfund transfer alert for 100% C/Fund. The C Fund has the best chart of our equity based funds. We will watch it closely and if it is overtaken by one of the others we will move. However, it is not our intention to move. Let me be clear about one thing regarding this trade. We do not expect the C Fund to move straight up. I said last week that we were looking for pullback and we still are. We are giving the C Fund a long leash and will not move out when it pulls back unless we detect a change in the long term trend. We had hoped to move into the C after this anticipated pullback but it became necessary to move out of the F Fund when Fed Chairman Jerome Powell unexpectantly stated that the Fed would increase rates two more times in 2023. Those rate increases will cause bond yields to rise and as you know bond yields and bond prices move in opposite directions. When we moved into the F Fund we were in effect betting that the Fed would not increase rates again and we bet wrong. That would have given us at least a short time to remain in the F Fund before we moved into the C Fund which we had hoped would be after a pullback. Nevertheless, that was not the case. So we moved on into the C Fund in search of the new trend.

Todays market data continues to suggest that the Fed will not raise rates as they said. The ISM’s manufacturing purchasing managers’ index for June came in slightly worse than expected. June’s reading was once again below 50, signaling that economic activity was declining. Later in the week, investors will be following data on the job market. This report (as many others have recently) suggests that inflation will continue to slow. So why then did the Fed say they will increase rates??? Their statement increased the confusion that I was talking about above. This is exactly what I was talking about!! It definitely created a strong headwind for bonds and that is why we abruptly moved out of the F Fund. Whether, the Fed actually goes through with those rate increases or not is irrelevant. Their statement caused bonds to sell off which resulted in our move. We were forced to take the Fed at their word whether we really believed it or not!! This type of fluidity is what has made it so hard to follow the trend since the beginning of 2022. Actually, there has been no sustained trend! This is an excellent example of what we have dealt with, but as I said, it is coming to an end. Will these buy and holders admit their underperformance when it comes? I doubt it seriously. Hang in there folks, our day is coming if it is not already here!

The days trading is generating the following results: Our TSP allocation is currently flat at +0.04%. For comparison, the Dow is adding +0.11%, the Nasdaq is off -0.04%, and the S&P 500 is holding on to a slight gain at +0.04%.

S&P 500 is little changed in shortened session to kick off the second half: Live updates

Today’s action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Buy. We are now invested at 100/C. Our allocation is now -2.53% for the year not including the days results. Here are the latest posted results:

| 06/30/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.5651 | 18.6172 | 68.8445 | 69.3086 | 38.0681 |

| $ Change | 0.0019 | 0.0561 | 0.8369 | 0.4541 | 0.4353 |

| % Change day | +0.01% | +0.30% | +1.23% | +0.66% | +1.16% |

| % Change week | +0.07% | -0.27% | +2.36% | +3.87% | +1.97% |

| % Change month | +0.32% | -0.36% | +6.61% | +8.31% | +4.57% |

| % Change year | +1.91% | +2.25% | +16.88% | +12.64% | +12.16% |