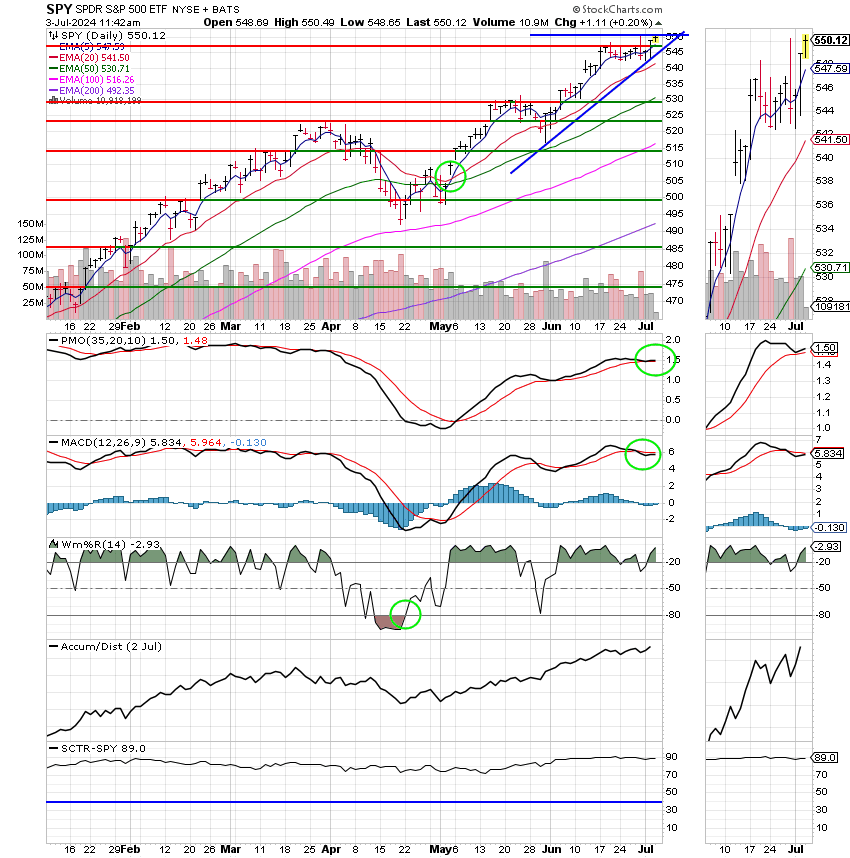

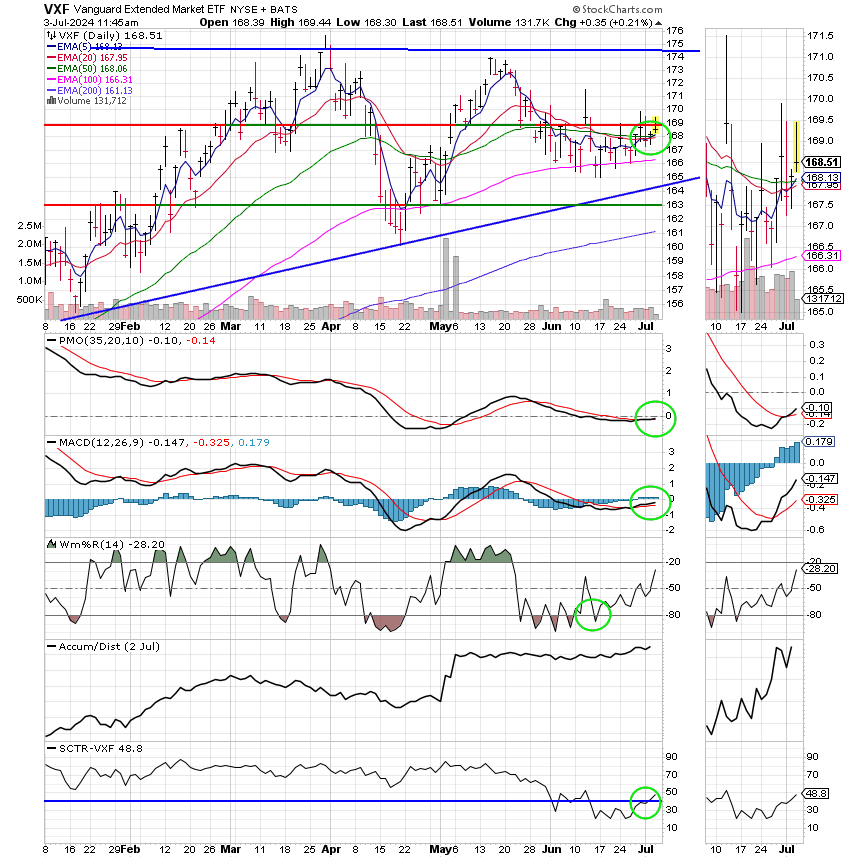

Good Day, No. I’m not on vacation. I’ve been dealing with my 91 year old mother. Those of you who have experienced this will understand and those of you who have not will not. God’s word says to Honor your mother and father so that your days will be long upon the earth and if God’s word says it then we try our best to do it around here. So my presence on Facebook has been a little less. Other than that I’m still managing everything the same way I always do. With regard to Facebook, I’ve noticed the discussion remains fixated on the C Fund which I can understand that. On the surface it’s okay. On the surface it continues to make money. All is well right?? Some of the recent criticism has had to do with how we are in the G Fund and how our charts aren’t any good. All I can say is that those folks obviously haven’t read a thing here. Our indicators told us to stay in the C fund. We never had a sell signal. I repeat, we never had a sell signal! So if you go on social media and say we did I can only assume it’s for nefarious reasons. So go back to whatever Facebook Group or service you came from. There is nothing for you here. We are not interested in competition. We are not interested in making the greatest return everyday, but then again if you’d been with us throughout the years you would already know that. Our focus is on keeping what we make. Our focus is on preparing for a successful retirement. Our focus is not or never will be on having the best return every day of every month. Our focus is on having the best return over a twenty year career. We did that for the last twenty and we’ll do it for the next. Most of all, our focus is on our Lord and Savoir Jesus Christ who came to this earth that we might have life and life abundant. We believe that it’s all His to give and to take….. So if you don’t like our returns or our faith then go to another service where you will be more comfortable. Enough said! So I will repeat this one more time for those of you who want to know. I got out of equities for fundamental reasons. Not because of the charts! Investment 101 says that if the breadth is poor then the risk is high. What do I mean? There are a handful of stocks such as Microsoft (MSFT) and Nvidia (NVDA) that are propping up the entire market. They continue to make gains based on their involvement in Artificial Intelligence commonly referred to as AI. There is no doubt that AI will revolutionize the world over the coming decade. Although I’m not so sure it is an altogether a positive thing. You can read the book of revelations in Bible for my concerns there….. Anyway, secularly speaking it is currently a very good investment. There is money to be made. However, as I already mentioned there are a handful of megacap stocks that are propping up the entire market. Apple, Microsoft, Alphabet, and Nvidia make up something like 30% if the weight of the S&P 500. So when they have a goo0d day it’s a good day and they’ve been having good days all of 2024 so far. Which brings us to breadth. Currently, for every stock that is trading above their 50 day m0ving average there are two that are not, which means simply that two thirds of the market is not participating in this uptrend. So what happens when these megacap tech stocks take a rest or pull back? I’ve been doing this for thirty years and I’ve never seen anything go straight up forever. Not even the mighty Apple! By investing in the C Fund your betting on a small group of horses to win every race and if you’ve ever been to Churchill Downs you will know that is not a wise strategy when placing bets. The risk is much higher because you are betting on a concentrated group of stocks against the whole field. Folks, I manage risk with my investments and I’m not comfortable with those odds. So I’m out until more of the market participates in this rally. Fundamentals say this market will pull back and while the advent of robinhood and computer trading has changed the market significantly in recent years they haven’t changed it that much. So let me get this straight. Let me be perfectly clear. Until more stocks participate in this rally I am out! That said, the S Fund is inching closer and closer to a buy signal. By the matter of fact one could come even as early as today, but remember one thing, close is not a buy signal and until you have one you don’t. So keep a close eye on your charts because the market is ever evolving in this environment. Fundamentally speaking we had the ADP private payrolls report today. According to CNBC private payrolls increased by 150,000 in June, less than forecast and the lowest total since January, according to an ADP report Wednesday. The total was less than the 160,000 Dow Jones estimate and below the upwardly revised 157,000 from May. Leisure and hospitality led with 63,000 jobs, followed by construction and professional and business services. Also, wage growth slowed to a 4.9% pace from a year ago, the smallest increase since August 2021. Next we had Jobless claims which rose with continuing claims coming in the highest since November 2021. Initial claims for unemployment insurance edged higher for the week ending June 29, the Labor Department reported Wednesday. First-time filings totaled 238,000 for the period, up 4,000 from the previous week and higher than the Dow Jones estimate for 233,000. On continuing claims, which run a week behind, the total of 1.858 million represented an increase of 26,000 and was the highest total since Nov. 27, 2021. Then on Friday we have the all important June Jobs report. In the end it will be what ultimately moves the market one way or the other in the short term. So stay tuned!! By the matter of fact. I just checked the charts and we have a fresh buy signal in the S fund. If this signal does not repaint, we will enter an interfund transfer for 100/S this afternoon!

The days trading has left us with the following results so far. Our TSP allotment is steady in the G Fund. For comparison, the Dow is currently off by -0.21%, The Nasdaq is higher by +0.42%, and the S&P 500 is setting another record at +0.23%.

S&P 500 inches higher as investors shake off weak data in shortened session: Live updates

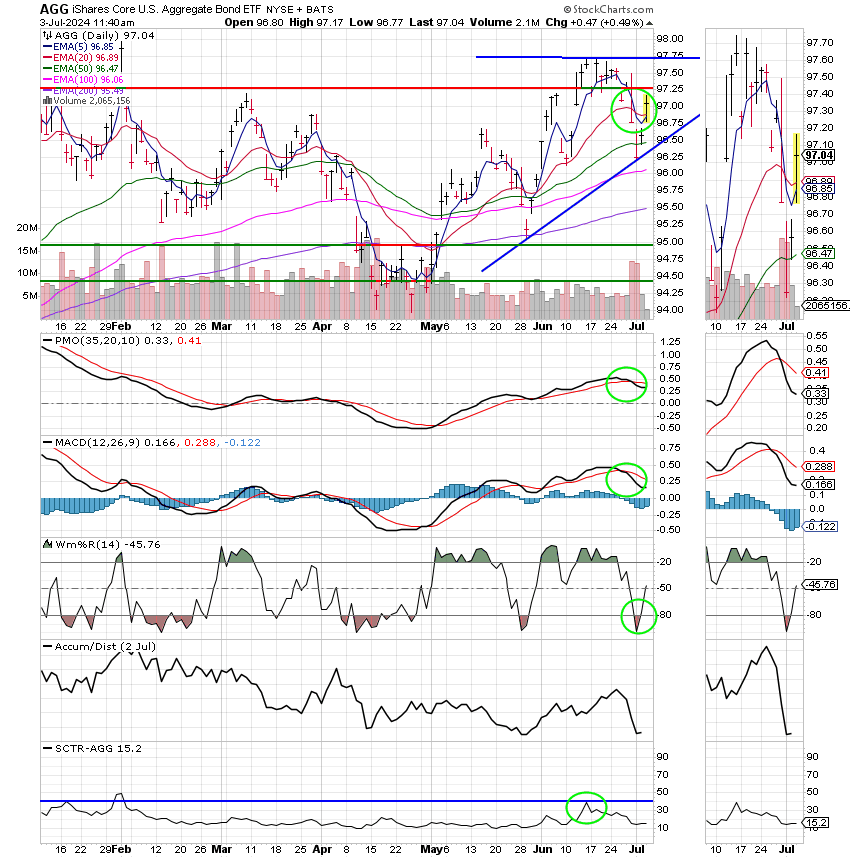

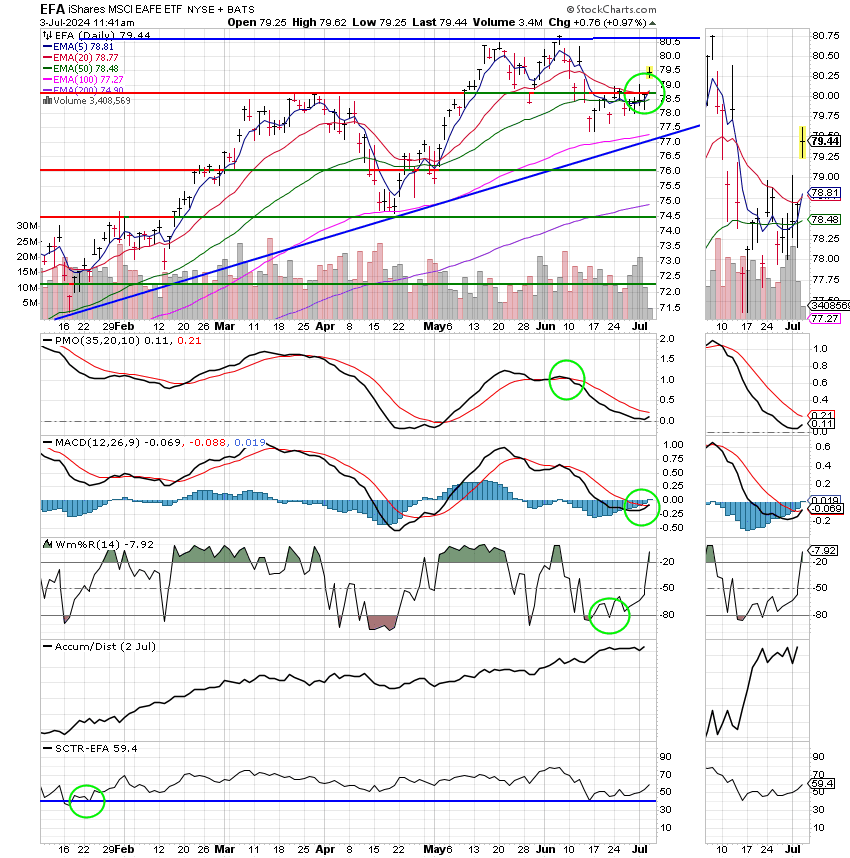

The days trading left us with the following signals: C-Buy, S-Buy, I-Hold, F-Hold. We are currently invested at 100/G but will be entering an interfund transfer for 100/S this afternoon. Our allocation is currently +5.64% for the year not including the days results. Here are the latest posted results:

| 07/02/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.3648 | 19.0498 | 86.4898 | 79.3226 | 42.7865 |

| $ Change | 0.0023 | 0.0601 | 0.5330 | 0.1983 | 0.1213 |

| % Change day | +0.01% | +0.32% | +0.62% | +0.25% | +0.28% |

| % Change week | +0.03% | -0.27% | +0.89% | -0.38% | +0.60% |

| % Change month | +0.03% | -0.27% | +0.89% | -0.38% | +0.60% |

| % Change year | +2.24% | -0.90% | +16.31% | +2.89% | +6.48% |