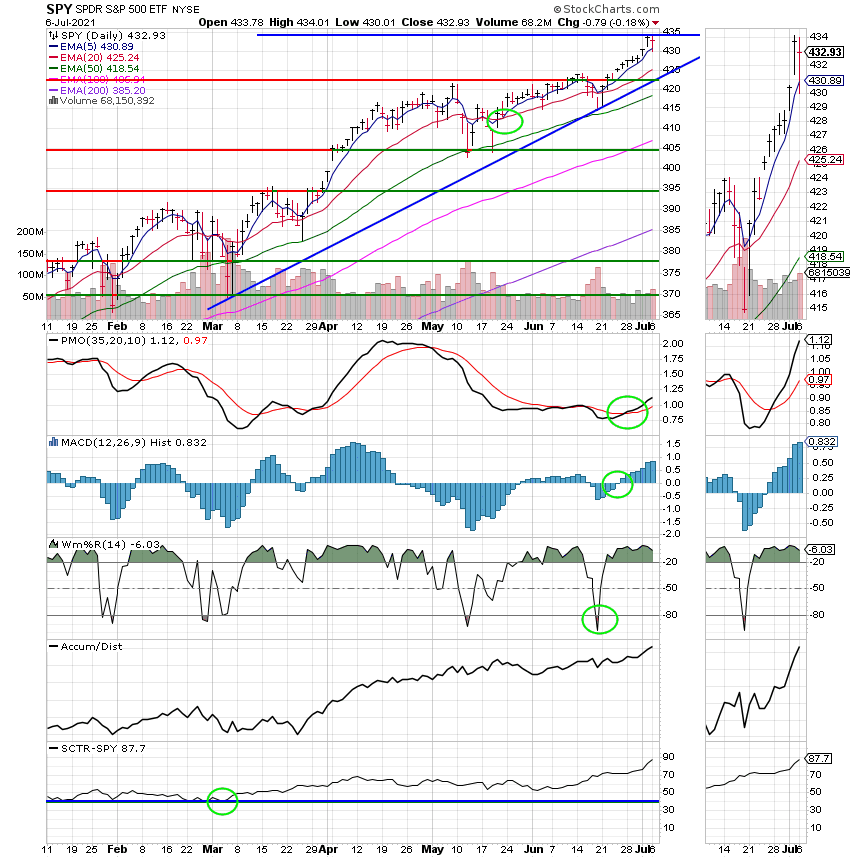

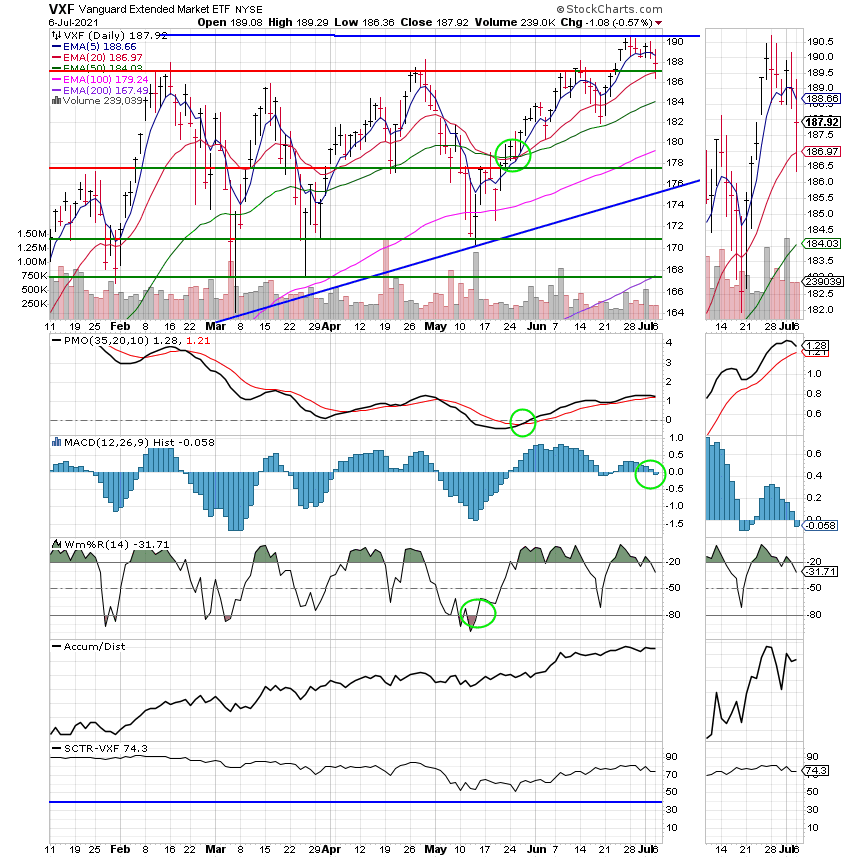

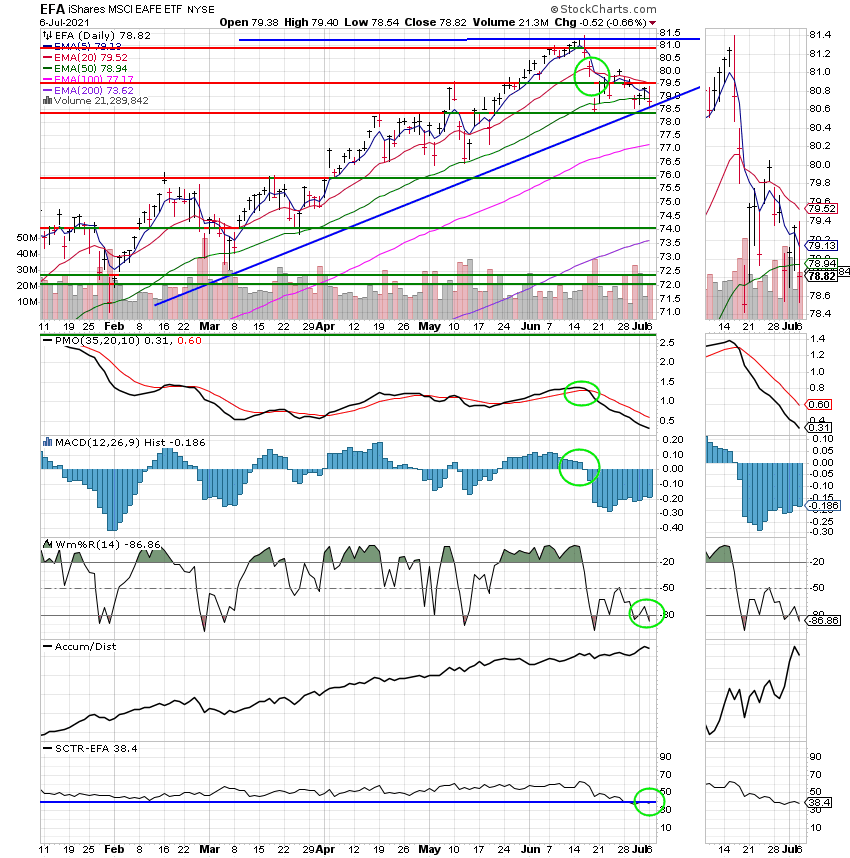

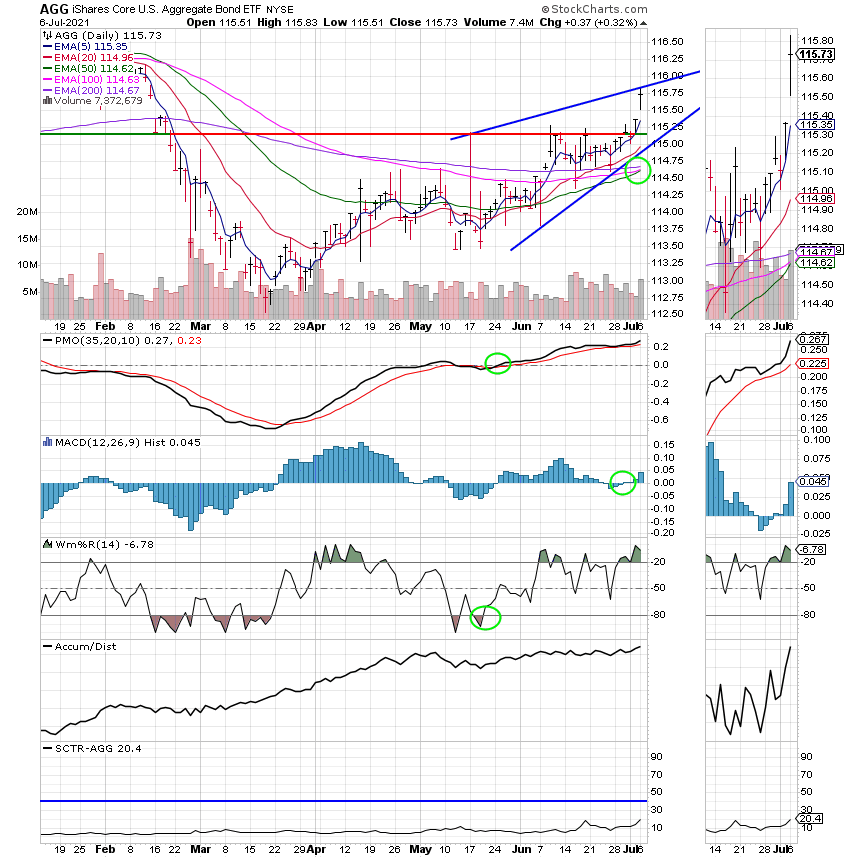

Good Evening, Sometimes things can be too good. Add that to the dog days of summer and you have the current market. The majority of the economic indicators that investors follow are doing so well that they are starting to think that the best part of the recovery is now behind us. “Everything is perfect and that worries me,” said Sarat Sethi, portfolio manager at DCLA, said on CNBC’s “Squawk Box” on Tuesday. “Since October, we’ve had a 5% correction, that’s it. I do think we’re in a little bit of a euphoria short-term. We do need to be careful and I do think you want to be in secular growth companies, not just chasing the market here because I do think the market’s going to be very picky as to what sectors are going to do well.” So the calm before the storm?? I really don’t think so. To me it’s more like a tired market entering the dog days of summer which are always a slow time. That said, given the current attitude I expect the market to be choppy for the rest of the year. I believe there are still gains to be make but that those gains will be harder to come by. That explains why the chart for the C Fund has overtaken the chart for the S Fund. Smaller stocks generally don’t perform as well in a choppy market. Think of investing in the smaller stocks contained in the S Fund as taking a fast elevator up during a market that is in rally mode, but….think of investing in those same stocks as jumping out of the window when you get to the top floor. In other words small and mid cap stocks drop faster when the market is selling off. Stocks that can make a lot can take a lot. So…when the market is choppy there will be a lot more downside than in a market that is moving straight up. Therefore, the the slower moving large cap stocks like the ones that make up the C fund tolerate a rising but choppy market much better than the aforementioned small stocks. Can this change? Can the market environment favor the S Fund once again. Absolutely, that’s the reason we watch the charts in the first place. Not so we will know what the market is going to do but because we don’t know what the market will do. I doubt that many of you thought when we first moved to the S Fund last year that we would gain over 65% before we exited the position. I know I did not. I also know from the many messages that I got that many of you doubted the S Fund and wanted to move to other funds each time the S Fund stumbled. Yet on every occasion for the past nine months that the S Fund failed to perform the way we thought it should our charts told us to hang in there and every time they did the S Fund moved higher and tacked onto it’s gains. That folks is the reason that we listen to our charts and not our hearts. That is also the reason that we issued an interfund transfer effective at the close of business today for 100% C Fund. Should it change again in a week or a month or several months we will change with it because that is what we do and that is how we do it. I must also add that we do everything we do with the guidance of our Heavenly Father who blesses us with all good things…..Give Him all the praise for He is worthy!!

The days trading left us with the following results: Our TSP allotment posted a drop of -0.57%. For comparison, the Dow fell -0.60%, the Nasdaq gained +0.17%, and the S&P 500 slipped -0.20%. We really can’t complain. We’ve had a good run and there’s likely more to go.

The days action left us with the following signals: C-Buy, S-Buy, I-Hold, F-Hold. We are now invested at 100/C. Our allocation is now +15.53% on the year not including the days results. Here are the latest posted results:

| 07/05/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.6167 | 20.9108 | 65.267 | 85.7282 | 38.7447 |

| $ Change | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| % Change day | +0.00% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change week | +0.00% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change month | +0.01% | +0.15% | +1.30% | +0.06% | +0.45% |

| % Change year | +0.66% | -1.35% | +16.73% | +15.53% | +9.48% |