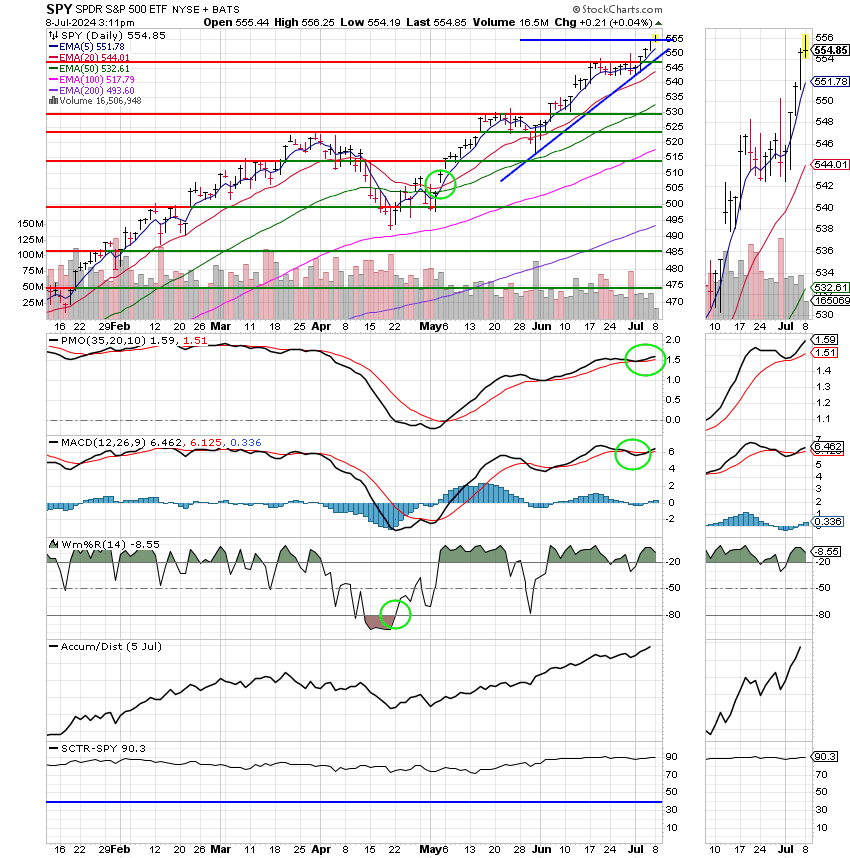

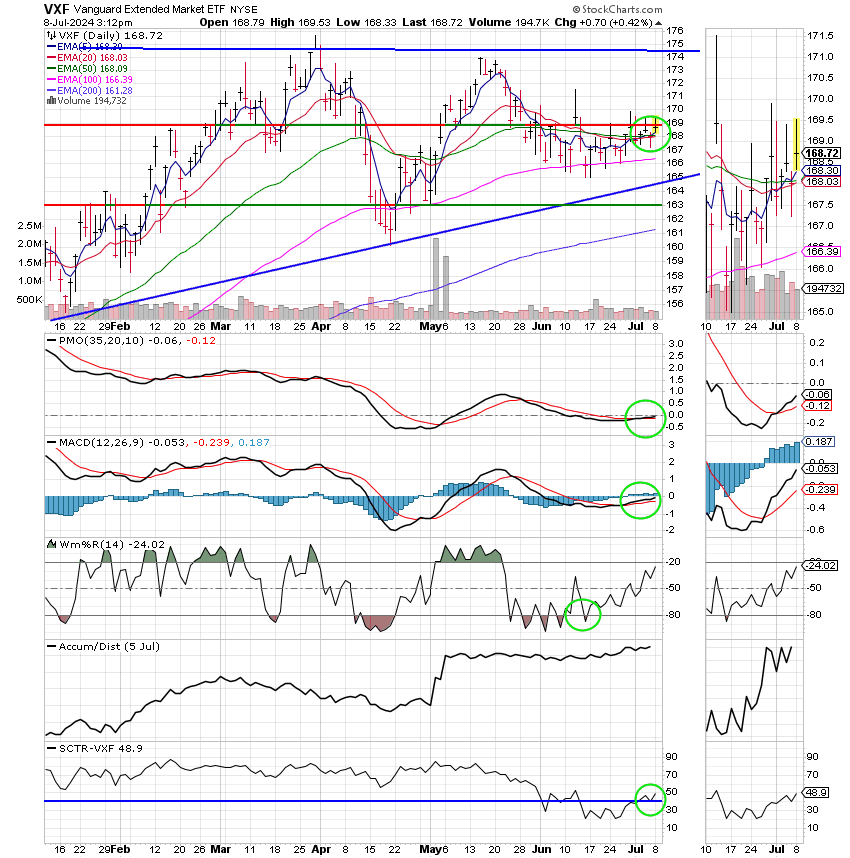

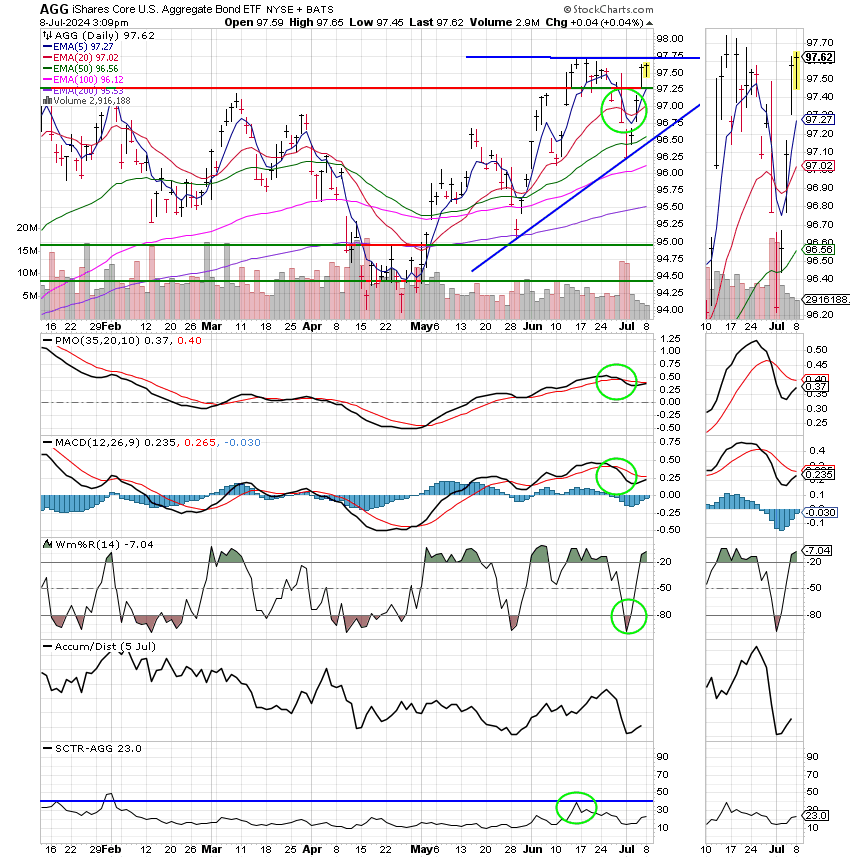

Good Afternoon, Each week we ask ourselves where we are going from here. Most think that the C fund will continue to rise unabated. I am not among them. I think that as a whole the market will move higher from here, but I’m pretty sure it won’t be straight up and will not occur in the same fashion as it did in the beginning of 2024. I have said for several weeks now that this rally cannot continue without the participation of small and mid caps and I am sticking to it. The current out performance of a handful of mega cap stocks has gone farther than I ever envisioned and I realize that I am looking like a stinker for saying this but I don’t care how much the market changes. It can’t continue to rally without the participation of two thirds of stocks. It cannot and it will not! We think that there will be a lot of sector rotation as we move into September. Money will flow back into neglected small and midcap stocks. Large Caps like the ones in the C Fund will also continue to rise but just not at the breakneck pace of the first half of the year. It’s likely that small and midcaps will out perf0rm large cap stocks into the new year. At least that’s what we think. So effective today, we are back in the equity market at 100/S. So far so good. We will see. We have a fresh buy signal in the S Fund and we feel that the Fed will cut rates soon putting some wind at our back. This should ignite the market and especially small caps as interest rates start to fall. Hopefully, the S fund will continue to advance enough that we will be able to ride out the peaks and valleys into the fall without having to change our allocation. There are no guarantees though, so we will not hesitate to sell if the chart for the S Fund tells us to do so. Also, we will not hesitate to roll back into the C Fund should it generate a fresh buy signal and continue to out perform the S Fund as it did in the first half of the year. We fully expect that at some point that capital will indeed start rolling back into Large caps for the simple reason that the AI (Artificial Intelligence) trade is not going away. “We believe the fundamental backdrop remains supportive for equities, driven by solid economic and earnings growth, interest rate cuts, and rising investment in AI,” UBS strategist Vincent Heaney wrote in a Monday note. What Mr. Heaney said are basically my thoughts as well. As interest rates begin to fall equites will rise on solid support. Looking forward this week we have two market moving reports. We have the CPI (consumer price index) on Thursday and the PPI(producer price index) on Friday. We need both reports to come in a little soft to boost the market. That would of course show that inflation is moderating and open the door for the Fed to begin reducing interest rates in September. Should they come in soft they would continue the trend of softening inflation in recent reports paving the way for the Fed to begin cutting. Keep praying! That’s where we could make some really nice gains!!

Todays trading so far has gone our way. Our TSP allocation is currently trading higher at +0.40%. For comparison, the Dow is off slightly at -0.08%, the Nasdaq is in the green at +0.12%, and the S&P 500 is somewhat flat at -0.03%. Now that’s the kind of out performance that we’re looking for. Praise God for that! Keep praying and hopefully we’ll have some more!

S&P 500 hovers near record as traders await inflation data and earnings: Live updates

Recent action has left us with the following signals: C-Buy, S-Buy, I-Buy, F-Hold. We are currently invested at 100/S. Our allocation is now +5.58% on the year not including the days results. Here are the latest posted results.

| 07/05/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.3716 | 19.2369 | 87.4191 | 79.2584 | 43.5669 |

| $ Change | 0.0045 | 0.1005 | 0.4876 | -0.2674 | 0.4154 |

| % Change day | +0.02% | +0.53% | +0.56% | -0.34% | +0.96% |

| % Change week | +0.06% | +0.71% | +1.98% | -0.46% | +2.43% |

| % Change month | +0.06% | +0.71% | +1.98% | -0.46% | +2.43% |

| % Change year | +2.27% | +0.07% | +17.56% | +2.81% | +8.43% |