Good Afternoon, The market is up again today as it awaits the next market moving news which will be the CPI (Consumer Price Index) released tomorrow and the PPI (Producer Price Index) released on Thursday. Both reports are measures of inflation that are closely monitored by the Fed. I expect that both reports will show inflation slowing. However, I don’t think that will be enough to dissuade the Fed from increasing rates at least two more times this year. While these reports support the narrative that the Fed may soon end their policy of increasing interest rates to control inflation they are not the only things the Fed watches. The main fly in the ointment right now is wage growth. The Fed closely monitors the Job market as part of their dual mandate and one of the things they look at closely when if comes to jobs is wage growth. While the job market as a whole had shown some slowing it has not been eno0ugh to convince the Fed that the economy will slow sufficiently to bring down inflation. Wage growth is the second component of the Job market that they watch. Right now it is exceeding what they feel is necessary to bring inflation down to their preferred target of two percent. My understanding is that they would like to see wage growth reduced until it is under four percent. Why four percent? I don’t know. You’ll have to ask an economist that question. My assessment of all this is that the Fed will continue to increase rates until they dent the economy sufficiently enough to bring the rate of inflation down to their 2% target. As I say every week, all you really have to look at is the rate of inflation. When if finally reaches two percent you can go all in and you will make money! No doubt about that. The easy way to understand this is to understand that the Fed will do whatever it takes to reach their goal for inflation of two percent and if that means damaging the economy sufficiently to cause a recession then so be it…..

Sometimes I am convinced that their are members of our group that watch the alerts that we put out but never read the blogs. There are reasons that we do what we do or at least try to do what we do and it is important to understand our strategy. First off, you may not agree with it and choose not to make the move. Secondly, what we do may make little or no sense to you if you don’t understand why were doing it. It’s kind of like listening to your GPS and never looking at the map while asking why in the heck did it want me to turn in that direction?? It is not good enough to just know what we are doing. You must also know why we are doing it and what to possibly expect. For example this week I had several folks send messages and make comments about the C Fund dropping after our initial investment. I understand that your gun shy. We’ve had a rough 18 months. How many times do I have to say that? However, that doesn’t mean that we just give up and stop trying to make money. The market can and is coming back to us. Had they read last weeks blog they would understand that we expected this down turn but did not think we could get in and out of the market in time to effectively take advantage of it and allow us to be positioned for the next run higher. In the event that they disagreed they could have moved to the sidelines during that period. Lets be real. Everyone here can do whatever they want to do and if in fact they are, then they need to fully understand what it is they are doing or they have no one to blame but themselves if they are unhappy. It takes a little effort to out perform the market!!

While we’re on the subject let me say that the little downturn last week is not the only one that we anticipate. We can’t predict the future. As I have often said, nobody and I mean nobody can!!!! That said, if the Fed goes through with their plan to increase rates two more times we feel that it will put sufficient pressure on the market to cause a downtrend in the neighborhood of 9%. If the selling comes if such a manner that we can sidestep it then we will. If not and we are forced to ride it out then we will do so. So don’t be surprised if at some time in the coming weeks that we sell and move to the side lines again. That is only one scenario but it is the one that is the most likely. Therefore, we must remain vigilant! For how long you ask?? Why until the rate of inflation returns to two percent of course!

One item of housekeeping. I am told they are still working on the phone app. As I told many of you already, they are rebuilding it from the ground up. It was totally unacceptable the way that it was for reasons that I will not go over here again. That is a waste of time. The end product should be finished sometime in August and will be worth the wait. Until then tell your friends they can fully access us here at MyTSPGuide.com

The days trading has so far left us with the following results: Our TSP allotment is currently trading higher at +0.25%. For comparison, the Dow has added +0.58%, the Nasdaq +0.05% and the S&P 500 +0.25%. Praise God for a couple days in the green!

Dow rises more than 100 points Tuesday as traders await key inflation data: Live earnings

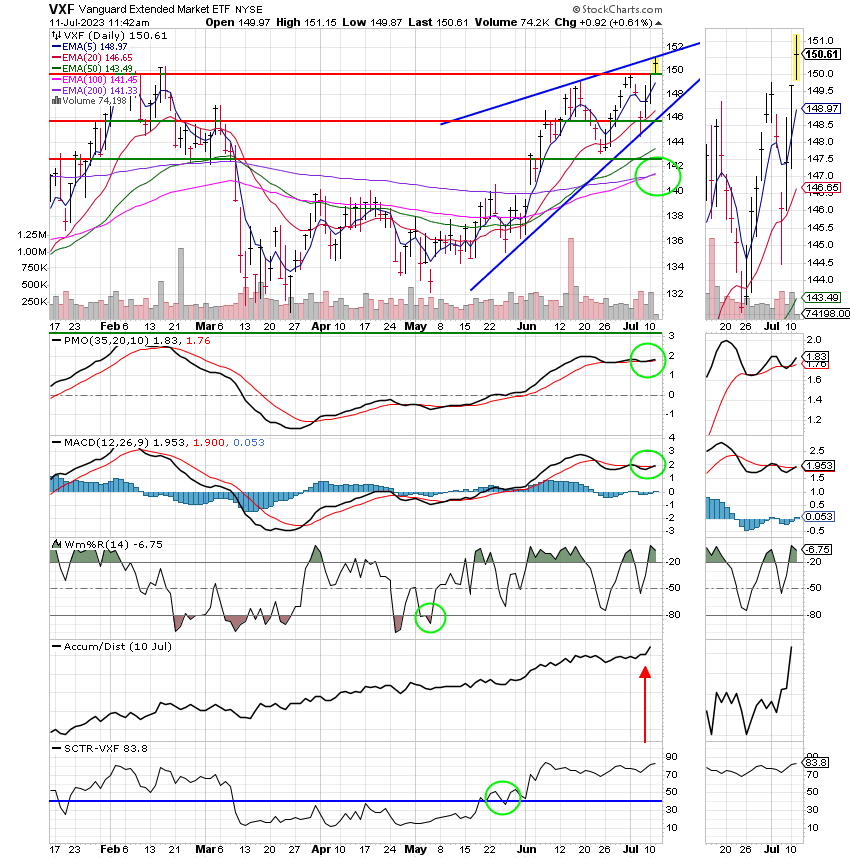

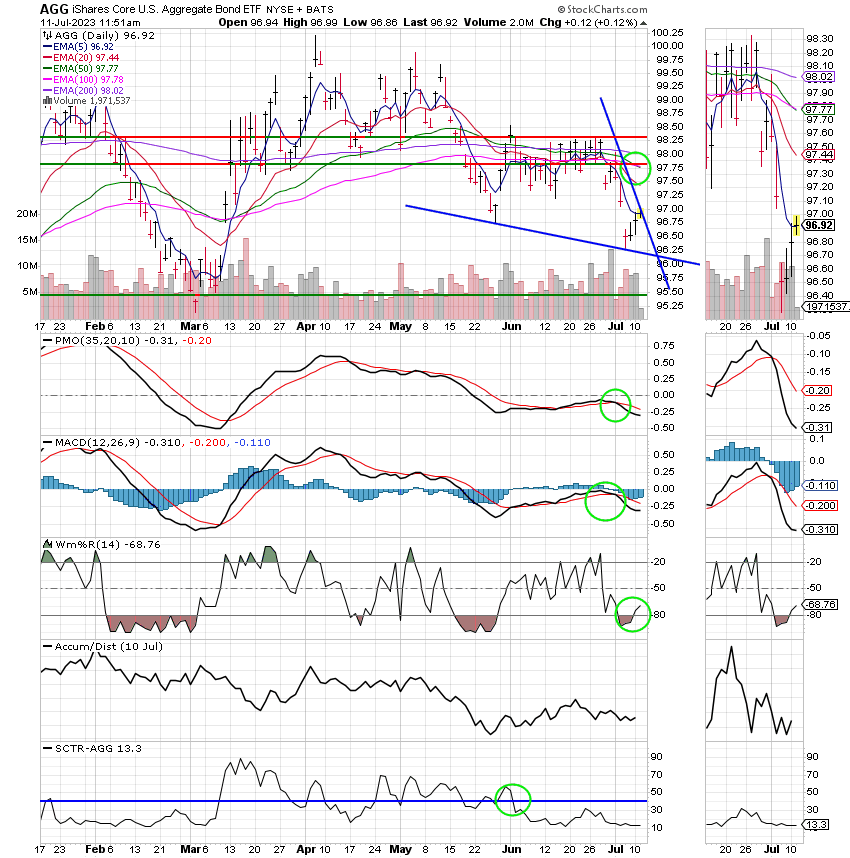

Recent action has left us with the following signals: C-Hold, S-Buy, I-Sell, F-Sell. We are currently invested at 100/C. Our allocation is now -3.38% not including the days results. Here are the latest posted results:

| 07/10/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.5843 | 18.4385 | 68.2399 | 69.6977 | 37.3488 |

| $ Change | 0.0058 | 0.0643 | 0.1635 | 1.0077 | 0.1187 |

| % Change day | +0.03% | +0.35% | +0.24% | +1.47% | +0.32% |

| % Change week | +0.03% | +0.35% | +0.24% | +1.47% | +0.32% |

| % Change month | +0.11% | -0.96% | -0.88% | +0.56% | -1.89% |

| % Change year | +2.03% | +1.27% | +15.85% | +13.27% | +10.04% |