Good Evening, Nothing is really changing right now. It’s pretty much the same old song and dance. Inflation, interest rates, Covid, and the war in the Ukraine. In the end it all comes full circle to inflation and tomorrows CPI report will be our next chance to measure that. The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. I think that it will be nearly impossible for this report to please the market. If it comes in too hot then then investors will view it as a mandate for the Fed to continue to be aggressive with their interest rate increases in order to bring inflation under control and traditionally the market does not do well in rising rate environments. If the report comes in lower than expected it will stoke recession fears. Investors will see the a lower report as evidence that the economy is slowing. either way the market will sell unless the report is goldilocks warm, just right. What is just right? I really wouldn’t even venture a guess. Almost everyone of these issues is related to the other. Supply Chain, Covid, Bond Yields, Yield curve inversions, interest rates, inflation, war in Europe….it all goes hand in hand and it takes a good deal of work to understand how one thing effects another and then another. It’s an awful lot like dominoes. However, if you don’t want to do all that work you really only need to know one thing and that is the same thing I’ve been saying all along. No matter what they do and no matter how the things they do effect the buying and selling in the end it will all come down to inflation. It’s really really simple. All you have to know is that the Feds preferred rate of inflation normally referred to as their target rate is 2 percent. The closer the rate of inflation which is currently over 8 gets to that 2% target the better things will get. The bottom line is the Fed likes it at 2% and we never fight the Fed……Never!! So we’ll see how the report goes in the morning and how the market reacts to it. I believe it will move the market. I just can’t say in which direction. I will say this. We are in a bear market and in a bear market surprises are to the down side. How long will we be in a bear market?? Until we start to see higher highs and higher lows………Remember if you are impatient with this market keep in mind that one of the primary reasons that many rallies in recent years were so robust and produced V-shaped moves was because the Fed was keeping interest rates low and conducting Quantitative Easing. As we have often repeated in 2022, that is no longer the case. Liquidity is going to have a substantial impact on how the market eventually recovers. If you have no patience then you better cultivate some because trying to to anticipate a bottom to this market is a recipe to lose money. All you can do is let the action unfold as you watch your charts and react when the trend shifts back up. Again, be patient!! You will have weeks and months to make your move. It’s not a race and it’s not a competition. It’s about how much money you have when you retire and for those purposes it’s always best to remember our guiding principle for investing. “It’s not what you make that’s important. It’s what you keep!!!”

The days trading left us with the following results: Our TSP allotment was steady in the G Fund. For comparison, the Dow dropped -0.62%, the Nasdaq -0.95%, and the S&P 500 -0,92%.

Dow drops more than 100 points, stocks fall ahead of key inflation report

The days action left us with the following signals: C-Hold, S-Hold, I-Hold, F-Hold. We are currently invested at 100/G. Our allocation is now -25.05% for the year not including the days returns. Here are the latest posted returns:

| 07/11/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.9444 | 18.8233 | 58.6647 | 61.4069 | 31.4423 |

| $ Change | 0.0044 | 0.0906 | -0.6829 | -1.2040 | -0.4867 |

| % Change day | +0.03% | +0.48% | -1.15% | -1.92% | -1.52% |

| % Change week | +0.03% | +0.48% | -1.15% | -1.92% | -1.52% |

| % Change month | +0.09% | +0.23% | +1.87% | +2.10% | -1.65% |

| % Change year | +1.24% | -9.88% | -18.46% | -26.41% | -20.28% |

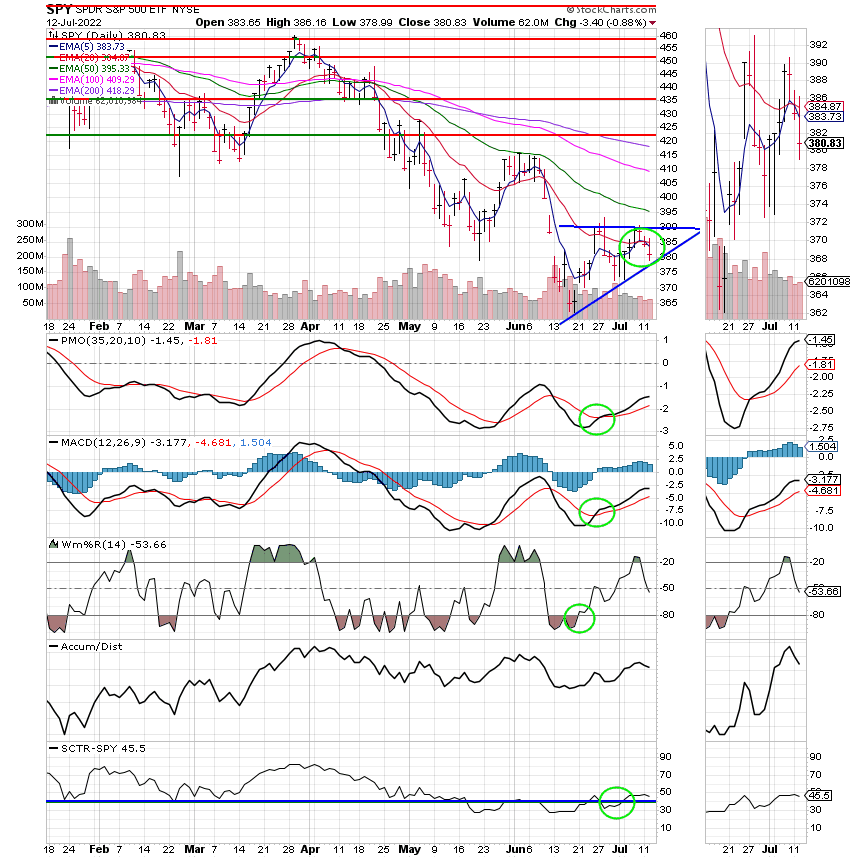

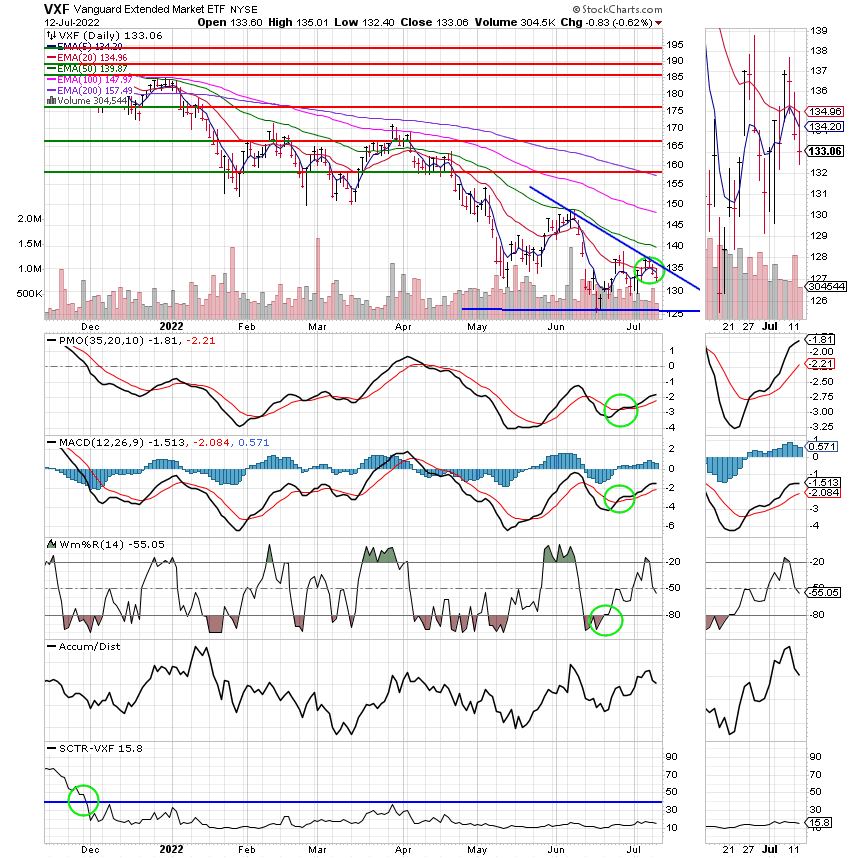

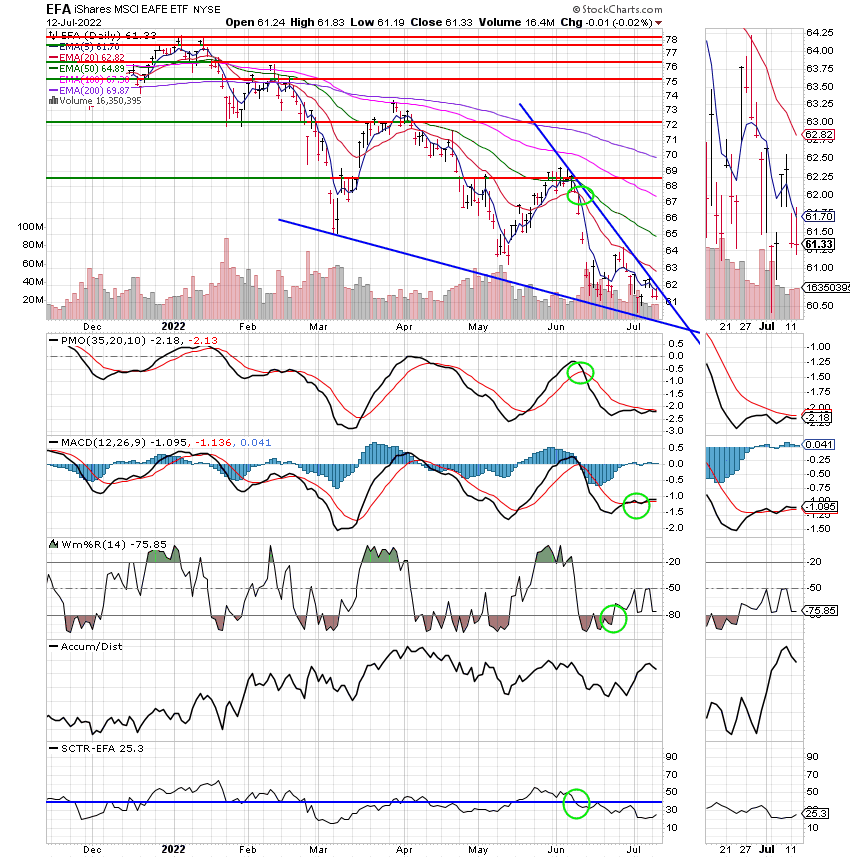

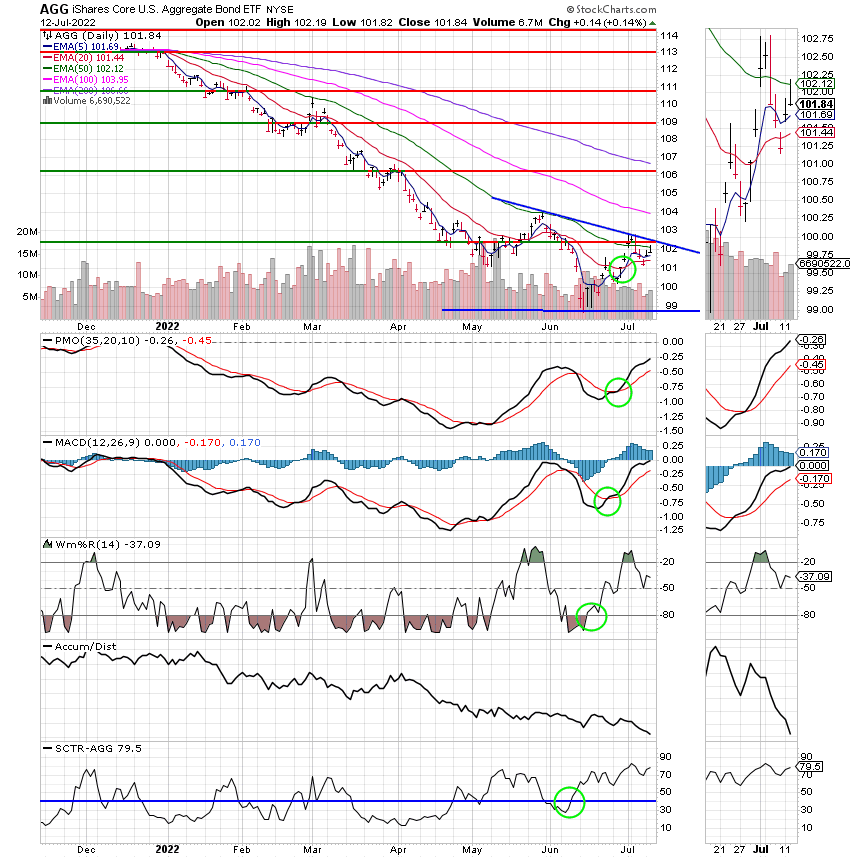

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

We’ll see what happens tomorrow. My expectations are that the choppy action with a lower bias will be around until the fall at the earliest. That’s all for tonight. Have a nice evening and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.