Good Evening, The market continues to be Corona news driven and today’s trading was a prime example. The market rose in the morning session led by mega cap tech stocks only to reverse and finish well within the red by the closing bell. Stocks rose in the morning on the news that Pfizer and German biotech BioNTech SE were granted fast track designation by the FDA for two of the companies’ four vaccine candidates against the coronavirus. They then quickly reversed in the afternoon session after California Governor Gavin Newsom ordered a massive reversal of the state’s reopening, shutting bars and banning indoor restaurant dining statewide and closing churches, gyms and hair salons in hardest-hit counties. The volatility was reflected in the Cboe Volatility Index (better known as the VIX), Wall Street’s fear gauge, which closed at its highest level since June 26. Its 4.9-point gain for the session was its largest since June 11. The market remains news driven and volatile as we anticipated it would be. I will be the first to admit that it takes a strong constitution to stomach this action….Nevertheless, we are still well within the green for the year and I thank God for that.

The days trading left us with the following results: Our TSP allotment gave up some of it’s recent gains dropping -1.86%. For comparison, the Dow eked out a gain of +0.04%, the Nasdaq lost -2.13%, and the S&P 500 fell -0.94%. Given today’s big reversal I wouldn’t be surprised at all to see a bounce tomorrow. We will see.

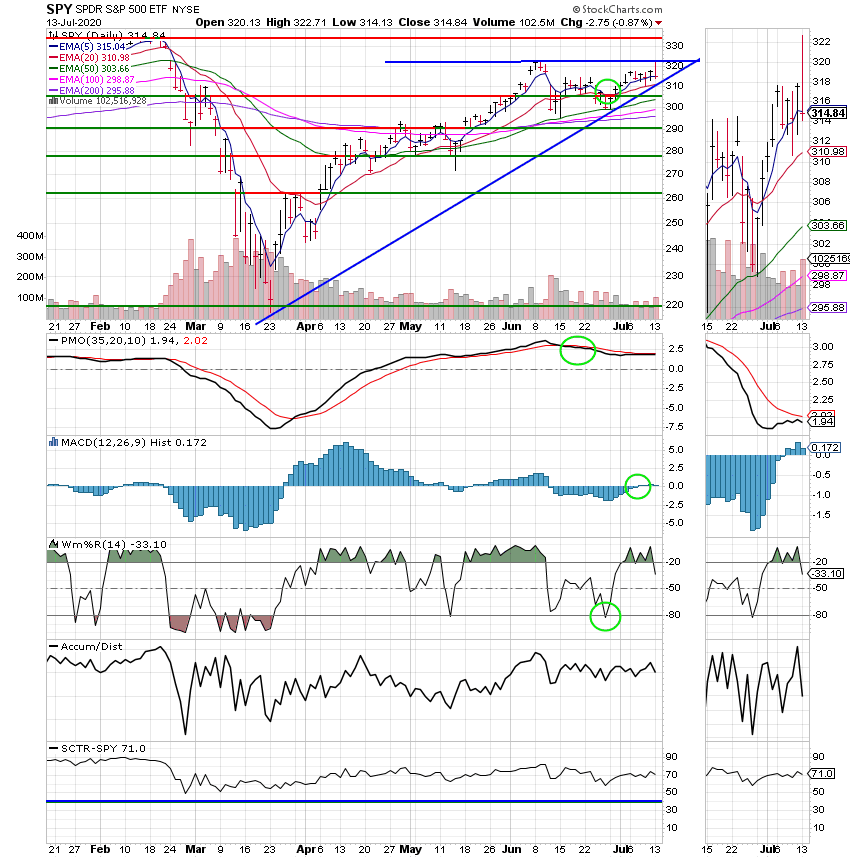

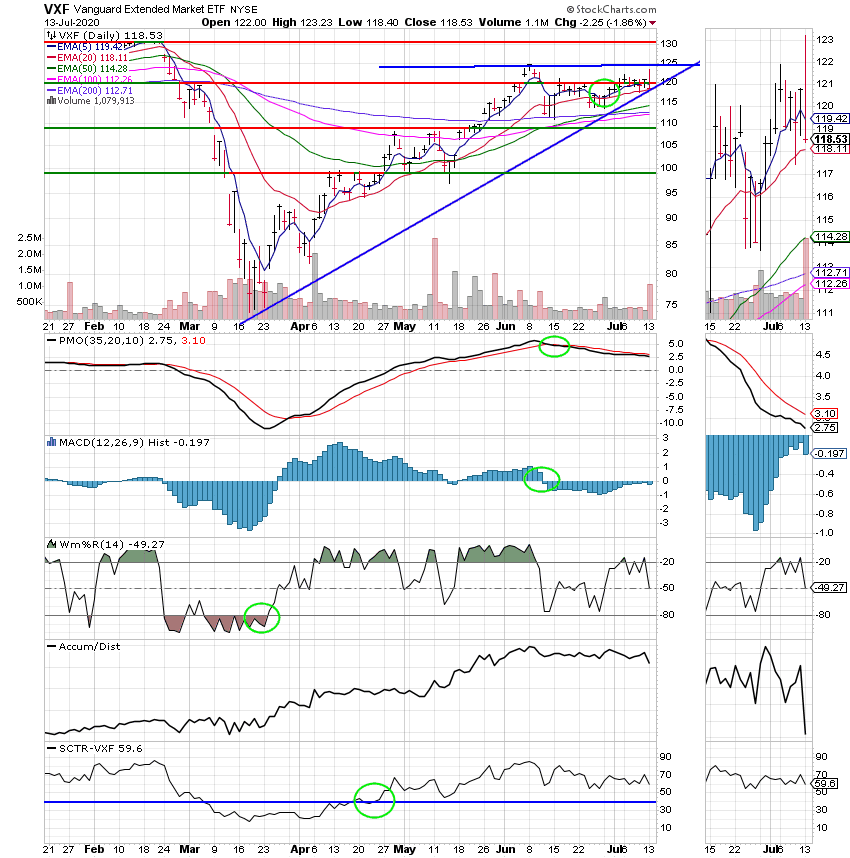

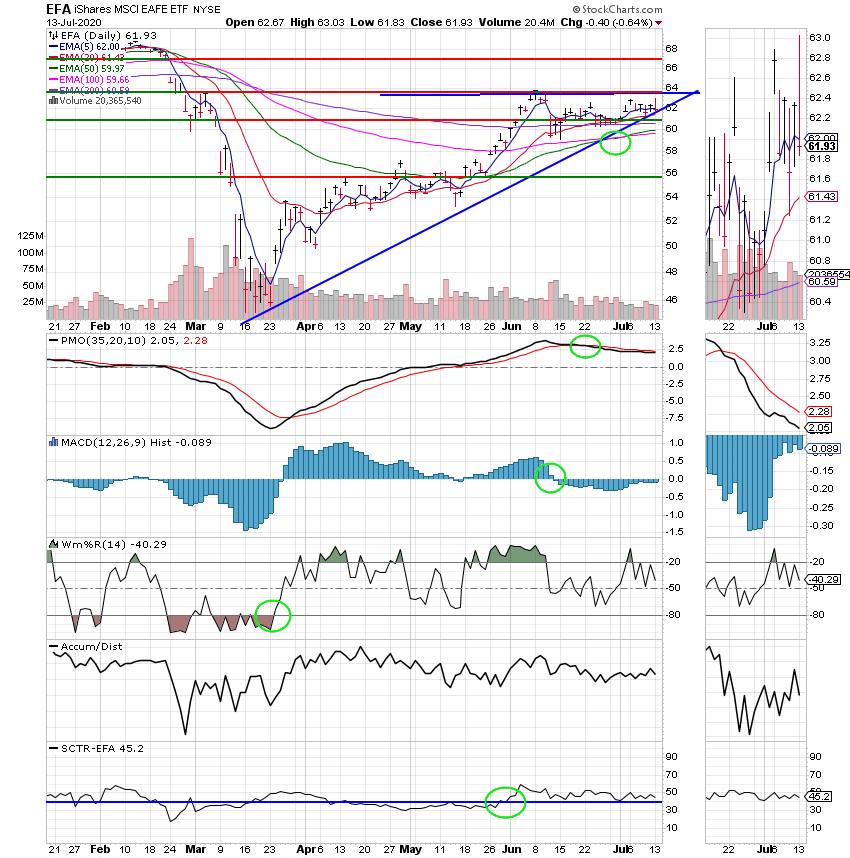

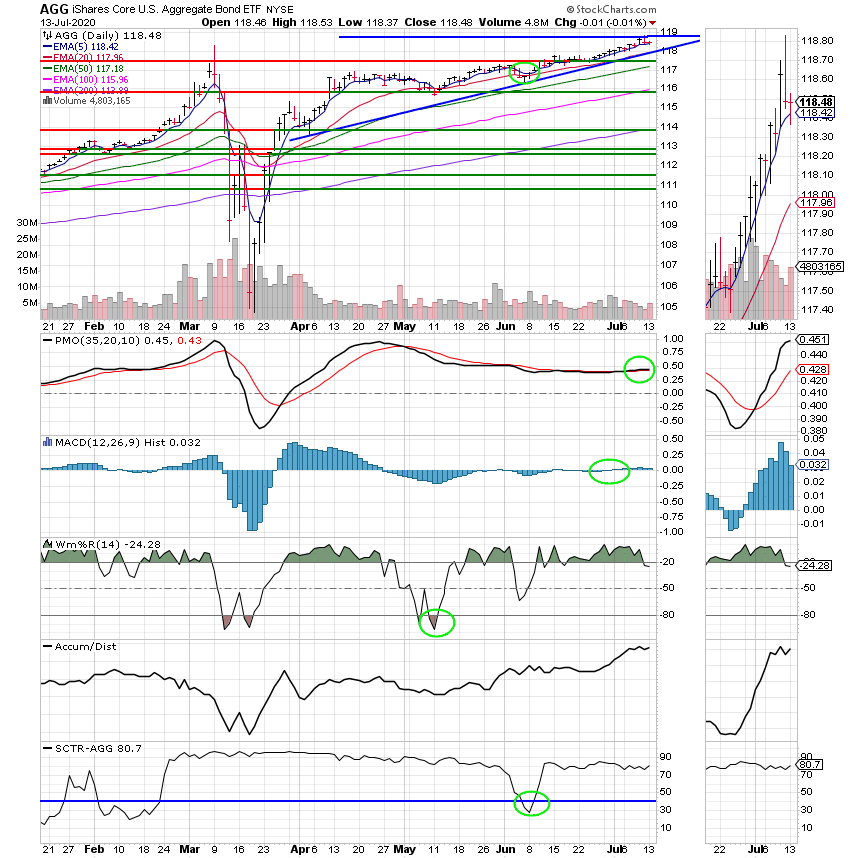

The days action left us with the following signals: C-Buy, S-Neutral, I-Neutral, F-Buy. We are currently invested at 100/S. Our allocation is now +16.56% on the year not including the days results. Here are the latest posted results:

| 07/10/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.4502 | 21.0288 | 47.0497 | 54.1006 | 29.6343 |

| $ Change | 0.0003 | -0.0261 | 0.4882 | 0.7191 | 0.1182 |

| % Change day | +0.00% | -0.12% | +1.05% | +1.35% | +0.40% |

| % Change week | +0.02% | +0.40% | +1.79% | +1.55% | +0.32% |

| % Change month | +0.02% | +0.54% | +2.79% | +2.10% | +1.87% |

| % Change year | +0.61% | +6.65% | -0.45% | -3.87% | -9.42% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 21.2562 | 10.1058 | 34.3736 | 10.1387 | 37.6769 |

| $ Change | 0.0387 | 0.0426 | 0.1744 | 0.0565 | 0.2288 |

| % Change day | +0.18% | +0.42% | +0.51% | +0.56% | +0.61% |

| % Change week | +0.31% | +0.65% | +0.78% | +0.85% | +0.92% |

| % Change month | +0.57% | +1.06% | +1.47% | +1.39% | +1.74% |

| % Change year | +0.33% | +1.06% | -1.38% | +1.39% | +-1.96% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 10.1607 | 21.9144 | 10.2014 | 10.2014 | 10.2015 |

| $ Change | 0.0661 | 0.1522 | 0.0870 | 0.0869 | 0.0869 |

| % Change day | +0.65% | +0.70% | +0.86% | +0.86% | +0.86% |

| % Change week | +0.98% | +1.04% | +1.22% | +1.22% | +1.22% |

| % Change month | +1.61% | +1.97% | +2.01% | +2.01% | +2.02% |

| % Change year | +0.33% | +1.06% | -1.38% | +1.39% | -1.96% |