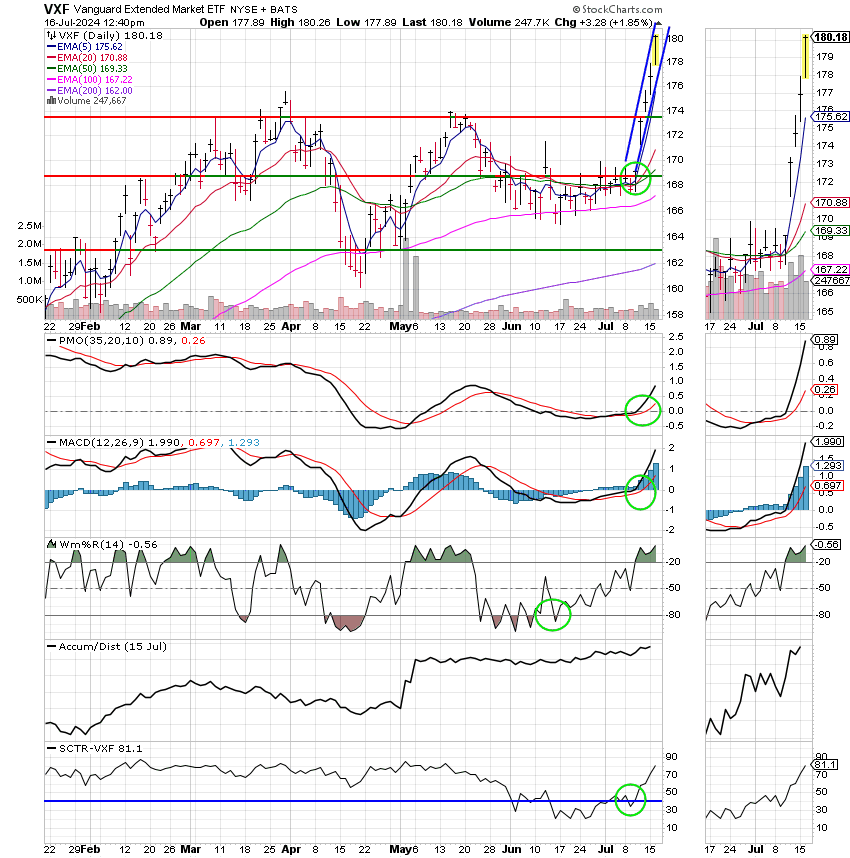

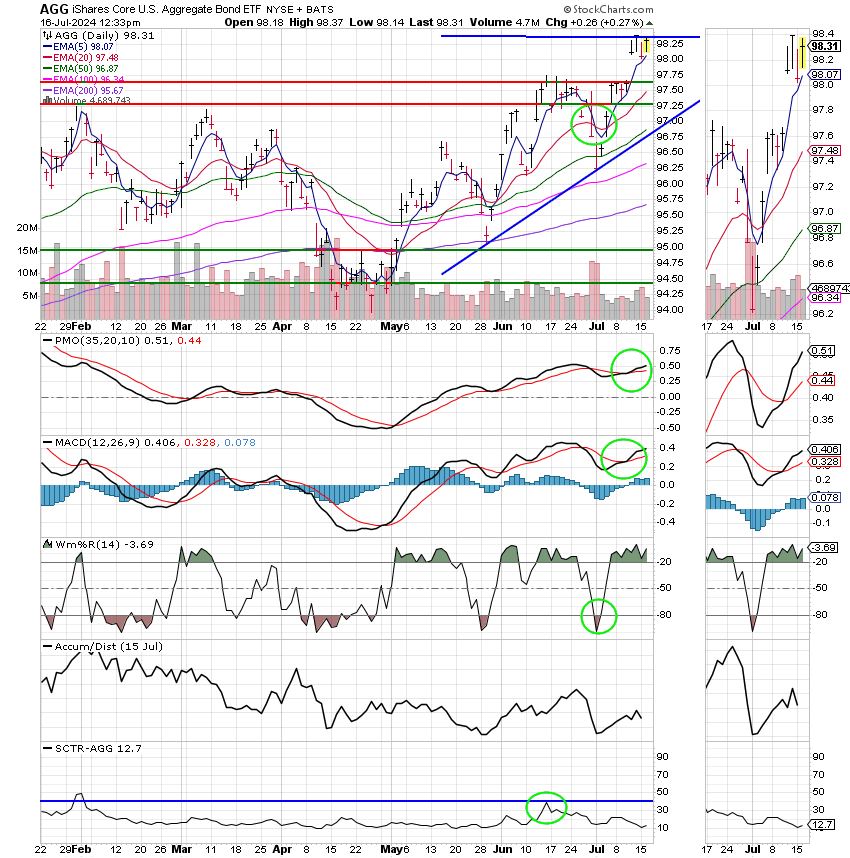

Good day, My what a difference a week makes. There are a couple things that I want to point out here, not because I want to say that I’m right, but so you will learn for the future. I have been writing for weeks that the market could not remain bifurcated meaning that ultimately small caps and mid caps would join large caps in the uptrend or large caps would fall to the level of small caps and midcaps. Small caps and midcaps simply make up too much of the market for that not to be a fact. I had one person tell me that I could never beat holding the C fund. He needs to check his returns for the last week and then tell me that again…… Folks when there is a sustained trend higher the whole market participates. There may be money that moves in and out of the various sectors but small caps, mid caps, and large caps all participate. Anyone that tells you otherwise kindly put really doesn’t know what their talking about. This run higher the mega cap stocks was the longest that I can remember in which small caps and midcaps did not participate. This was largely to do with two things. The biggest was the AI (Artificial Intelligence ) trade which fueled the rally in 2024 (actually before that). AI today is like the internet stocks where in the late 90’s. It is changing the face of industry that is to say how things are done. It is the next big leap in technology. So it only makes sense that the market will invest in it. Mega Cap stocks like Nvidia and Microsoft have fueled this boom in technology while smaller companies have been neglected. This is why the C fund worked so well while the S fund underperformed and it did so for such a long period that some short sided traders began to see it as the norm. That is the reason I say they know nothing. A few stocks cannot keep the whole market floating forever. It is quite literally impossible for that to happen. AI was the big reason that this market was so bifurcated but it had help and that help was the key to the current rally in small caps. Many if not most traders got so caught up in what was happening with the AI trade that they forgot all about the bigger picture. The lost sight of the forest for the trees!! This market is still in the latter stages of a recovery from the pandemic. Remember all the stimulus pumped into the market to keep the economy floating during the pandemic and the inflation that resulted from all that cheap money following the pandemic? Remember how the Fed increased rates to control that inflation??? Remember how the Fed started reducing the massive balance sheet of treasury notes and mortgage backed securities that they accumulated during the pandemic??? All this resulted in higher interest rates. After all, that was the idea. To put the brakes on the economy to slow inflation!! And….what does higher interest rates affect the the most? Small and midsized businesses. Folks this may be complicated but it is not rocket science. Small Caps and mid caps have been held in check buy higher interest rates!!! So what changed??? Last weeks CPE (Consumer Price Expenditure) report showed that inflation was slowing to the point that the Fed could now realistically expect to reach it’s target of a two percent rate of inflation in the foreseeable future and that ladies and gentlemen paved the way for the fed to begin a campaign of reducing interest rates which will likely begin in September. Fed Chairman Jerome Powell as much as confirmed that in remarks he made before congress yesterday. So to sum it up, the CPE report this past Friday showed that inflation was slowing. The market immediately anticipated a Fed rate cut in September and the rotation into rate sensitive small caps began and continues. Further fueling this rotation is the markets view that the republican party is likely to do well in the November elections after an unsuccessful assassination attempt on former President Trump this past weekend. That market views the parties less restrictive policies as a boost for smaller businesses in the U.S. Just one thing concerning the latter event. I am not talking about this event in a political sense but rather in regard to how it effects our investments. It is a tragedy when any former or sitting president or any elected official for that matter in the United States of America is the target of assassination. That is not who we are and we need to pray the peace of Jesus over our nation. We are in fact, One Nation Under God. That is WHO WE ARE!

The days trading so far has left us with the following results. Our TSP allocation is currently trading +1.79% higher. For comparison, the Dow is adding +1.37%, the Nasdaq is flat at +0.00%, and the S&P 500 is modestly higher at +0.23%. Folks, let me be blunt for once so you understand clearly. Our critics said how could you possibly out perform the market? You couldn’t done that all those years… Well we did and we are! This is how we did it and this is how we will continue to do it with God’s help, Give Him all the praise for He and He alone is worthy! This market is starting to return to normal and this is routinely what we do in a normal market. Those folks can stay in there lane and we’ll stay in ours…. The Fast Lane! Praise God!!

Dow jumps 500 points to record, Russell 2000 gains nearly 2%: Live updates

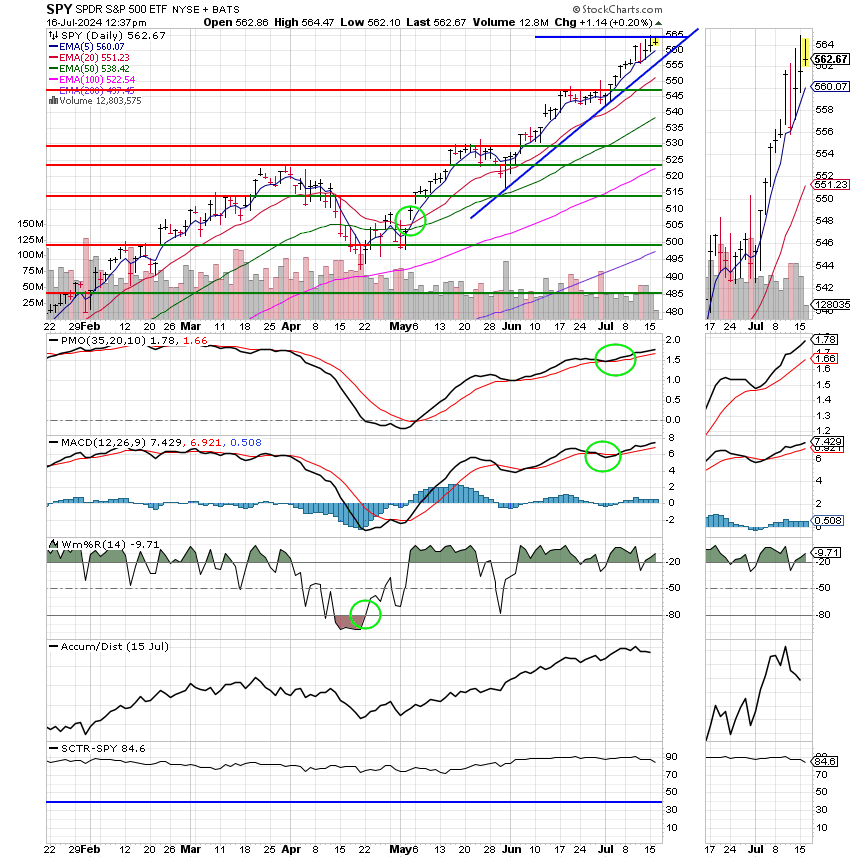

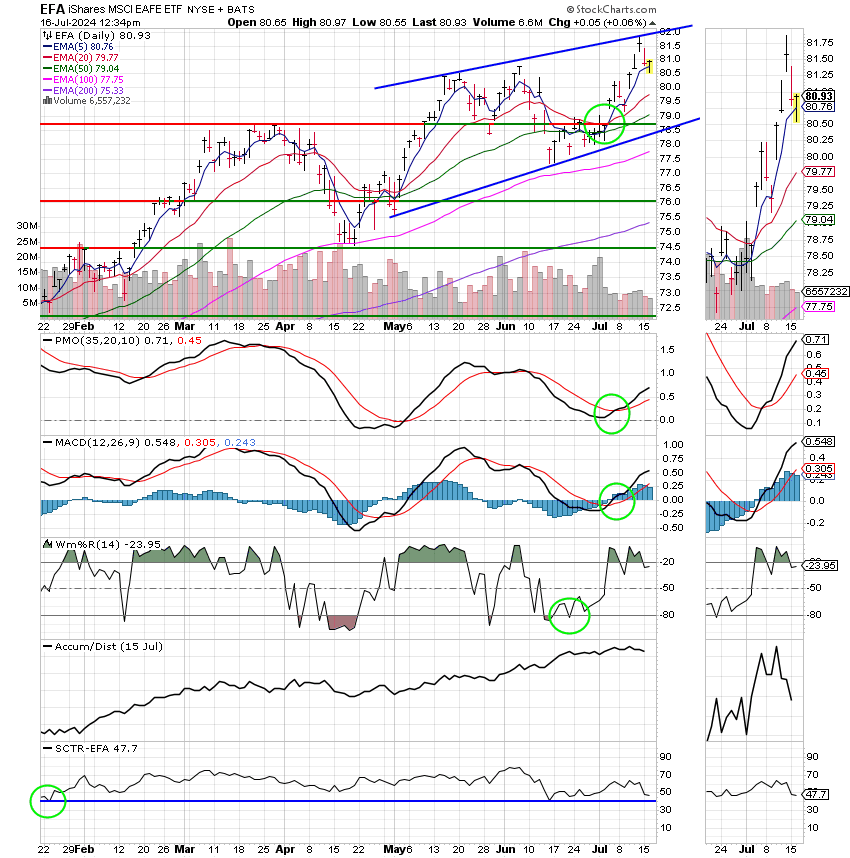

The current action has left us with the following signals: C-Buy, S-Buy, I-Buy, F-Buy. We are currently invested at 100/S. Our allocation is now +11.25% for the year not including the days results. Here are the latest posted results:

| 07/15/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.3945 | 19.3439 | 88.4514 | 83.4362 | 44.1053 |

| $ Change | 0.0069 | -0.0520 | 0.2587 | 0.9616 | -0.2720 |

| % Change day | +0.04% | -0.27% | +0.29% | +1.17% | -0.61% |

| % Change week | +0.04% | -0.27% | +0.29% | +1.17% | -0.61% |

| % Change month | +0.19% | +1.27% | +3.18% | +4.79% | +3.70% |

| % Change year | +2.40% | +0.63% | +18.94% | +8.22% | +9.76% |