Good Evening, There’s no use in writing a book here. The overall narrative remains the same. Investors are focusing on inflation, what the Fed might do, and if it will result in a recession. This week the Fed enters their black out period when they can’t say anything ahead of the upcoming July meeting. Right now traders believe that there is over a 90% chance that the Fed will increase rates another quarter point at the next meeting. After that it’s up in the air given the most recent economic reports showing that inflation may be starting to slow. So void of any Fed speak this week, the main focus will be upon quarterly earnings reports that are now beginning to roll in. Up to now the earnings have been nothing less than resilient although one has to wonder when and if the Feds rate increases could start to effect them negatively. Right now though, conditions continue to be goldilocks warm for a soft landing which is to say that the rate of inflation will come down to the Fed Target of 2% without a recession. However, there is a large contingent out there that insists that a soft landing is impossible. We will see!

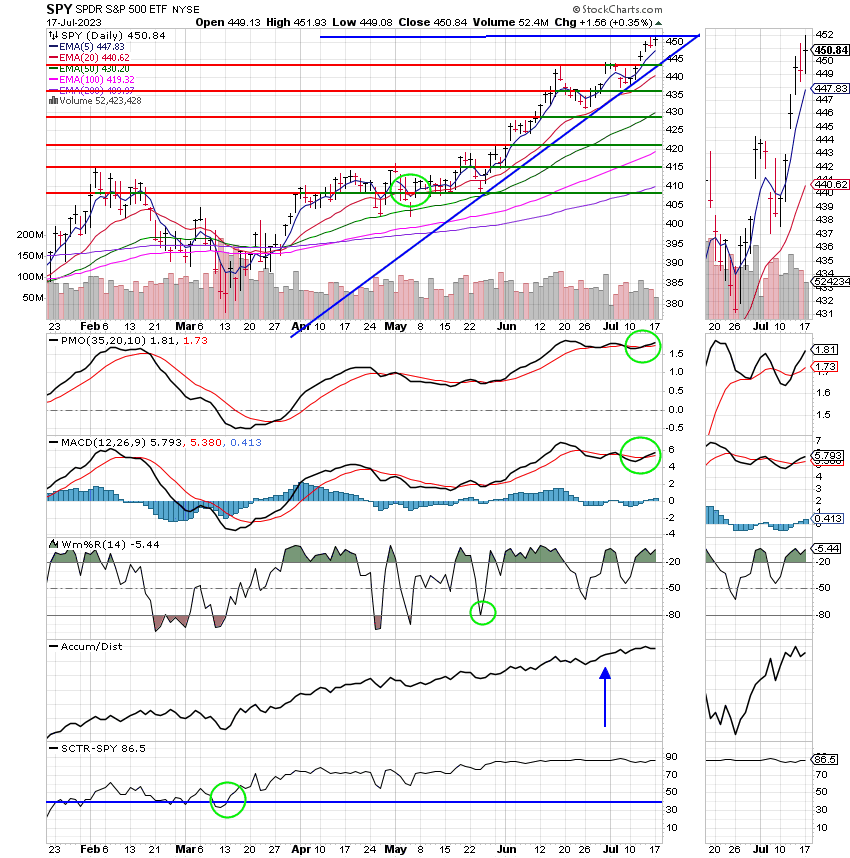

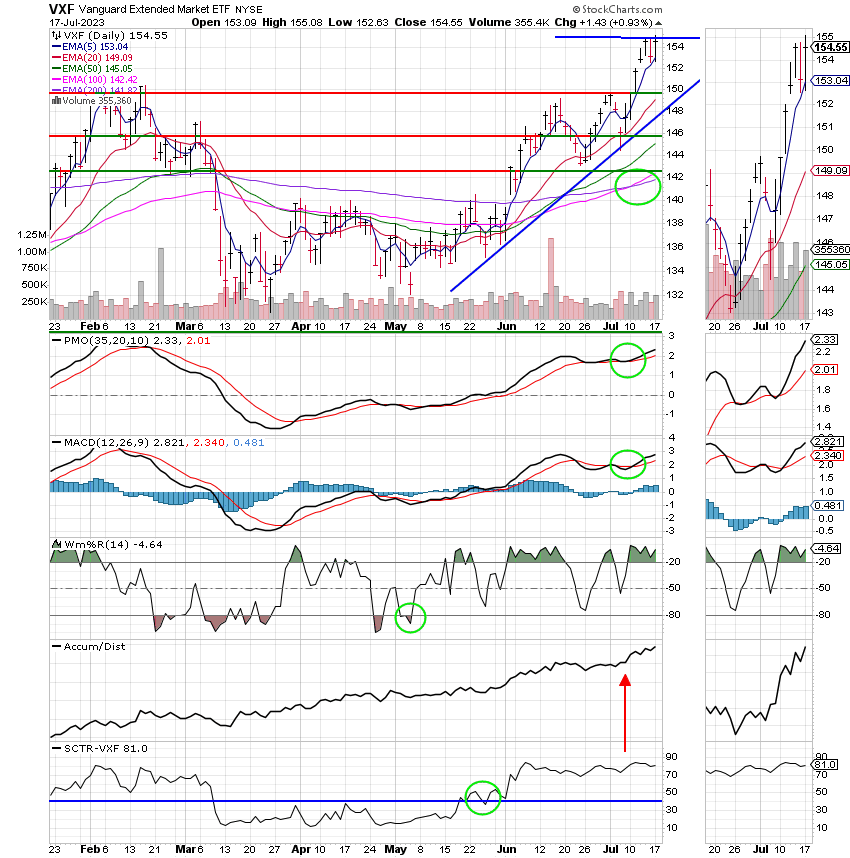

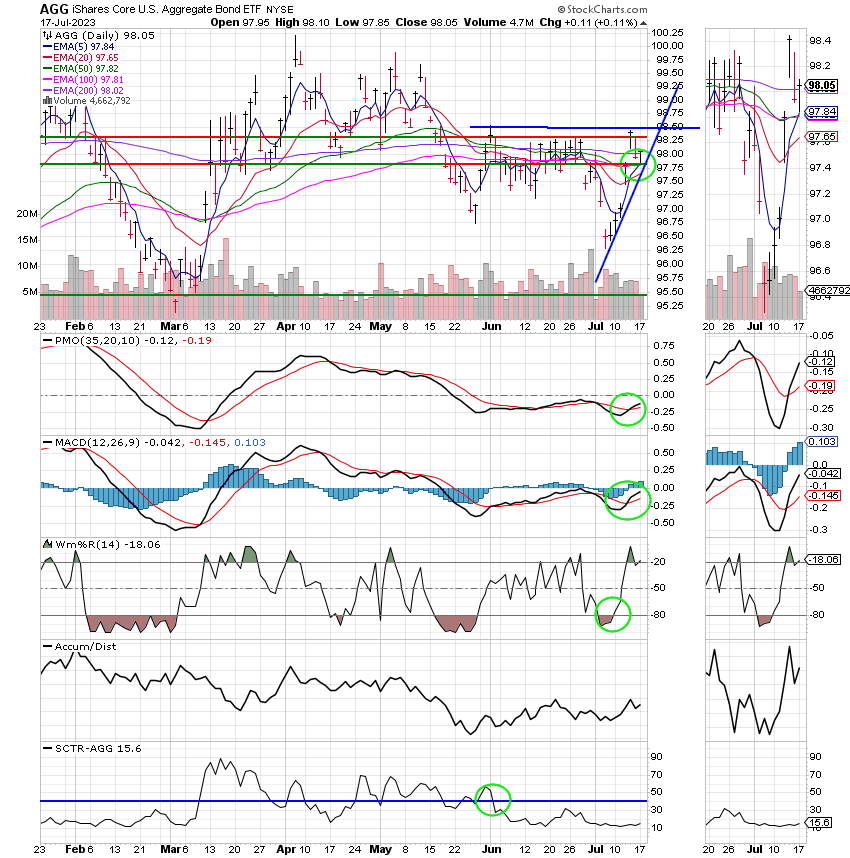

Our allotment continues to perform well. Heretofore we have not seen the pullback that we have been anticipating. We will continue to monitor the charts for any weakness showing that it could be starting. Should the charts deteriorate, we won’t hesitate to use our last move for July. That said, for now we will remain invested at 100/C as it offers us the most stability in the event that we experience some selling.

The days trading left us with the following results. Our TSP allotment posted a gain of 0.39%. For comparison, the Dow added +0.22%, the Nasdaq +0.93%, and the S&P 500 +0.39%. Praise God for a day in the green!

Dow rises for sixth straight day, closes at highest level in 2023: Live updates

The days action left us with the following signals: C-Buy, S-buy, I-Buy, F-Hold. We are currently invested at 100/C. Our allocation is now -1.27% not including the days gains. Here are the latest posted results:

| 07/14/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.592 | 18.6543 | 69.7345 | 71.3406 | 38.8917 |

| $ Change | 0.0019 | -0.0775 | -0.0690 | -0.6950 | -0.1776 |

| % Change day | +0.01% | -0.41% | -0.10% | -0.96% | -0.45% |

| % Change week | +0.08% | +1.52% | +2.44% | +3.86% | +4.46% |

| % Change month | +0.15% | +0.20% | +1.29% | +2.93% | +2.16% |

| % Change year | +2.07% | +2.45% | +18.39% | +15.94% | +14.58% |