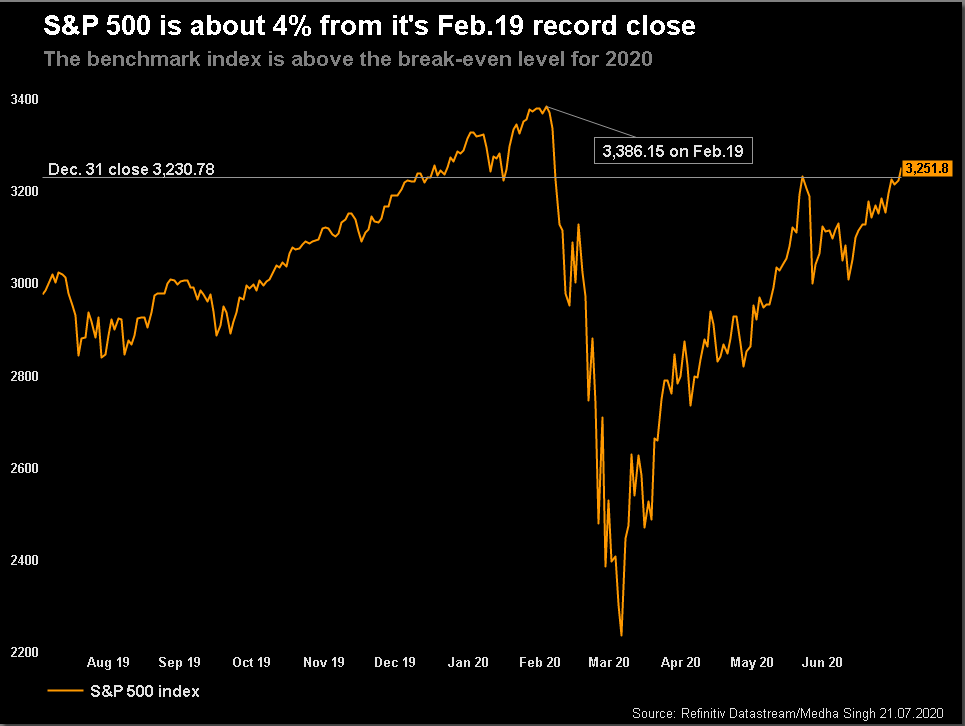

Good Evening, The market continues to shift between to so called stay at home stocks and recovery stocks. Today the emphasis was on the recovery stocks as investors are keeping a close eye on congress in anticipation of another round of stimulus as current long term unemployment benefits approved in the last stimulus bill are due to run out in two weeks. Financial, industrial and energy stocks made the biggest gains in the S&P 500 and Dow. A drop in tech shares moved the Nasdaq lower which is understandable given that most of the stay at home stocks are tech stocks such as Microsoft (MSFT) and Netfix (NFLX). As you can see the dynamics remain the same. Not to be overlooked are current developments in the battle with Covid 19. The most recent news had good results being reported by several pharmaceutical companies on vaccines in the developmental stage. The most recent of them was a report by AstraZeneca that their vaccine being developed in cooperation with Oxford University produced a promising immune response in a large, early-stage human trial, according to newly released data published Monday in the medical journal The Lancet. Put it all together and you have a market that favors recovery stocks. Plain and simple. The market has clearly ignored surging cases of Covid 19 in favor of the vaccines that will bring it under control. I would be amiss not to mention one other thing the market is ignoring that will eventually cause problems for the economy. That is the National Debt. The cost of all this stimulus is being ignored at the moment but is says here that it can’t be ignored forever. Today noted Hedge fund billionaire Leon Cooperman said he thinks the market is overvalued, and that it is overlooking “a number of things.” The nation’s rapidly growing national debt is among Cooperman’s biggest concerns. Due to the stimulus, the national debt is exploding as Washington scrambles to rescue the US economy from the shock of the pandemic. “I am focused on something the market is not focusing on at the present time and that is: Who pays for the party when the party is over?” Cooperman said. The deficit is growing at a rate “well in excess of the growth rate of the economy,” he added. “To me, that means more of our nation’s income will have to be devoted to debt service, which will retard economic growth in the long term.” You’ve got to admit. He has a point……All we can do is pray and put it all in God’s hands. That is the only way we will ultimately avoid this train wreck.

The days trading left us with the following results: Our TSP allotment posted a gain of +0.50%. For comparison, the Dow added +0.60%, the Nasdaq dropped -0.81%, and the S&P 500 posted a modest gain of +0.17%. I thank God for the gain.

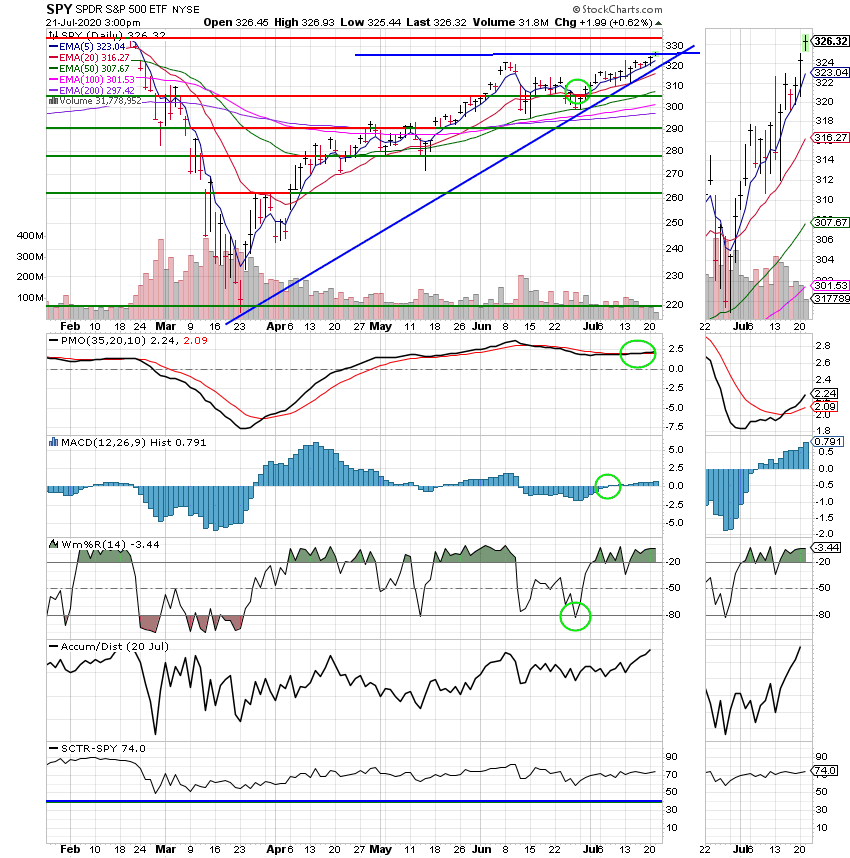

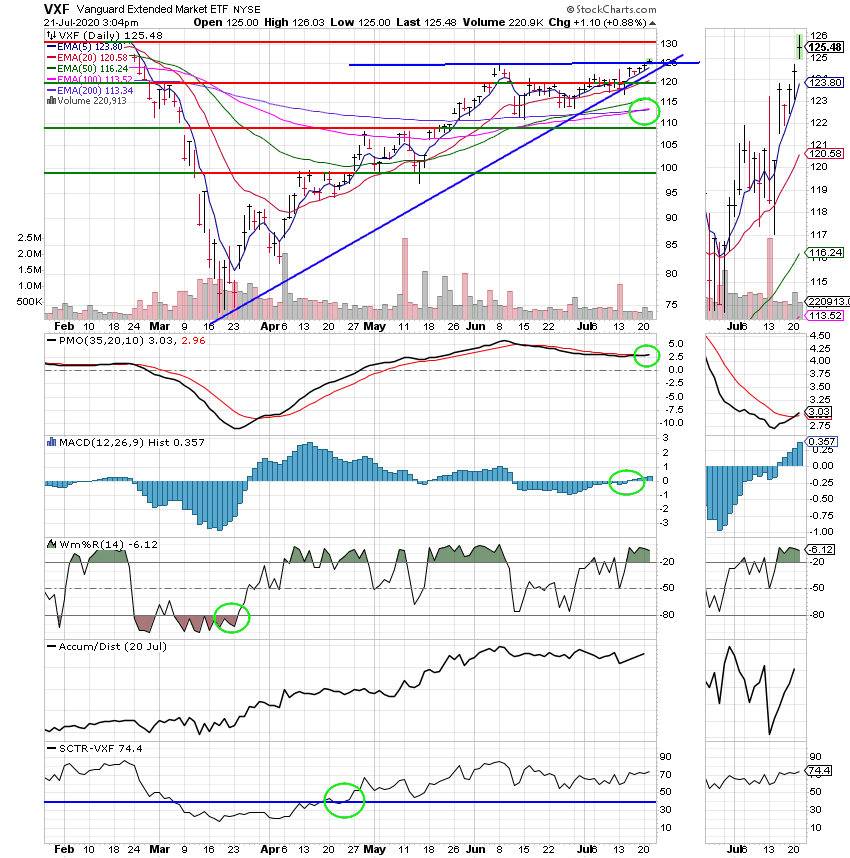

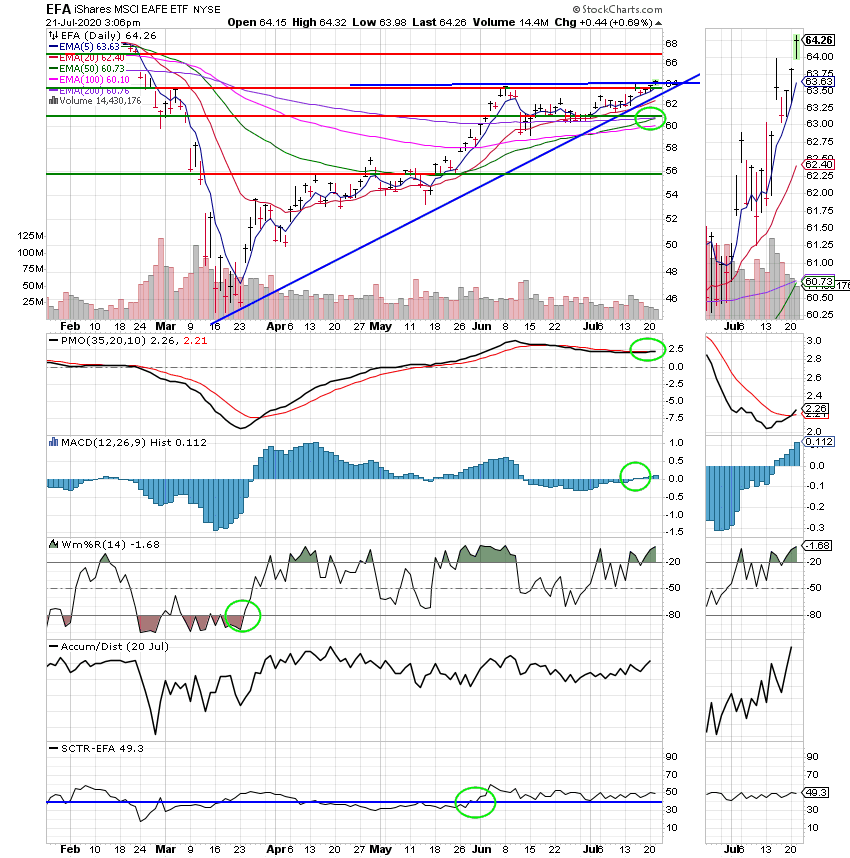

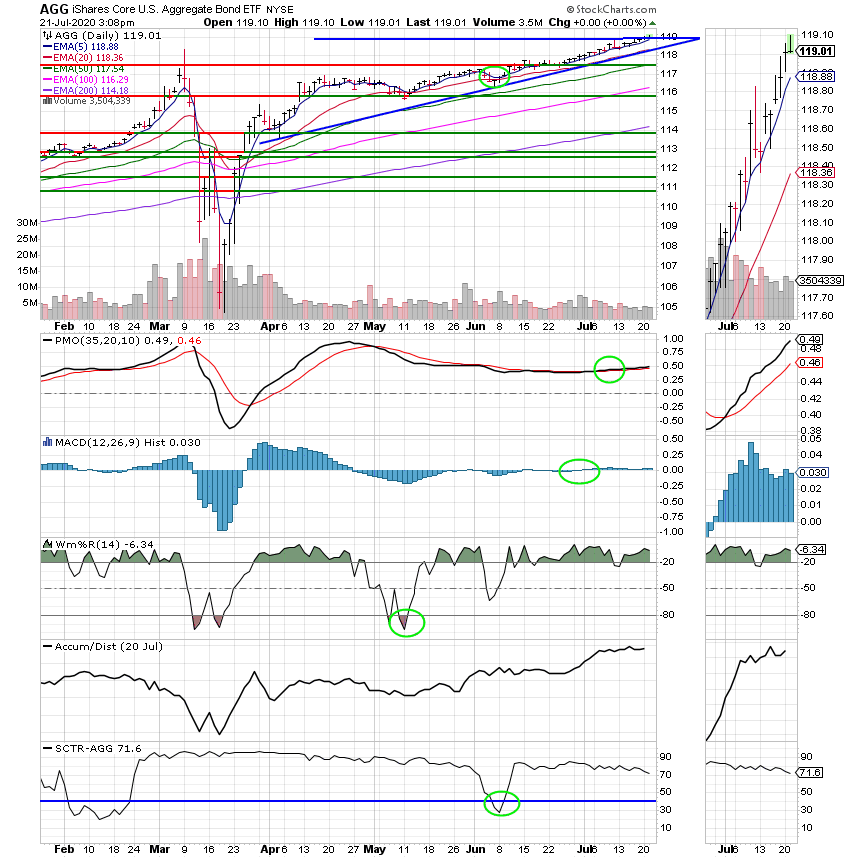

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Buy. We are currently invested at 100/S. Our allocation is now +20.04% on the year not including the days results. Here are the latest posted results:

| 07/20/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.4535 | 21.1016 | 48.0466 | 55.712 | 30.4498 |

| $ Change | 0.0010 | 0.0233 | 0.4013 | 0.4160 | 0.1639 |

| % Change day | +0.01% | +0.11% | +0.84% | +0.75% | +0.54% |

| % Change week | +0.01% | +0.11% | +0.84% | +0.75% | +0.54% |

| % Change month | +0.04% | +0.88% | +4.97% | +5.14% | +4.67% |

| % Change year | +0.63% | +7.02% | +1.66% | -1.00% | -6.93% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 21.3779 | 10.2329 | 34.8924 | 10.3066 | 38.3556 |

| $ Change | 0.0364 | 0.0380 | 0.1548 | 0.0500 | 0.2020 |

| % Change day | +0.17% | +0.37% | +0.45% | +0.49% | +0.53% |

| % Change week | +0.17% | +0.37% | +0.45% | +0.49% | +0.53% |

| % Change month | +1.14% | +2.33% | +3.00% | +3.07% | +3.57% |

| % Change year | +0.91% | +2.33% | +0.11% | +3.07% | +-0.19% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 10.3569 | 22.3647 | 10.4519 | 10.452 | 10.4522 |

| $ Change | 0.0583 | 0.1336 | 0.0743 | 0.0743 | 0.0744 |

| % Change day | +0.57% | +0.60% | +0.72% | +0.72% | +0.72% |

| % Change week | +0.57% | +0.60% | +0.72% | +0.72% | +0.72% |

| % Change month | +3.57% | +4.07% | +4.52% | +4.52% | +4.52% |

| % Change year | +3.57% | -0.53% | +4.52% | +4.52% | +4.52 |