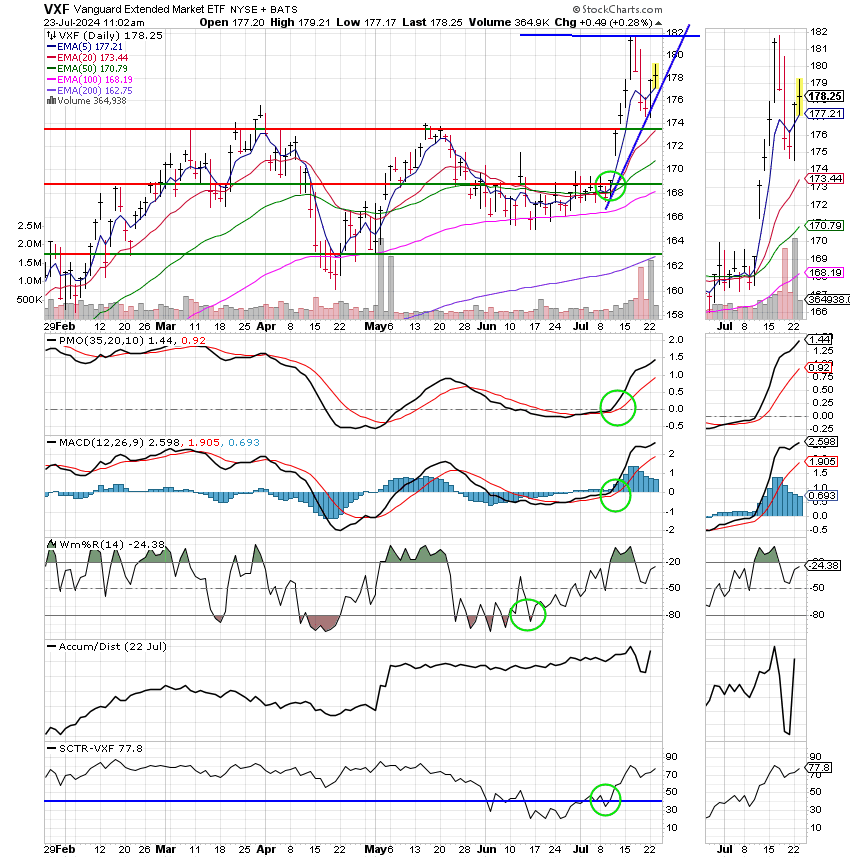

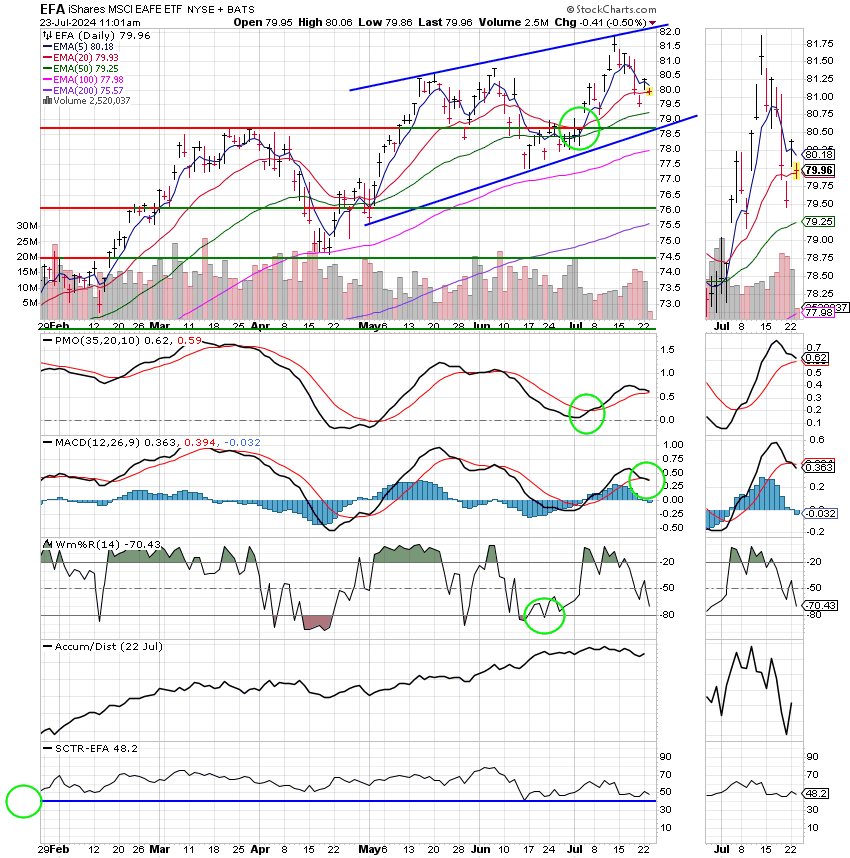

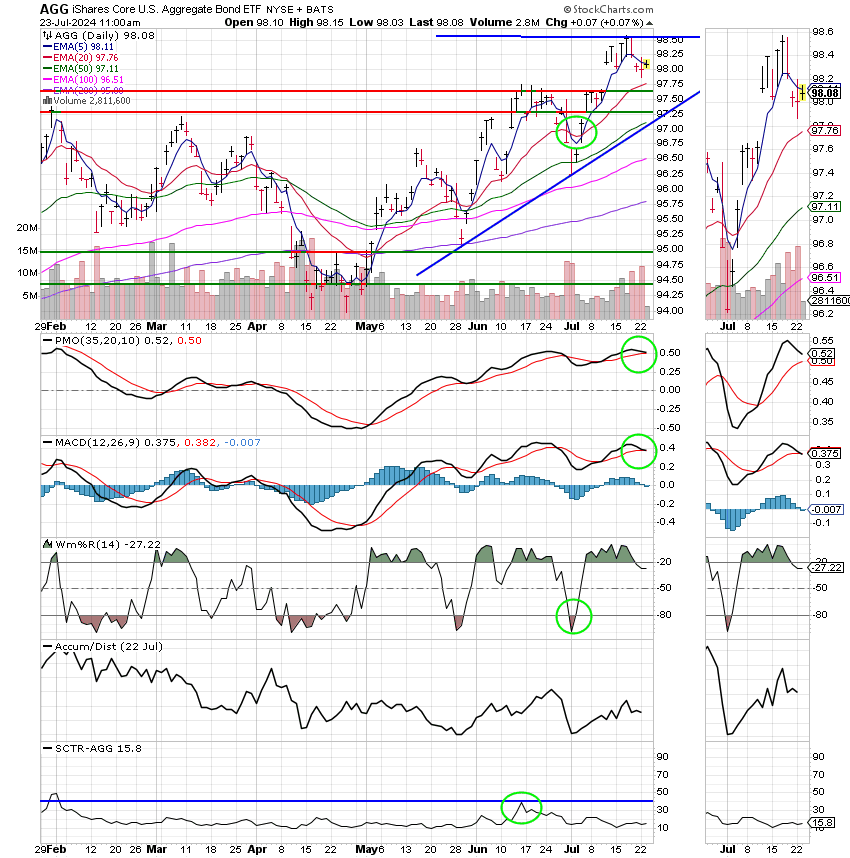

Good Day, Last week ended up on a bit of a sour note but really that’s to be expected after such an intense run. A great majority of traders were sitting on some really nice profits in mega cap tech stocks and decided to take some profits once they realized that there was indeed a rotation out tech into rate sensitive small and mid cap stocks. So…mega cap stocks rose again yesterday, the rotation is over right? Scott when are you going back to our beloved C fund?? Those are questions I had. Well I know this is the answer I always give, but I will move when the charts tell me to move! The rotation that started about two weeks ago has in fact not ended. We look at three time frames when assessing the market Short , intermediate, and of course long. Our primary interest here is the intermediate to long term time frame. For the past twenty plus years we keyed in on the short term time frame but it got to the point where the market makers were manipulating that so much that we were getting beat pretty bad. That cumulated in the new system we are running now. I’m not really going into that again other than to say that is the reason we are focusing on the intermediate and long term time frames. Market manipulation made it hard if not impossible to execute our market strategy using a short term outlook. So we decided to concede the short term gains to the day traders and primarily follow the longer term trends. Which brings me back full circle to where I started. As I said, there are three frames of focus in the market and this week they are different. This week the short term traders are focusing on tech earnings with some of the big boys on tap to report. For instance Alphabet (the parent of google) and Tesla are rep0rting after the closing bell. Their goal is to make some quick gains off what should be positive reports from these tech giants. So did they abandon the rotation into rate sensitive stocks? Absolutely not! They have the ability to move quickly and make some quick gains and they are doing so. They pumped the tech trade up just long enough to enhance their performance and when they are done they will continue buying small and midcaps with the profits. In other words the rotation from large caps into small and midcaps is not over. If you get out now you’ll likely be caught holding the bag. As I said before, the market will not remain bifurcated for forever. This rotation is just the process of equalizing the pressure so to speak. Large caps will not cease to move higher. They will just underperform until small and midcaps which took the past 6 months or so off catch up. Then at that time we’ll have to assess which one is performing the best. Of course you can always invest in portions of each so you’ll be outperforming in one and under performing in the other. That is the most popular strategy, but it can bite you as it did to many folks the past two weeks. Our strategy with the current market remains the same. We will remain in the S Fund as long as our charts tell us we can do so. At the same time we will monitor the other funds for any change in momentum there. We’ll prioritize staying in the trend and then when the time comes and the momentum shifts in large caps we’ll consider possible changes with regard to performance.

The days trading so far has generated the following results: Our TSP allocation is currently in the green at +0.29%. For comparison the D0w is off -0.18%, the Nasdaq is higher at +0.25%, and the S&P 500 is flat at +0.02%.

Stocks are little changed Tuesday as traders await key tech earnings: Live updates

Recent trading has left us with the following signals: C-Hold, S-Buy, I-Hold, F-Hold. We are currently invested at 100/S. Our allocation is now +11.81% on the year not including the days results. Here are the latest posted results:

| 07/22/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.4104 | 19.3239 | 87.4108 | 83.8601 | 43.6302 |

| $ Change | 0.0068 | -0.0084 | 0.9365 | 1.1464 | 0.3579 |

| % Change day | +0.04% | -0.04% | +1.08% | +1.39% | +0.83% |

| % Change week | +0.04% | -0.04% | +1.08% | +1.39% | +0.83% |

| % Change month | +0.27% | +1.17% | +1.97% | +5.32% | +2.58% |

| % Change year | +2.49% | +0.53% | +17.54% | +8.77% | +8.58% |