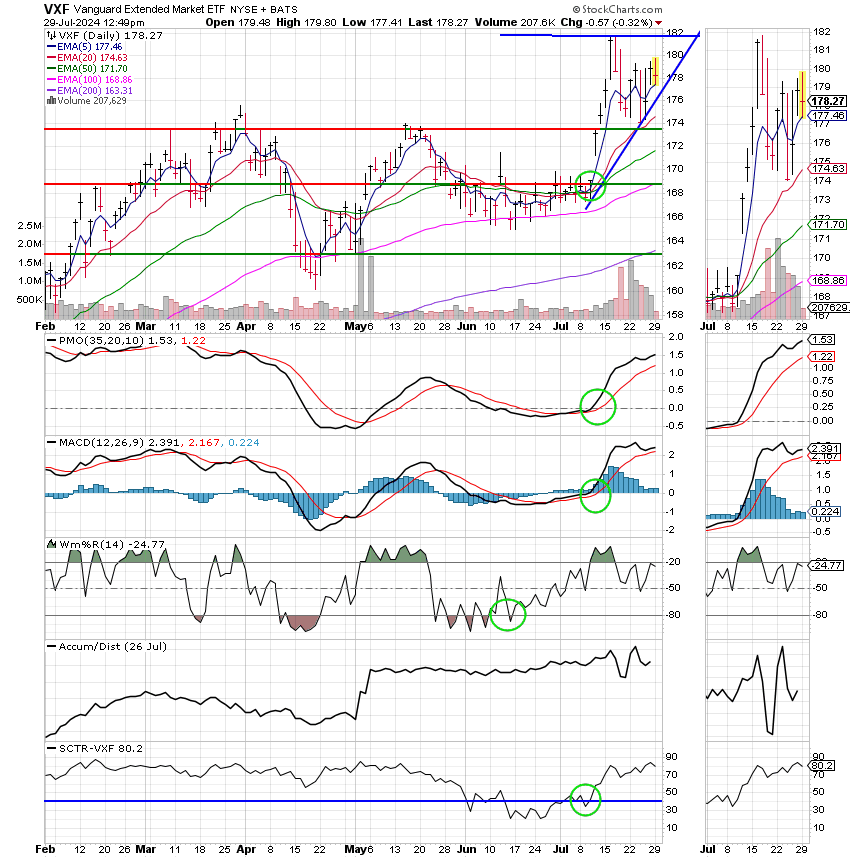

Good Morning, What else can I say? Our system is allowing us to see clearly once again and our market strategy is doing what it has always done. That is why we follow the trend. Everyone believes that their way (strategy) is the best way to make money. Most of them have a real ego problem where this is concerned. If you don’t think so then look at all the unkind things that were said about us the past two years while we adjusted to what I will call the modern market. This is a cruel world and their are a lot of jealous people these days. Honestly, we have always said here that there are different ways to make money. Some of them make more and some of them make less. Some of them are consistent and some of them are volatile. That is the nature of the game. They all require a system to execute their varying strategies. That is with the exception of the buy and hold strategy. That is the reason so many folks use it. It requires no system, no skill, and no effort, but make no mistake it is a viable strategy. It is the one that most folks use because of the fact that it requires no skill and very little time. That said, virtually any market strategy with the right system and a little skill will allow you to best their returns, but that’s not what Wallstreet will tell you. Ever wonder why? I’ll tell you why, because Wallstreet needs money to make money and they don’t have it when it is sitting in cash. They need AUM (Assets under management) that are invested in stocks. So they sell you their story which after all is true. Leave your money invested and you will make money. Yes indeed, you will make money while they make even more than that! To me what they say is a half truth and a half truth is the same thing as a lie. They serve their father and we serve ours… So just by the nature of things folks that use strategies like ours are in conflict with folks that run strategies like theirs. They hate us because our very existence is a threat to their livelihood. As the young folks say just sayin…. I said several weeks earlier that the market would not stay bifurcated and that it had already done so longer than I could ever remember. It had been that way for such a long period that a lot of folks were beginning to believe that was the way it is now. We positioned ourselves in the S Fund and began to wait. Fortunately we didn’t have to wait too long before the mega cap tech stocks that had been leading the market higher for what seemed like forever began to sell off and money began flowing into smaller cap stocks as the market started to equalize. Folks, I said it then and I’ll say it again now. No small group of stocks not matter how big and how good they are will lead the market higher forever. It’s never going to happen. It can’t! You can’t leave 2/3rds of the market behind. It’s not rocket science. It’s just plain common sense. Our market strategy here is to ride the trend. What we did this time is the same thing we did for close to thirty years using the old system. We waited for the trend that we were expecting and invested in mid and small caps (the S Fund) when our new system told us it was time. No crystal ball, nothing special. Those of you that have been with us throughout the years know. It was just a routine transaction conducting with Gods blessing. If we are faithful to seek Him there will be many more. It’s just a matter to staying in the flow of doing the right thing.

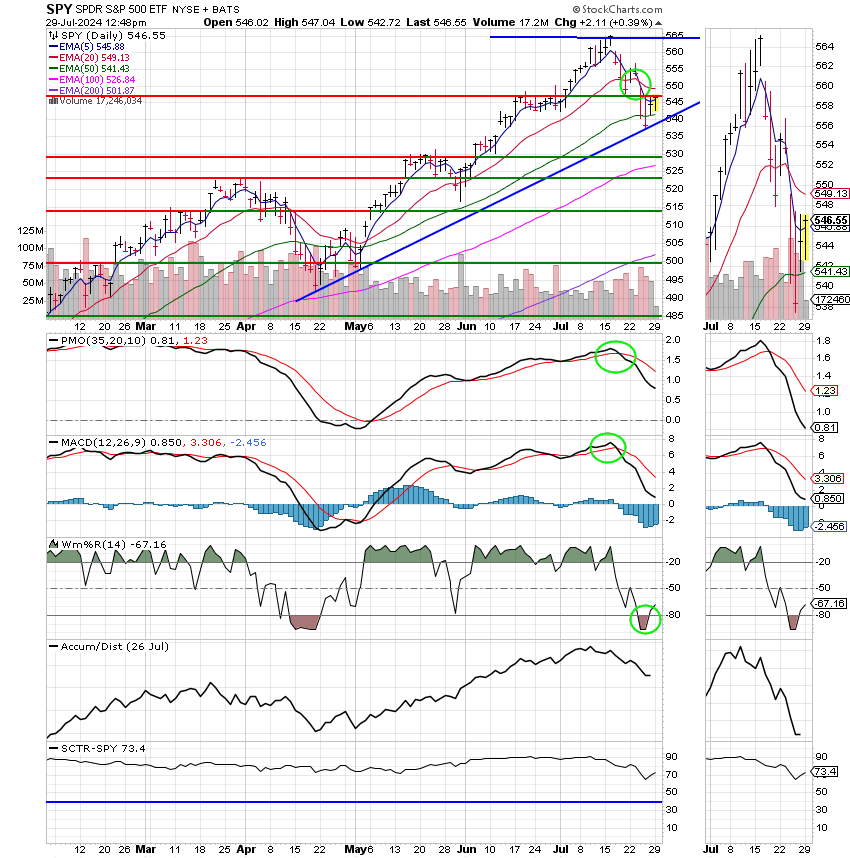

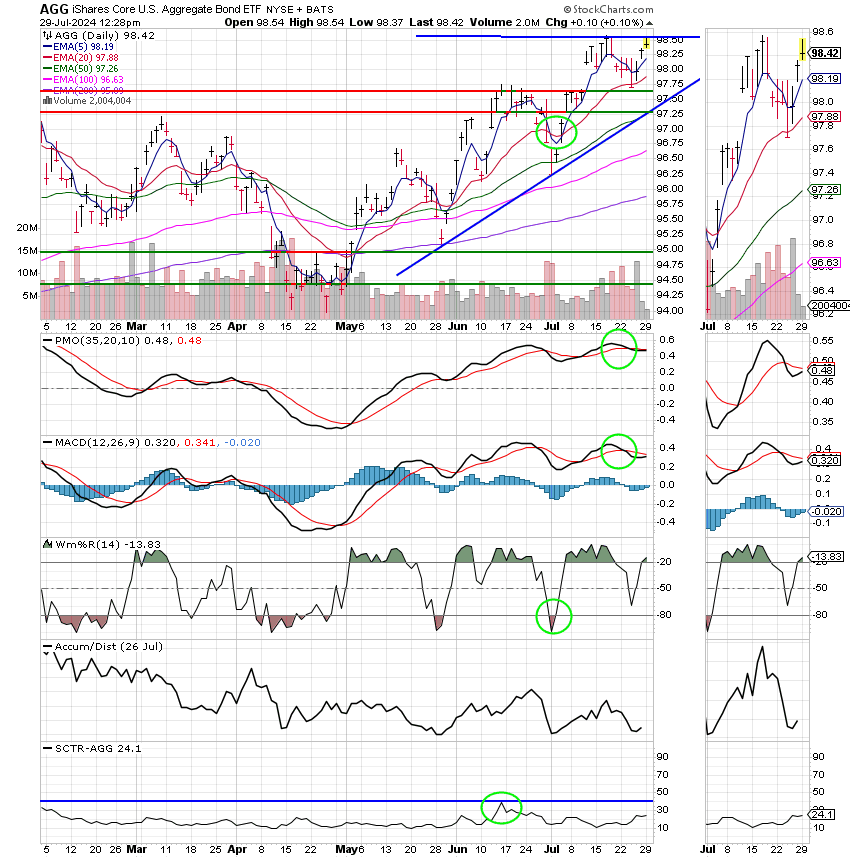

So where are we going in the short term. This week the market is looking forward to additional earnings reports and the Fed meeting which starts tomorrow and ends Wednesday at 2:00 PM eastern time. Investors will be looking for the earnings reports to be just right. They want them to show that the economy is holding up well but not running too hot. Any news falling below are above those expectations could result in some selling. The idea is that the economy will remain goldilocks warm and enable it to come in for a soft landing while the Fed begins to lower interest rates. Now, the elephant in the room, as I mentioned above the Fed meeting will conclude on Wednesday at 2:00 PM. It is widely expected that the Fed will not reduce rates at this meeting. That is pretty much a given. So what investors will be watching closely will be Jerome Powell’s post market remarks and the accompanying Fed statement. They will be looking for clues that will tell them if the Fed will reduce rates in September. Right now the Fed futures are pricing in three rate cuts in September, November, and December. We will see about that, but our main concern now is the September meeting. If the Fed Cuts rates that meeting expect a big rally. If they fail to cut rates expect some strong selling. Each economic and earnings report heading into that meeting will create volatility as market players assess them as to how they will affect the chances for future rate cuts, but for now the trend is moving higher. So you can expect any dips to by bought albeit with the money being allocated back into small and midcaps in expectation of the beginning of rate cuts by the Fed. This is due to the fact that smaller companies borrow more money and therefore are more rate sensitive. Well folks that’s it for not only the next week but for the next month as well. Our task will be to watch our charts and see how it all plays out. Remember, none of us have a crystal ball. Only fortune tellers have those….. whatever happens, we will calmy watch our charts and do what they tell us to do. As I said above routinely……. don’t get faked out!!!!!

Todays trading has generated the following results. Our TSP allotment is trading slightly lower at -0.18%. For comparison, the Dow is somewhat flat at +004%, the Nasdaq is adding +0.55%, and the S&P 500 is up +0.35%.

S&P 500 rises ahead of major tech earnings reports set for later this week: Live updates

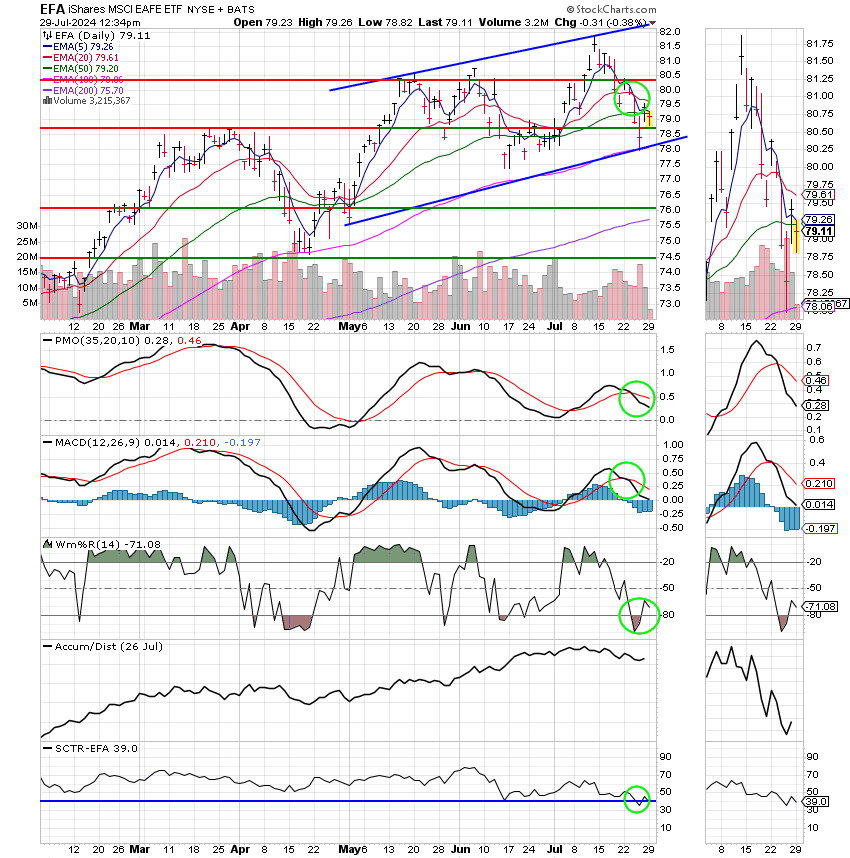

The most recent results have left us with the following signals: C-Sell, S-Buy, I-Sell, F-Buy. We are currently invested at 100/S. Our allocation is now +12.46% on the year not including the days results. Here are the latest posted results:

| 07/26/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.4196 | 19.3847 | 85.7625 | 84.3468 | 43.1191 |

| $ Change | 0.0023 | 0.0717 | 0.9457 | 1.3035 | 0.4442 |

| % Change day | +0.01% | +0.37% | +1.11% | +1.57% | +1.04% |

| % Change week | +0.09% | +0.27% | -0.82% | +1.97% | -0.35% |

| % Change month | +0.32% | +1.48% | +0.04% | +5.93% | +1.38% |

| % Change year | +2.54% | +0.84% | +15.33% | +9.41% | +7.31% |