Good Evening, It appears that a lot of the Greek no vote was already priced in as the market was relatively quiet given the gravity of the news. It could have been a lot worse. However, there may have been some support as the Greek banks are still getting emergency assistance and there are yet more meetings scheduled for tomorrow. This reminds me of a family with teenagers that have gotten in trouble. Everybody knows that they must be disciplined, but they want to get it over with because they have a vacation together scheduled for later this summer. The teenagers (in this case Greece) are complaining (the no vote) about the punishment (Austerity measures). We will see where these new talks take us. I don’t expect a big market recovery as long as there is no agreement. Just more volatility every time there is a new rumor/report about the negotiations. It’s the song that never ends.

The days selling left us with the following results: Our TSP allotment dropped -0.863%. For comparison, the Dow lost -0.26%, the Nasdaq -0.34%, and the S&P 500 -0.39%. It was the I fund that weighed heavily on our Thrift allotment.

The days action left us with the following signals: C-Sell, S-Neutral, I-Sell, F-Neutral. We are currently invested at 30/C, 40/S, 30/I. Our allocation is now +2.70% not including the day’s results. Here are the latest posted results:

| FUND |

G |

F |

C |

S |

I |

|

| JUL 02 CLOSE |

$14.7581 |

$16.7740 |

$27.6980 |

$38.1032 |

$25.9962 |

|

| DAILY CHANGE |

0.0009 |

0.0300 |

-0.0087 |

-0.1192 |

0.0087 |

|

| THIS MONTH (%) |

0.01 |

-0.22 |

0.69 |

0.01 |

0.77 |

|

| FUND |

L 2050 |

L 2040 |

L 2030 |

L 2020 |

L Income |

|

| JUL 02 CLOSE |

$15.5139 |

$27.2594 |

$25.5548 |

$23.4820 |

$17.7133 |

|

| DAILY CHANGE |

-0.0079 |

-0.0116 |

-0.0074 |

-0.0036 |

0.0007 |

|

| THIS MONTH (%) |

0.48 |

0.42 |

0.37 |

0.3 |

0.12 |

|

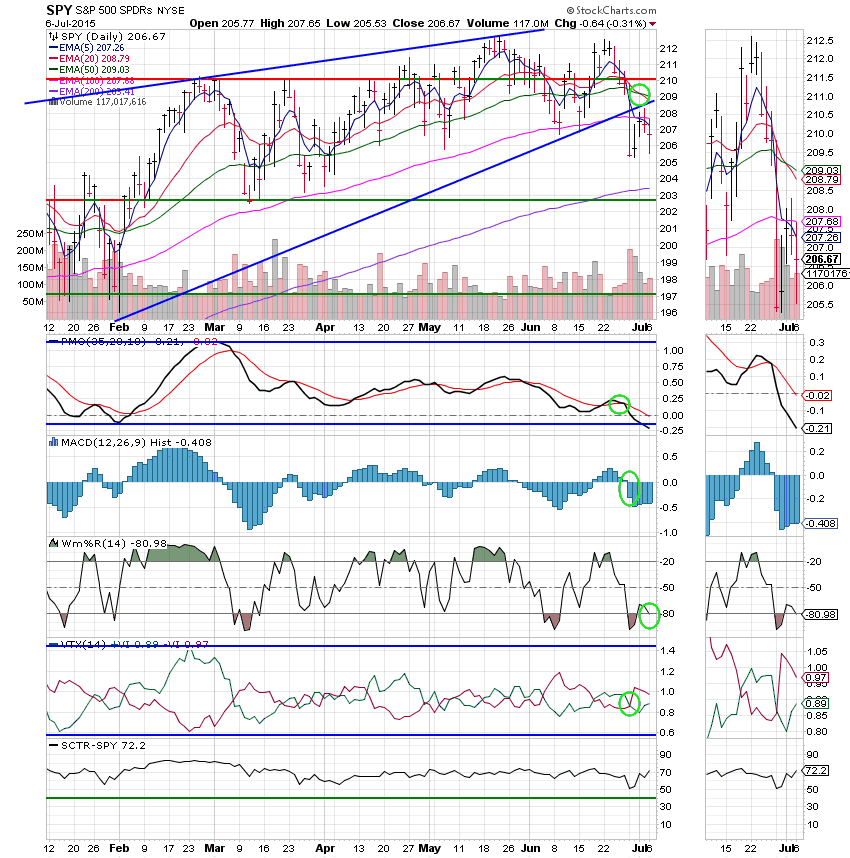

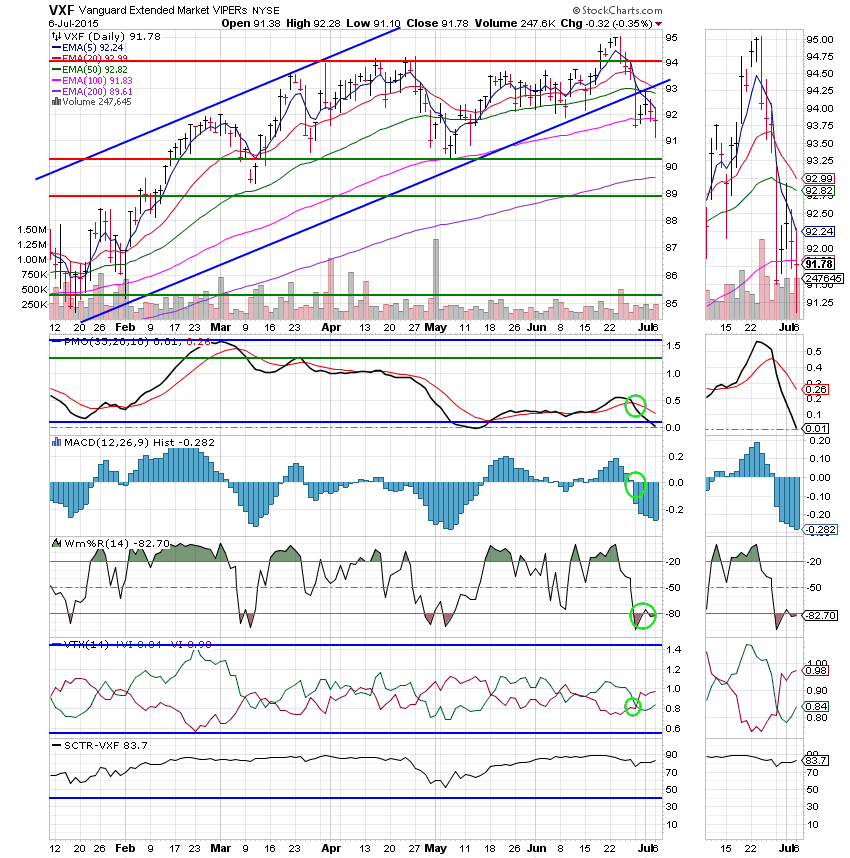

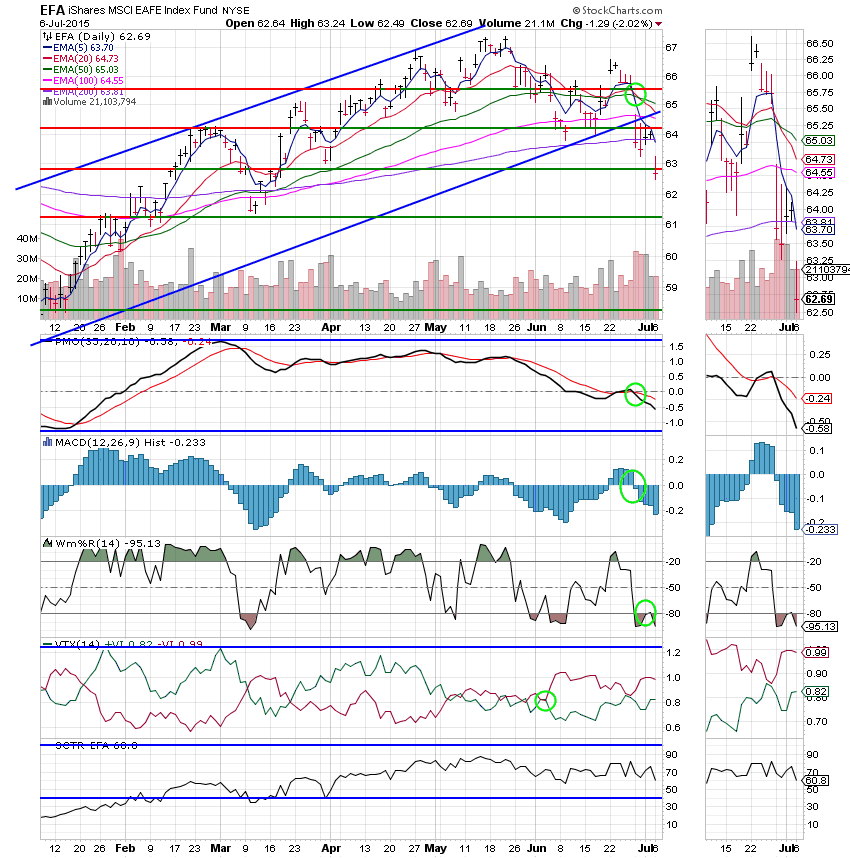

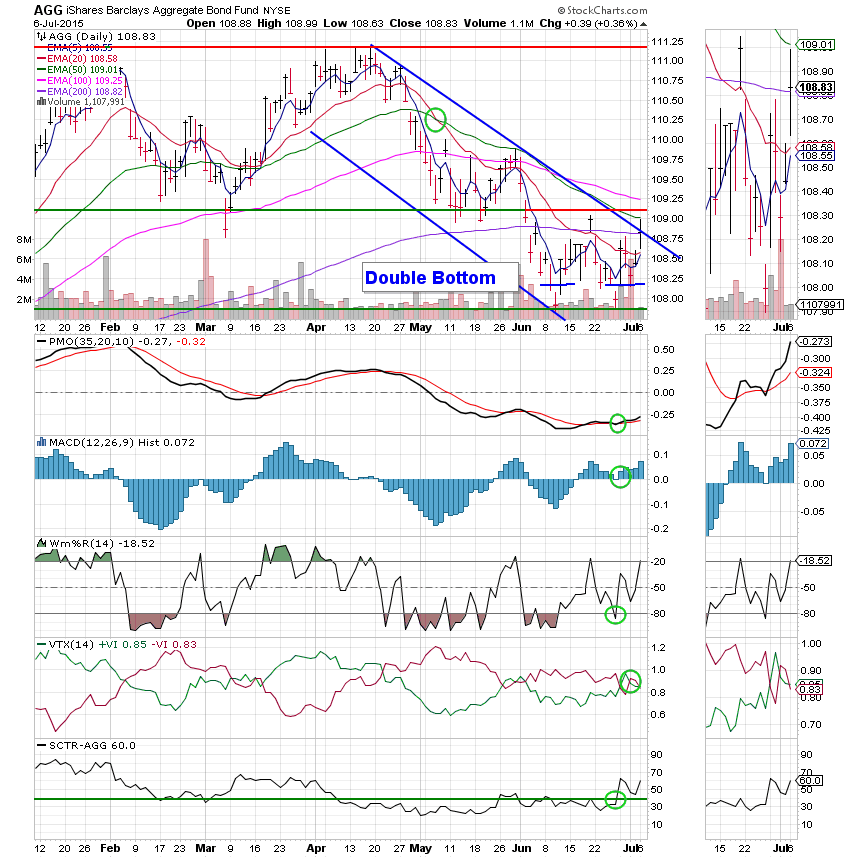

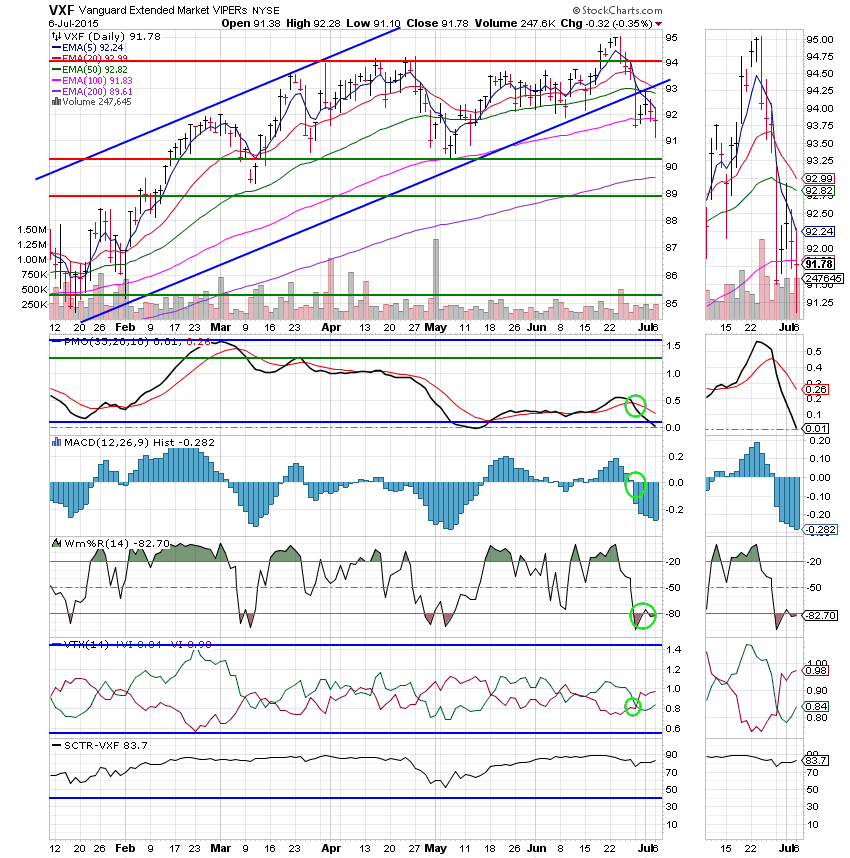

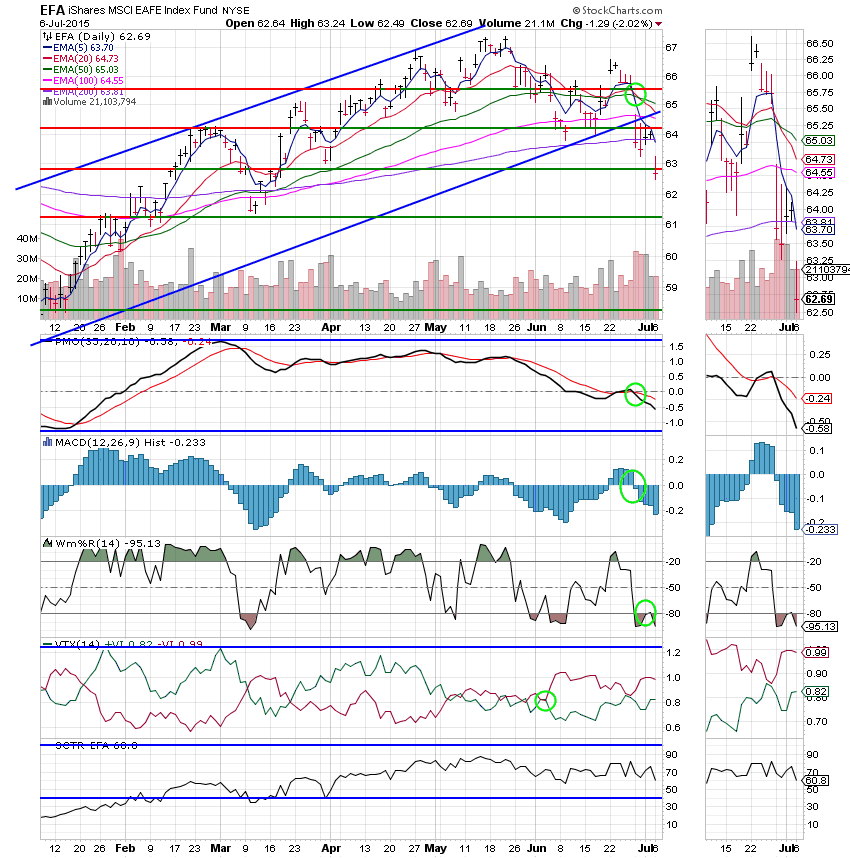

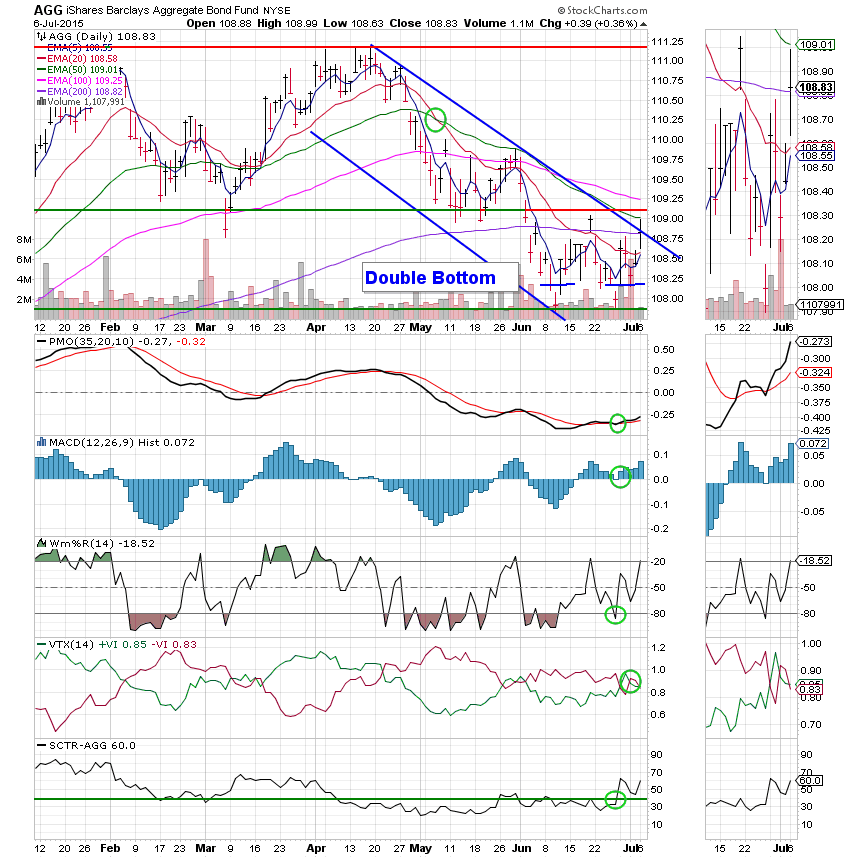

Lets take a look at the charts. (All signals annotated with Green Circles)

C Fund: The C Fund generated a sell signal today when the Williams %R moved into a negative configuration. That put Price, the PMO, MAC D, Wms%R, and the SCTR all negative configurations which generated the overall sell signal.

S Fund: Price again finished right at the 100 EMA which seems to be acting as resistance. It is currently the only one of our indicators that is not in a negative configuration as the 20 EMA is still over the 50 EMA. However, if price fails to move back above the 50 EMA it will ultimately pull the 20 EMA down through the 50 EMA and barring a change in the other indicators will generate a sell signal. We are watching this small cap/ mid cap blend closely. Should it move to a sell we will honor all the sell signals in our equity based funds. We are doing this in an effort to avoid a whipsaw signal. That is to say, a chart that immediately changes directions after just generating a new signal.

I Fund: The I Fund continues to deteriorate after generating a sell signal. Price finished below support at close to 62.80. If this one does not improve in the coming days we will honor the sell signal. I have been waiting to see which direction small caps go before selling this position. Small caps have almost been like an indicator in themselves as they have been the first stocks to lead us up when the market has changed directions. As I have stated, given the abundance of recent whipsaw signals, I am making every effort possible to keep from leaning the wrong way. By all means if you are uncomfortable with that strategy sell your position in the I Fund.,

F Fund: Price moved back up above the 200 EMA today. I have identified a double bottom which indicates that this Fund may well be starting back up. This strength does not bode well for stocks. We will keep a close eye on bonds! The only negative that I can take away from today’s chart is that the VTX whipsawed back into a bearish reading. That said, the VTX has been in a tight trading range and could quickly turn bullish again. I do not use the VTX as one of my main indicators. I use it more to confirm the signals that I am getting in the PMO and MAC D. I added it to our charts last year in an effort to battle all those blasted V shaped reversals. That said, it’s a clear cut indicator in that it’s either bullish are bearish. Right now it is reflecting the overall indecision that exists in bonds….

OK, where do we go from here? It’s about as clear as mud, isn’t it? We have the EU that’s meeting again with the Greek Government tomorrow. We have the Greek Prime Minister still talking to Angela Merkle of Germany. We have the EU still providing emergency funding to keep Greek banks open. My point is that this is a news driven market. One good piece of news from the above mentioned items or anything else related to Greece and those who took an early defensive posture will find themselves leaning the wrong way. That is the reason I am taking the full measure to prevent an early sell. This is a volatile market and subject to a whipsaw at any moment based on current news. My plan is to keep a close eye on small caps. And what did they do today? The IWM (Russell 2000) was only off -0.03%. That hardly gives me the confidence to go to cash. We will sell or not sell depending on what small caps do. That’s all for tonight. I will try to put out a news letter every night, but my earthly father is in the hospital and is in pretty bad shape. So if my blogs are short you will know why. I covet your prayers for him. He is 84 years old and is a retired Marine officer. May God continue to bless your trades!

God bless, Scott

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.