Good Evening, The market started with a somewhat strong snap back rally, but I wasn’t impressed. Even at it’s best, it only gained back about 60% of what was given up yesterday. Of course, it was unable to even hold those gains. That’s hardly enough to inspire confidence in equities! The poor close made me glad that I’m not stocks. In my portfolio on the street, I nearly nearly matched the gain of the S&P 500 with only 17% of my cash invested! Right now it’s all about the next news report. Traders just aren’t willing to go long in this type of environment. Thus, the afternoon fade. There’s just too much risk in holding stocks overnight until we put China and Greece in our rear view mirror. Also, if I had to make a prediction about tomorrow, I’d say that we’ll have a bad close as well. More than likely traders will be unwilling to bet on Greece by holding over the weekend. The next (and I use that term loosely) Greek decision should be made on Sunday. Should a deal be struck, the market will assuredly gap up on Monday. That said, it would be lucrative to be in equities on Monday if that is the case. You know what I say? It’s also quite lucrative when all those little pictures of fruit line up on a slot machine………. Remember, it’s not what you make that’s important, it’s what you keep! That’s our motto here. If there’s a viable long term trend starting, then we’ll have a long period to get invested. We’re not day traders here. That’s not what we do!

The days trading left us with the following results: Our TSP allotment fell back -0.37% as money flowed back to stocks for a day. However, a day does not make or break a trend. Eventually, this market will break one way or the other and when it does we’ll go with it. For comparison, the Dow moved up +0.19%, the Nasdaq +0.26%, and the S&P 500 +0.23%. Bonds and stocks are often like this. It’s rare that they move in the same direction as they did last year. We’ll see were this all takes us. I thank God that we are still maintaining a gain on the year!

China relief fuels Wall St. gains; Apple drops

The days action left us with the following signals: C-Sell, S-Sell, I-Sell, F-Neutral. We are currently invested at 100/F. Our allocation is now +1.74% on the year. Here are the latest posted returns.

| 07/09/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7646 | 16.8443 | 27.3681 | 37.6149 | 25.436 |

| $ Change | 0.0009 | -0.0758 | 0.0617 | 0.1194 | 0.5127 |

| % Change day | +0.01% | -0.45% | +0.23% | +0.32% | +2.06% |

| % Change week | +0.04% | +0.42% | -1.19% | -1.28% | -2.15% |

| % Change month | +0.06% | +0.20% | -0.51% | -1.27% | -1.40% |

| % Change year | +1.01% | +0.25% | +0.75% | +3.63% | +5.03% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.6723 | 23.3171 | 25.3181 | 26.9675 | 15.322 |

| $ Change | 0.0203 | 0.0857 | 0.1202 | 0.1447 | 0.0978 |

| % Change day | +0.12% | +0.37% | +0.48% | +0.54% | +0.64% |

| % Change week | -0.23% | -0.70% | -0.93% | -1.07% | -1.24% |

| % Change month | -0.11% | -0.41% | -0.56% | -0.66% | -0.77% |

| % Change year | +1.27% | +1.83% | +2.06% | +2.23% | +2.43% |

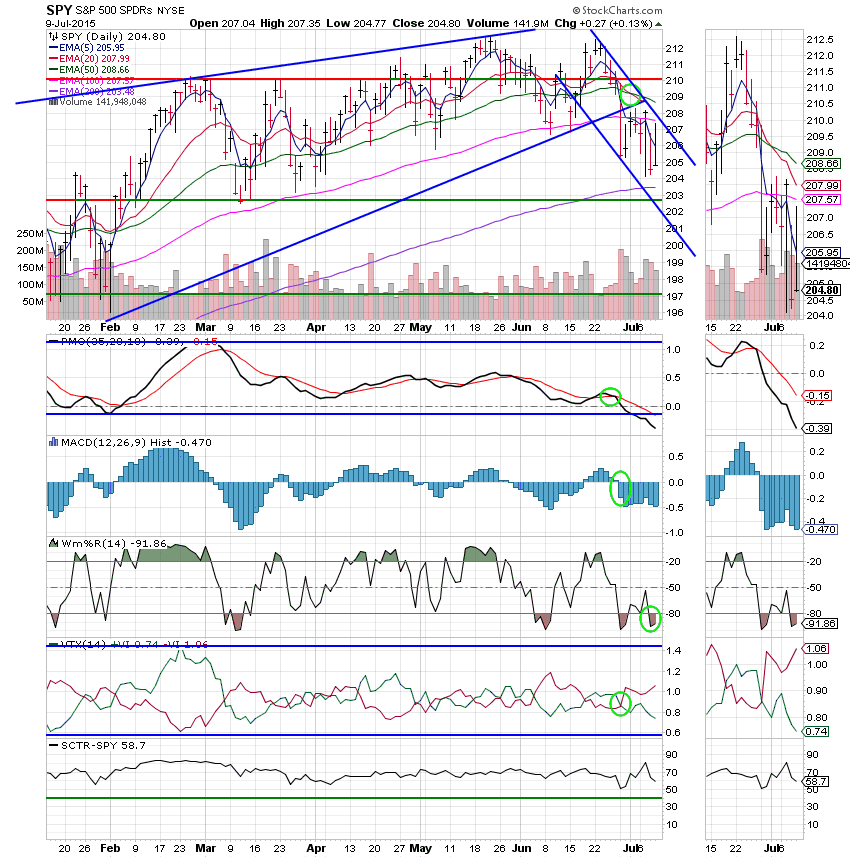

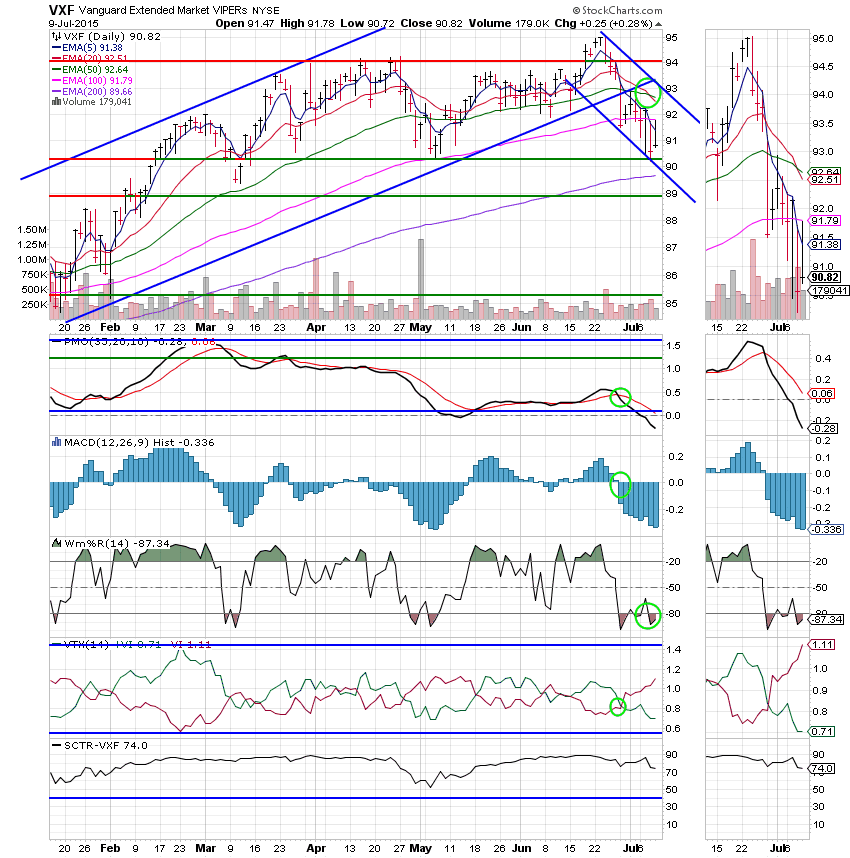

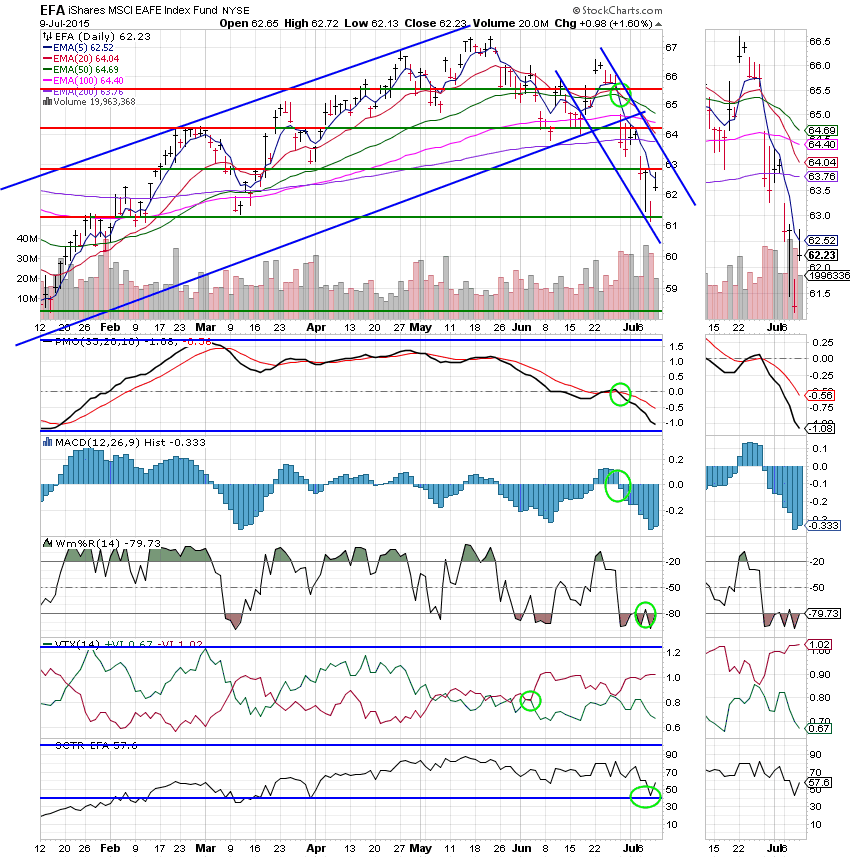

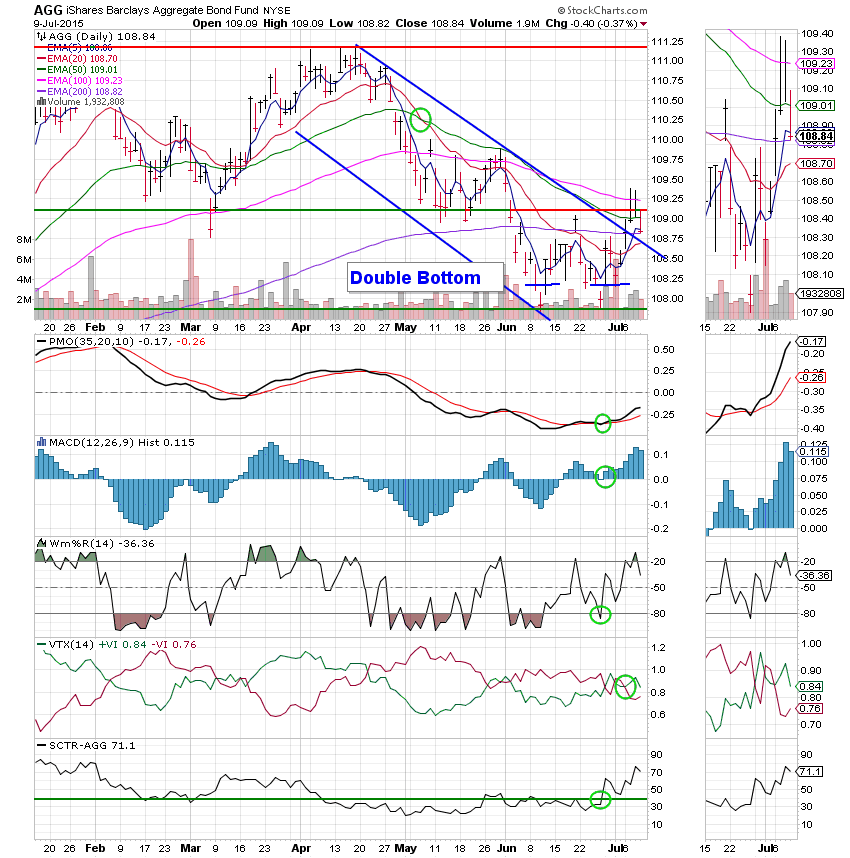

Lets hit the charts. (All signals annotated with Green Circles)

C Fund: This one still has all five indicators in a negative configuration. Although, it did manage a gain today, price still remains well below it’s 100 EMA and in the middle of the newly established descending channel.

S Fund: Ditto the C Fund only add that support at close to 90.20 is holding well for now.

I Fund: European stocks made a nice rebound today on optimism for a Greek deal. However, just as with our other equity based funds, the I Fund still has all five indicators in negative configurations and price remains in the middle of a descending channel. Unlike the others, Price is well below it’s 200 EMA. This fund may be searching for a bottom, but for now I consider it in a down trend.

F Fund: I’m not really sure where thrift came up with -0.45% on the day as the F Fund actually lost -0.37%. Hopefully, this discrepancy will show up in tomorrows results. Today, price fell back below it’s 50 EMA but remains above it’s 100 EMA as well as the upper trend line of the descending channel. I still think this one is heading higher based on the execution of the double bottom. The neckline (not annotated) of the double bottom should now act as support. Today’s action was a result of the rally in stocks. If and when stocks fail, the F Fund will be back in business.

Folks, I look at a lot of charts besides these and right now all of them show the strong possibility for some additional downside. Based on these observations, I expect to see more selling before we find the bottom of this downtrend. If that is the case, bonds will have more good days ahead. That’s all for tonight. Keep praying and God will keep blessing. Have a nice evening!