Good Evening, Well the Dog Days of summer are officially here. It was an absolutely boring day of trading and little ground was gained or lost. While there are exceptions, for the most part this is a typical summer trading day.

Our allotment gained a modest +0.17%. For comparison, the Dow added +0.14%, the Nasdaq lost -0.38%, and the S&P 500 dropped +0.14%.

The days action left us with the following signals: C-Buy, S-Buy, I-Neutral, F-Neutral. We are currently invested at 100/F. While we have buy signals in the C and S Funds, I am not inclined to chase them higher as this point. They are simply too extended. It is of extreme importance to find the proper entry point and that will come after we have a pullback. After all, now that we have the dog days of summer, how long can the major indices continue to set new highs before they take a rest?? We must keep our discipline and avoid the temptation to chase already extended stocks. Its true that the market whipsawed shortly after we moved our money. However, we must not allow that fact to cloud our judgment as we deal with the here and now.

Our allocation is now +1.34% on the year not including the days gains. Here are the latest posted results:

| 07/18/16 |

|

|

|

Prior Prices |

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

15.0654 |

17.8998 |

29.582 |

37.6637 |

23.9177 |

| $ Change |

0.0018 |

0.0080 |

0.0716 |

0.0785 |

0.0378 |

| % Change day |

+0.01% |

+0.04% |

+0.24% |

+0.21% |

+0.16% |

| % Change week |

+0.01% |

+0.04% |

+0.24% |

+0.21% |

+0.16% |

| % Change month |

+0.07% |

+0.07% |

+3.33% |

+4.07% |

+2.80% |

| % Change year |

+1.01% |

+5.57% |

+7.33% |

+6.89% |

-0.74% |

| |

L INC |

L 2020 |

L 2030 |

L 2040 |

L 2050 |

| Price |

18.1619 |

23.9376 |

26.0414 |

27.7052 |

15.704 |

| $ Change |

0.0099 |

0.0244 |

0.0367 |

0.0447 |

0.0283 |

| % Change day |

+0.05% |

+0.10% |

+0.14% |

+0.16% |

+0.18% |

| % Change week |

+0.05% |

+0.10% |

+0.14% |

+0.16% |

+0.18% |

| % Change month |

+0.71% |

+1.49% |

+2.12% |

+2.46% |

+2.79% |

| % Change year |

+2.19% |

+3.14% |

+3.90% |

+4.27% |

+4.51% |

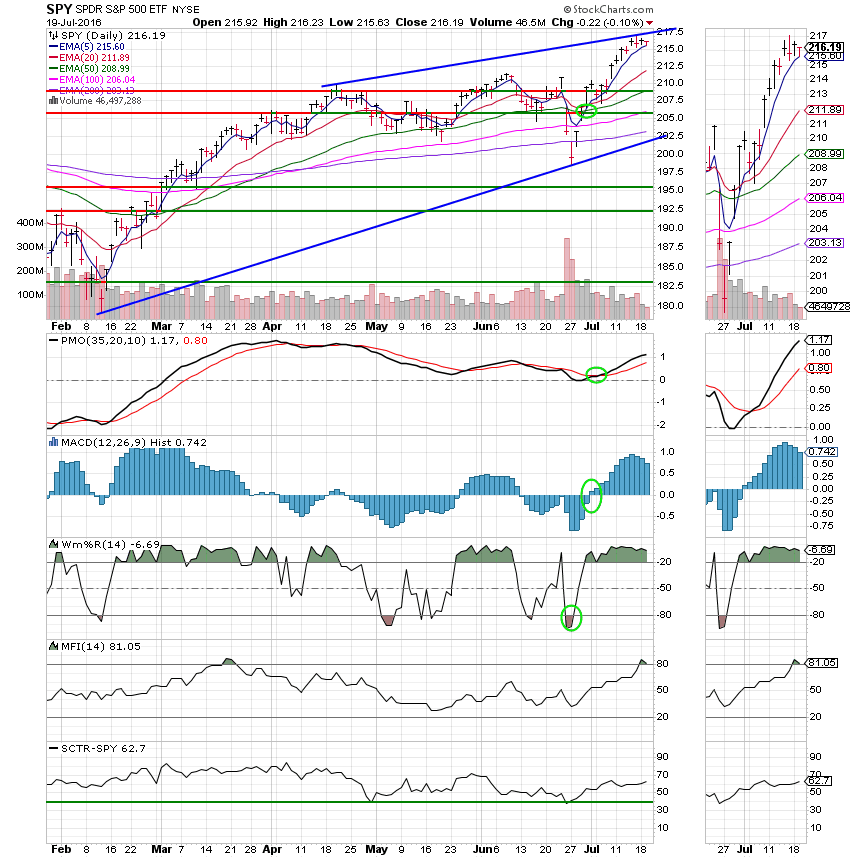

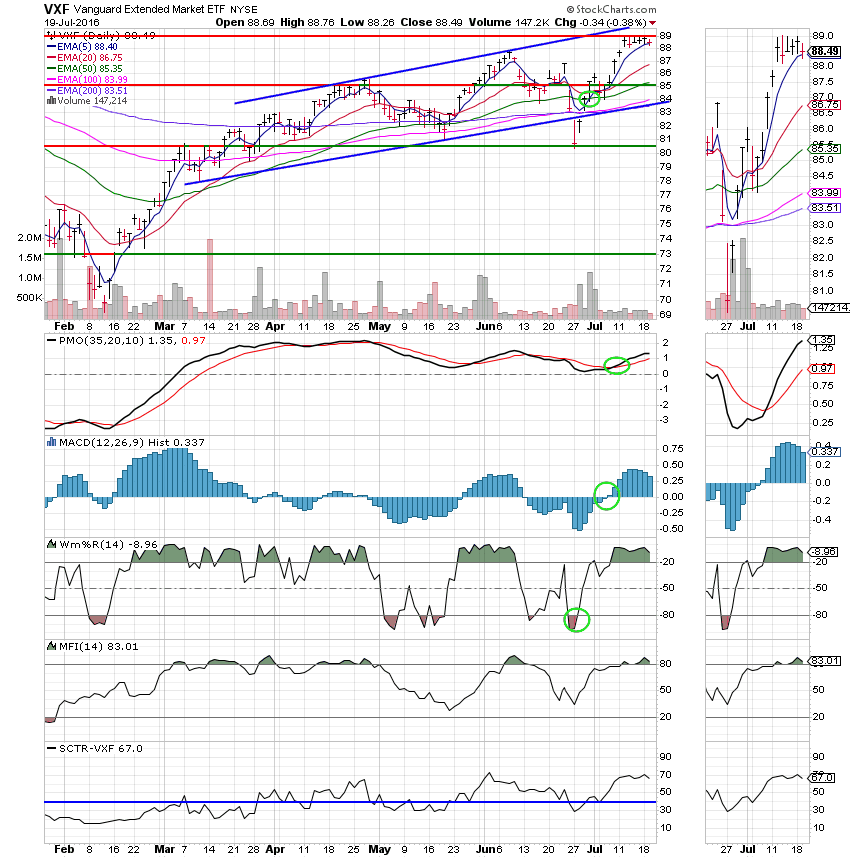

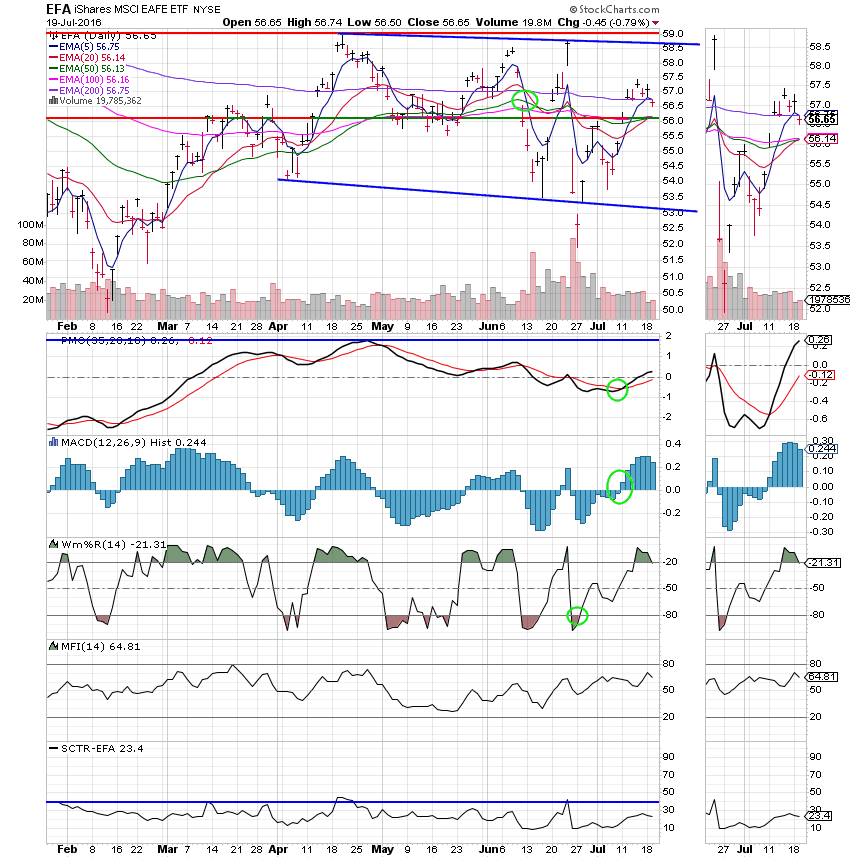

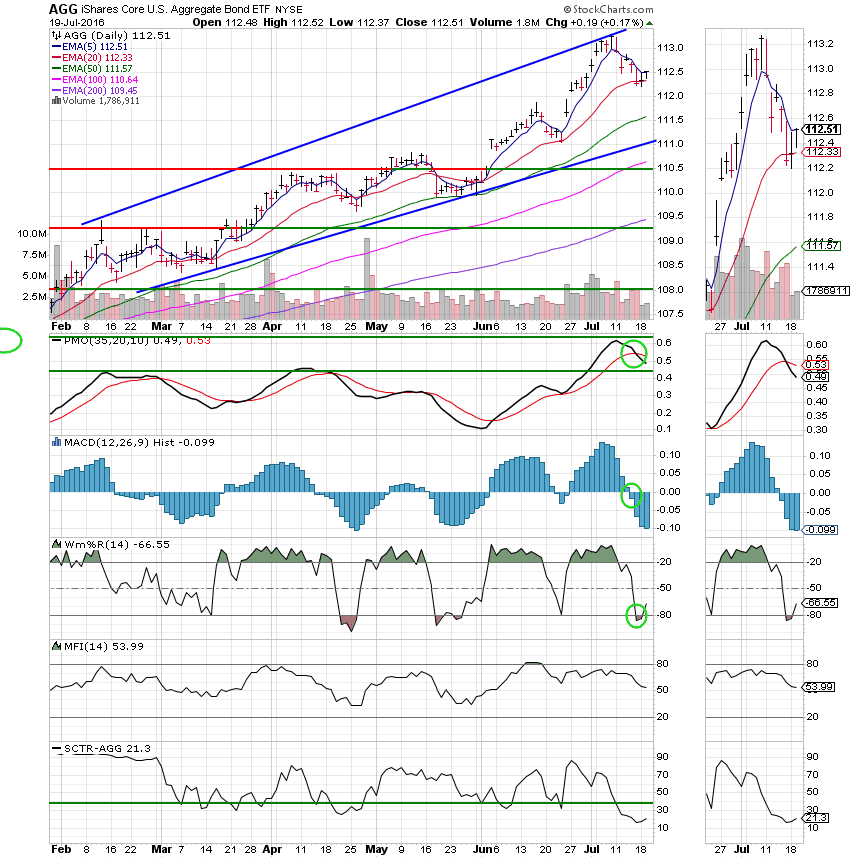

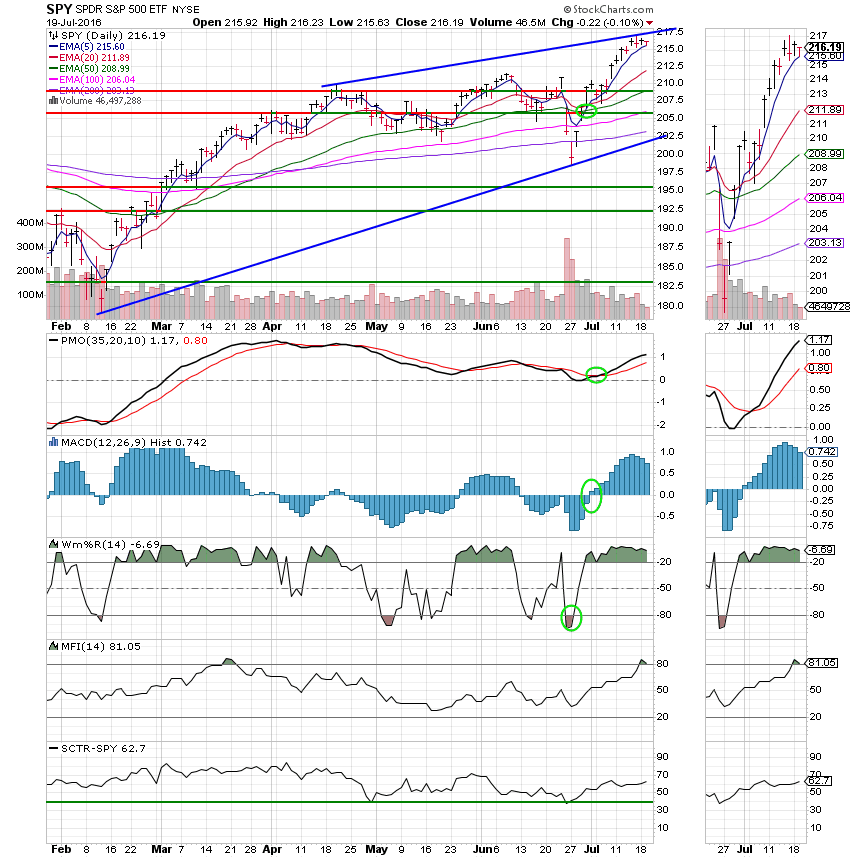

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

I added a new indicator tonight. I thought we might try it out and see how it performs. It is the MFI or Money Flow Index. It basically does the same thing as the CMF does but it seems to be a little more responsive. I reserve that area of my charts to try and get a feel for different indicators. We’ll see how it works!

C Fund: This ones still a buy, but it appears to have encountered resistance in the 216 area. While it has a solid buy signal, it is extended. I would prefer to see it pull back to around 208 before I would consider putting money to work here. The chart remains in an uptrend.

S Fund: As it is most of the time, this chart is pretty much the same deal as the C Fund. It is extended and has encountered resistance at 89. It currently has the best SCTR of any of our TSP funds at 67.0. However, that’s nothing to brag about….

I Fund: The I Fund continues to trade in a wide range which is in a slight downtrend. The 20 EMA did cross back up through the 50 EMA which is slightly bullish. Nonetheless, the I Fund has a lot of work to do before it can generate a buy signal. An SCTR of only 23.4 bears witness to this….

F Fund: The F Fund despite some selling remains on a solid neutral signal due to the large separation between it’s EMA’s. The 5 EMA is still trading above the 20

EMA as price remains in an uptrend that is still in tact after the recent selling. The 20 EMA is currently acting as resistance. We will leave our funds here rather than risk a downturn in an extended stock market.

That’s all for tonight. Be advised that I am only blogging a couple of times a week now due to family responsibilities. I will put out an Alert if there are any changes in our allocation which I monitor on a daily basis. After all, I have money invested as well. Have a great evening and may God continue to bless your trades.

God bless, Scott

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.