Good Evening, A relatively strong dollar is a good thing, but a dollar that’s too strong is not. The dollar continued to rise today resulting in a drop in commodities, namely oil. This put a damper on the market and things finished pretty flat.

The days action left us with the following results: Our TSP allotment eked out a gain at +0.009%. For comparison, the Dow added +0.08%, the Nasdaq +0.17%, and the S&P 500 +0.08%. As I said it was a flat day, but I thank God for the gains.

Nasdaq ekes out another record amid earnings

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Neutral. We are currently invested at 33/C, 33/S, 34/I. Our allocation is now +1.40% on the year not including the days results. Here are the latest posted results:

| 07/17/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7719 | 16.8294 | 28.3778 | 38.5043 | 26.4624 |

| $ Change | 0.0009 | 0.0101 | 0.0315 | -0.1671 | -0.0622 |

| % Change day | +0.01% | +0.06% | +0.11% | -0.43% | -0.23% |

| % Change week | +0.04% | +0.43% | +2.42% | +1.12% | +2.02% |

| % Change month | +0.11% | +0.11% | +3.16% | +1.07% | +2.58% |

| % Change year | +1.06% | +0.16% | +4.46% | +6.08% | +9.27% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.804 | 23.7382 | 25.9037 | 27.6771 | 15.7793 |

| $ Change | -0.0006 | -0.0080 | -0.0138 | -0.0198 | -0.0136 |

| % Change day | +0.00% | -0.03% | -0.05% | -0.07% | -0.09% |

| % Change week | +0.48% | +1.09% | +1.38% | +1.56% | +1.75% |

| % Change month | +0.63% | +1.39% | +1.74% | +1.96% | +2.20% |

| % Change year | +2.02% | +3.67% | +4.42% | +4.92% | +5.49% |

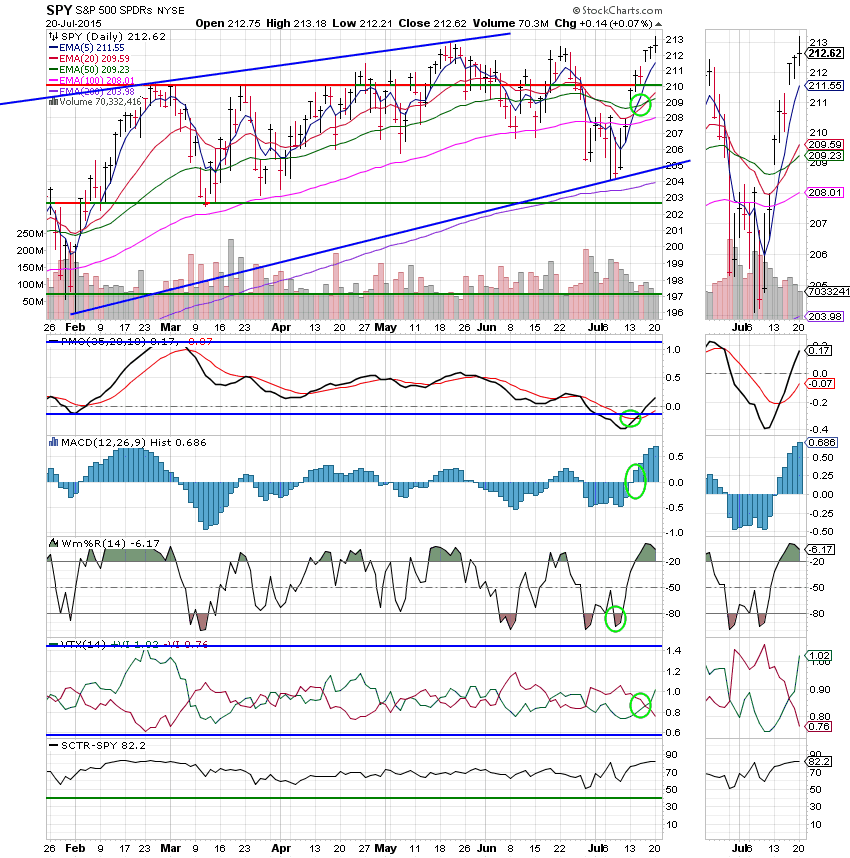

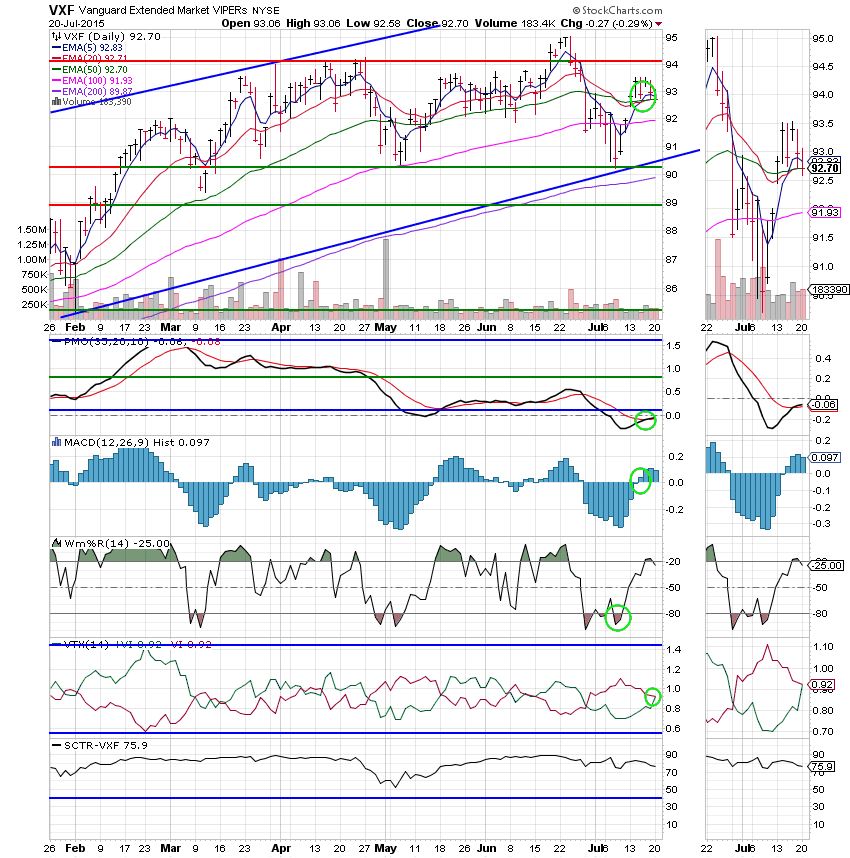

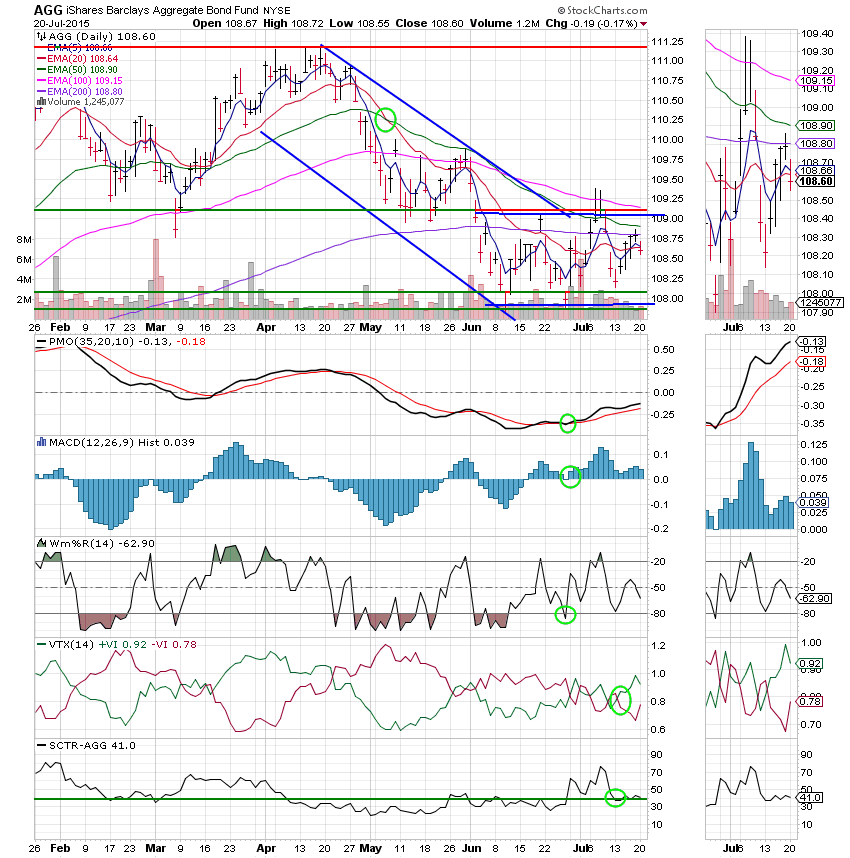

Let’s hit the charts: (All signals annotated with Green Circles)

C Fund: Price managed a small gain so the C Fund rolls on with all five indicators in positive configurations.

S Fund: Price fell back today pulling most of the indicators slightly lower, but not enough to change their signals. Although, it did manage to jumble things up closing right on it’s 50 EMA and pulling the 20 EMA to the same position. It’s hard to tell which way this will go with the jumbled signals. However, the other indicators and the VTX in particular are pointing up. The VTX moved to a bullish signal today.

I Fund: Priced continues to struggle with resistance at 65.60. That said, it has reclaimed the ascending trend line with all other signals in positive configurations. As with the S Fund, the VTX moved to a bullish signal. I would like to see resistance 65.60 breached. That would be a pretty clear signal that we are moving up.

F Fund: Price continues to drift sideways in the same trading range just above support at close to 108.15. This chart remains Neutral with all other indicators in positive configurations. We’ll keep a close eye on that support. The longer the price can stay above it, the more likely it is that it has put in lasting bottom.

There’s not a lot to say at this point. A lot of analysts are saying that we are heading higher in the short term. Overall, I’d have to say that the charts support that call. For now, we’re positioned well for any run that may come. May our Heavenly Father continue to guide our hand. Give Him all the praise for He and He alone is worthy. Have a nice evening!