Good Evening, As we anticipated in yesterday’s blog, the Apple report drove the market lower today. Due to it’s large market cap, so goes apple, so goes the major indices, especially tech! One other factor that we are having to contend with is a dip in earnings for last quarter which are expected to decline 1.5%. Put it all together and we are facing stiff headwinds. It’s just a little harder to make progress right now.

The days trading left us with the following results: Our TSP allotment dropped -0.28%. For comparison, the Dow lost -0.38%, the Nasdaq -0.70%, and the S&P -0.24%.

Wall Street ends lower as tech stocks weigh

The days action left us with the following signals: C-Buy, S-Neutral, I-Neutral, F-Neutral. We are currently invested at 33/C, 33/S, 34/I and are out of trades until August. Our allocation is now +1.10% on the year not including today’s results. Here are the latest posted results:

| 07/21/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7756 | 16.8339 | 28.2807 | 38.188 | 26.5307 |

| $ Change | 0.0009 | 0.0261 | -0.1198 | -0.2129 | 0.0143 |

| % Change day | +0.01% | +0.16% | -0.42% | -0.55% | +0.05% |

| % Change week | +0.03% | +0.03% | -0.34% | -0.82% | +0.26% |

| % Change month | +0.13% | +0.14% | +2.81% | +0.24% | +2.84% |

| % Change year | +1.09% | +0.19% | +4.11% | +5.21% | +9.55% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7982 | 23.7129 | 25.8631 | 27.6216 | 15.7442 |

| $ Change | -0.0090 | -0.0329 | -0.0487 | -0.0627 | -0.0401 |

| % Change day | -0.05% | -0.14% | -0.19% | -0.23% | -0.25% |

| % Change week | -0.03% | -0.11% | -0.16% | -0.20% | -0.22% |

| % Change month | +0.60% | +1.28% | +1.58% | +1.75% | +1.97% |

| % Change year | +1.99% | +3.56% | +4.26% | +4.71% | +5.25% |

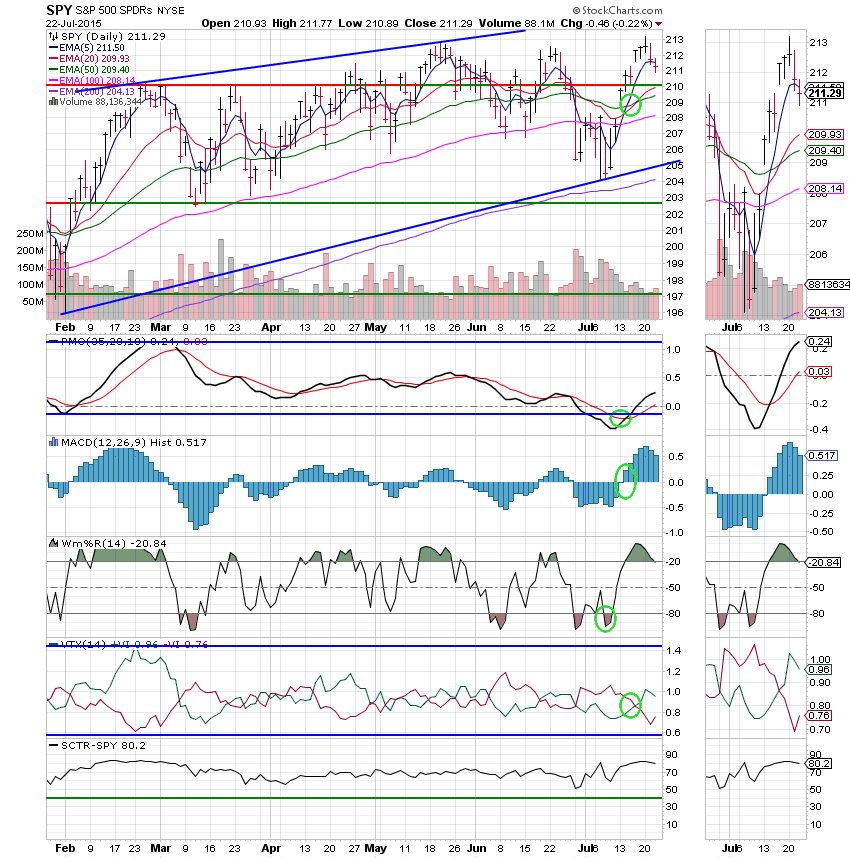

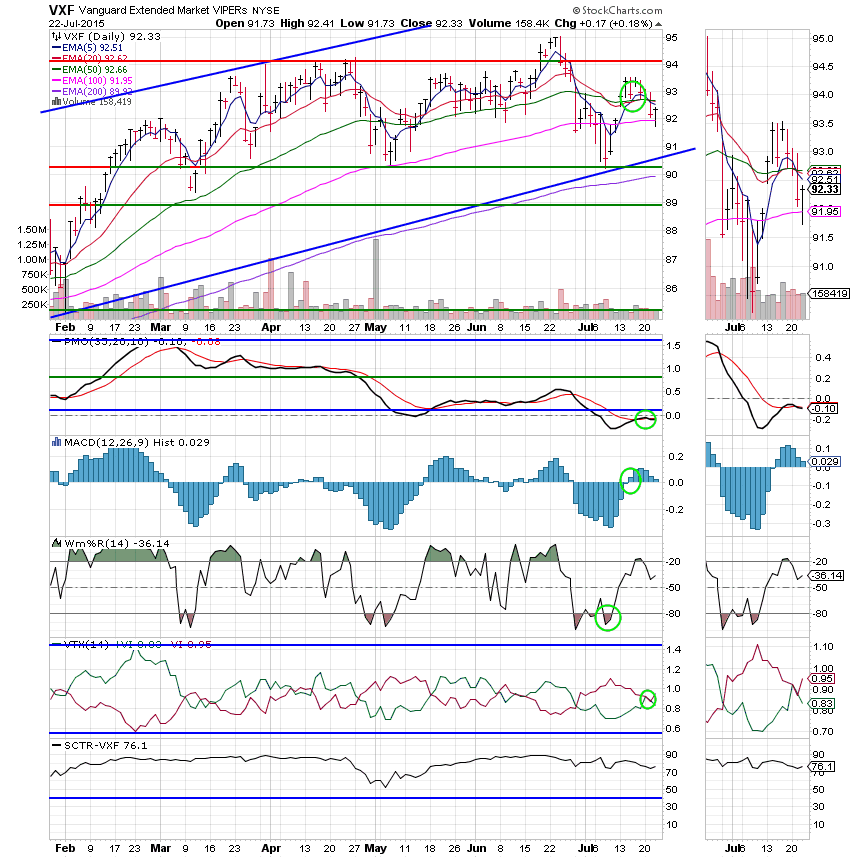

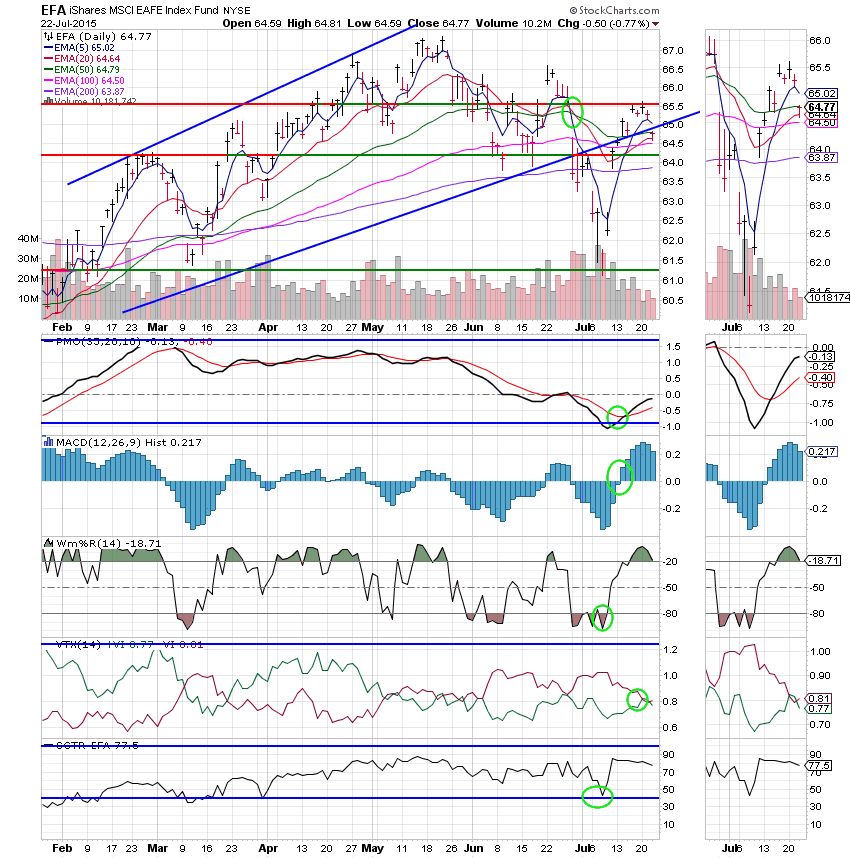

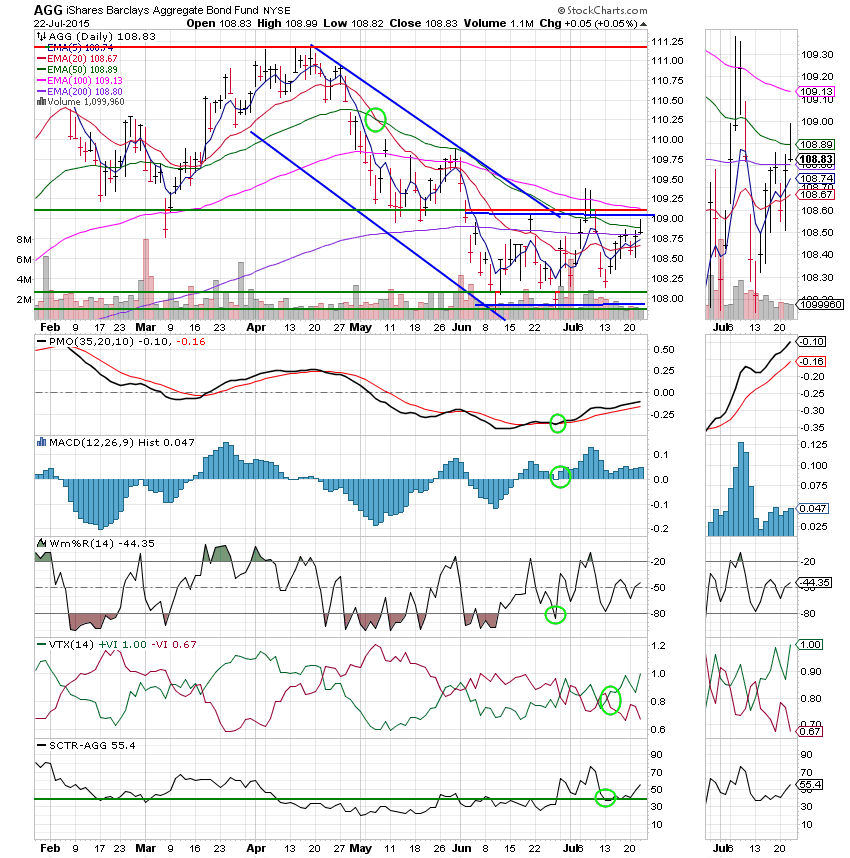

Let’s take a look at the charts: (All signals annotated with Green Circles)

C Fund: Price declined a little more today. However, it is high enough that it is not dragging any of the other indicators down. So this one is still a buy.

S Fund: The 5 and 20 EMA’s passed down through the 50 EMA and the PMO dipped slightly below it’s EMA to generate two negative signals. However, the MAC D and Williams %R are positive. So this one is still neutral. The indicators are not moving strongly, so this chart could easily whipsaw back to a buy signal. Be cautious with these signals!

I Fund: Price dropped back to it’s 50 EMA today, but the PMO, MAC D, and Williams %R remain positive. So this one is still neutral.

F Fund: The F Fund finished the day with a very slight gain. It continues to trade sideways and remains within it’s established trading channel. The 20 EMA may be starting to turn up and the PMO is rising. We’ll keep an eye on this one to see if this momentum can build.

We’ll see if the market can shake off these tech blues tomorrow. Remember, even when it seems like we’re going nowhere, God is still with us. If we are faithful, he has a plan for us. He is for us and not against us and will supply all our needs. That’s all for tonight. See you tomorrow!