Good Evening, Lower oil prices enticed an extended market to take a rest today. No real damage was done with support holding and stocks finishing well off their lows for the day. However, the VIX moved up again leading me to believe there will be some downside in the coming days or weeks. I will add those charts at the bottom so you can see what I’m talking about.

The days trading left us with the following results: Our TSP allotment slipped back -0.12%. For comparison, the Dow lost -0.42%, the Nasdaq -0.05%, and the S&P 500 -0.30%. Not much was working out there today.

Wall St. declines as earnings take center stage

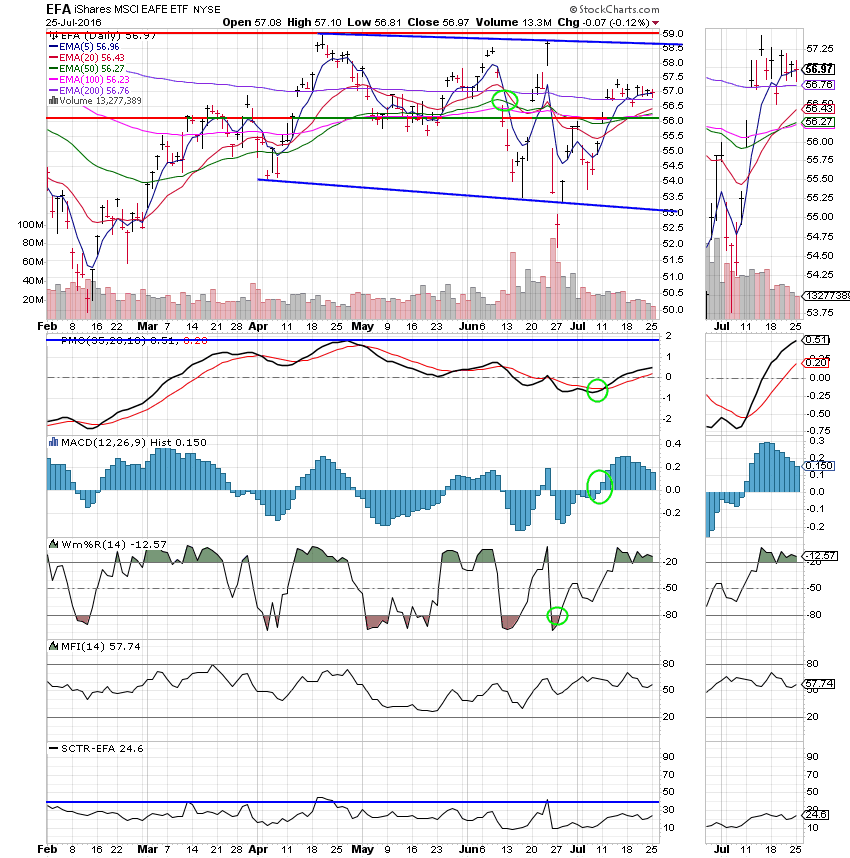

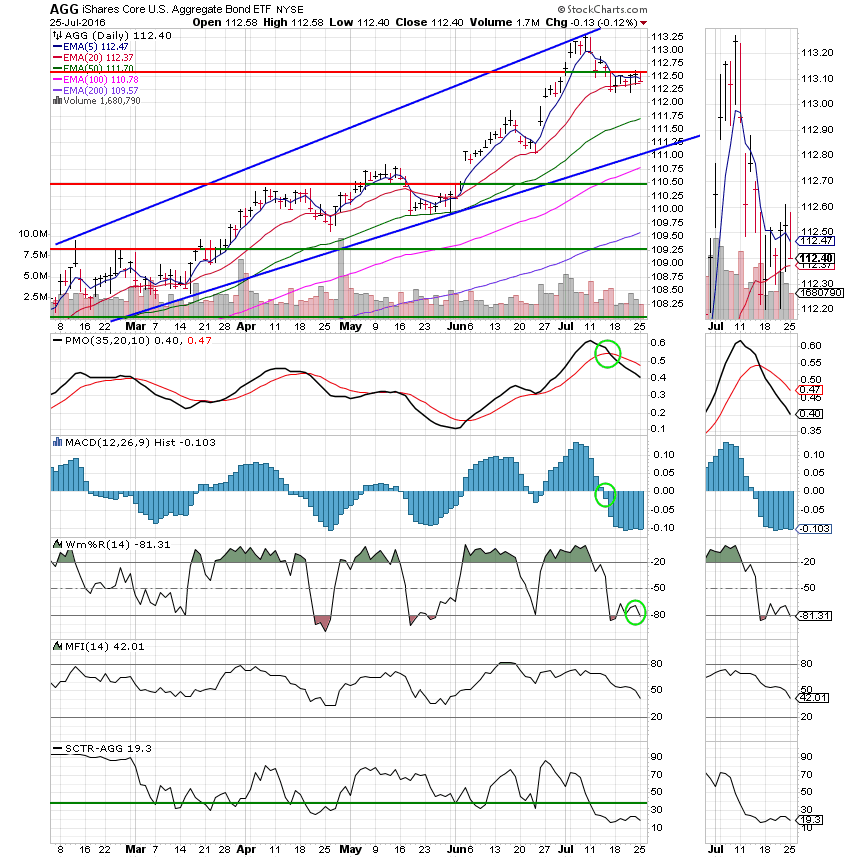

The days action left us with the following signals: C-Buy, S-Buy, I-Neutral, F-Neutral. We are currently invested at 100/F. Our allotment is now +1.42% on the year not including todays results. Here are the latest posted results.

| 07/22/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 15.0679 | 17.9141 | 29.6983 | 37.8974 | 23.8782 |

| $ Change | 0.0006 | -0.0018 | 0.1347 | 0.2483 | -0.1016 |

| % Change day | +0.00% | -0.01% | +0.46% | +0.66% | -0.42% |

| % Change week | +0.03% | +0.12% | +0.64% | +0.83% | -0.01% |

| % Change month | +0.09% | +0.15% | +3.74% | +4.71% | +2.63% |

| % Change year | +1.02% | +5.66% | +7.75% | +7.55% | -0.90% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 18.1742 | 23.9678 | 26.0869 | 27.7612 | 15.7398 |

| $ Change | 0.0084 | 0.0236 | 0.0369 | 0.0461 | 0.0299 |

| % Change day | +0.05% | +0.10% | +0.14% | +0.17% | +0.19% |

| % Change week | +0.12% | +0.23% | +0.32% | +0.36% | +0.41% |

| % Change month | +0.78% | +1.62% | +2.30% | +2.67% | +3.02% |

| % Change year | +2.26% | +3.27% | +4.08% | +4.48% | +4.75% |

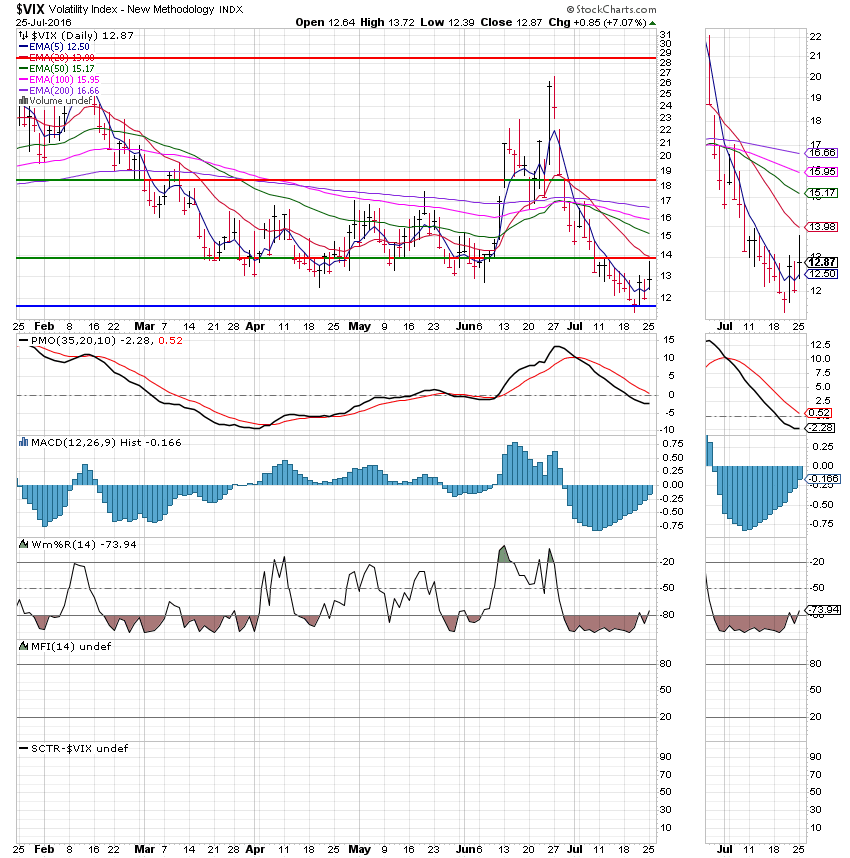

VIX: Here is the volatility index. Note the sizeable spikes two out of the last three days.

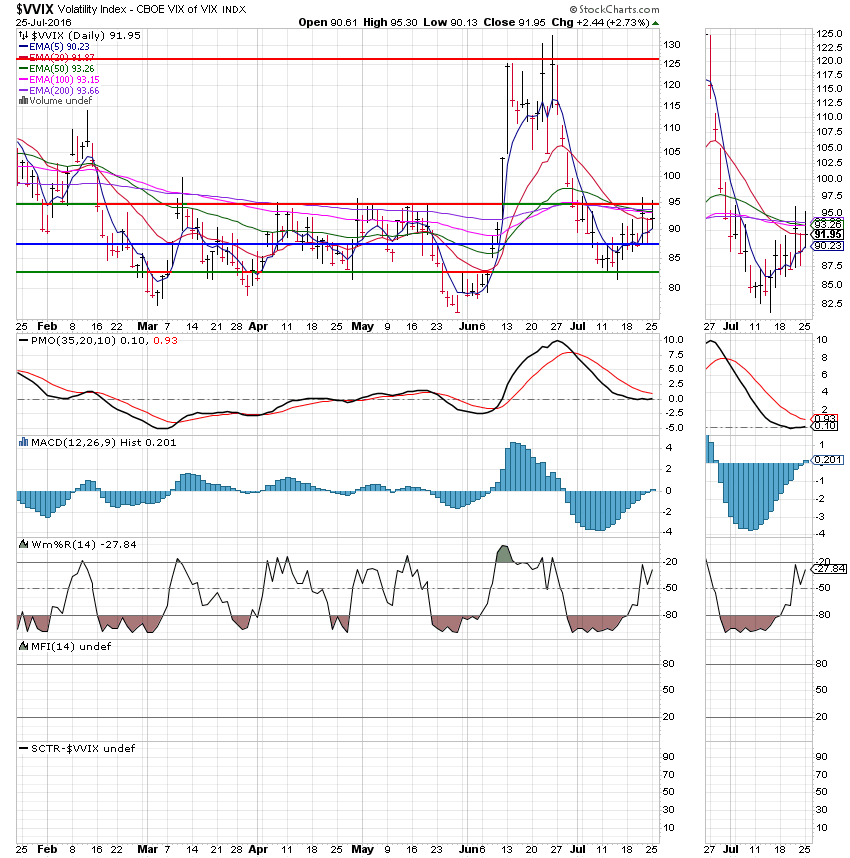

The VVIX: This is a measure of the volatility of the volatility index. Laugh if you will, but it is often the earliest indicator when the market changes direction. As you can see it is definitely moving up spiking two out of the last three days.

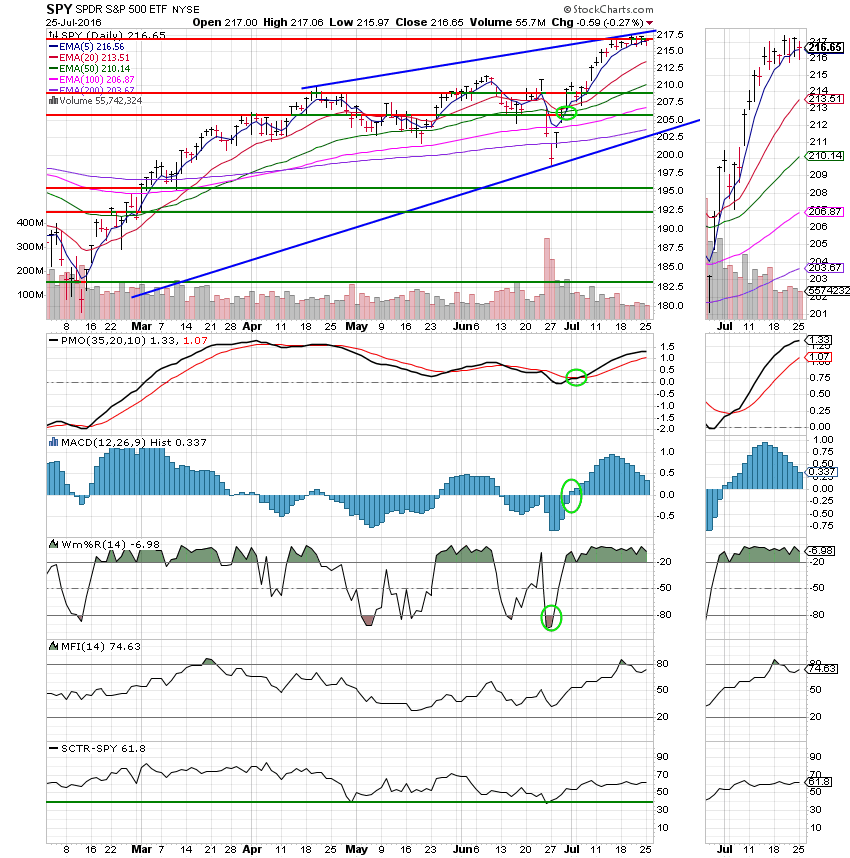

C Fund:

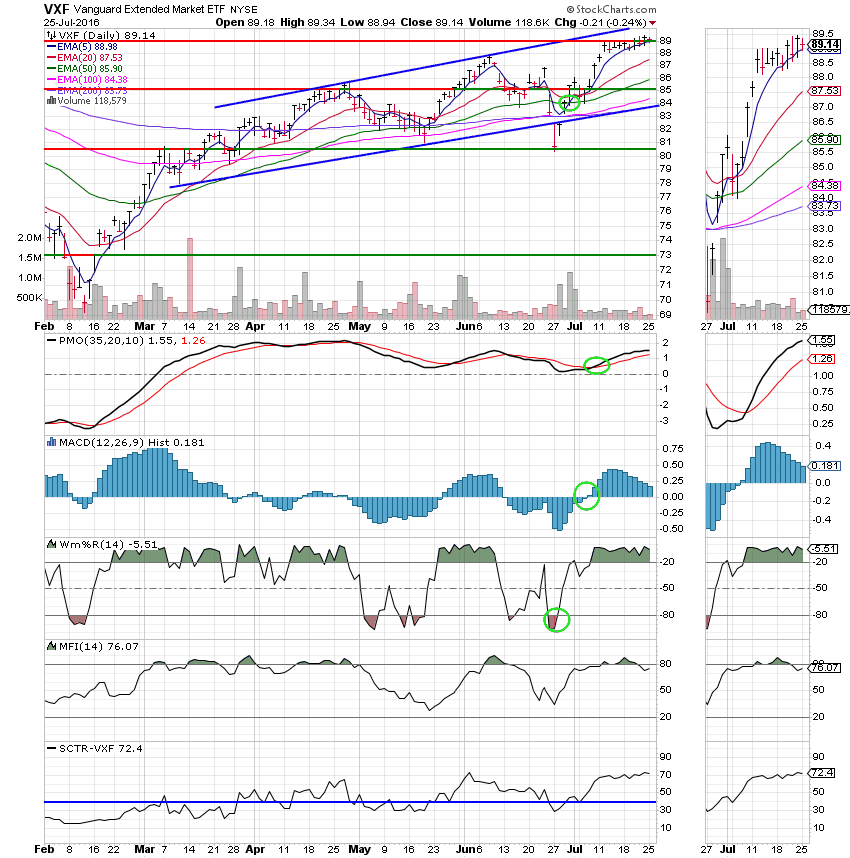

S Fund:

I Fund:

F Fund:

The VIX is definitely indicating that some downside is coming. How much, I can’t say. What I can say is that this market is extended and due for some kind of correction which definitely supports the VIX. As I mentioned above, the VVIX which is a measure of the volatility of the VIX is definitely moving up. Our strategy is to wait for the market to pullback and find a good entry point into the equity market which for us is the C,S, or I Funds. That’s all for tonight. Have a great evening and may God continue to bless your trades.