Good Evening, Yesterday we talked about how the charts were looking oversold and primed for a bounce. Today, we got the bounce as China fears subsided. We’ll see if we can get a little more back tomorrow. The focus will be on the FED which concludes it’s meeting and releases it’s statement at 2:00 PM ET. Expectations are for a dovish FED given the situation in China. All it will really take to keep things going will be some type of statement indicating that a rate hike is unlikely in September. The FED is usually market friendly, but we really won’t know until the statement is released.

The days’s trading left us with the following results: Our TSP allotment gained +1.21%. For comparison, the Dow added +1.09%, the Nasdaq +0.98%, and the S&P 500 +1.24%. Praise God for a good day!

The days action left us with the following signals: C-Neutral, S-Sell, I-Neutral, F-Neutral. We are currently invested at 33/C, 33/S, 34/I. Our allocation is now -1.45% on the year not including the days results. Here are the latest posted results:

| 07/27/15 |

|

|

|

|

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

14.7811 |

16.9201 |

27.5979 |

37.1661 |

25.8682 |

| $ Change |

0.0027 |

0.0413 |

-0.1602 |

-0.3696 |

-0.1966 |

| % Change day |

+0.02% |

+0.24% |

-0.58% |

-0.98% |

-0.75% |

| % Change week |

+0.02% |

+0.24% |

-0.58% |

-0.98% |

-0.75% |

| % Change month |

+0.17% |

+0.65% |

+0.32% |

-2.45% |

+0.28% |

| % Change year |

+1.13% |

+0.70% |

+1.59% |

+2.40% |

+6.81% |

| |

L INC |

L 2020 |

L 2030 |

L 2040 |

L 2050 |

| Price |

17.7202 |

23.4288 |

25.4551 |

27.1151 |

15.4148 |

| $ Change |

-0.0190 |

-0.0761 |

-0.1114 |

-0.1404 |

-0.0919 |

| % Change day |

-0.11% |

-0.32% |

-0.44% |

-0.52% |

-0.59% |

| % Change week |

-0.11% |

-0.32% |

-0.44% |

-0.52% |

-0.59% |

| % Change month |

+0.16% |

+0.07% |

-0.02% |

-0.11% |

-0.16% |

| % Change year |

+1.54% |

+2.32% |

+2.62% |

+2.79% |

+3.05% |

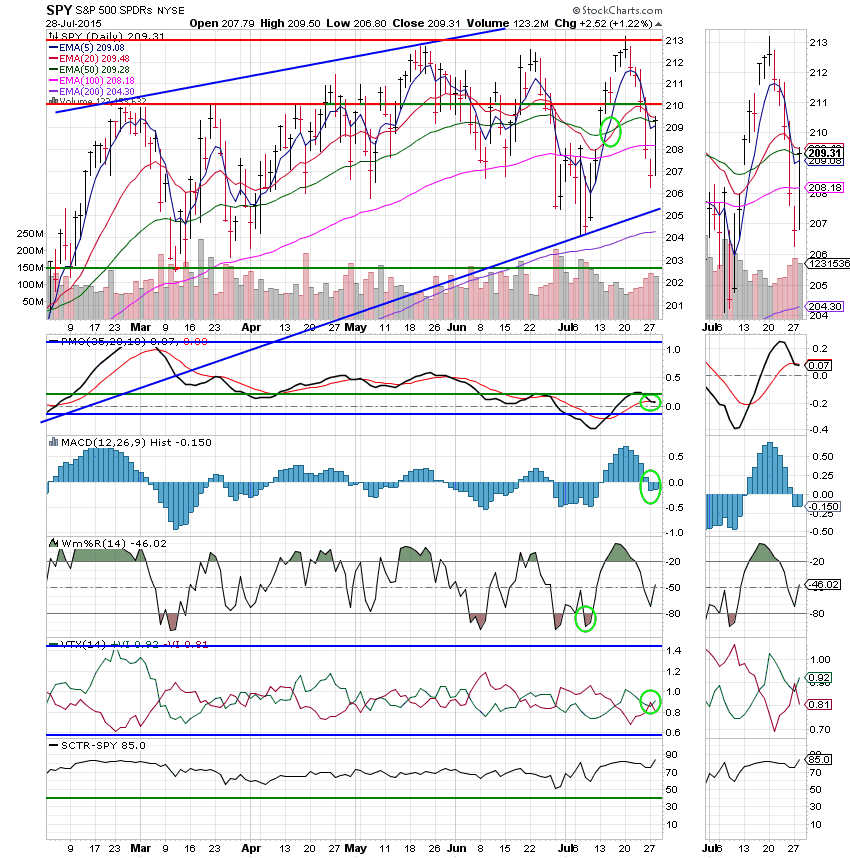

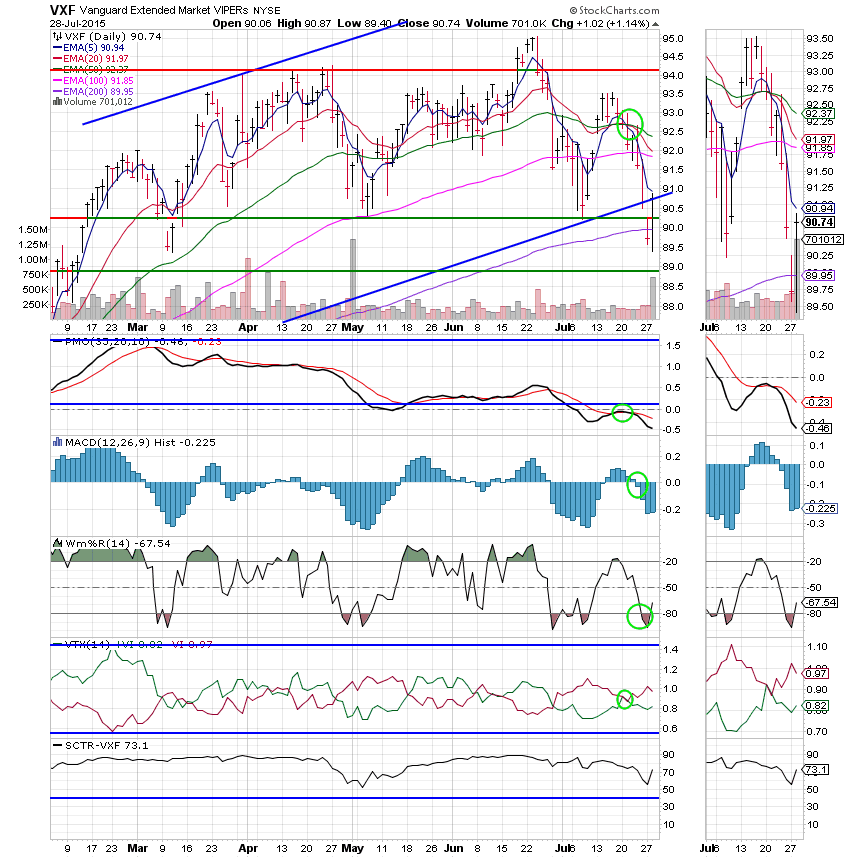

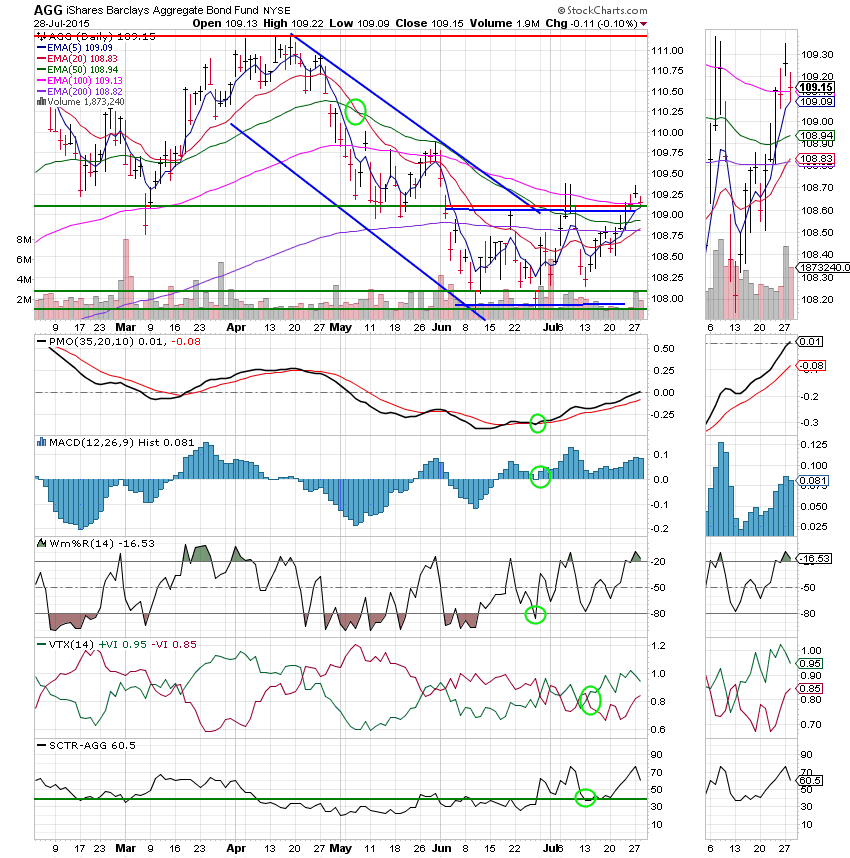

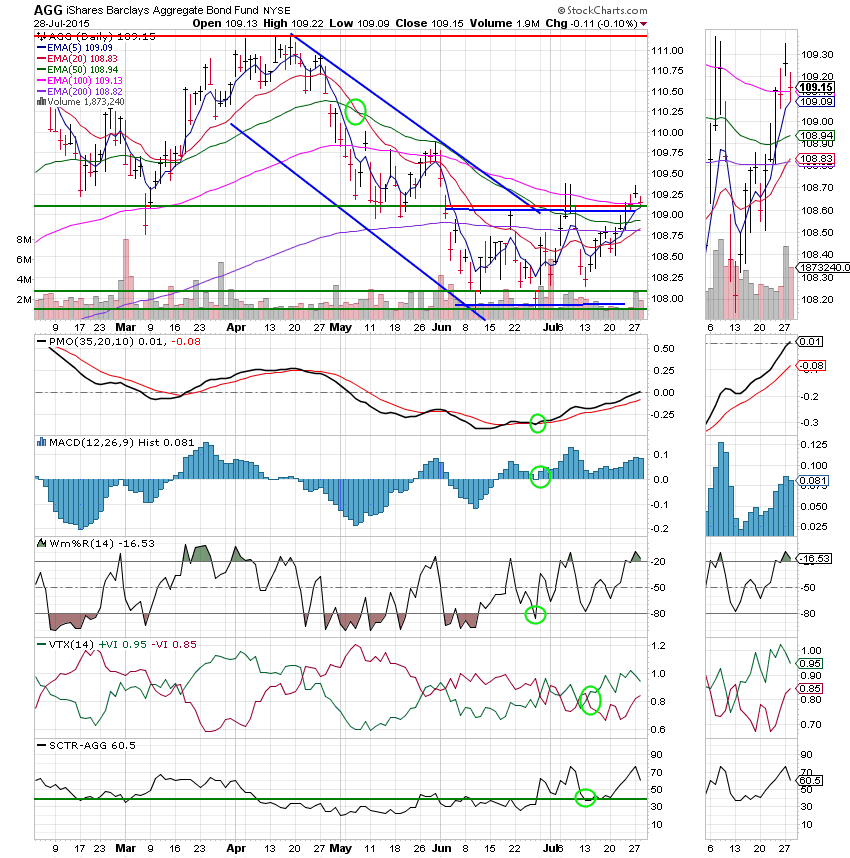

Lets take a look at the charts. (All signals annotated with Green Circles)

C Fund: The PMO and MACD are still in negative configurations so this one remains neutral. The VTX moved to a bullish signal. Yesterday, we discussed the VTX turning up as a possible signal of a bounce. Our observation was correct! Price regained it’s 50 EMA so there’s no chance of a sell signal at this time.

S Fund: The Williams %R turned up indicating that there is likely more upside in the short term. Price, the PMO, MACD, and VTX are all still in negative configurations. So this one is still a sell.

I Fund: This was one of the two charts yesterday where we pointed out that the VTX was calling for a bounce. It turned out to be an accurate early indicator. We should pay closer attention to this indicator when we are considering selling a position. Price closed right on resistance at 64.25. The PMO flattened out in slightly oversold territory. It will be very bullish if it turns up.

F Fund:Support held at close to 109.10. Price moved down today, but really not much considering the great day for stocks. I expect this fund to be highly sensitive to any interest rate talk by the FED tomorrow. The Fund remains in a short term up trend for now, but it still has a lot of work to do before it can generate a buy signal.

Thank God, we got a nice bounce today. We’ll keep an eye on things to see if we can get some follow though tomorrow. As I mentioned earlier the whole days outcome will hedge on the FED statement. If it is favorable, we could make up a lot of lost ground. My guess is that it will be, but that’s only a guess. That’s all for tonight! May God continue to bless your trades. Give Him all the praise! Have a great evening.

God bless, Scott

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program in to the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.