Good Evening, The day started in a negative fashion, but picked up when the dip buyers and machines stepped in to drive us into the green. After that, the investors seemed disinterested in chasing sticks higher and the market faded into the the afternoon finishing flat for the day. Breadth was a little better than even so there were a few opportunities in individual stocks. However, for the most part it was a typical, ho hum, slow, flat, nobody cares cause it ain’t going anywhere, summer trading day.

The days slow trading left us with the following results. Our TSP allotment eked out a gain of +0.055%. For comparison the Dow was off -0.03%, the Nasdaq added +0.33%, and the S&P 500 finished even at +0.00%.

Wall Street ends flat; Expedia flies after the bell

The days action left us with the following signals: C-Buy, S-Sell, I-Neutral, F-Neutral. We are currently invested at 33/C, 33/S, 34/I. Our allocation is now +0.09% for the year. Here are the latest posted results:

| 07/30/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7839 | 16.8867 | 28.151 | 37.9359 | 26.042 |

| $ Change | 0.0009 | 0.0105 | 0.0032 | 0.1048 | -0.0390 |

| % Change day | +0.01% | +0.06% | +0.01% | +0.28% | -0.15% |

| % Change week | +0.04% | +0.05% | +1.42% | +1.07% | -0.09% |

| % Change month | +0.19% | +0.45% | +2.33% | -0.43% | +0.95% |

| % Change year | +1.15% | +0.51% | +3.63% | +4.52% | +7.53% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.78 | 23.617 | 25.7223 | 27.4469 | 15.6265 |

| $ Change | 0.0019 | 0.0022 | 0.0037 | 0.0061 | 0.0033 |

| % Change day | +0.01% | +0.01% | +0.01% | +0.02% | +0.02% |

| % Change week | +0.23% | +0.48% | +0.61% | +0.70% | +0.77% |

| % Change month | +0.49% | +0.87% | +1.03% | +1.11% | +1.21% |

| % Change year | +1.89% | +3.14% | +3.69% | +4.05% | +4.47% |

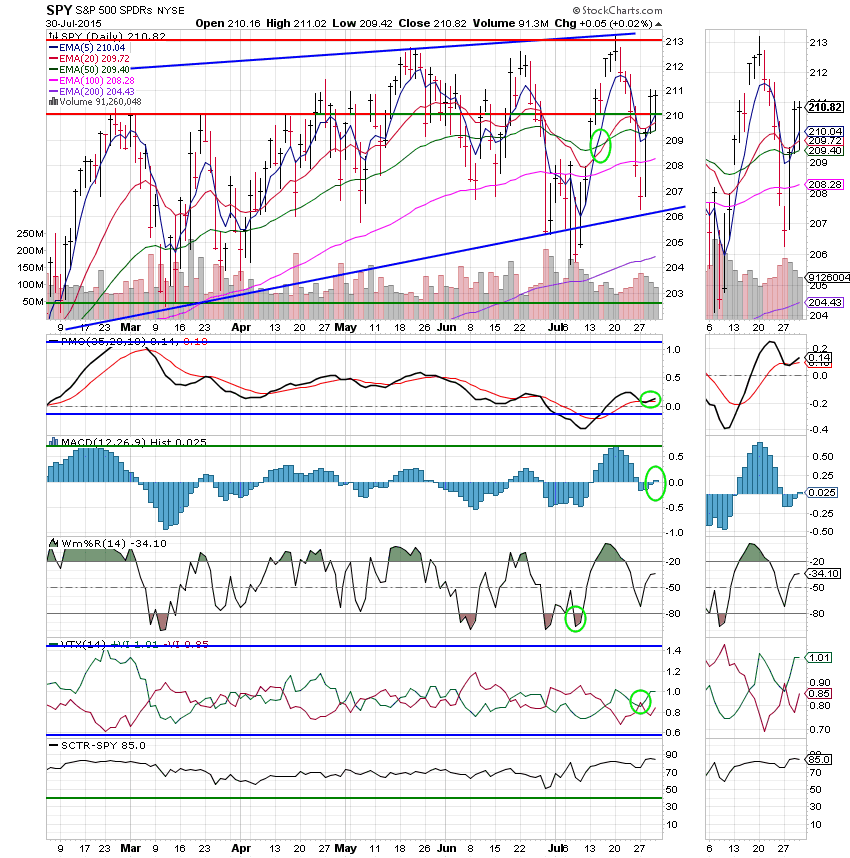

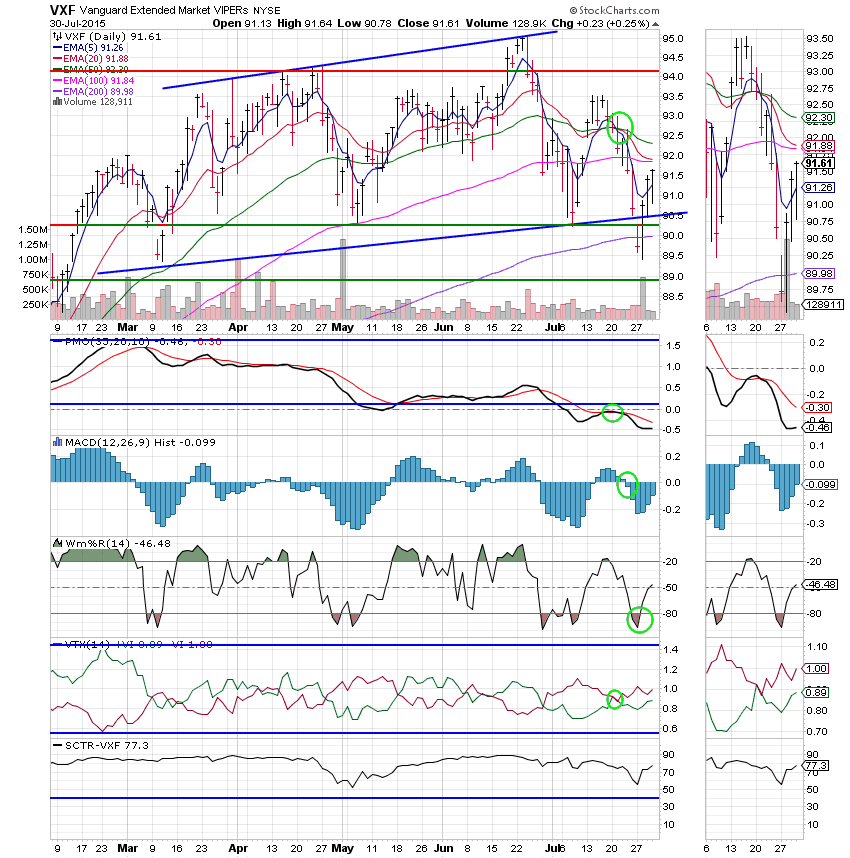

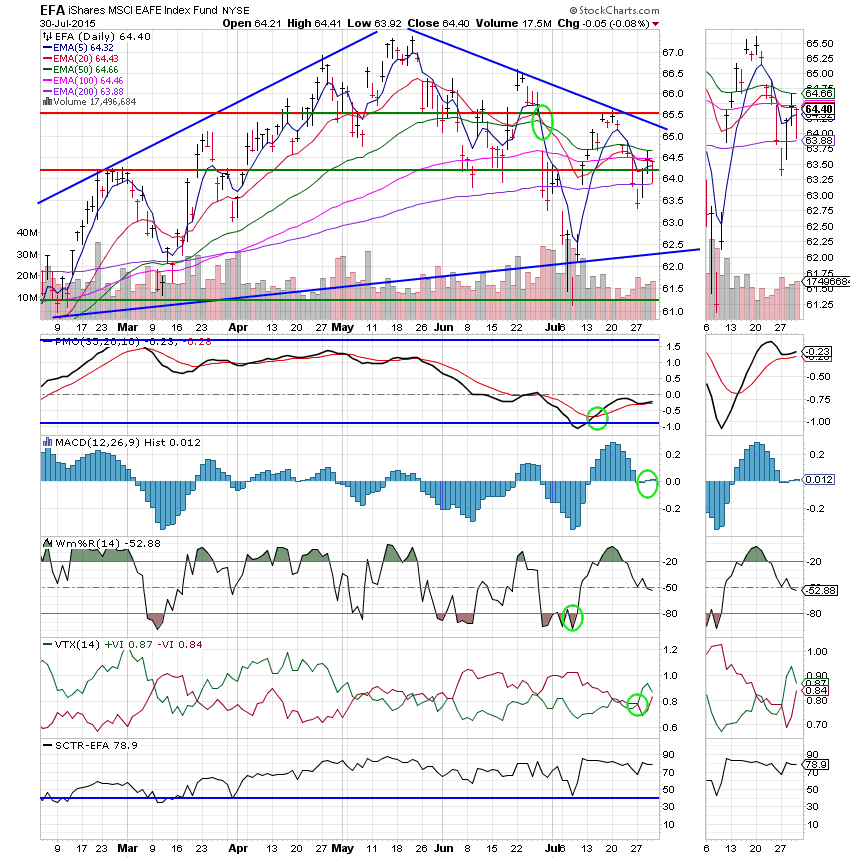

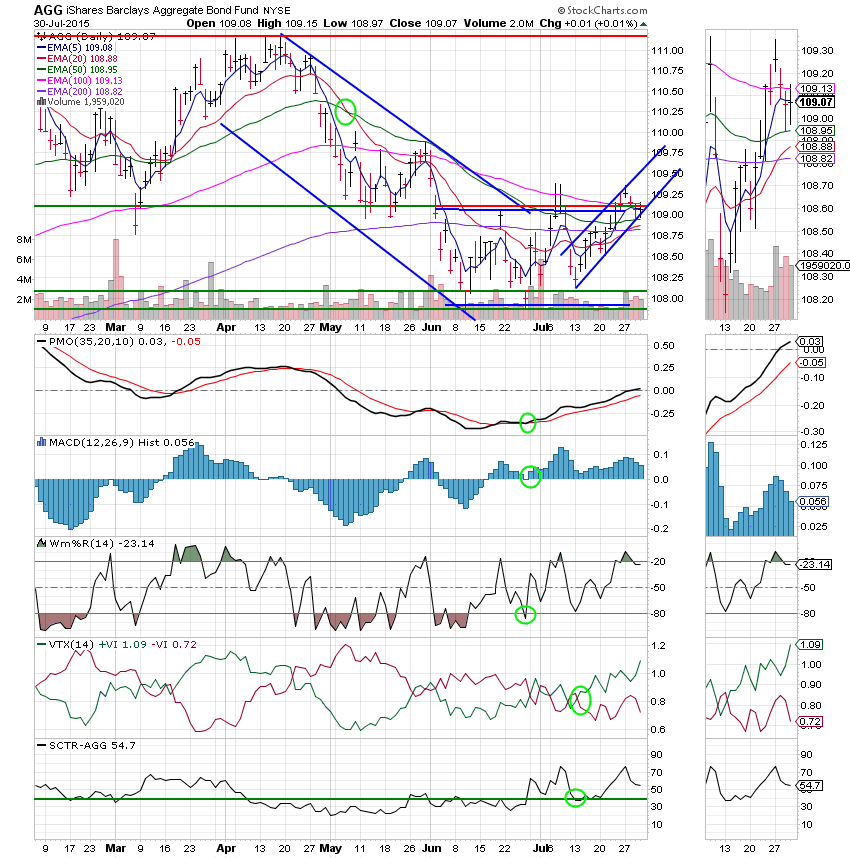

Here are the charts: (All signals annotated with Green Circles)

C Fund: The MAC D moved to a positive configuration today. That now makes all indicators positive. This one’s a buy.

S Fund: The S Fund was best of our equity based funds today. However, it took the most damage in the recent sell off and still has a lot of work to do before that is repaired. Right now, the Williams %R is the only indicator that is not in a negative configuration. The good news is that it is signaling more short term gains. This one is still a sell.

I Fund: The I Fund slipped a little today with price closing just below it’s 100 EMA. The PMO , MAC D, Williams %R and VTX are all positive for an overall neutral signal. The VTX turned down today. Is is signaling some more downside to come for the I Fund? We’ll keep an eye on this indicator. It’s not always a sure thing, but it can sometimes be useful as an early indicator much like a canary in a coal mine.

F Fund: The F Fund keeps hanging in there. For now price remains within the short term ascending channel. This chart still has a lot of work to do to get back to a buy signal, but it is clearly making progress. In particular, the PMO is rising through neutral territory with a lot of room to run. This is bullish. The other indicators are looking fairly strong as well. This one is a strong neutral.

I thank God as our allocation was able to move back into positive territory today. Tomorrow is the last trading day of the month. Will we have a let down after three positive days? A lot of folks think so, but I really can’t say one way or the other. As usual, we’ll just have to keep a close eye on the charts. Have a nice evening and may God continue to bless all your trades!