Good Evening, The ebb and flow continues and fortunately it has been mostly positive for the past two sessions. The market was focused on two issues today. Mostly, investors were watching stimulus negotiations between Democrats and Republicans on Capital Hill. Both sides report progress made but say they still a ways to go. Specifically, they agree on a $1,200.00 stimulus check to be mailed out but have been unable to agree on an amount for extended unemployment benefits. Secondly, investors focused on continued tension between China and the US. President Trump threatened to ban the popular app TIKTOK due to security concerns. Microsoft stepped in and entered into negotiations with TIKTOK to buy it’s US, Australian, and Canadian operations. The Chinese government then called the US a “rogue” nation and further called President Trumps action a “money grab”. The bottom line is that when the top two economies don’t get along everyone is watching…. The technical situation is unchanged with the major indices all in choppy up trends. As long as corporate earnings reports remain halfway decent and progress toward a Covid-19 vaccine is made expect more of the same. In our last blog we outlined the news events that are shaping the current market. Those remain unchanged. For now we’ll continue to monitor our charts for any change of character in the market. Until we see one we will remain invested at 100/S. The small and midcap stocks that make up the S Fund include many of the so called recovery stocks and thus do well any time positive corona virus or related economic news is released. Also as we mentioned in the last blog, we are betting on a Covid -19 vaccine before the end of January. So far so good. Our return is good! Of course, I thank God for that.

The days trading left us with the following results: Our TSP allotment posted a gain of +0.37%. For comparison, the Dow was up +0.62%, the Nasdaq +0.35%, and the S&P 500 +0.36%. Praise God for another day in the green!

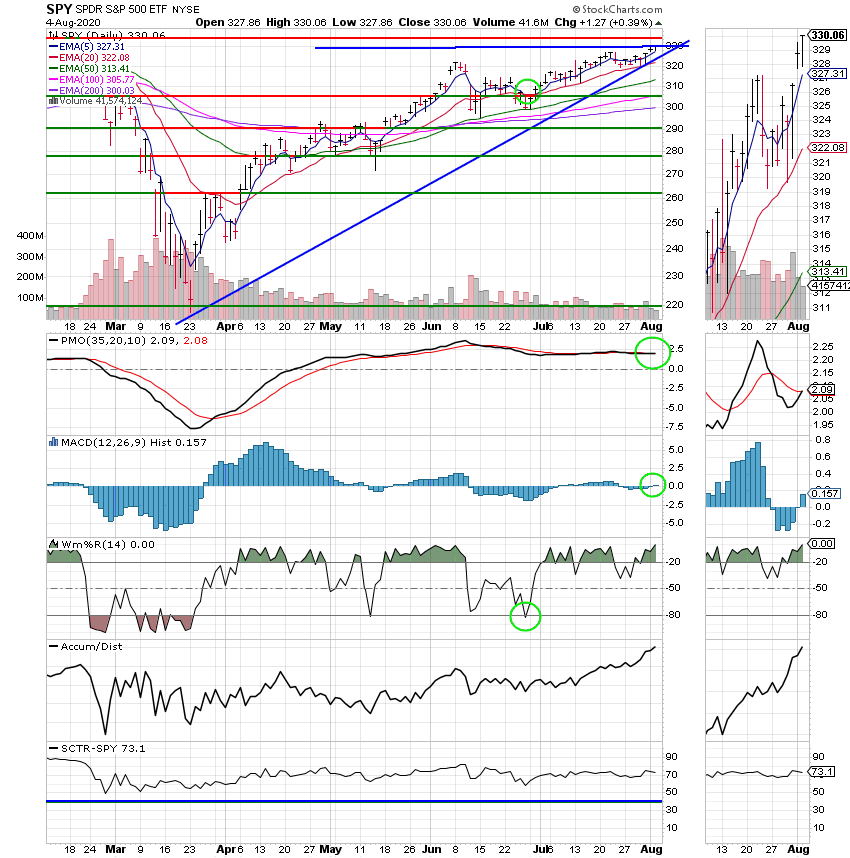

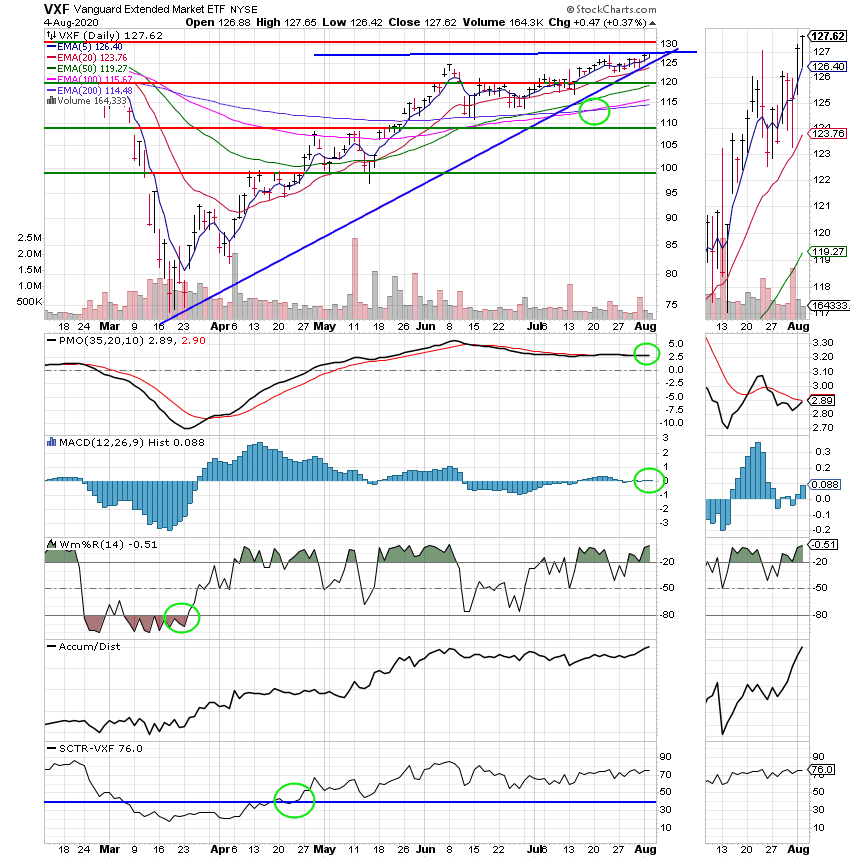

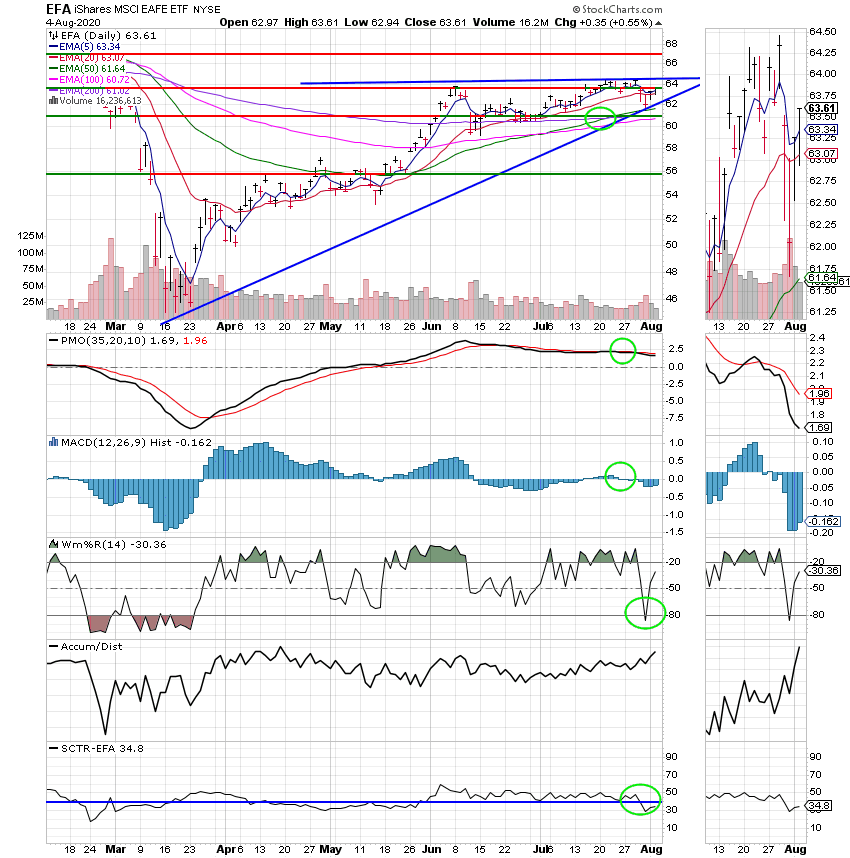

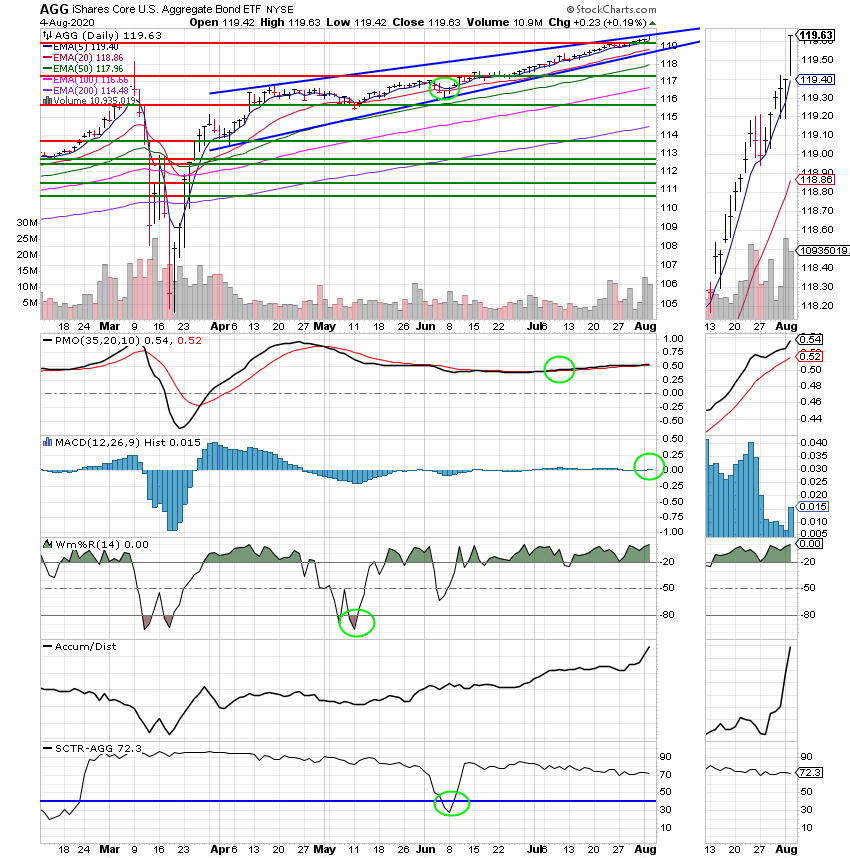

The days action left us with the following signals: C-Buy, S-Buy, I-Neutral, F-Buy. We are currently invested at 100/S. Our allocation is now +22.60% on the year not including the days results. Here are the latest posted results:

| 08/03/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.4579 | 21.2096 | 48.7017 | 56.8998 | 30.0819 |

| $ Change | 0.0010 | -0.0189 | 0.3486 | 0.8890 | 0.3132 |

| % Change day | +0.01% | -0.09% | +0.72% | +1.59% | +1.05% |

| % Change week | +0.01% | -0.09% | +0.72% | +1.59% | +1.05% |

| % Change month | +0.01% | -0.09% | +0.72% | +1.59% | +1.05% |

| % Change year | +0.66% | +7.57% | +3.05% | +1.11% | -8.05% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 21.4155 | 10.2669 | 35.0298 | 10.351 | 38.5342 |

| $ Change | 0.0443 | 0.0484 | 0.1990 | 0.0646 | 0.2625 |

| % Change day | +0.21% | +0.47% | +0.57% | +0.63% | +0.69% |

| % Change week | +0.21% | +0.47% | +0.57% | +0.63% | +0.69% |

| % Change month | +0.21% | +0.47% | +0.57% | +0.63% | +0.69% |

| % Change year | +1.08% | +2.67% | +0.51% | +3.51% | +0.27% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 10.4086 | 22.4829 | 10.5134 | 10.5135 | 10.5137 |

| $ Change | 0.0762 | 0.1758 | 0.1003 | 0.1003 | 0.1003 |

| % Change day | +0.74% | +0.79% | +0.96% | +0.96% | +0.96% |

| % Change week | +0.74% | +0.79% | +0.96% | +0.96% | +0.96% |

| % Change month | +0.74% | +0.79% | +0.96% | +0.96% | +0.96% |

| % Change year | +4.09% | +0.00% | +5.13% | +5.14% | +5.14% |