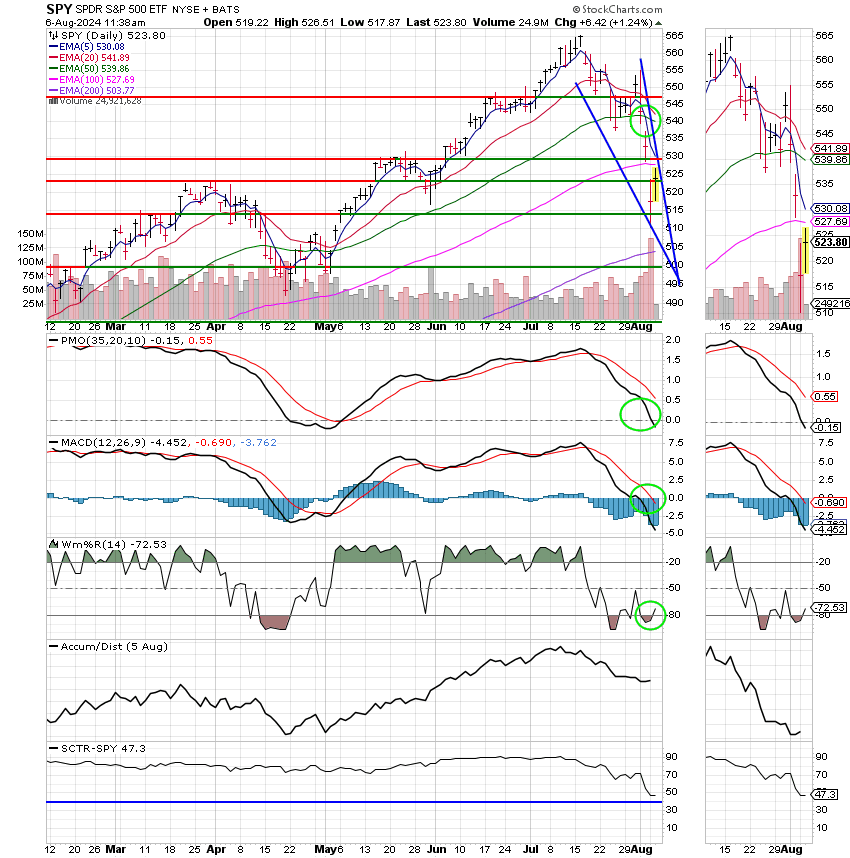

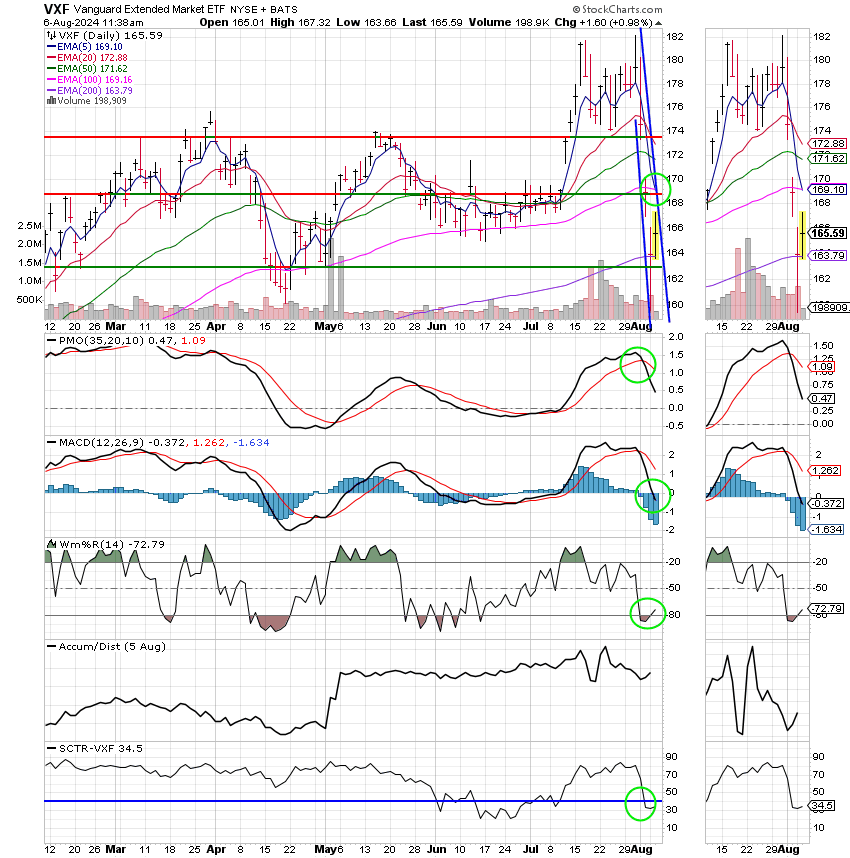

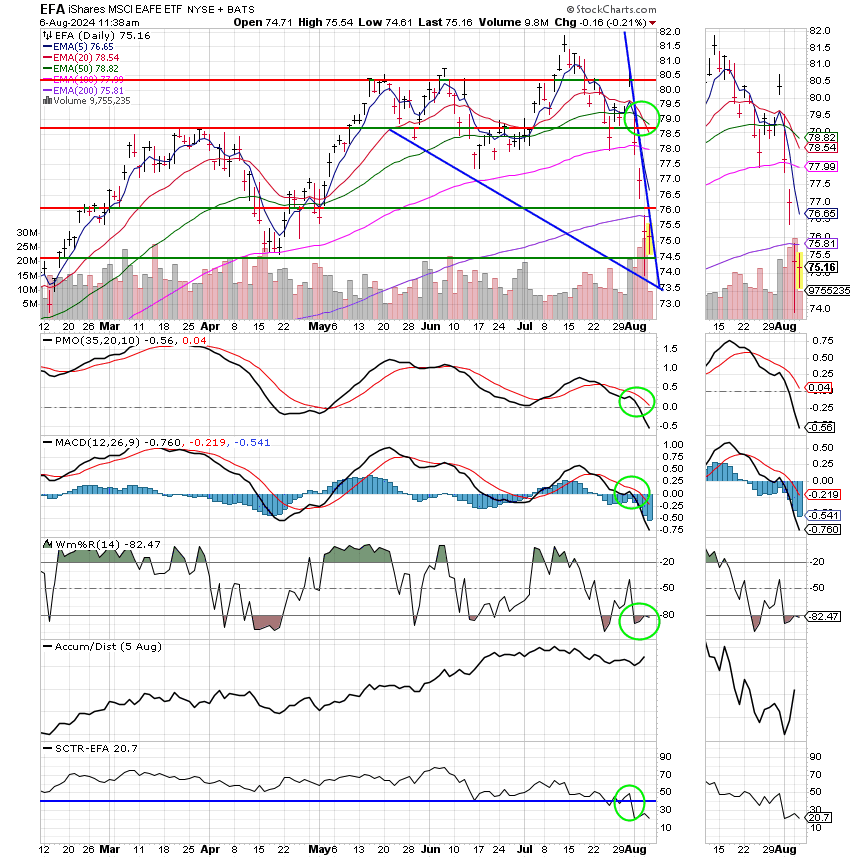

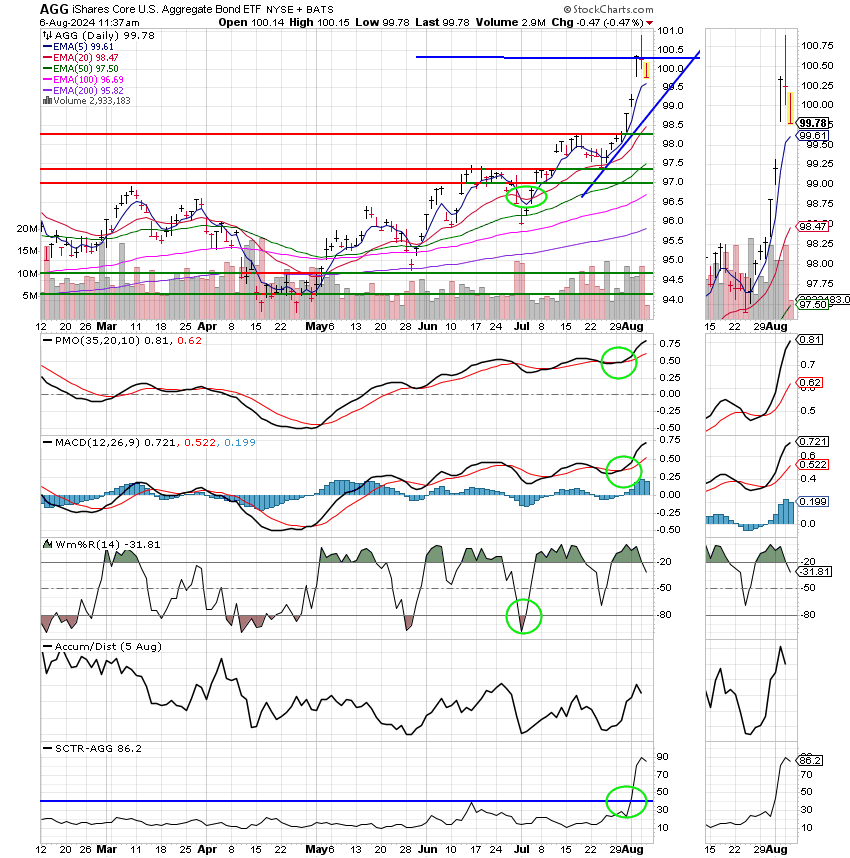

Good Morning, Well, that was a wild week wasn’t it? A weak jobs report panicked investors into the biggest sell off since the fall of 2022. The Nikkie in Japan actually sold off to the tune of 12.8% which was their biggest sell off since the market crash of 1987! Folks, there’s no reason to panic. The overall picture is still healthy. I must add that I agree with Blackrock which said that this labor weakness was not the same as the labor weakness that led to many past sell offs and recessions, that it had more to do with immigration than layoffs and looking at the figures I whole heartedly agree. This is what they had to say: “Stocks will once again find their footing and recover from a global market sell-off as recession worries abates and the unwinding of the yen carry trade settles, according to BlackRock. “We think risk assets can recover as recession fears ease and the rapid unwinding of carry trades stabilizes,” the firm’s Investment Institute wrote said. “We keep our overweight to U.S. equities, driven by the AI mega force, and see the selloff presenting buying opportunities. “We think growth will be supportive of risk assets and believe markets are pricing in too many Fed rate cuts,” the note added. The firm also says that the recent weaker-than-expected jobs report that preceded the Friday market sell-off more closely resembles a slowdown in hiring as opposed to a recession. BlackRock added that the main driving force behind the rise in the unemployment is an uptick in labor supply due to immigration as opposed to layoffs, which is a key difference compared to previous recessions. Folks, they nailed it. That’s the reason they are such a respected investment firm. They know what their doing! As far as the current weakness goes….. It may or may not be over. It’s a total waste of time to speculate. It is best just to watch the charts and react to what you see. That said, how you react depends on what your priorities are. I’m going to tell you again where our priority is. Its not what you make that’s important. It’s what you keep! Sell is not a dirty word!!! We sold and moved to the G Fund Friday and as usual received a lot of criticism for doing so. I was told your panicking! Really? Let me explain the facts to you. When the market sells off to the tune of 7% in two days it will move the charts and generate new signals. If you get a sell signal and you sell that’s just a routine move. Nothing more, nothing less. Our charts told us that this was the time to get out. Next they said your losing all your gains from July. Well, I don’t know about you but I still have a little bit more than I had at the beginning of July and I’m still up for the year. I will also add that was before yesterdays sell off. So I still have those things. Then they said, it’s going to bounce and your not in. You sold out!!! There they go again. Treating sell as if it’s a dirty word. At this point I’m like, can you come up with anything else negative to say??? This made me aware that coordinating a group like this is like adjusting a thermostat. Some folks will say they are too cold, some will be just right and some will be too hot. The bottom line is this. I didn’t lose a thing in July and while I was in the S fund the C and the I funds lost money. So my balance came off it’s high during a vicious sell off. So what! I was positioned in the best place I could be. I kept my principle and actually added a modest amount to it. Lose??? No we didn’t lose. I was in fact playing with house money. I was investing money that I didn’t have in the beginning of July. So my question to you is this. If I sold immediately every time I had a gain then how many gains that came after that would I have missed over the years. You see this is what people cannot understand, they cannot get past the short term action. They cannot see the forest for the trees. If you allow the short term action to determine your overall strategy you will lose. Period! I cannot stress this enough. Would I like to have kept everything I made in July? Why sure, who wouldn’t. My move this time may or may not work out performance wise, but I can never lose sight of the fact that I achieved my main goal which was to keep what I have. Again, that is my goal and that is the one that allowed me to have a successful retirement. In the end you must all have a goal. So what are you trying to achieve with your investing? Decide what that is and stick to it, but let me warn you. One size does not fit all!! Now, all that said, where are we going from here?? It’s rather simple. This weeks action and economic reports all but guaranteed that the Fed will start decreasing rates in September. By the matter of fact, the case for a 0.5% decrease instead of just a .25% increase has been clearly made. Our strategy is to watch our charts for the best entry point back into equities heading into September. We will look for both the best entry point as well as the best fund to enter with. Will it be small caps, larger caps, or possibly international stocks? We will watch our charts like a hawk to determine these things. We must not get in a hurry, but rather take our time and make the best most informed decision that we can make. Above all, we must not allow short term anxiety to determine or rush our long term decisions. We must not allow outside criticism to pressure us into bad decisions. Other folks will say what they say and about 90% will be negative noise. There’s no Jesus in that… Just do the best you can, keep your eyes on God and let the rest take care of it’s self. Outside pressures will kill you just as fast in this business as emotions will. Just make a trade and then move on to the next trade and whatever trades you make, make sure they are in pursuit of your long term goal. Whatever, that might be!! Stick to your guns!!

The days action so far has left us with the following results. Our TSP allotment is steady in the G Fund. For comparison, the Dow is rebounding +1,13%, the Nasdaq +1.58%, and the S&P 500 +1.44%. The bounce seems to be gaining steam. We will see.

Dow rallies 500 points, S&P 500 up 1% as Wall Street rebounds from sell-off: Live updates

Recent action has left us with the following signals: C-Sell, S-Sell, I-Sell, F-Buy. We are currently invested at 100/G. Our allocation is now +6.36% on the year not including the days results. Here are the latest posted results:

| 08/05/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.4417 | 19.8469 | 81.491 | 77.4056 | 40.7723 |

| $ Change | 0.0063 | -0.0088 | -2.5142 | -2.3385 | -1.2276 |

| % Change day | +0.03% | -0.04% | -2.99% | -2.93% | -2.92% |

| % Change week | +0.03% | -0.04% | -2.99% | -2.93% | -2.92% |

| % Change month | +0.06% | +1.53% | -6.08% | -8.48% | -6.80% |

| % Change year | +2.66% | +3.25% | +9.58% | +0.40% | +1.47% |