Good Morning, This morning the headline is ‘Dow Futures Jump 100 Points As Market Comes Off Losing Week’. I can hear it now. We jumped out of the market and there it goes up again. I’m not following this anymore. We would be better off had we stayed in one fund etc. so forth an so on…. I’ve spent more time explaining than doing analysis since the end of the pandemic. I’m not going over that in detail again. If you want to understand that process and what took place you can read the bogs from the archives and relive every painful moment and make no mistake it was painful. The overall dynamic of the market changed as a result of the quantitative easing and subsequent quantitative tightening and it took us a year and a half to adapt to it. That period ended in June. The short version is that we developed a new set of indicators that analyze the market from an entirely different perspective than we used in the past 25 years. It took time to put them in place and it took time to learn how to best interpret them. Now it will take time to see the results. That is where it requires patience. As I have said and said and repeated, we underperformed during that 18 month period and that is where everybody is hung up. That is where I am wasting all my time explaining. I have have been over this. It was a bump in the road for those of us that have been doing this for a career. I am not bragging when I say this but we already had so many gains running our aggressive system that this period of underperformance is more of a minor inconvenience than a loss. If you haven’t been around then ask your friends that have. If I am misrepresenting anything that I have said then move on and use one of the many buy and hold services that are out there. Why waste your time criticizing us then you can go somewhere else where your comfortable? The absolute bottom line is that you have to trust the process. We are the the same folks that made the big gains for the past 25 years. We run an aggressive system, but it is an aggressive system that puts and emphasis on preserving our precious capital. Yes, it can be done. We successfully did for years prior to the pandemic. In the entire 25 year period prior to the pandemic the sum total of all our losses where less than 5 percent. That’s right, all of them together. Don’t believe me??? Again, ask your friends. So let me reiterate, you have to trust the process. Everything started over again for us at the end of June. Compare returns if you must but do it on a monthly basis. Yes we fell back 28% in that 18 month period but what did we make prior to that? Over 400% in 20 years. Again, ask your friends. Please please ask your friends that have been doing this with us for a while. This service is free. Our prayer is that you use it to develop the best style to make money that fits your specific needs and preferences. Above all things. Do what works best for you!!!! If that means buying and holding then find one of those systems that meets your needs. I pray that you have nothing but success. One more thing on this issue. A lot of folks have said How could you have had such a bad year. How could your God who you claim to follow let this happen to you??? Good question. First off, I will praise Him whether I do well for not. Secondly, His word says in Romans 8: 28 that “We know all things work together for the good of them that love God , to them who are called according to His purpose.” This period worked for our good because we love Him. Remember, the scripture doesn’t say some things. No, it says all things!! We took that time to focus on Him and develop a new system to put in place beside our old one that will allow us to see past all the deception that exists in the market today. I don’t know any way to put it any plainer than this. I am totally confident in what we are doing. We got this!!

You must understand a couple things about our style and these moves. First thing is that we aren’t timing the market. We are following the trend. Every time I make move I invariably get the same question. “Couldn’t you get this change to us earlier. I didn’t have time to make the change before the deadline.” Folks, I can’t control exactly when the charts generate a signal. I put the alert out when it is generated, be it early in the morning, late in the morning or in the afternoon. Our charts are focused on the intermediate to long term. So it doesn’t really matter if you take a day or two to make the change. The period we are focusing on is from a week or more to a month or more. The volatility of the market is what determines how many moves we make in a year. There have been years when we didn’t move the money at all and years where we moved it a dozen times. Again, it depends on the volatility. So when you see an alert don’t panic. If you chose to follow us then just make the move when it’s convenient. There in NO HURRY!

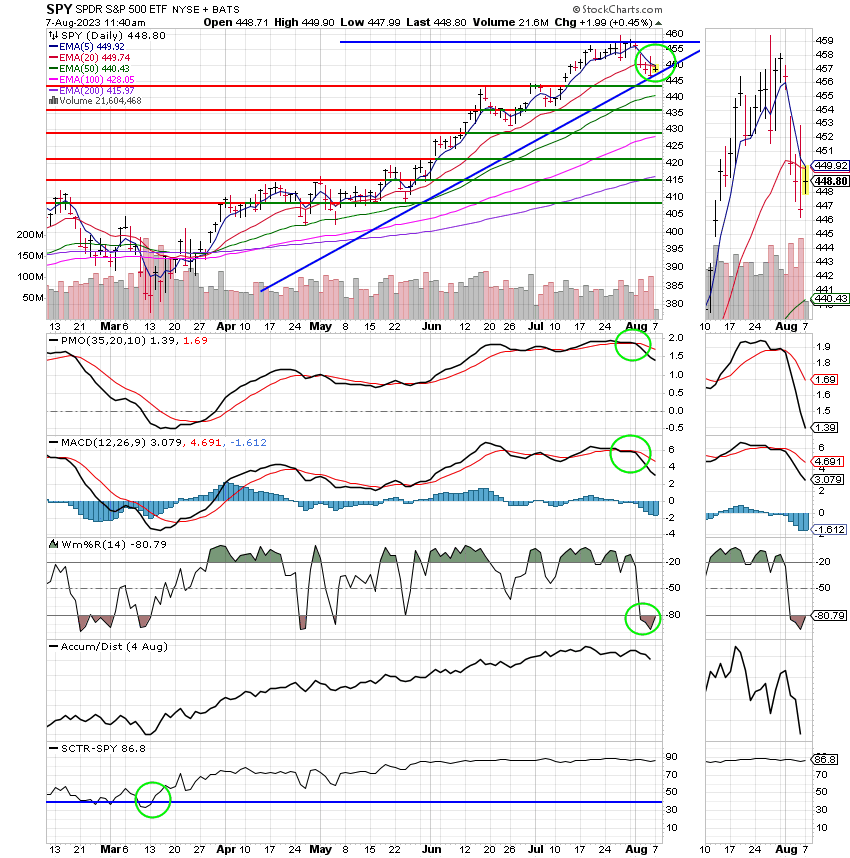

How about todays market? As I noted above it is bouncing a bit today. The short term trend broke lower last week and that’s still the case. The long term trend is still moving higher. We expect that there will be some days like today over the next week or so when stocks are higher, but we do not anticipate any new highs until we see an overall pullback. Investors will be focused this week on continued earnings and on Thursday’s Consumer Price Index (CPI) Report. Of course they will attempt to interpret this data as to how it might influence the Fed meeting in September. There are many out there that think the Fed is done increasing rates. That appears to be the overall consensus. So any news contrary to this opinion will result in additional selling. This type of scenario will continue until the rate or inflation is reduced to two percent. Looking down the road, I think that inflation will remain persistent in the 2-3% range and will likely result in the Fed leaving rates at an elevated level for a longer period of time before they actually begin to reduce rates. The big rally will start when rates move lower. Until then, expect more of the same….

The days trading is generating the following results: Our TSP allotment is steady in the G Fund. For comparison, the Dow is up +0.89%, the Nasdaq is lower at -0.17%, and the S&P is higher at +0.44%.

Dow rises 300 points as Wall Street rebounds off losing week: Live updates

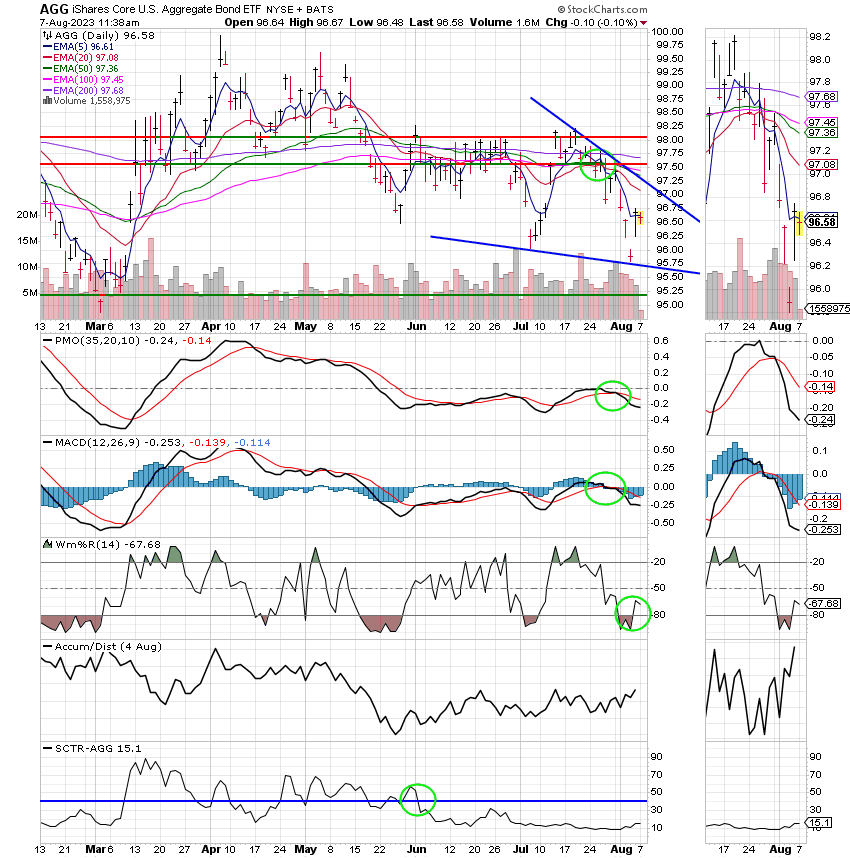

Recent action has left us with the following signals: C-Sell, S-Sell, I-Sell, F-Sell. We are currently invested at 100/G. Our allocation is now -1.82% for the year not including the days results. Here are the latest posted results:

| 08/04/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.6328 | 18.4709 | 69.3457 | 71.4617 | 38.0032 |

| $ Change | 0.0020 | 0.1521 | -0.3645 | -0.1690 | 0.1276 |

| % Change day | +0.01% | +0.83% | -0.52% | -0.24% | +0.34% |

| % Change week | +0.08% | -0.60% | -2.26% | -1.69% | -2.93% |

| % Change month | +0.04% | -0.72% | -2.40% | -2.65% | -2.91% |

| % Change year | +2.31% | +1.45% | +17.73% | +16.14% | +11.96% |

I Fund:

F Fund:

Nothing to add here. We just need to continue to monitor our charts for the next change in trend. That’s all for today. Have a nice afternoon. and may God continue to bless your trades!