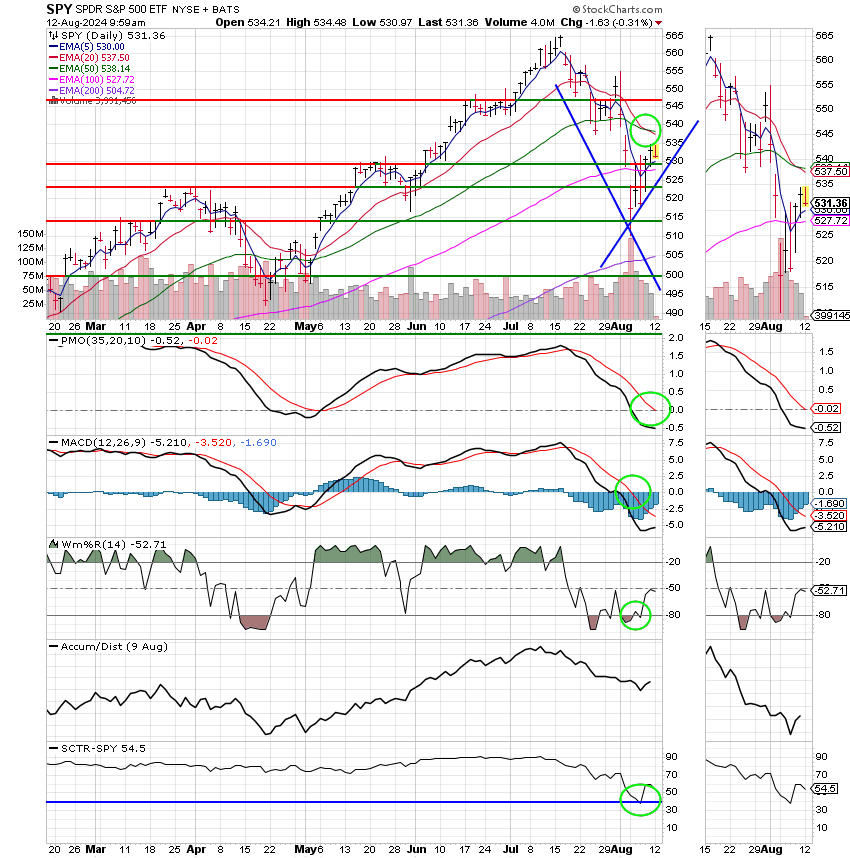

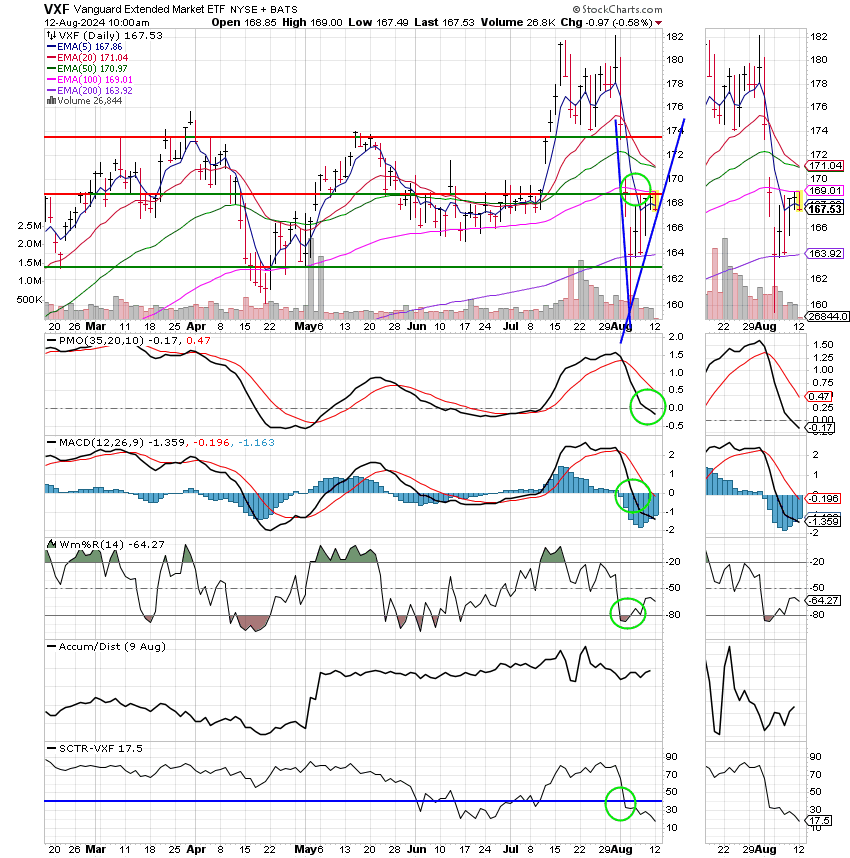

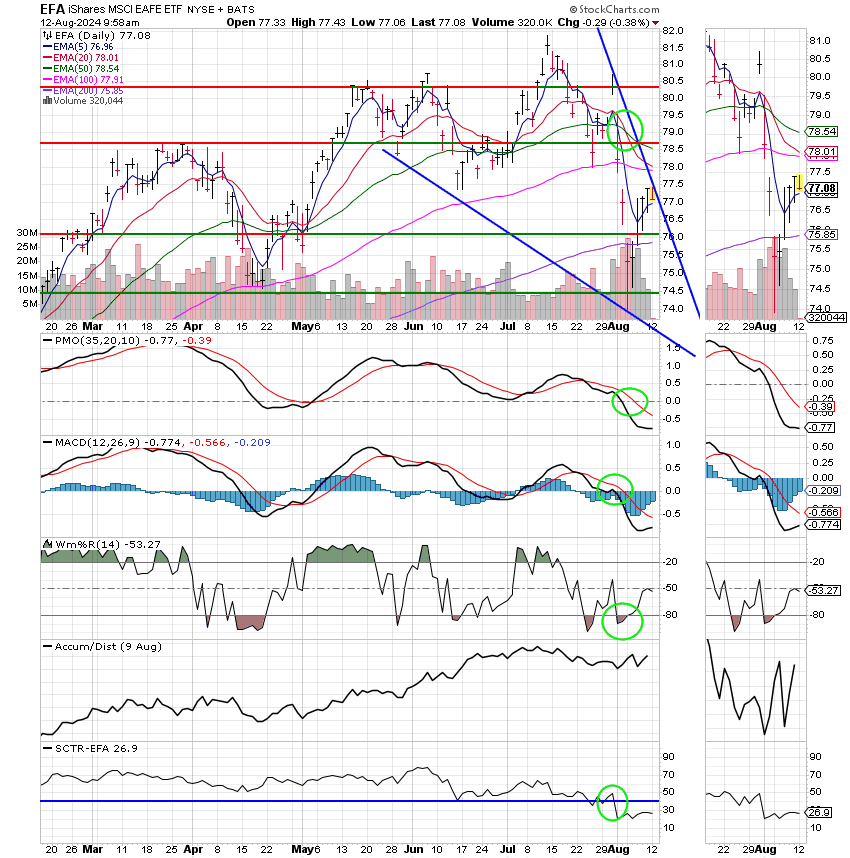

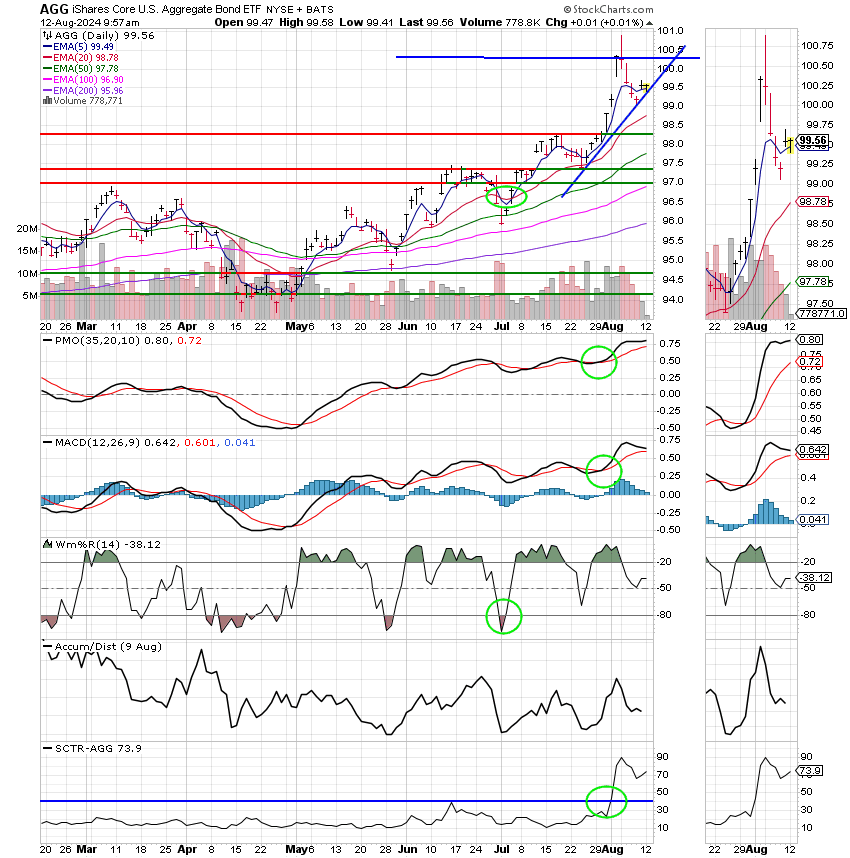

Good Morning, Let me start this morning off with our main motto/priority here. “It’s not what you make that’s important. It’s what you keep.” It drives everything we do here. We’re not out to win the tracker contest or have the best return during the break room discussions. No, we’re here to make solid returns and build retirement portfolios. If we wanted to do all those 0ther things then we’d charge a fee and do them. So that’s the reason, we do what we do and that is the reason we make the decisions we make. That’s not to say that we won’t be aggressive. We’ve been accused of doing too much of that on multiple occasions, but the thing to know is this. We pick our battles carefully. We do it when we have the best chance to win and for the most part we’ve done that. Yes, our results departed from from the norm while we made some critical adjustments to our system in 2022 and 2023. We’ve discussed that in detail if you want to go back in the archives and see h0w it all went down. It’s all a matter of record. However, now we’re back to doing the same old thing we did for 20 plus years prior to the pandemic and recovery. Of course, that’s keeping what we have and adding to it. Keeping is our priority and adding is second to it. That’s never going to change. Anyway, as I said above our charts are still showing a significant chance of reversal. So we believe the volatility is not finished. Can you get it the market now and be successful? Yes you can, but you have to realize that there is an elevated risk of the market reversing on you. The risk is high and the reward is high as well. Our focus is on the risk. We’d like to see it a little lower. In this volatile environment that may happen fast or not. We simply need to watch our charts for a good entry point whenever it comes. We don’t get excited or panic. We simply watch the charts and do what they say. It’s all routine. We trust our system and believe in our strategy which is to ride the trend. Moving forward we’ll be watching the upcoming CPI report closely following last weeks softer than expected jobs report. There is little doubt that the market will swing from exuberance to panic and we must trust in our charts to keep us grounded. Emotion and/or Panic will get you killed in this business!!!!

The market has opened with the following results. Our TSP allotment is steady in the G Fund. For comparison, the Dow is off -0.33%, the Nasdaq is higher at +0,36%, and the S&P 500 is lower at -0,22%. We’ve got a long day ahead, so these results are likely to reverse. Certainly nothing to build confidence….

Stocks wobble as traders struggle to build on last week’s comeback: Live updates

Recent action has generated to following signals: C-Sell, S-Sell, I-Sell, F-Hold. We are currently invested at 100/G. Our allocation is now +6.41% on they year not including the days results. Here are the latest posted results:

| 08/09/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.45 | 19.6925 | 83.9848 | 79.5703 | 42.1177 |

| $ Change | 0.0021 | 0.0603 | 0.4004 | 0.0992 | 0.1001 |

| % Change day | +0.01% | +0.31% | +0.48% | +0.12% | +0.24% |

| % Change week | +0.08% | -0.82% | -0.02% | -0.22% | +0.28% |

| % Change month | +0.10% | +0.74% | -3.20% | -5.92% | -3.73% |

| % Change year | +2.71% | +2.44% | +12.94% | +3.21% | +4.82% |