Good Morning, We are approaching the halfway point of August. It seems like we just left a successful July and entered this normally lackluster month with a sell off and a sell signal. So far the month has followed the script. Flat with no surprises. At least not yet. This is the month when a lot of traders take advantage of the slow action to get away before labor day marks the official end of summer. It has always had the feel of a set it and forget it month. That’s not to say that there are no exceptions because there are. That’s why we watch the charts, but for the most part this is it, flat. Most investors look to September as a down month. The official book says September and October historically have some of the worst returns of the year. As I have mentioned in previous blogs. My opinion is that the negative period for stocks normally starts around the middle of August and ends sometime in the latter part of October. Does that effect what I do? No the least bit. I continue to watch the charts and do my best to foll0w the trend. No one but God knows the future and even one piece of unexpected news can easily effect the trajectory of the market. That is why it has always served us best to let the price action determine where we invest. Right now we find ourselves invested in the G Fund as we reach the halfway point of the month. 2023 has been anything but a normal year. You all know the story. Quantitative tightening threw everything including our indicators into disarray. Although, we repaired the post pandemic damage to our indicators the market remains unsettled with inflation still running well above the Feds comport range of two percent. I think its running approximately 3.7% but I could be wrong. It’s definitely over two and that is enough for us. As I have repeated on a weekly basis, the market will continue to be unsettled as long as the rate of inflation exceeds the two percent threshold set by the Fed. Everything and I mean everything will continue to be evaluated for how it will effect future Fed policy. Market players will continue to ask two questions. Will the Fed increase again and when will they start to cut interest rates again. Until those issues are settled to their satisfaction, the drama will increase prior to each Fed meeting. As for today, the focus is almost entirely on Septembers Fed meeting. The overall consensus is that the Fed will not increase rates but that they will hold rates steady for an extended period of time. Recent reports have thrown that view into doubt, however, with chatter reigniting on the possibility of the Fed increasing rates again in September. I find this unlikely but as we have often seen, the market doesn’t like surprises. Surprise equals risk. So this warrants close observation as the Fed meeting approaches. I hate to keep repeating the same thing week after week (Actually year after year now) but the post pandemic market narrative has not changed. I can create new things to talk about just to make things interesting but I would much rather make money than create interest. I find it more important to keep our eye on the ball (now that we can see it again) rather than be entertaining….. I also want emphasize one thing more than anything else. To keep your focus on G0d is to really keep your focus “on the ball”. Give Him all the praise for He and He alone is worthy!!

The days trading is generating the following results: Our TSP allotment remains steady in the G Fund. For comparison the Dow is off -0.07%, the Nasdaq is higher at +0.40%, and the S&P 500 is trading in the green at +0.22%. Stocks are now well off their lows for the morning. We will see if the days uptrend can hold…..

Stocks are little-changed, continuing sluggish August trading: Live updates

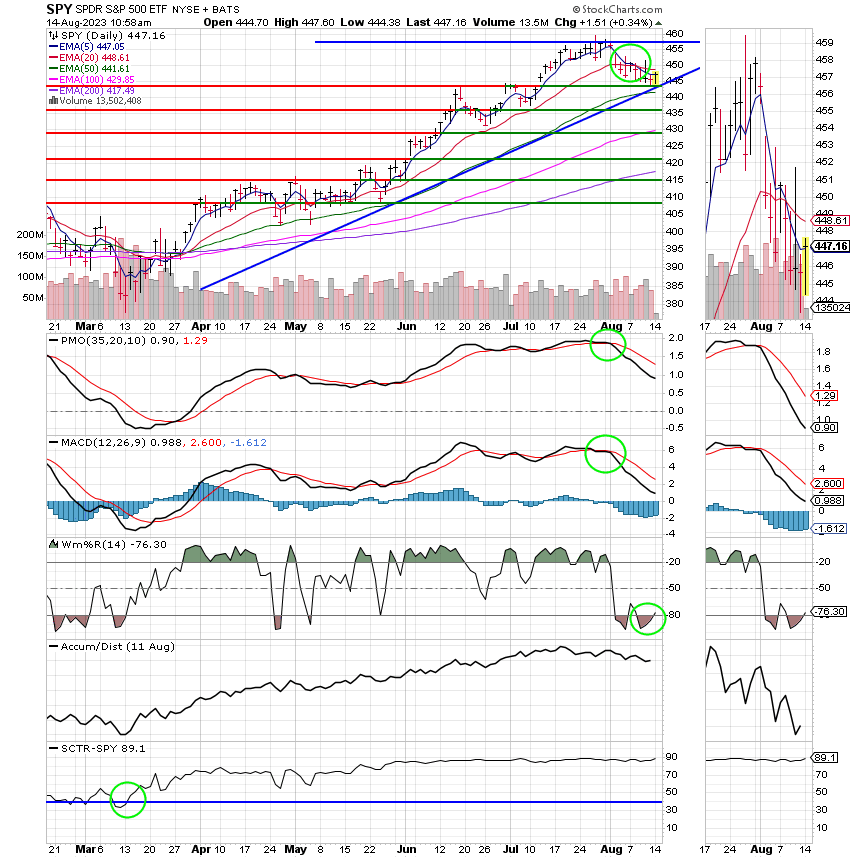

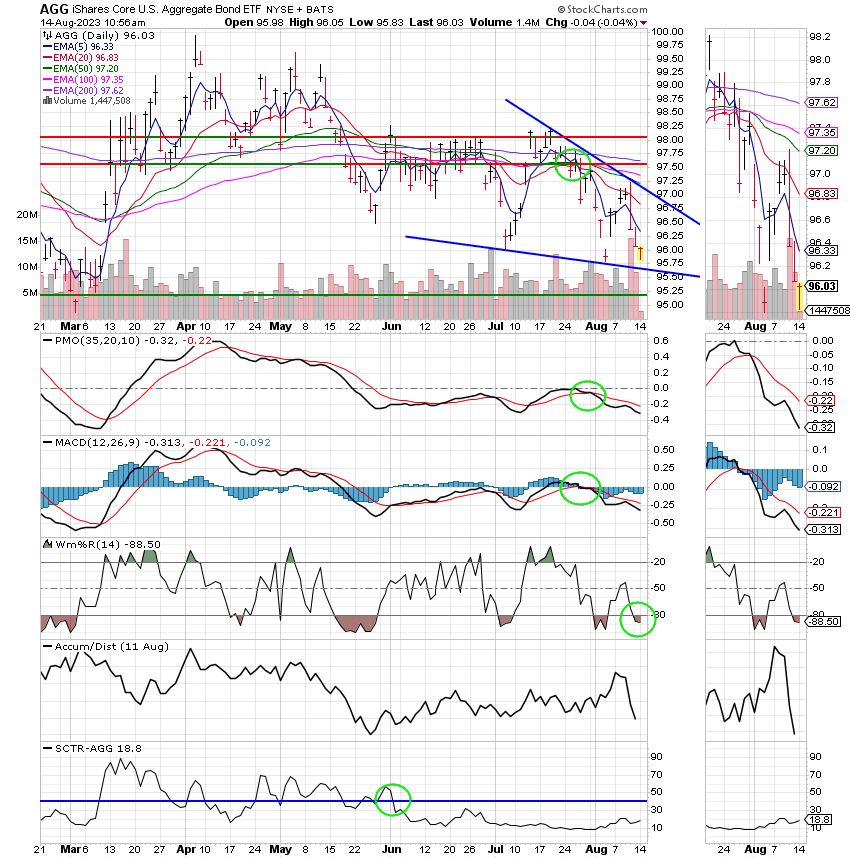

Recent action has left us with the following signals: C-Sell, S-Sell, I-Sell, F-Sell. We are currently invested at 100/G. Our allocation is -1.74% not including the days results. Our current monthly return is -2.32%. Here are the latest posted results:

| 08/11/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.6469 | 18.3534 | 69.1565 | 70.2391 | 37.9419 |

| $ Change | 0.0020 | -0.0671 | -0.0642 | -0.0733 | -0.2972 |

| % Change day | +0.01% | -0.36% | -0.09% | -0.10% | -0.78% |

| % Change week | +0.08% | -0.64% | -0.27% | -1.71% | -0.16% |

| % Change month | +0.12% | -1.35% | -2.67% | -4.31% | -3.06% |

| % Change year | +2.39% | +0.80% | +17.40% | +14.15% | +11.78% |