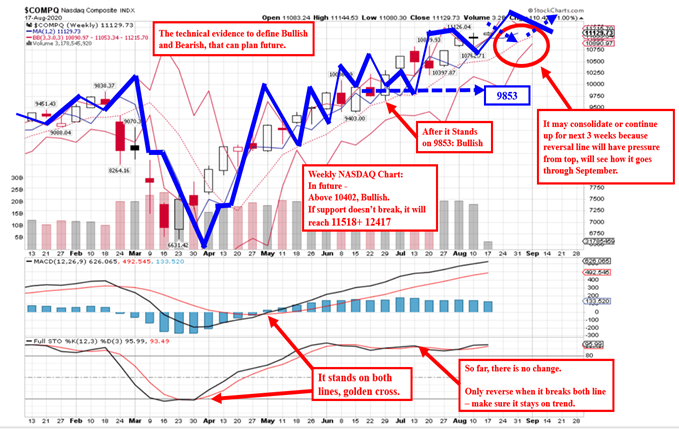

Good Afternoon, This afternoon we will be focusing on the Nasdaq ($COMPQ) and the Philladaphia Semiconductor Index (SOXX). They give us some additional insight into current market conditions. Lets start with a chart!

Above is the Nasdaq market breather indicators. So far the indicators are still healthy, not extreme.

Both DMI and MTM are resonating and continue positive.

Both DMI and MTM are resonating and continue positive. Today the S&P 500 and NASDAQ reached their all-time-high, so it’s wave pattern must be changed.

Dow Jones’s expected value will be: 28300 + 29400

SOXX index’s expected value will be: 2288 + 2482

The performance of NASDAQ and SOXX, are helping to push S&P 500 index higher.

Back in 2000 dot com bubble, the S&P 500 was around 1200-1350. Now S&P 500 is all time high around 3390. We should not be surprised to see it reach 7000 – 10000 in next 10-15 years…

Hope this analysis can help reference your TSP : )

May God Bless,

Wayne