Good Evening, Just when you though it couldn’t do it, the market marched higher to new records today. Stocks were looking a little weak in the morning session but received a shot in the arm when a report was released saying Durable Goods orders had increased beyond expectations. U.S. durable goods orders jumped by 11.2% in July, easily topping a 4.3% estimate. When you couple that with a blowout earnings report from mega tech firm Salesforce.com, declining Corona Virus cases, improving Corona Virus treatments, and renewed trade talks with China you have the recipe for skeptical investors to finally embrace the recovery. That’s what happened today and that’s what will continue to happen as the recovery gains steam. That has always been our strategy and so far it’s looking pretty good.

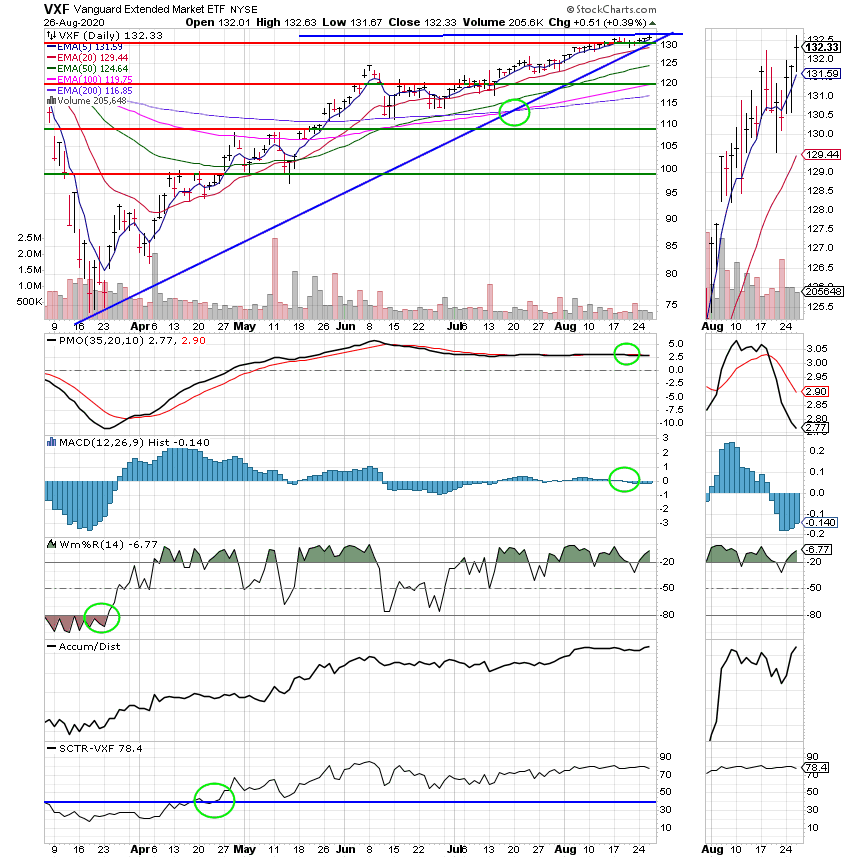

I keep getting a lot of questions about the C Fund vs the S Fund. I could write a book on that one… The S fund is made up of mid cap and small cap stocks. The C Fund is made up of large cap stocks. Most of the companies that will benefit from the the recovery after being hurt the most by the pandemic are smaller companies that fit under the umbrella of the S fund. Since we are betting on recovery we are invested in the S Fund which has out performed the C Fund since late May. Now that was not the case today as mega cap stocks outperformed. However one day does not make a trend. That is the reason, we watch the charts. Should momentum shift entirely in favor of the C Fund, we won’t hesitate to change our allocation but right now we’re going to stick with the girl we brought to the dance.

The days trading left us with the following results: Our TSP allotment posted a gain of +0.39%. For comparison, the Dow added +0.30%, the Nasdaq +1.73%, and the S&P 500 +1.02%. Praise God for a day in the green! I am most thankful for the wonderful year we are having.

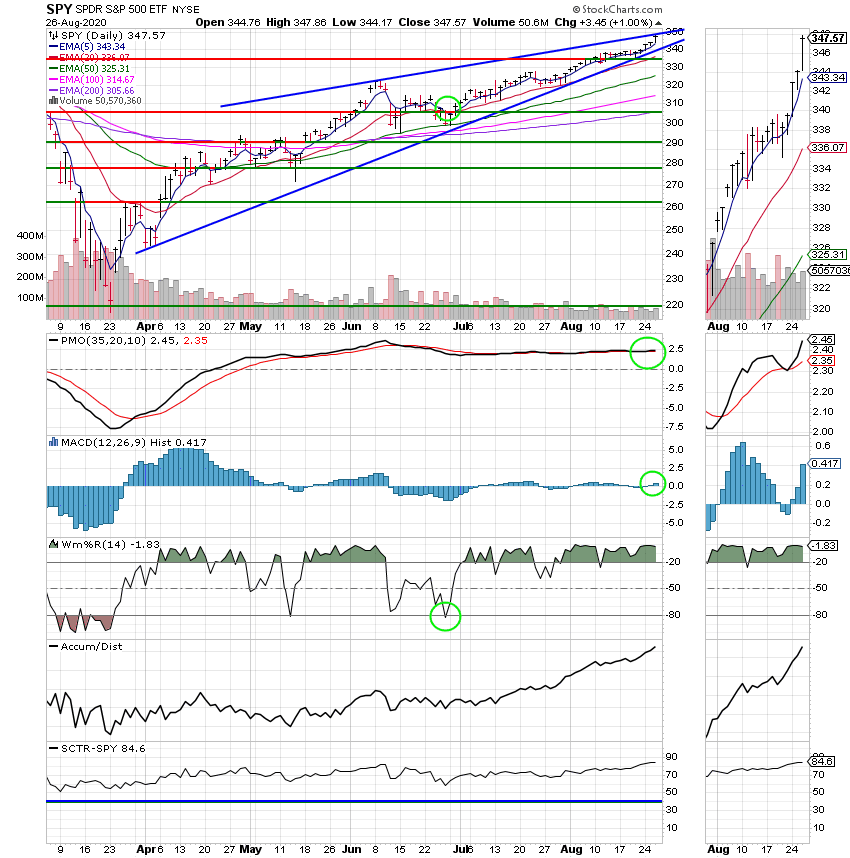

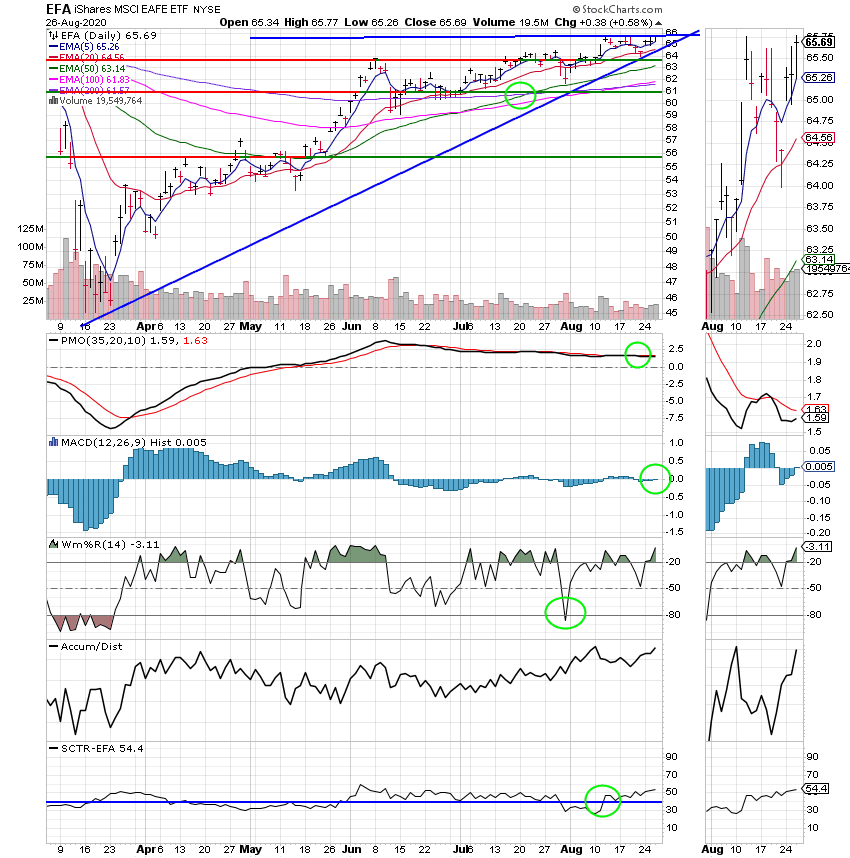

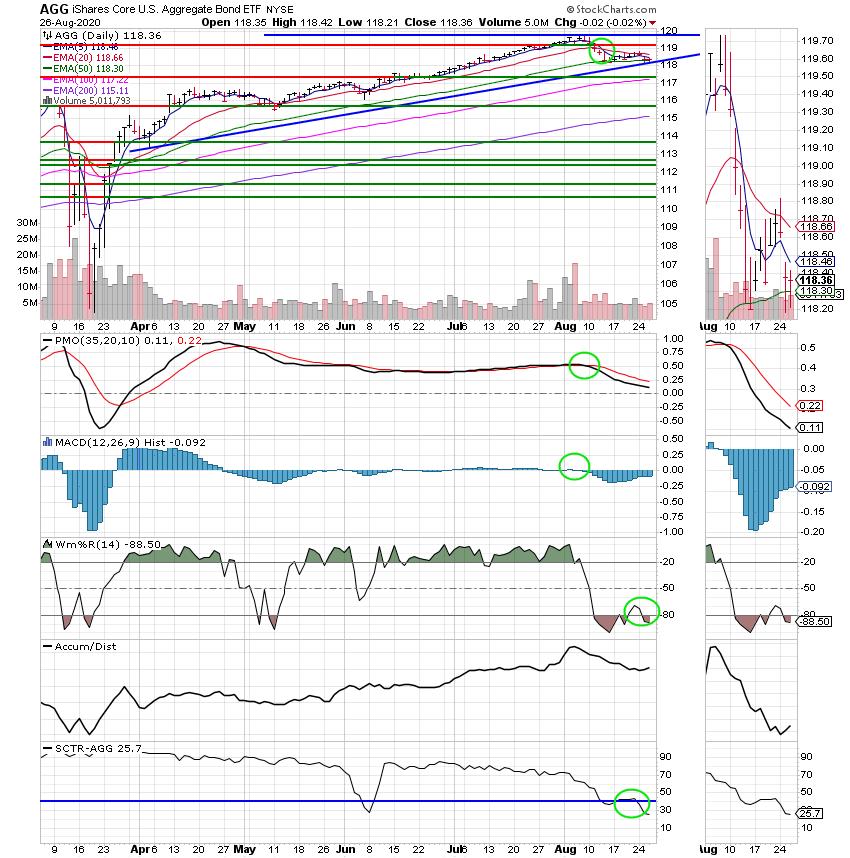

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Sell. We are currently invested at 100/S. Our allocation is now +27.12% on the year not including the days results. Here are the latest posted results:

| 08/25/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.4637 | 21.0743 | 50.9743 | 59.0016 | 31.2121 |

| $ Change | 0.0003 | -0.0381 | 0.1834 | 0.1548 | 0.0072 |

| % Change day | +0.00% | -0.18% | +0.36% | +0.26% | +0.02% |

| % Change week | +0.01% | -0.18% | +1.38% | +1.00% | +1.40% |

| % Change month | +0.04% | -0.73% | +5.42% | +5.34% | +4.85% |

| % Change year | +0.69% | +6.88% | +7.86% | +4.84% | -4.60% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 21.6105 | 10.48 | 35.9029 | 10.6335 | 39.6787 |

| $ Change | 0.0090 | 0.0109 | 0.0452 | 0.0146 | 0.0595 |

| % Change day | +0.04% | +0.10% | +0.13% | +0.14% | +0.15% |

| % Change week | +0.29% | +0.66% | +0.79% | +0.86% | +0.94% |

| % Change month | +1.12% | +2.56% | +3.08% | +3.37% | +3.68% |

| % Change year | +2.00% | +4.80% | +3.01% | +6.34% | +3.25% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 10.7387 | 23.243 | 10.9506 | 10.9506 | 10.9508 |

| $ Change | 0.0171 | 0.0398 | 0.0245 | 0.0244 | 0.0244 |

| % Change day | +0.16% | +0.17% | +0.22% | +0.22% | +0.22% |

| % Change week | +1.00% | +1.07% | +1.31% | +1.31% | +1.31% |

| % Change month | +3.93% | +4.20% | +5.16% | +5.16% | +5.16% |

| % Change year | +7.39% | +3.38% | +9.51% | +9.51% | +9.51% |

S Fund:

I fund:

F Fund:

The news favored the recovery today. The big tech firms proved again with Salesforce’s blow out earnings report that they can deliver even during a pandemic with stay at home work. The question we now have to ask ourselves is has the nature of the economy changed? Has the nature of work changed? Is this the new normal? If so will mega cap tech firms such as Apple, Google, Amazon, and Microsoft prosper and does that swing the momentum back to big cap stocks and the C Fund? We will have to watch the charts closely over the coming days to answer these questions. The biggest question we have to ask is is the character of this market changing and if so is it a permanent change??? We will see. That’s all for tonight. Have a nice evening and may God continue to bless your trades!