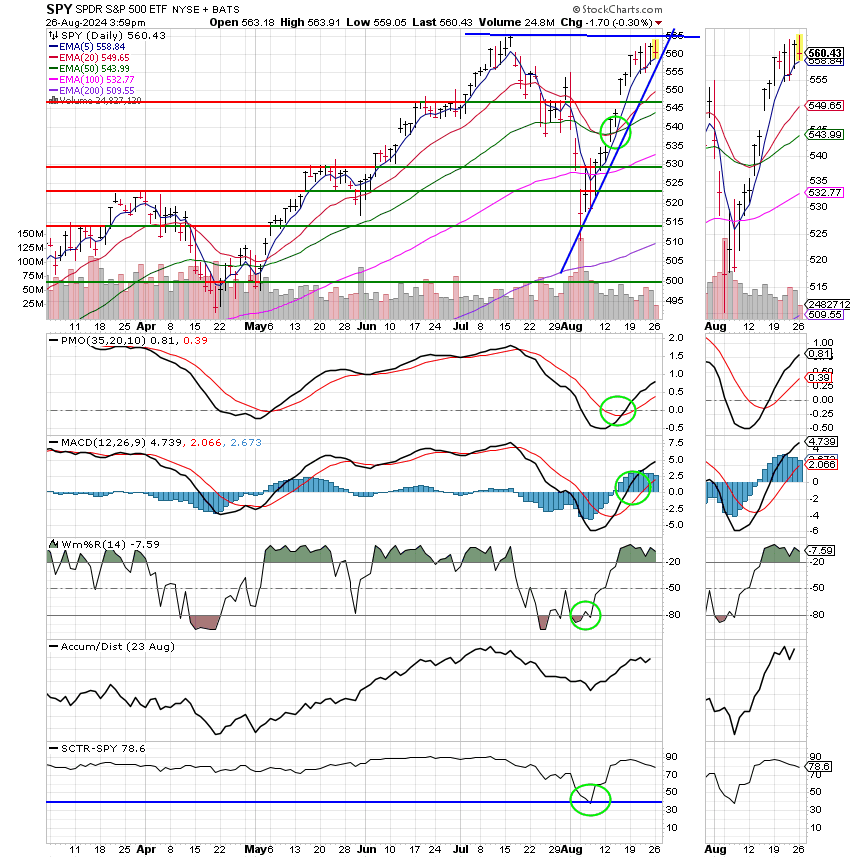

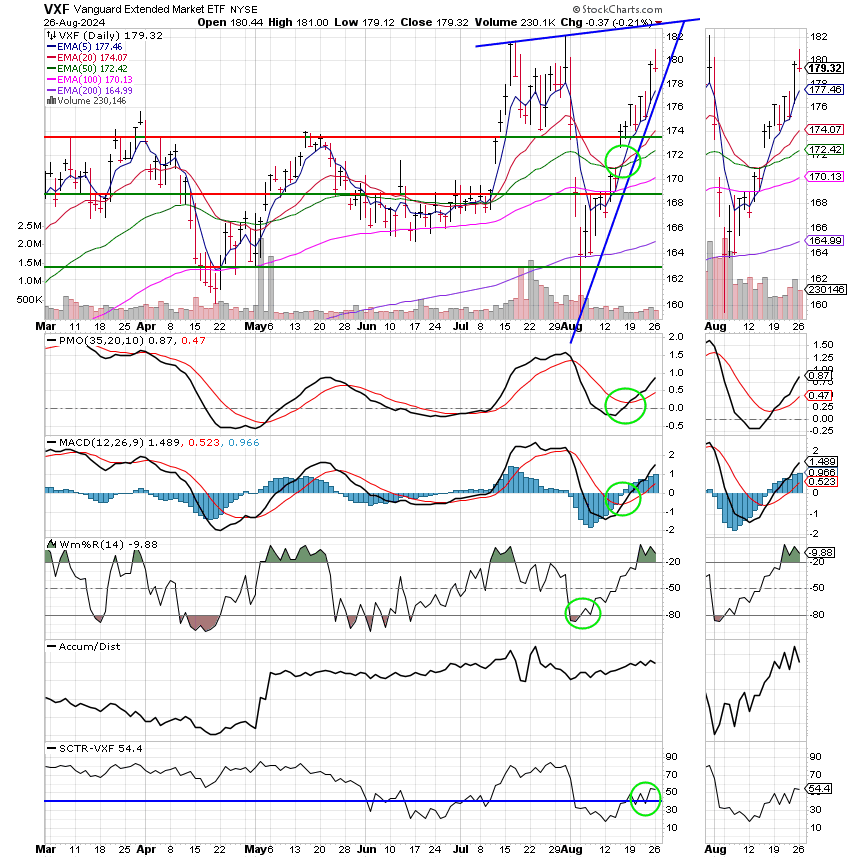

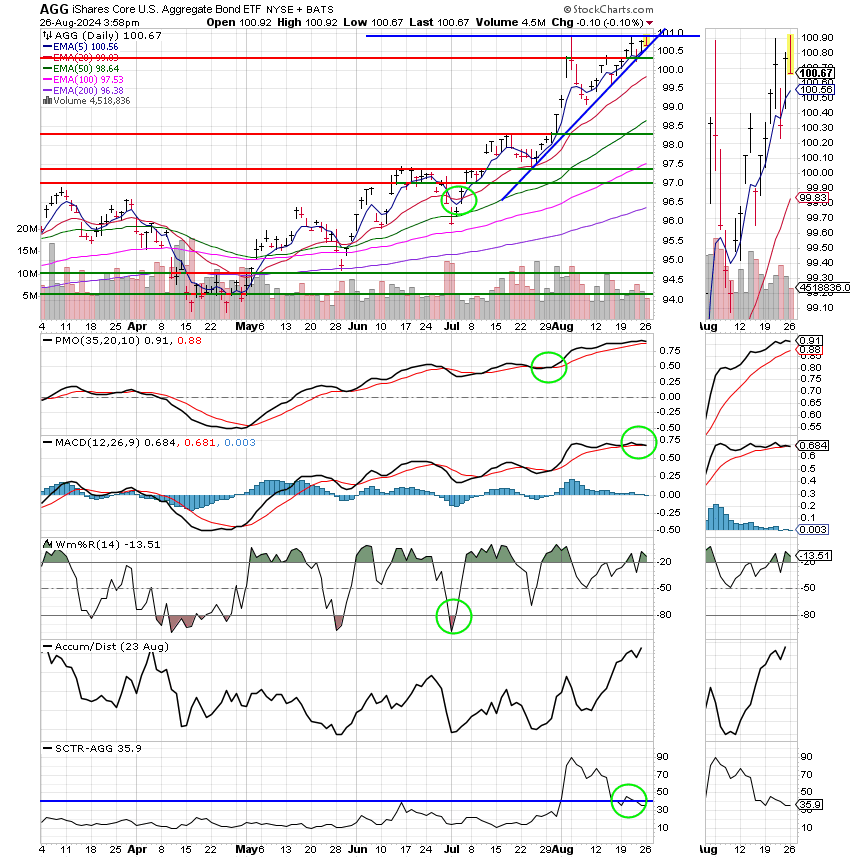

Good Afternoon, We remain fully invested at 100/C. I’m not expecting to make any money right now. More than likely the market will trade sideways with a volatile twist heading into September. Two questions I have gotten are #1 Why stay invested and #2 Are we going to move to the S Fund or When are we moving to the S Fund. #1 – Being invested now is not always about making money now. Everyday is not a moon shot. Sometimes it’s about being positioned for the next run. It would be nice if we had a crystal ball and could say that the market is going to rally on such and such a day. Then we could make an interfund transfer that would fall on that day and everything would be good. That’s not the case though and we need to be invested before the next Fed meeting which we believe will give the market a boost when the Fed reduces rates. Also, we don’t know what will happen before then. There may be another news release that tells the market more about the Fed reducing rates which of course will fuel a rally. So we must be stay invested. Also we only get two trades a month, so we don’t want to have to waste a trade to buy back in in September. #2. Refer to #1. We are out of trades for August. To be honest with you, even though the S Fund has had a couple of really nice days of out performance it’s chart is still lagging behind the chart for the C Fund. Most likely because of the higher level of volatility in the current market. It is my thought that volatility will continue until the rate of inflation returns to two percent. Something we have been saying here for a few years now. How about the market leading up to September? Well we have two market moving events this week The first is Nvidia’s (NVDA) quarterly report. Of course NVDA is the market darling of the tech AI related rally that fueled the market for most of this year. It is now considered a bellwether stock based on not only it’s market cap which I think at one time earlier this year (and may still be) was the largest in the market but also because it is an indicator of the Artificial Intelligence boom. It’s kind of like Apple AAPL used to be. So went Apple, so went the market. It’s like that when a stocks market cap gets into the trillions. It has a big influence on the market. Anyway, watch the Nvidia report on Wednesday. I think it’s released after the bell. The 2nd market moving event this week is huge. It is the CPE report at 8:30 AM EDT on Friday. Folks, this one is the Feds Favorite report for inflation and it’s the last one before the September Fed meeting. It could easily influence the size of the September rate decrease. If the rate decrease is +0.50% I can almost guarantee you that there will be a big rally. I think +0.25 % is already priced in. We will see and I guess it goes without saying that if for some unforeseen reason there is no rate decrease there will be a huge selloff. Here is a little bit about the report. The next release of the Personal Consumption Expenditures (PCE) Price Index is scheduled for August 30, 2024 at 8:30 AM EDT. The previous release was on July 26, 2024. The PCE Price Index is a chain-type price index that measures the changes in the price of goods and services purchased by consumers, excluding food and energy. The Federal Reserve closely monitors the core PCE price index when making monetary policy decisions. There you have it. Once again, I expect the market to trade mostly sideways until the Fed meeting which is the second week in September if I am correct.

The days trading so far has left us with the following results. Our TSP allotment is in the red at -0.31%. For comparison, the Dow is trading modestly higher at +0.19%, the Nasdaq is off -0.88%, and the S&P 500 is giving up -0.31%.

Dow touches new record then struggles, S&P pulled down by tech: Live updates

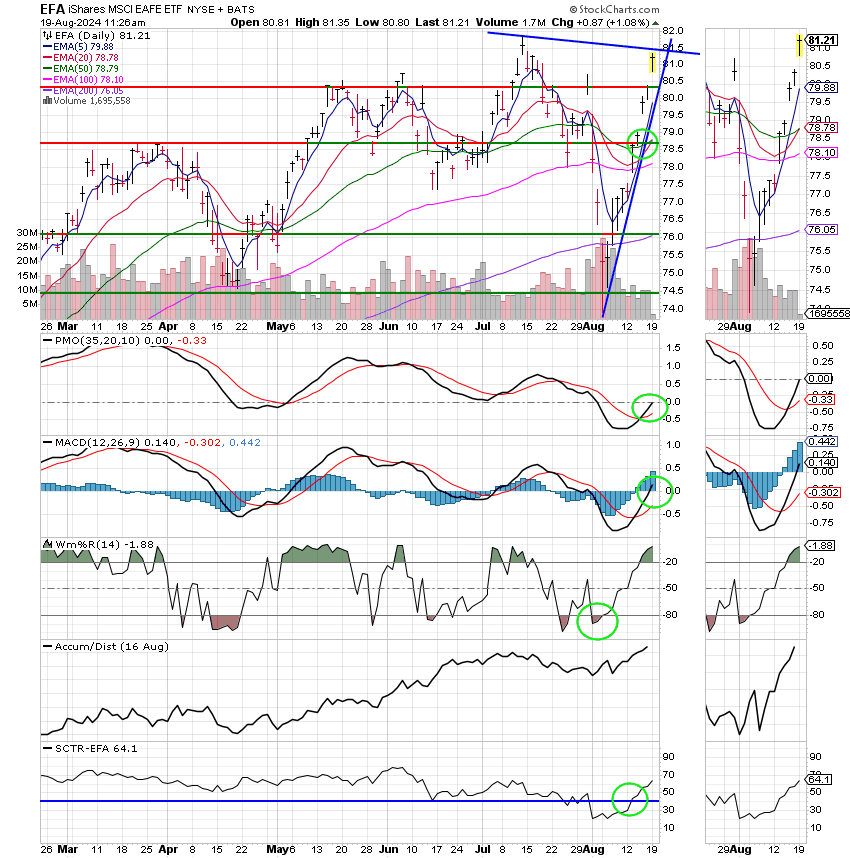

Recent action has generated the following signals: C-Buy, S-Buy, I-Buy, F-Buy. We are currently invested at 100/C. Our allocation is now +10.04% for the year not including the days results. Here are the latest posted results:

| 08/23/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.4794 | 19.9298 | 88.6214 | 84.8012 | 44.9442 |

| $ Change | 0.0021 | 0.0801 | 1.0064 | 2.1176 | 0.6439 |

| % Change day | +0.01% | +0.40% | +1.15% | +2.56% | +1.45% |

| % Change week | +0.08% | +0.67% | +1.47% | +3.09% | +2.72% |

| % Change month | +0.26% | +1.96% | +2.14% | +0.26% | +2.74% |

| % Change year | +2.87% | +3.68% | +19.17% | +10.00% | +11.85% |