Good Evening, Energy and slow manufacturing activity pulled the market down today with the only bright spot being the Nasdaq which outperformed as stocks such as Facebook and Alphabet (the parent company of Google) made big gains. Stocks remain in a tight trading range as we wait for them to resolve one way or the other. Of course our group is waiting for a pullback that seems way overdue….. The days trading left us with the following results: Our TSP allotment dropped -0.42%. For comparison, the Dow lost -0.15%, the Nasdaq gained +0.43%, and the S&P fell back -0.13%. There wasn’t much working today unless you were in tech.

The days trading left us with the following signals: C-Buy, S-Buy, I-Neutral, F-Neutral. We are currently invested at 100/F. Our allocation is now +1.91% on the year not including the days results. Here are the latest posted results:

| 07/29/16 |

|

|

|

Prior Prices |

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

15.0734 |

18.0017 |

29.6841 |

38.1467 |

24.4466 |

| $ Change |

0.0019 |

0.0483 |

0.0487 |

0.1245 |

0.4475 |

| % Change day |

+0.01% |

+0.27% |

+0.16% |

+0.33% |

+1.86% |

| % Change week |

+0.04% |

+0.49% |

-0.05% |

+0.66% |

+2.38% |

| % Change month |

+0.13% |

+0.64% |

+3.69% |

+5.40% |

+5.07% |

| % Change year |

+1.06% |

+6.17% |

+7.70% |

+8.26% |

+1.46% |

| |

L INC |

L 2020 |

L 2030 |

L 2040 |

L 2050 |

| Price |

18.2126 |

24.0612 |

26.2275 |

27.9339 |

15.8492 |

| $ Change |

0.0299 |

0.0788 |

0.1209 |

0.1490 |

0.0948 |

| % Change day |

+0.16% |

+0.33% |

+0.46% |

+0.54% |

+0.60% |

| % Change week |

+0.21% |

+0.39% |

+0.54% |

+0.62% |

+0.70% |

| % Change month |

+1.00% |

+2.01% |

+2.85% |

+3.31% |

+3.74% |

| % Change year |

+2.47% |

+3.67% |

+4.64% |

+5.13% |

+5.48% |

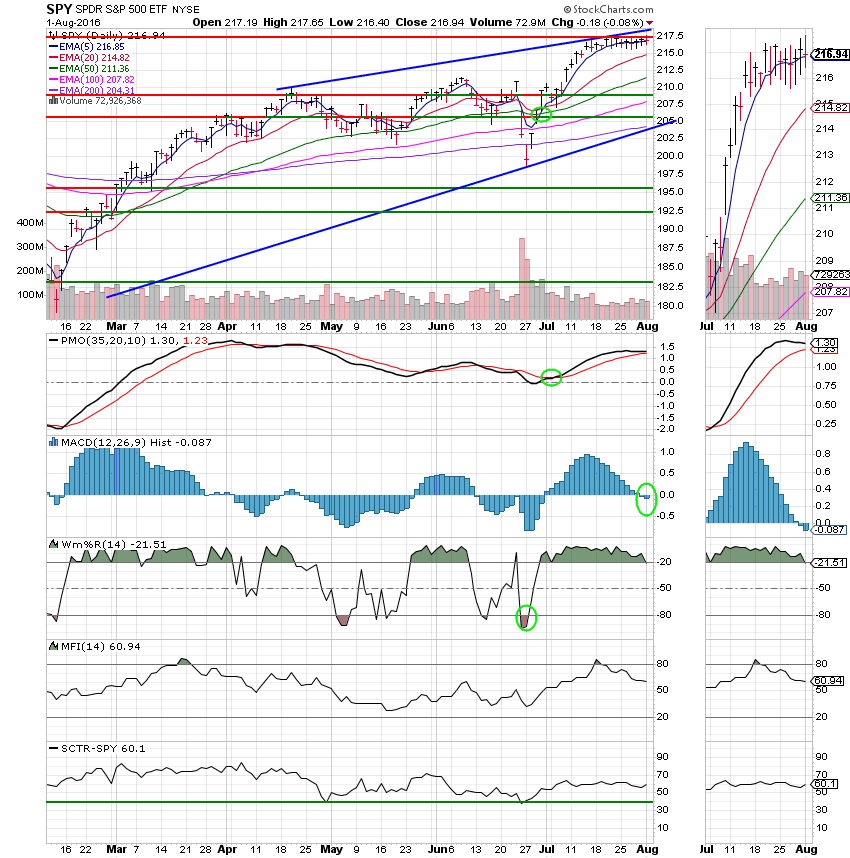

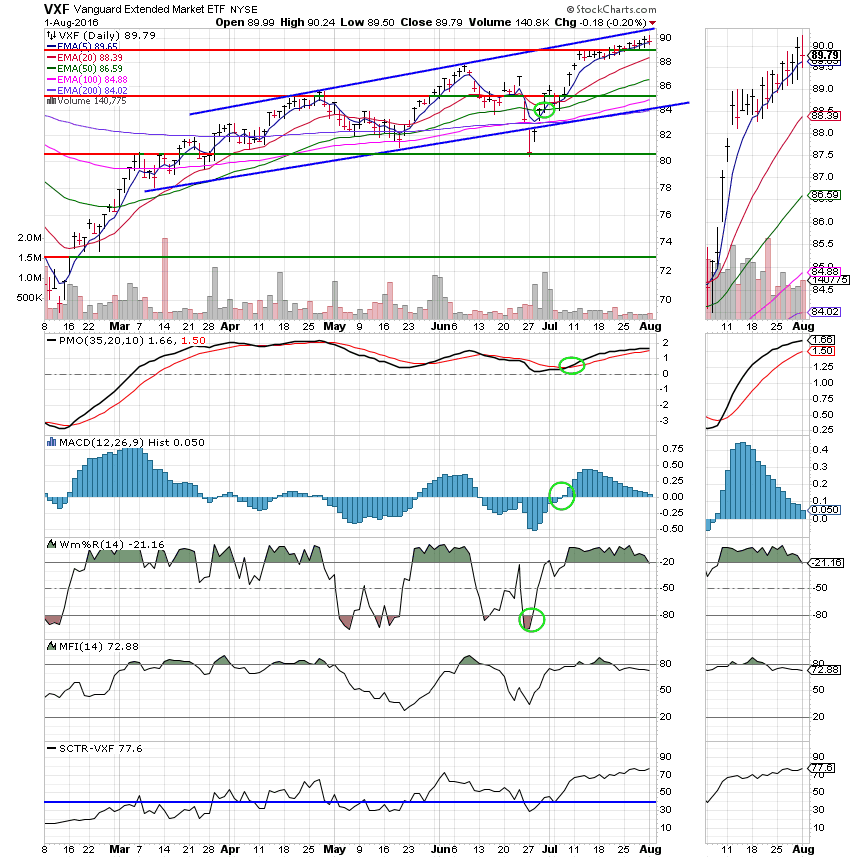

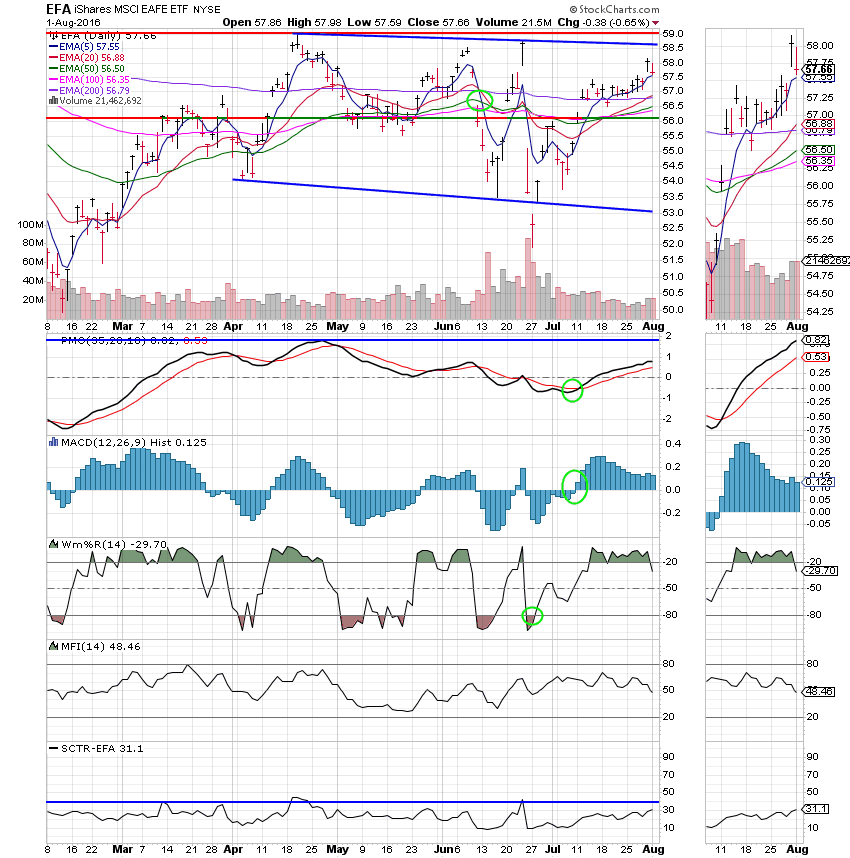

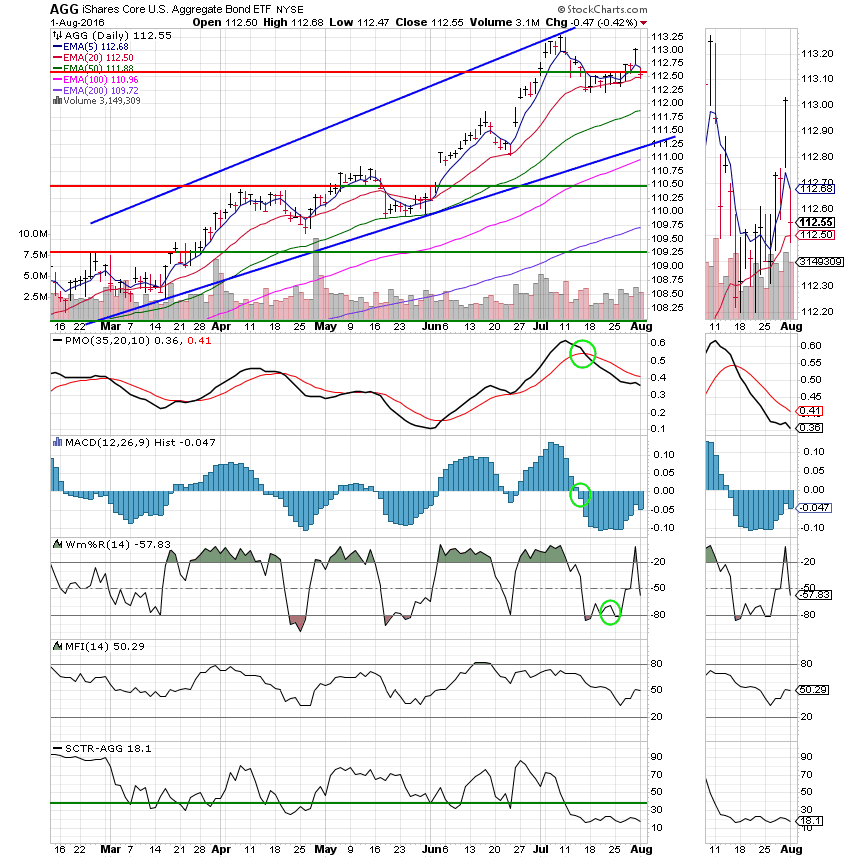

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund:

S Fund:

I Fund:

F Fund:

We continue to wait for a pullback. I’d like to say patiently….. It’s so tempting to chase, but one has to wonder if the machines are about to fake the market players out again. We’ll continue to hold on in the F Fund as long as we can. It gets tougher to do as we move forward. Nonetheless , we are committed and must maintain our discipline. This tight trading range will eventually resolve and it’s anybody’s guess in which direction it will go. The consensus among most investors is that the market is extended and can’t move much higher, but it seems like the consensus has been wrong for a while. We’ll keep an eye on the charts and see where it all goes when the smoke finally clears. Also, keep praying! God will guide our path in this market as He always has. Have a great evening!

God bless, Scott

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.