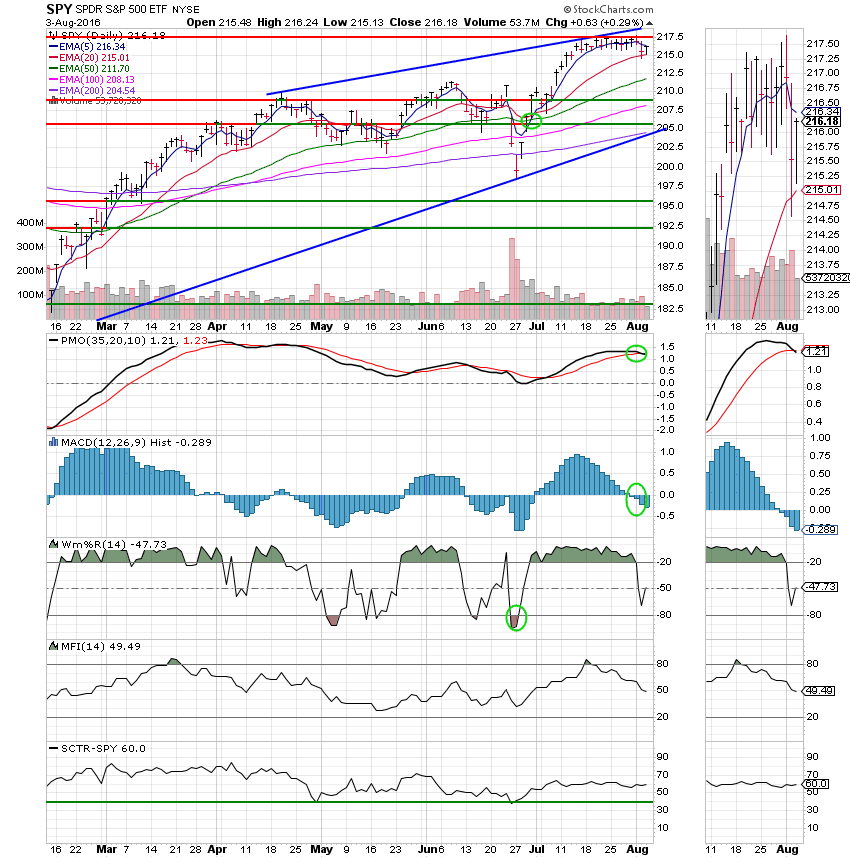

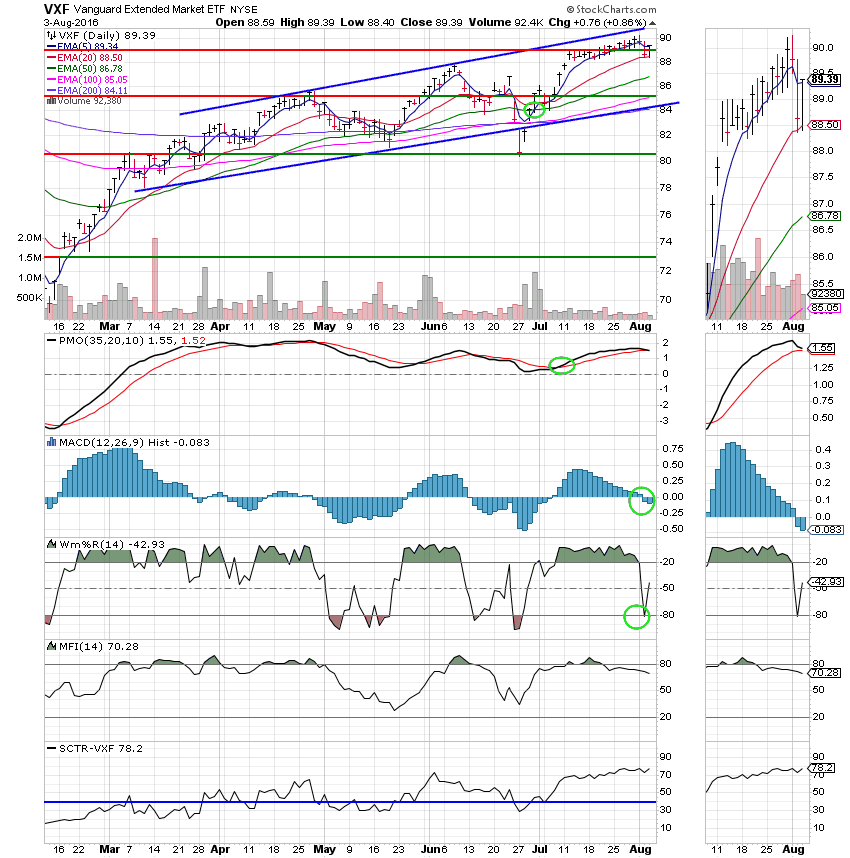

Good Evening, Just when the bears had the advantage and we thought we were finally heading down, the dip buyers showed up to put us right back in the same trading range. However, with the dog days of summer in mid swing it will be hard for the bulls to gain any meaningful ground. The bottom line is that this market remains range bound and it is impossible to know in which direction it will ultimately go. A lot of market players think it’s going to be down, but they have been wrong for years now. So who’s to really say that this time is any different.

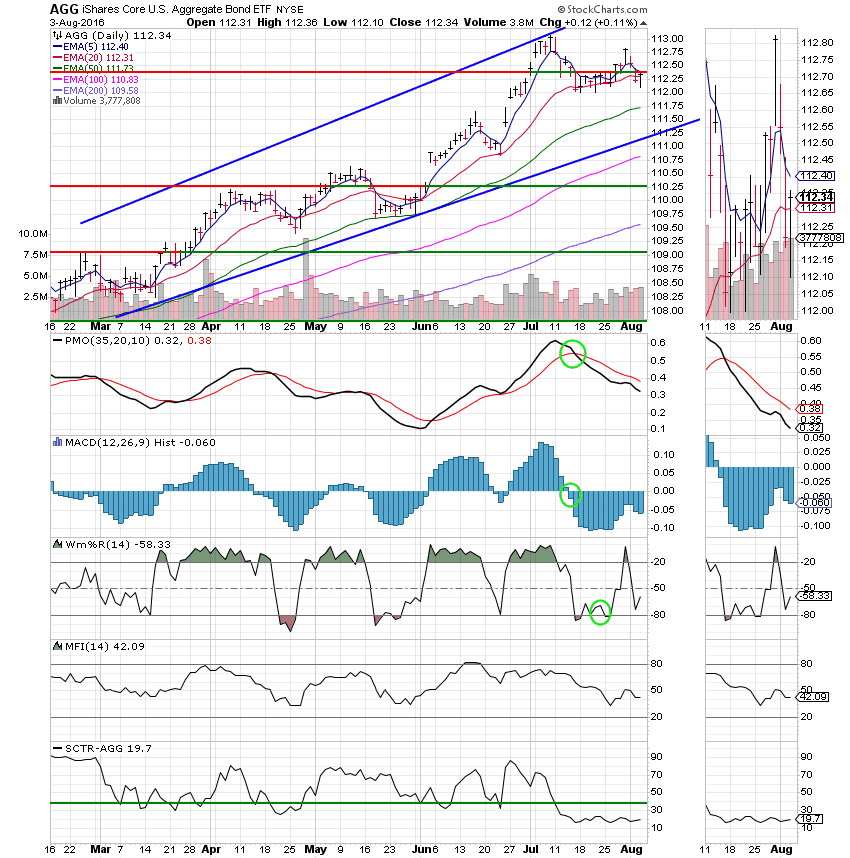

The days trading left us with the following results: Our TSP allotment eased up +0.11%. For comparison, the Dow gained +0.23%, the Nasdaq +0.43%, and the S&P +0.31%.

Energy, financial stocks give Wall St. modest lift

The days action left us with the following signals: C-Neutral, S-Buy, I-Neutral, F-Neutral. We are currently invested at 100/F. Our allotment is now +1.48% on the year not including the days results. Here are the latest posted results:

| 08/02/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 15.0746 | 17.9262 | 29.4587 | 37.6034 | 24.1872 |

| $ Change | 0.0006 | -0.0378 | -0.1877 | -0.4690 | -0.0257 |

| % Change day | +0.00% | -0.21% | -0.63% | -1.23% | -0.11% |

| % Change week | +0.01% | -0.42% | -0.76% | -1.42% | -1.06% |

| % Change month | +0.01% | -0.42% | -0.76% | -1.42% | -1.06% |

| % Change year | +1.07% | +5.73% | +6.88% | +6.72% | +0.38% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 18.1746 | 23.9556 | 26.0624 | 27.7286 | 15.7177 |

| $ Change | -0.0221 | -0.0620 | -0.0974 | -0.1215 | -0.0783 |

| % Change day | -0.12% | -0.26% | -0.37% | -0.44% | -0.50% |

| % Change week | -0.21% | -0.44% | -0.63% | -0.73% | -0.83% |

| % Change month | -0.21% | -0.44% | -0.63% | -0.73% | -0.83% |

| % Change year | +2.26% | +3.22% | +3.99% | +4.35% | +4.60% |