Good Evening, Things started off good in the morning, but were on the way down by the afternoon on concerns about dropping oil. Traders tried and failed to get a bounce two times during the day. However, they did manage to drive us off the lows of the day before the close. I said before and I still say that the benefits of low oil will ultimately outweigh the negatives. I’m not as convinced that oil will keep going down as everybody else is. A few notable experts are saying that the Saudi’s will be forced to cut production as their wells are starting to fill with water from pumping so long at capacity. After hearing them speak, I agree. My downside target for oil is and has been in the 42.00 dollar per barrel range. We will see. Either way, I’m steering clear of energy stocks on the street and I recommend that you do the same.

The days trading left us with the following results: Our TSP allotment slipped back -0.3194%. For comparison the Dow lost -0.52%, the Nasdaq -0.25%, and the S&P 500 -0.26%.

Weak oil prices, China worries drag Wall Street lower

The days action left us with the following signals: C-Buy, S-Sell, I-Neutral, F-Neutral. We are currently invested at 33/C, 33/S, 34/I. Our allocation is now +0.50% on the year not including the days results. Here are the latest posted results:

| 07/31/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7848 | 16.9344 | 28.0874 | 38.0506 | 26.3334 |

| $ Change | 0.0009 | 0.0477 | -0.0636 | 0.1147 | 0.2914 |

| % Change day | +0.01% | +0.28% | -0.23% | +0.30% | +1.12% |

| % Change week | +0.04% | +0.33% | +1.19% | +1.37% | +1.03% |

| % Change month | +0.19% | +0.74% | +2.10% | -0.12% | +2.08% |

| % Change year | +1.15% | +0.79% | +3.39% | +4.83% | +8.73% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7905 | 23.6522 | 25.7713 | 27.5062 | 15.6661 |

| $ Change | 0.0105 | 0.0352 | 0.0490 | 0.0593 | 0.0396 |

| % Change day | +0.06% | +0.15% | +0.19% | +0.22% | +0.25% |

| % Change week | +0.29% | +0.63% | +0.80% | +0.92% | +1.03% |

| % Change month | +0.55% | +1.03% | +1.22% | +1.33% | +1.46% |

| % Change year | +1.95% | +3.29% | +3.89% | +4.27% | +4.73% |

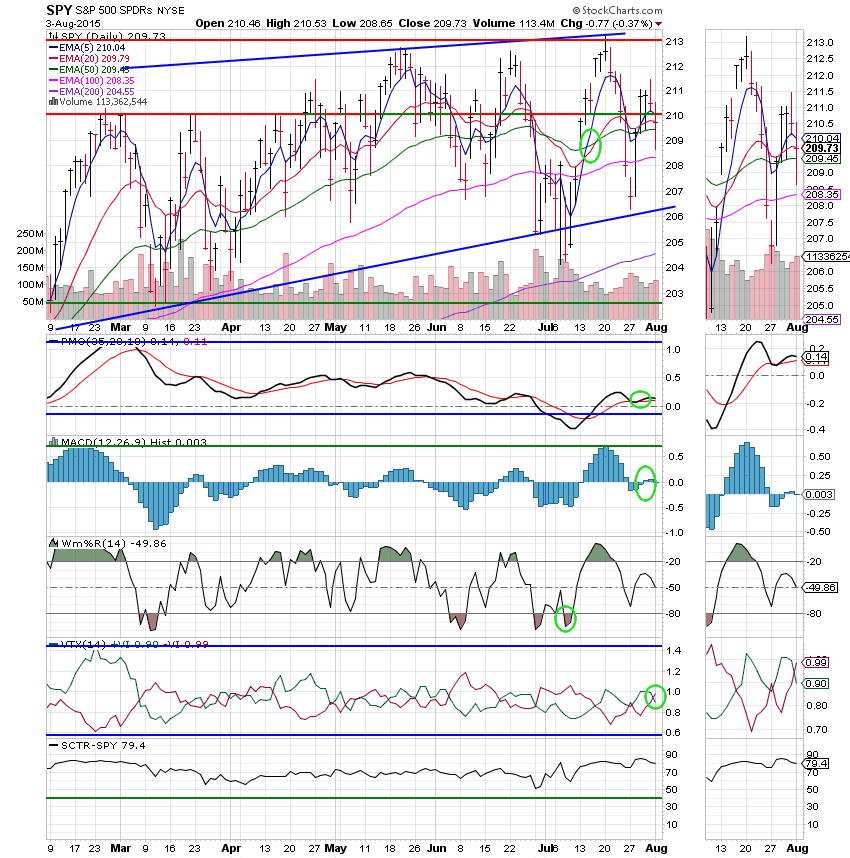

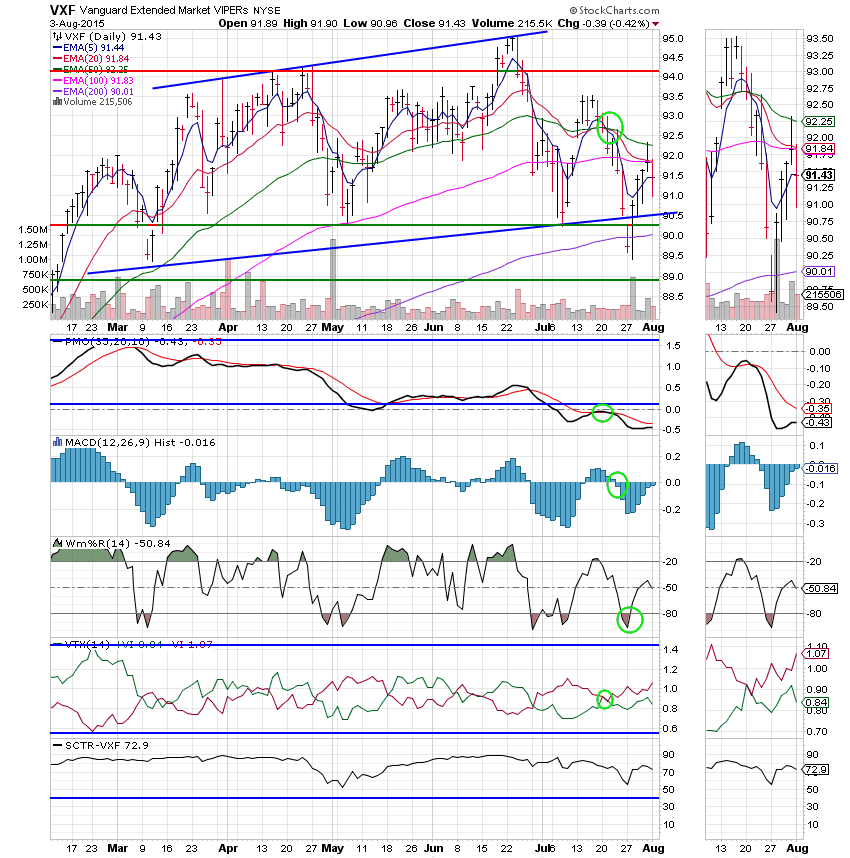

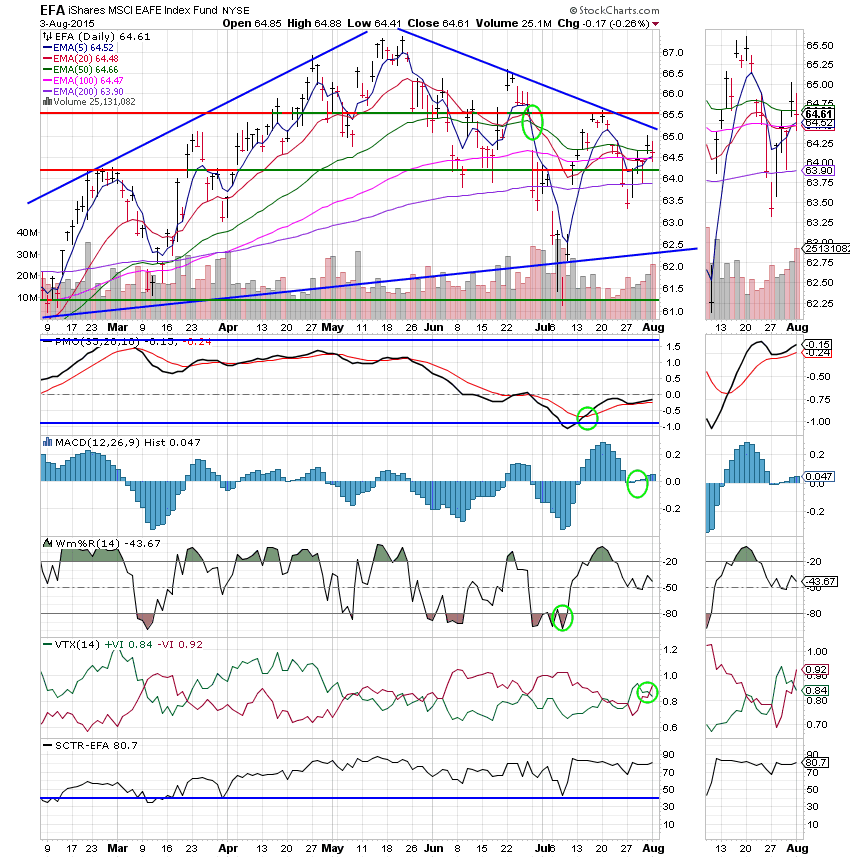

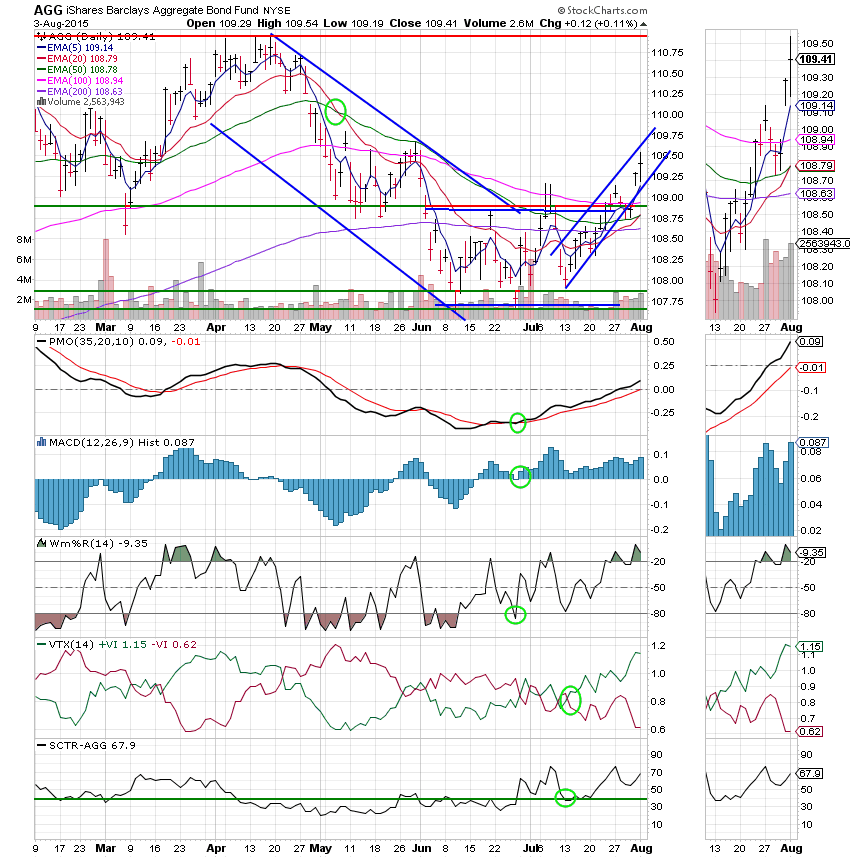

Here are the charts. (All signals annotated with Green Circles)

C Fund: Price slipped back below support and closed right on it’s 20 EMA. Price, the PMO, MAC D, and Williams %R are all in positive configurations so the C Fund is still hanging on to it’s by signal. However, without some positive action tomorrow it will likely slip to neutral. The VTX did move to a bearish signal. That signal has been whipsawing quite a bit of late so I’m not sure how much we can read into change. Nevertheless, we’ll keep an eye on it as it can sometimes be an excellent early indicator.

S Fund: Price moved back down below it’s 20 EMA. All indicators with the exception of the Williams %R are in negative configurations so this one is still a sell.

I Fund: Price moved back below it’s 20 EMA today. Also negative, the VTX moved to a bearish signal. This one’s still neutral for now, but negative signals in price and the VTX bear watching,

F Fund: The F fund continues to strengthen. Price made another small gain moving further up into the newly established ascending channel and pulling it’s 20 EMA up through it’s 50 EMA. All indicators with the exception of price are in a positive configurations. This one is a strong neutral. The strong action in bonds may indicate further weakness in stocks!

Of course our allocation is only a recommendation. You can stick with it or read and react to the signals in whatever way you feel comfortable with. Inevitably, I will get a message from one or two folks that bought and sold the signals in their own way and out performed our allocation. We tend to be very conservative with our allocation as it is used as a baseline for so many folks. You can always take more risk and make more money, but it usually equals out over several years. Some years it pays to be conservative and some years not. We’ll see what happens tomorrow. It says here that if the dollar goes up and oil goes down then stocks will go down. If not, then they will rise. Either way, God’s still in control. May He continue to bless your trades. Have a great evening!