Good Evening, The mighty Apple which carries the most weight in many indexes dropped on concerns about it’s I phone sales, particularly in China. In addition, new rumors surfaced about a possible interest rate increase in September. The sum result of all this was a negative day on wall street. It really wasn’t that bad and could even be considered run of the mill action for August…….

The days trading left us with the following results: Our TSP allotment slipped back -0.0487%. For comparison, the Dow dropped -0.27%, the Nasdaq -0.19%, and the S&P 500 -0.22%.

Wall Street moves lower on Apple, interest rate worries

The days action left us with the following signals: C-Neutral, S-Sell, I-Neutral, F-Neutral. We are currently invested at 33/C, 33/S, 34/I. Our allocation is now +0.22% on the year not including the days results. Here are the latest posted results:

| 08/03/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7875 | 16.9756 | 28.0099 | 37.8841 | 26.3004 |

| $ Change | 0.0027 | 0.0412 | -0.0775 | -0.1665 | -0.0330 |

| % Change day | +0.02% | +0.24% | -0.28% | -0.44% | -0.13% |

| % Change week | +0.02% | +0.24% | -0.28% | -0.44% | -0.13% |

| % Change month | +0.02% | +0.24% | -0.28% | -0.44% | -0.13% |

| % Change year | +1.17% | +1.04% | +3.11% | +4.37% | +8.60% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7862 | 23.6271 | 25.7327 | 27.456 | 15.633 |

| $ Change | -0.0043 | -0.0251 | -0.0386 | -0.0502 | -0.0331 |

| % Change day | -0.02% | -0.11% | -0.15% | -0.18% | -0.21% |

| % Change week | -0.02% | -0.11% | -0.15% | -0.18% | -0.21% |

| % Change month | -0.02% | -0.11% | -0.15% | -0.18% | -0.21% |

| % Change year | +1.92% | +3.18% | +3.74% | +4.08% | +4.51% |

Let’s take a look at the charts. (All signals annotated with Green Circles)

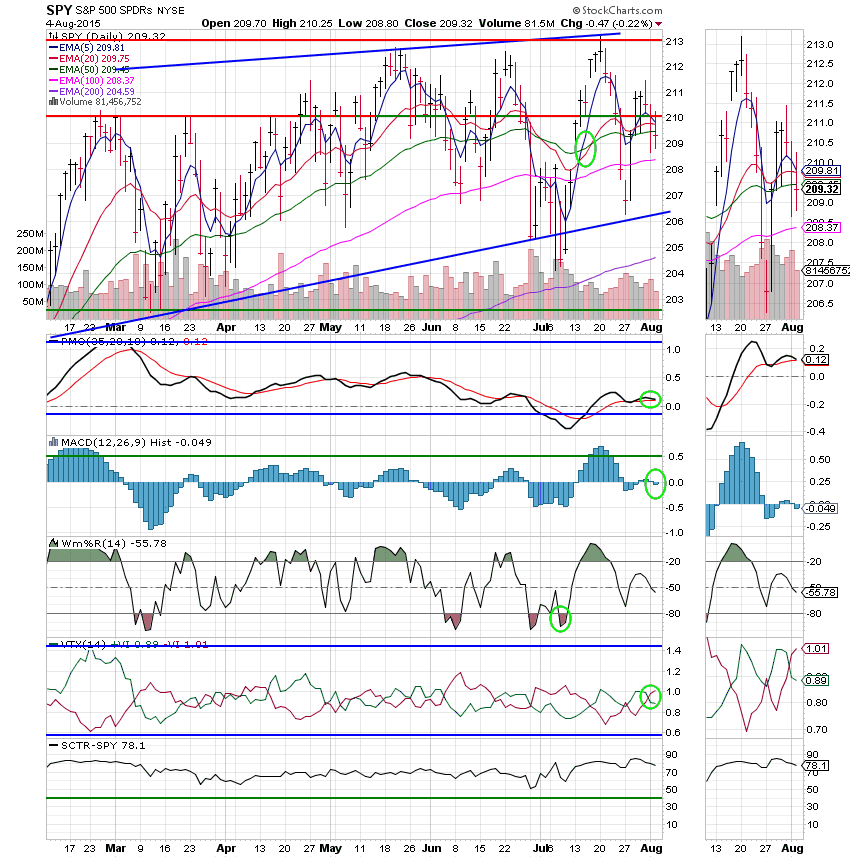

C Fund: Price dropped below it’s 50 EMA today. The PMO and MAC D, both moved into negative configurations producing a new overall signal of Neutral.

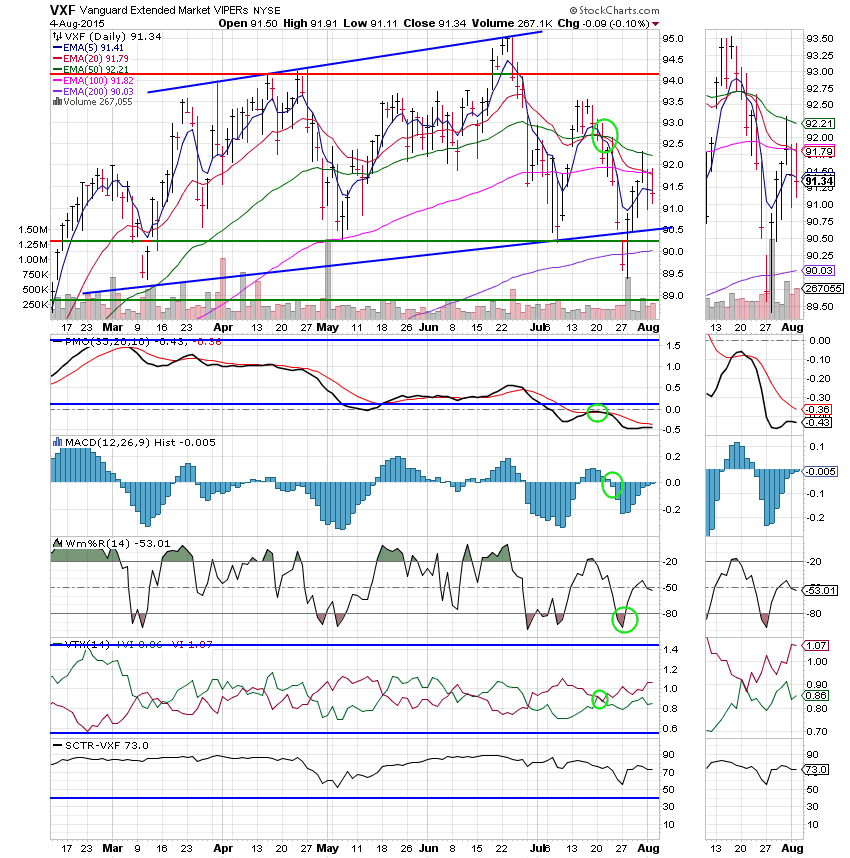

S Fund: Price remained in the same range between the 50 and 100 EMA’s. All indicators with the exception of the Williams %R are negative making this one a sell.

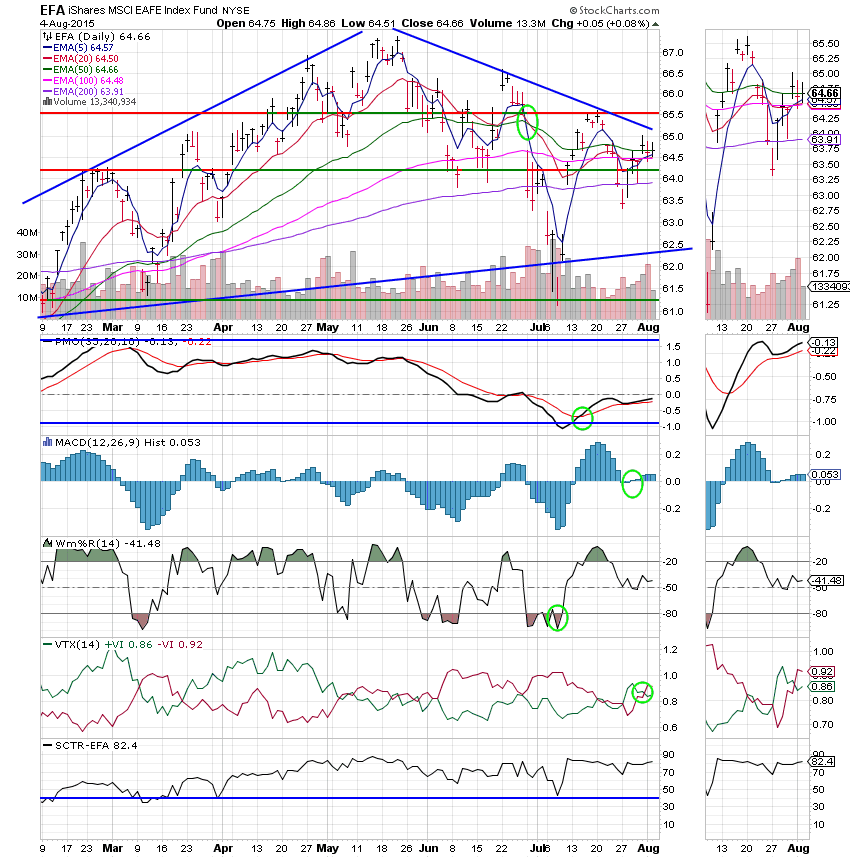

I Fund: Price moved back up to it’s 20 EMA today. The PMO, MAC D, and Williams %R all remain in positive configurations leaving this chart at neutral. The SCTR is now a healthy 82.4.

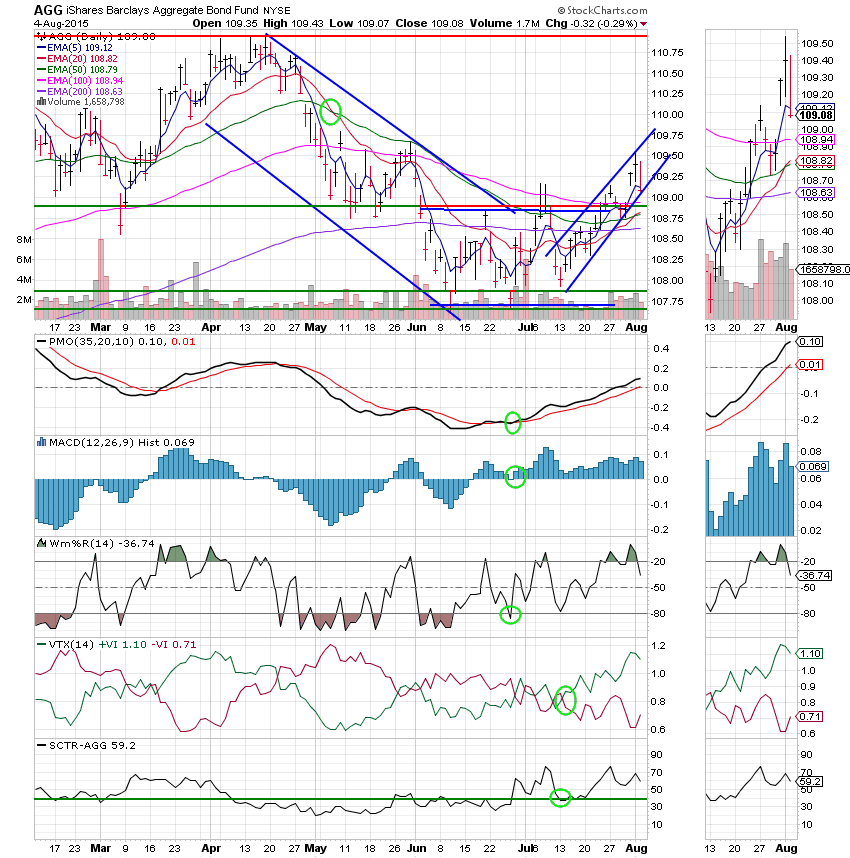

F Fund: Bonds took a hit today which is no surprise given the the rumor of a September interest rate increase. Price dropped to the bottom of the ascending channel, but the F fund is still in a short term up trend for now. All signals with the exception of price are positive so this chart remains neutral.

I’ll probably wear this phrase out in the coming weeks, but to me the trading is typical for the dog days of summer. We’ll keep a close eye on the C Fund for now with regard to any possible moves in our allocation. For the mean time. the market is doing enough to keep the major indices afloat. That’s about it! Have a nice evening and I’ll see you tomorrow. May God continue to bless your trades!