Good Evening, The market bounced back and set new highs again today. When I first learned how to invest and pretty much ever since then it has been considered unwise to invest in and extended market. For those of you that don’t understand this terminology the term overbought might apply. This all refers to a market that is at it’s highs and has been at it’s highs for a while. Another way of putting it is a market that is due for a pullback. Prior to 2009 you could pretty much set your clock by the pullbacks after the market reached new highs. However, since the advent of computer algorithms and the Fed’s financial engineering, the market is void of meaningful pullbacks and full of V shaped recoveries. The end result of all of this is that investors must chase high priced stocks or be left behind. Defensive minded traders are punished every time they move to safe havens. That’s the shape of things since 2009 and it doesn’t appear to be changing. Market pundits continue to say the sky is falling, but they look worse than Chicken Little. Nevertheless one has to ask how long this 7 year bull market can continue….

The days trading left us with the following results: Our TSP allotment slipped back -0.18%. For comparison the Dow gained +0.32%, the Nasdaq +0.56%, and the S&P 500 +0.28%.

Wall St. ends at record highs; commodity shares climb

The days action left us with the following signals: C-Neutral, S-Buy, I-Buy, F-Neutral. We’re still invested at 100/F. We’d like to get back into equities, but it’s just to risky to do it without a pullback. Everyone needs to keep in mind that this is retirement money not mad money…. Our allotment is now +1.80% on the year not including the days results.

| 08/12/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 15.0807 | 17.9821 | 29.8653 | 38.2537 | 24.8043 |

| $ Change | 0.0006 | 0.0487 | -0.0223 | -0.0103 | 0.0392 |

| % Change day | +0.00% | +0.27% | -0.07% | -0.03% | +0.16% |

| % Change week | +0.03% | +0.42% | +0.12% | -0.02% | +2.85% |

| % Change month | +0.05% | -0.11% | +0.61% | +0.28% | +1.46% |

| % Change year | +1.11% | +6.06% | +8.36% | +8.57% | +2.94% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 18.248 | 24.1524 | 26.3656 | 28.1028 | 15.9571 |

| $ Change | 0.0036 | 0.0045 | 0.0048 | 0.0052 | 0.0022 |

| % Change day | +0.02% | +0.02% | +0.02% | +0.02% | +0.01% |

| % Change week | +0.23% | +0.44% | +0.61% | +0.71% | +0.79% |

| % Change month | +0.19% | +0.38% | +0.53% | +0.60% | +0.68% |

| % Change year | +2.67% | +4.07% | +5.20% | +5.76% | +6.19% |

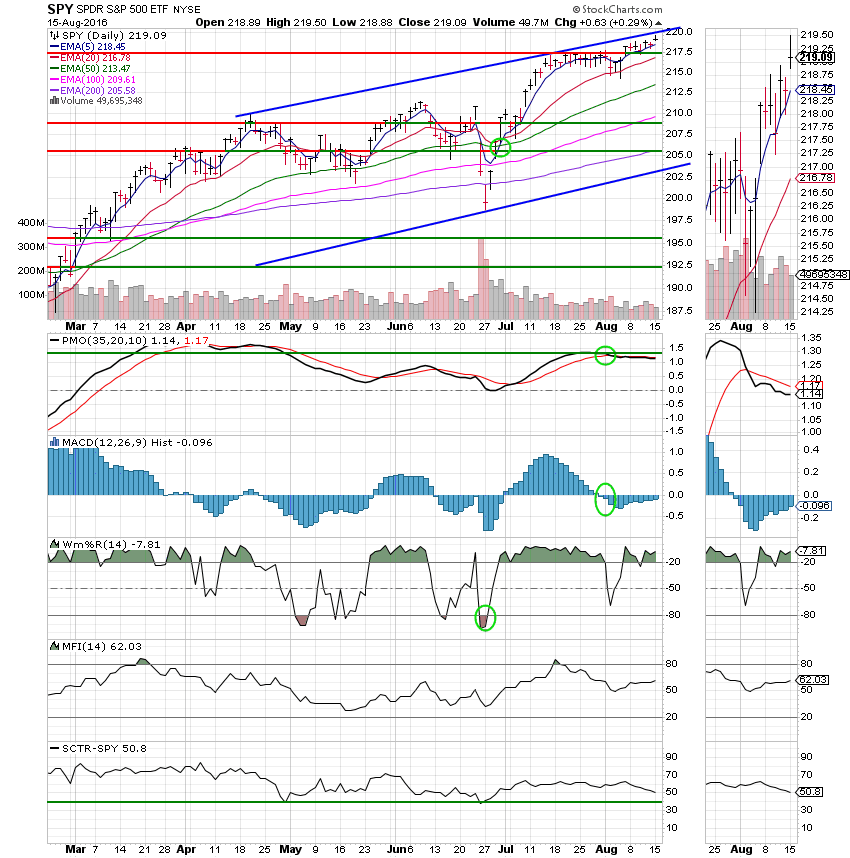

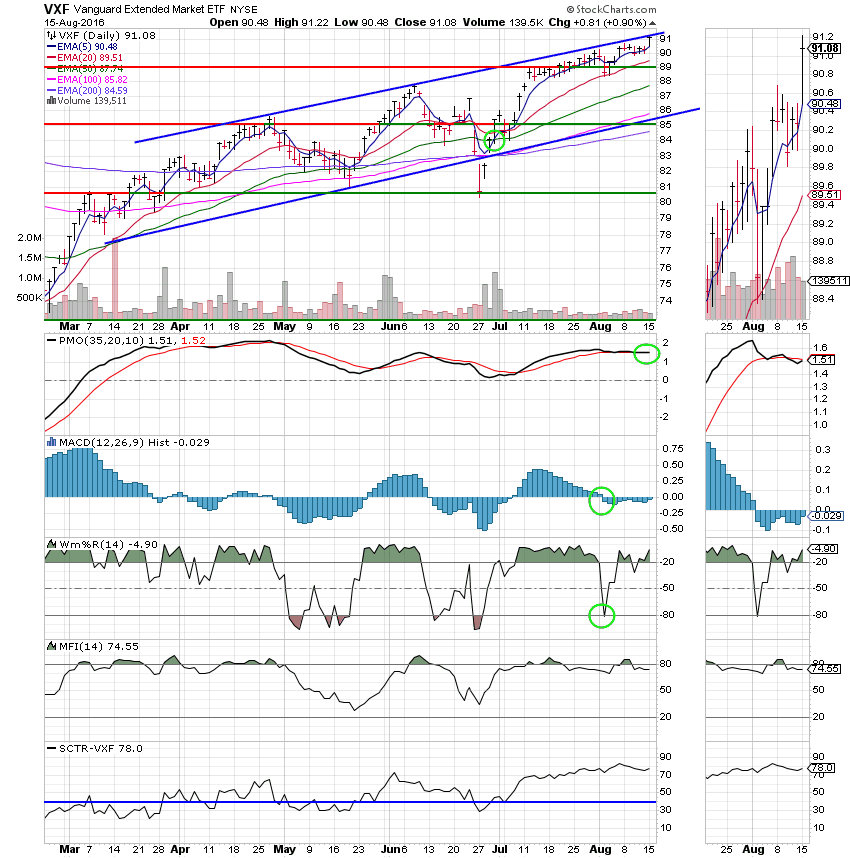

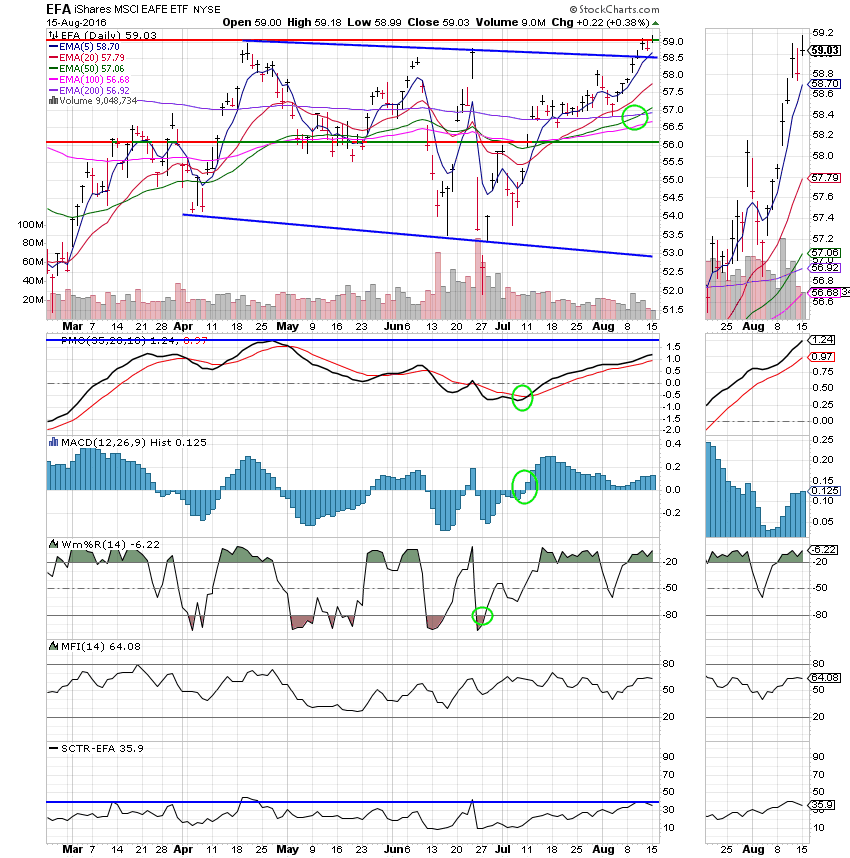

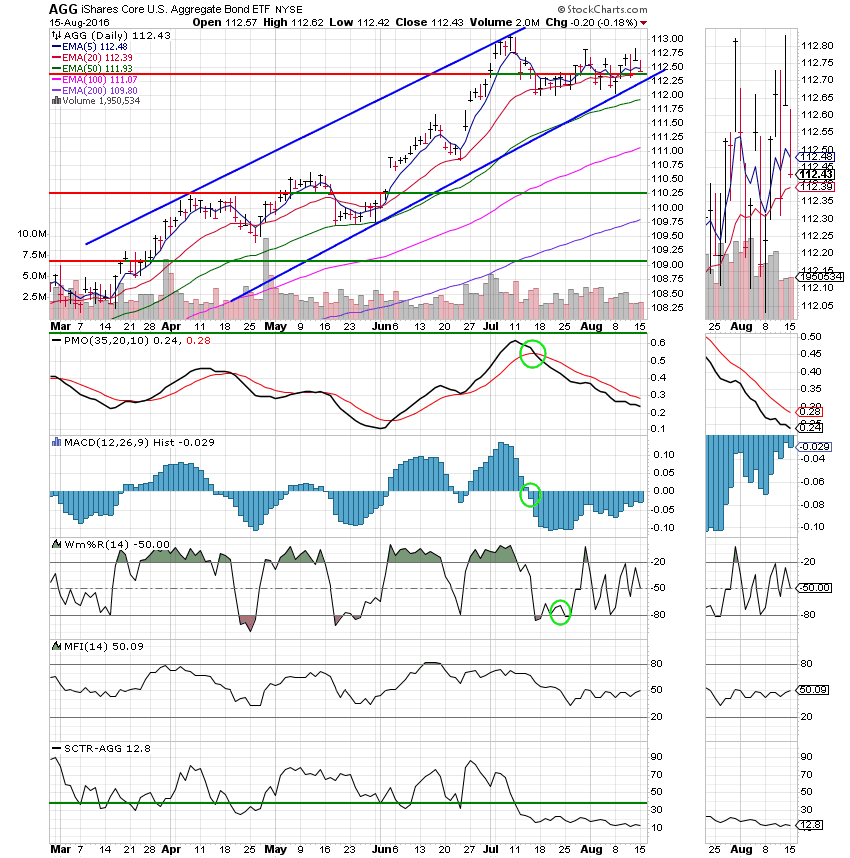

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund: The Trend is up and the C Fund is moving higher. However, with the MACD and PMO in negative configurations it is still neutral.

S Fund: The S fund generated another buy signal when the PMO whipsawed back up through it’s signal line. I’m not sure how much faith we can put into this signal. We really need to see some separation between the PMO and it’s signal line. It could easily whipsaw below the signal line again in the coming days. At any rate the trend remains up for now. I might add that the S Fund has the best SCTR of any of our TSP Funds at this time.

I Fund: The I Fund tested but failed to break through resistance at 59.0. A break though this area would be bullish. An SCTR of 35.9 shows that this fund still has a lot of work to do despite it’s current buy signal.

F Fund: The F Fund continues to move higher. Albeit at a snails pace. The threat of an interest rate increase in September is putting some downward pressure on this fund. However, with stocks as extended as they are it could be considered unwise to move to equities without a meaningful pullback. Sometimes you just get stuck and right now we’re stock. We need a pullback!

We need a pullback. A move to equities right now could easily put us into the red should the market pullback and that’s not someplace we need to be going into September. If we are patient we may yet see a sell off. Keep praying. God will see us through this one just like He always has. Give Him all the praise! That’s all for tonight. Have a nice evening!