Good Evening, So far it’s been a typical August market. A lot of aimless drifting with a slightly negative bias. That’s the reason I’m in no hurry to move the TSP Guide allocation. It doesn’t really matter what your in, it’s pretty much treading water.

The days trading left us with the following results: Our TSP allotment gave up -0.22%. For comparison, the Dow dropped -0.24%, the Nasdaq -0.03%, and the S&P 500 -0.14%. Not a lot of difference so I’d just as soon be in a safe haven right now. Sooner or later we’ll break out of this tight trading zone we have been in and when we do we’ll have plenty of time to jump on the train….or will it be into the life boat?

The weeks action left us with the following signals: C-Neutral, S-Neutral, I-Buy, F-Neutral. For the most part the charts I am looking at are neutral and you know what? They are pretty much an accurate reflection of the market. We are currently invested at 100/F. Our allocation is now +1.82% on the year not including the days results. Here are the latest posted results.

| 08/18/16 |

|

|

|

Prior Prices |

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

15.0844 |

17.9857 |

29.923 |

38.3938 |

24.7781 |

| $ Change |

0.0006 |

0.0270 |

0.0664 |

0.2378 |

0.1003 |

| % Change day |

+0.00% |

+0.15% |

+0.22% |

+0.62% |

+0.41% |

| % Change week |

+0.02% |

+0.02% |

+0.19% |

+0.37% |

-0.11% |

| % Change month |

+0.07% |

-0.09% |

+0.80% |

+0.65% |

+1.36% |

| % Change year |

+1.13% |

+6.08% |

+8.57% |

+8.96% |

+2.83% |

| |

L INC |

L 2020 |

L 2030 |

L 2040 |

L 2050 |

| Price |

18.2562 |

24.1693 |

26.3898 |

28.1319 |

15.9756 |

| $ Change |

0.0144 |

0.0383 |

0.0595 |

0.0739 |

0.0475 |

| % Change day |

+0.08% |

+0.16% |

+0.23% |

+0.26% |

+0.30% |

| % Change week |

+0.04% |

+0.07% |

+0.09% |

+0.10% |

+0.12% |

| % Change month |

+0.24% |

+0.45% |

+0.62% |

+0.71% |

+0.80% |

| % Change year |

+2.72% |

+4.14% |

+5.29% |

+5.87% |

+6.32% |

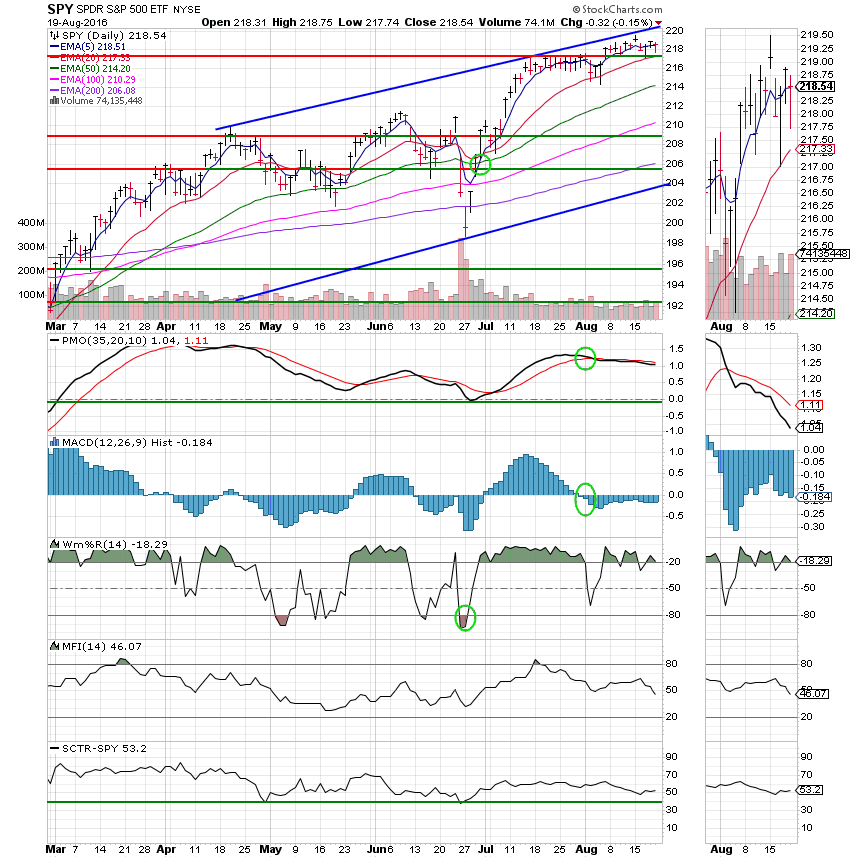

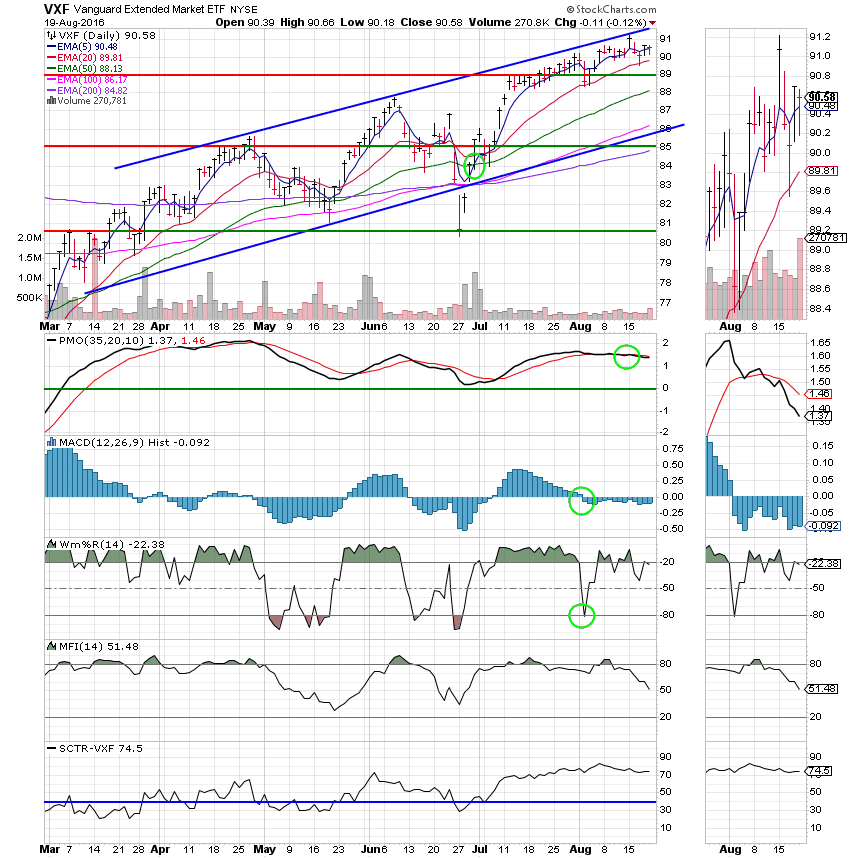

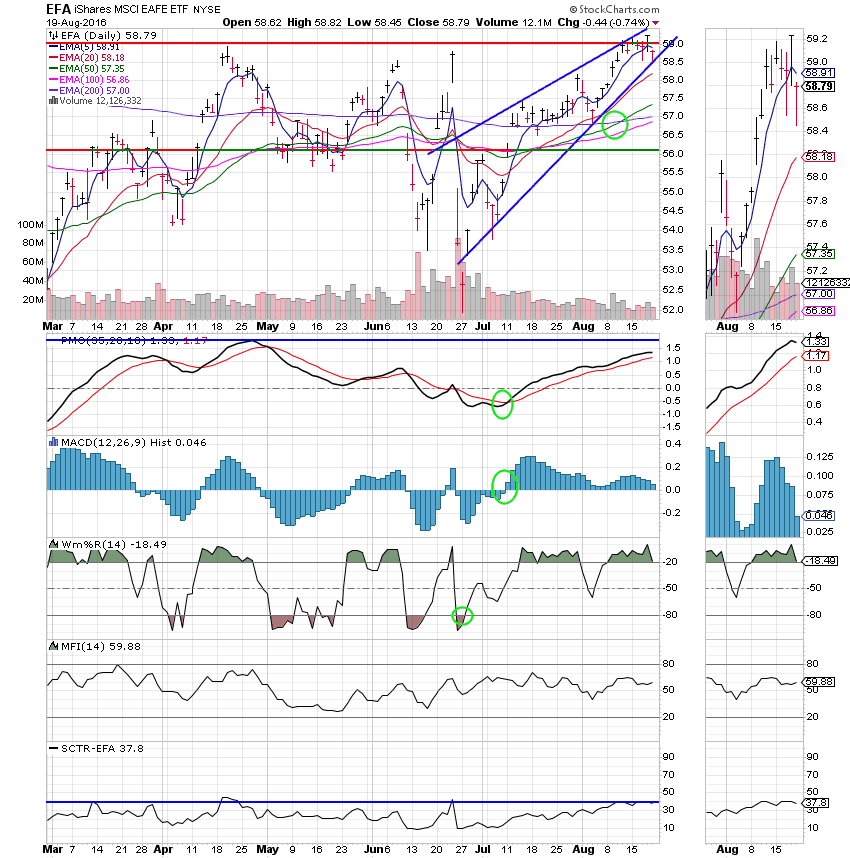

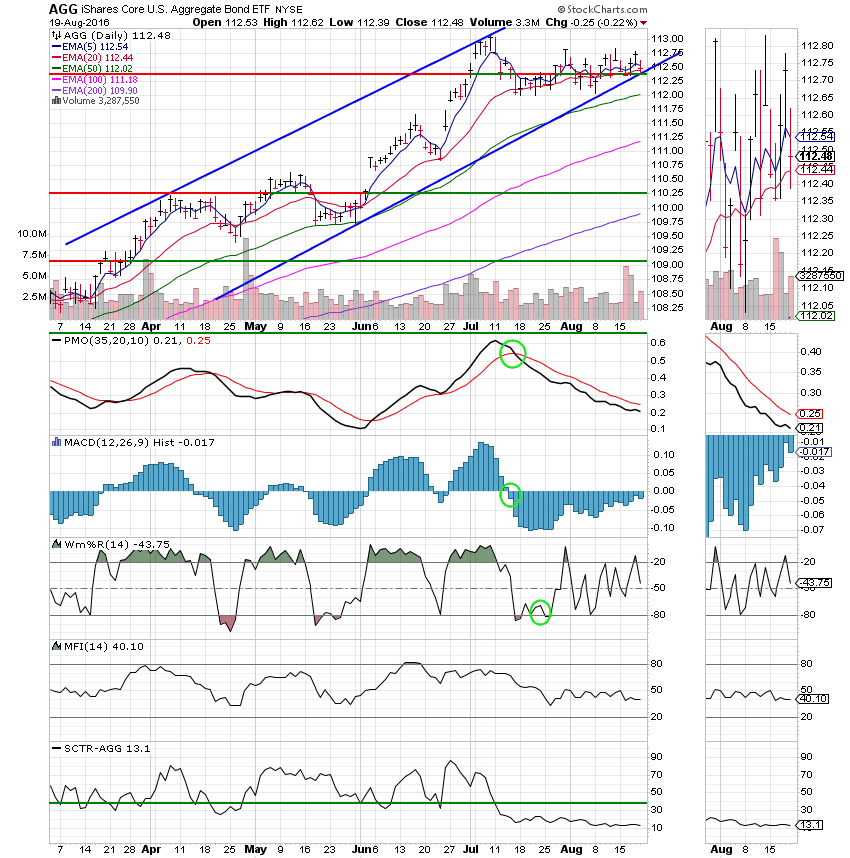

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund: Same ole here. Nothing new to report. Price continues to drift sideways just above support at a little over 217.

S Fund: This one actually made a little progress this week. It was very little and very slow…. The S fund still has the best SCTR of any of the TSP funds at 74.5.

I Fund: The I Fund is hanging onto it’s buy signal. However price took a nice plunge today. No doubt it will move back to a neutral sign if there is much more of that. An SCTR of 37.8 would keep me from buying here. Also, price fell back below support at 59.0

F Fund: Price continues to move sideways just above support at 112.30. As long as support holds and our equity charts don’t shake loose I’m happy to hang out here until the market resolves the current trading zone one way or the other. I will add that an SCTR of 13.1 doesn’t give me a lot of confidence that there will be much in the way of gains.

I’m just like most traders right now. I’d like to be in stocks and moving up! By the matter of fact I am in stocks on the street and I haven’t made any progress this month there either. So I know for a fact that the market is doing what it so often does in the month of August which is not much. My plan is to remain patient, trust in God, and pick my entry point into equities carefully when and if it comes. That’s all for tonight. Have a great weekend and I’ll see you Monday!

God bless, Scott

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.