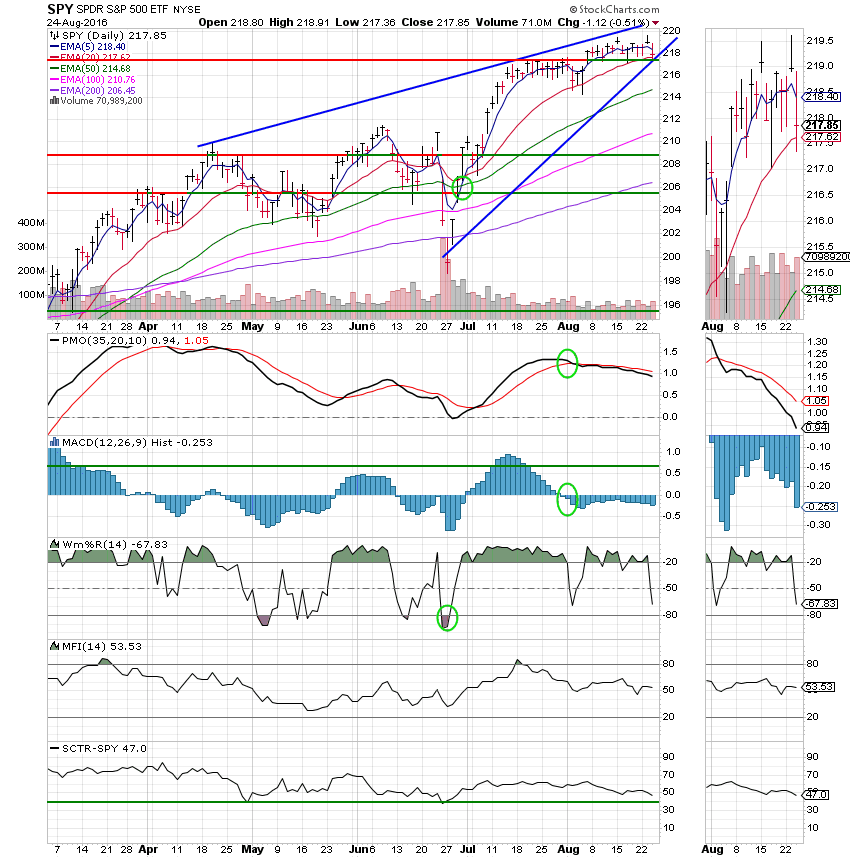

Good Evening, The market experienced a little more than it’s recently normal drop today. Actually, it was not so much the drop as it was the lack of dip buyers to drive it back to or near the neutral point. Is this the beginning of something bigger? Of course that could always be the case, but before we get too excited we should take note of the fact that we are still in the same trading zone that we have been in for the past 8 weeks. Yeah, it’s been a while… Anyway, It seems that investors aren’t willing to make any bets ahead of Janet Yellen’s speech at Jackson Hole Wyoming on Friday. As I have been saying, it’s all about that speech. That’s the next foreseeable market moving event. I might also add that Hillary Clintons speech in which she knocked the makers of EpiPens for price gouging causing all biotechs to sell off which drove the market down even further. No politics here…just commenting on the market. If you owned any biotech stock today then you know exactly what I’m talking about!

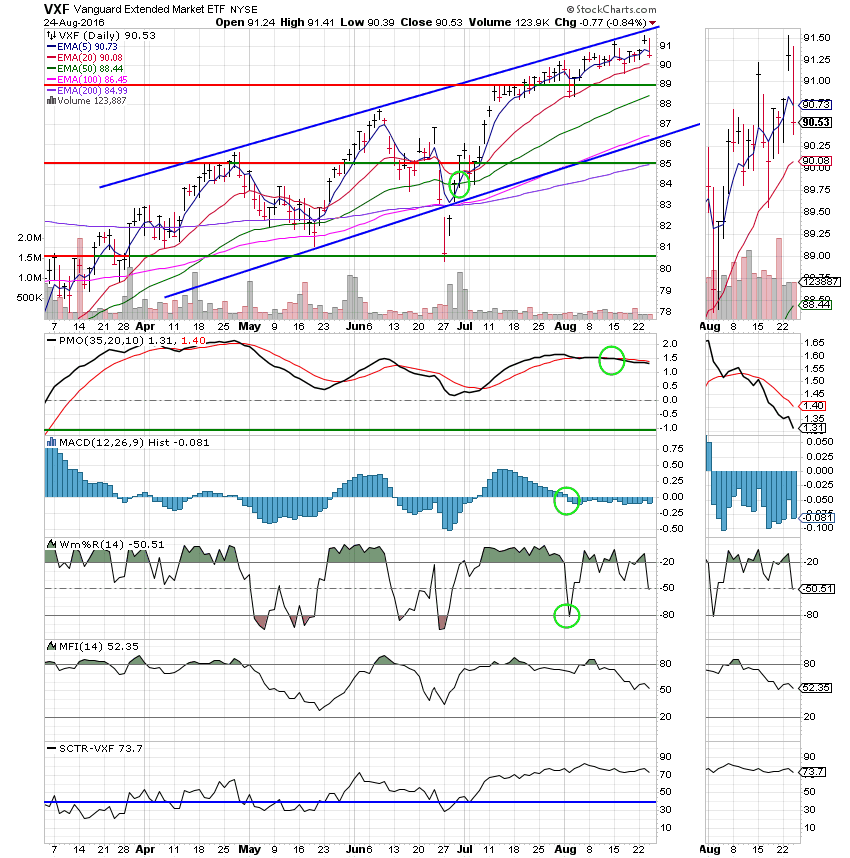

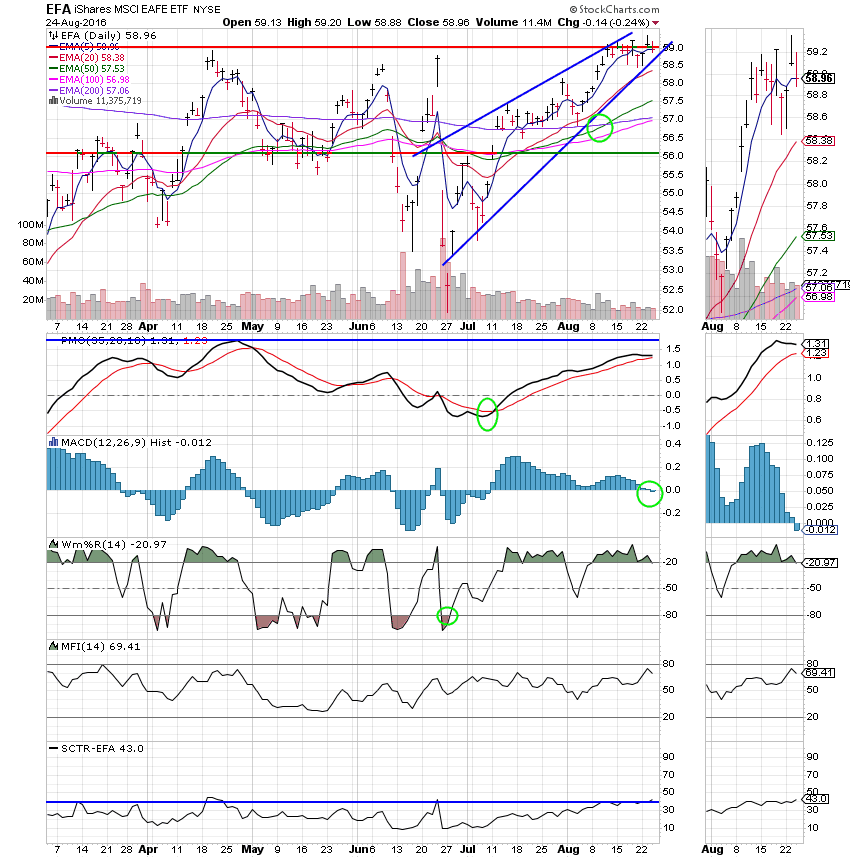

The days trading left us with the following results: Our TSP allotment slipped back -0.04% which is not bad when compared to the major indices. For instance, the Dow lost -0.35%, the Nasdaq -0.81%, and the S&P 500 -0.52%.

Wall St. falls as healthcare, materials stumble

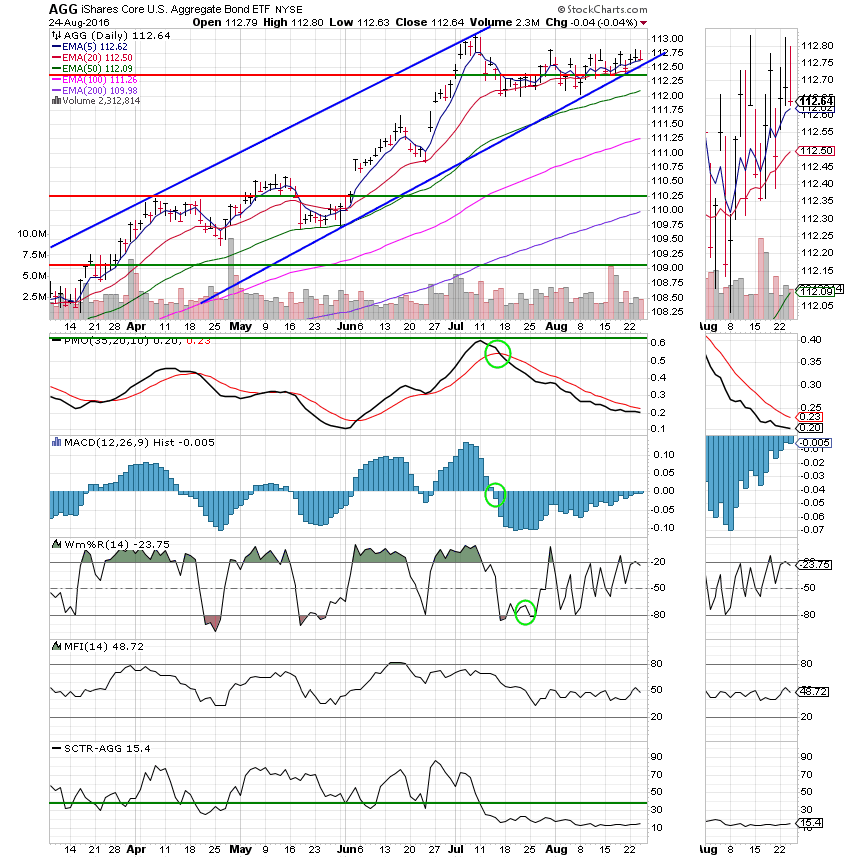

The days action left us with the following signals: C-Neutral, S-Neutral, I-Buy, F-Neutral. We are currently invested at 100/F. Our allocation is now +1.84% on the year not including the days results. Here are the latest posted results:

| 08/23/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 15.0875 | 17.9892 | 29.9274 | 38.6736 | 24.8338 |

| $ Change | 0.0006 | 0.0007 | 0.0594 | 0.2193 | 0.1372 |

| % Change day | +0.00% | +0.00% | +0.20% | +0.57% | +0.56% |

| % Change week | +0.02% | +0.22% | +0.14% | +0.78% | +0.70% |

| % Change month | +0.09% | -0.07% | +0.82% | +1.38% | +1.58% |

| % Change year | +1.15% | +6.10% | +8.58% | +9.76% | +3.07% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 18.2656 | 24.1915 | 26.4235 | 28.1742 | 16.0033 |

| $ Change | 0.0136 | 0.0388 | 0.0614 | 0.0767 | 0.0498 |

| % Change day | +0.07% | +0.16% | +0.23% | +0.27% | +0.31% |

| % Change week | +0.11% | +0.20% | +0.28% | +0.32% | +0.37% |

| % Change month | +0.29% | +0.54% | +0.75% | +0.86% | +0.97% |

| % Change year | +2.77% | +4.24% | +5.43% | +6.03% | +6.50% |