Good Afternoon, Happy labor day! I hope this note finds you relaxing with family and friends. After all you earned it. August is now officially on the books and September is underway although the market won’t begin the new month until tomorrow. September is traditionally the worst month of the year for the market and the results since they’ve been keeping records bear that out. However, September is not a bad year every year. I know folks that sell in the end of August and don’t get back into the market until the end of October as a strategy. I know others that “Sell in May and Go Away” and don’t get back into equities until November. Yes, for some folks those are viable strategies. I never really tracked them to see how the do. Personally, the seasonal thing has been at best hit or miss for me since I’ve been investing. So I might watch the charts a little more in a traditionally bad month but that’s about it. I have made some really good money during those months in the past. My philosophy on that (as you know) is that you have to be in it to win it. So I don’t avoid the market purely based on the season. To each his own I guess. This month looks like it could be one of those that buck the trend. The Fed meets in a week or so and will almost surely trim interest rates. There’s almost no debate about that. The only real question is by how much? It’s been a long cycle on tightening to fight inflation and the first rate cut will officially usher in a new cycle of loosening monetary policy once again to ensure the economy keeps moving in the right direction. So the last few weeks and the coming few weeks are a transition phase from one cycle to the other. I don’t expect much to happen in the way of market movement one way or the other barring some unforeseen disastrous piece of news. The market will probably move higher and lower on news related to the Fed meeting ending up about where it started by the time the long awaited meeting arrives. A lot of smoke and no fire so to speak. The reason we need to be invested now other than the fact that the charts are sill a buy is that we need to be positioned for the first drop in interest rates because in the long run when interest rates drop the market will rise. I know people that invest purely like that as well…… All I can say is that I like that strategy a lot more than a like the seasonality thing LOL . Also, on a positive note earnings season ended up being good which supports a soft landing scenario for the economy. According to CNBC only seven S&P 500 companies have yet to report this season, a sign that the second-quarter earnings season is wrapping up. Nvidia’s beat last Wednesday put the S&P 500 over the top this season — with an exactly 13% earnings growth rate for the second quarter, according to financial data firm LSEG. That is the strongest earnings growth since Q4 2021, unexpectedly passing the 11.4% growth rate from Q1 2022. Headed into earnings season, Wall Street was expecting a smaller 10.6% growth rate. Leading the way, the tech, financials and health-care sectors all saw earnings growth of more than 20%. Only two sectors, though — materials and real estate — are ending the season with earnings contractions.

Earnings and revenue beats wound up being basically right on par with recent trends — an 80% beat rate on earnings and a 60% beat rate on revenues. Revenue growth of 5.5% for S&P 500 companies was also modestly better than the 4.2% growth expected headed into the season. Only materials and industrials saw revenue contractions. So things are looking pretty good heading into the Fed meeting. I appears that they have everything that they need to begin the new cycle of rate cuts. We will see. For now we remain invested at 100/C ahead of the meeting. So far so good. Praise God for that.

The market is closed today for the holiday but Friday’s trading left us with the following results. our TSP allotment posted a gain of +1.01%. F0r comparison, the Dow added +0.56%, the Nasdaq +1.13%, and the S&P 500 was of course +1.01%. Praise God for such a good day!

The action in August left us with the following signals: C-Buy, S-Buy, I-Buy, F-Hold. We are currently invested at 100/C. Our allocation is now +10.34% for the year. Here are the latest posted results:

| 08/30/24 |

|

|

|

Prior Prices |

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

18.4962 |

19.8266 |

88.8635 |

84.794 |

45.1255 |

| $ Change |

0.0042 |

-0.0490 |

0.8998 |

0.6370 |

0.1470 |

| % Change day |

+0.02% |

-0.25% |

+1.02% |

+0.76% |

+0.33% |

| % Change week |

+0.09% |

-0.52% |

+0.27% |

-0.01% |

+0.40% |

| % Change month |

+0.35% |

+1.43% |

+2.42% |

+0.25% |

+3.15% |

| % Change year |

+2.97% |

+3.14% |

+19.50% |

+9.99% |

+12.30% |

More Prices & Returns

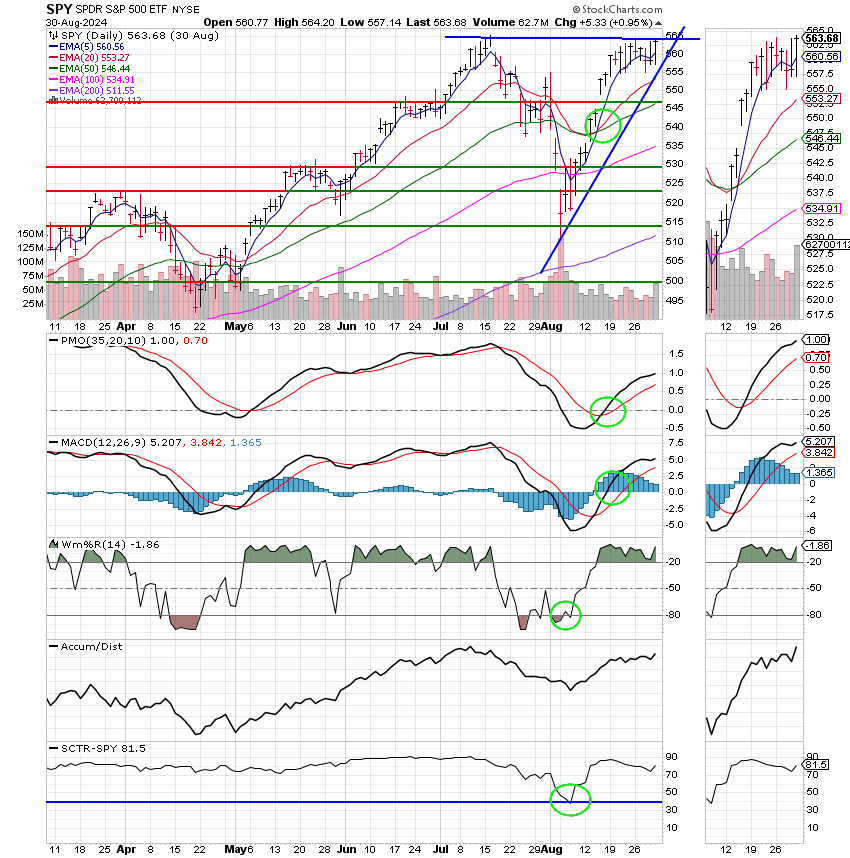

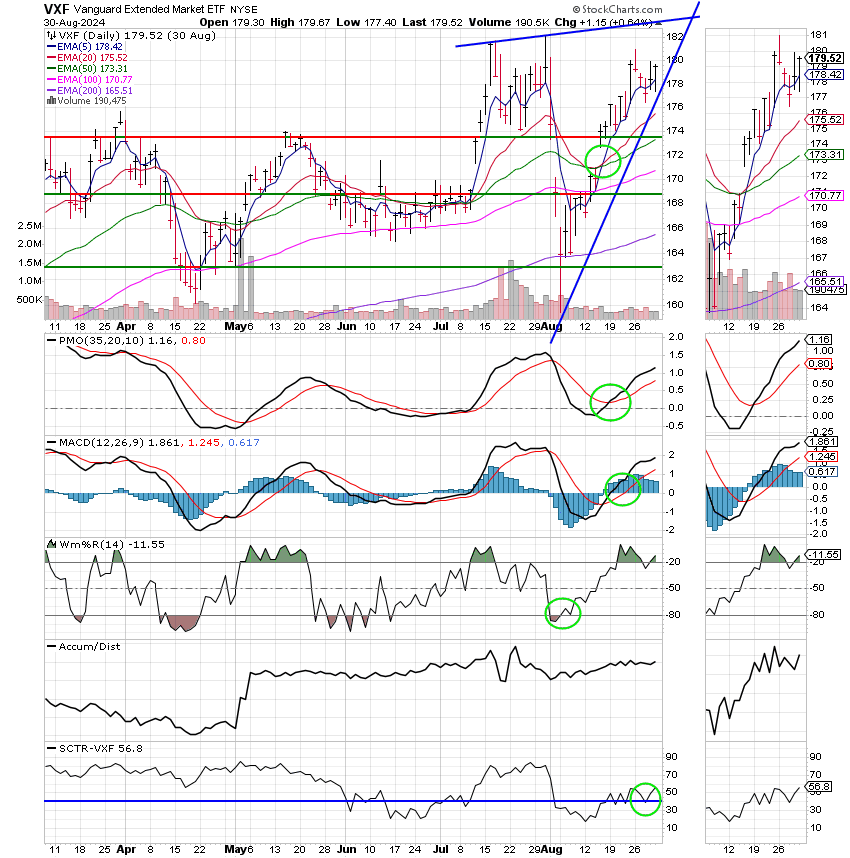

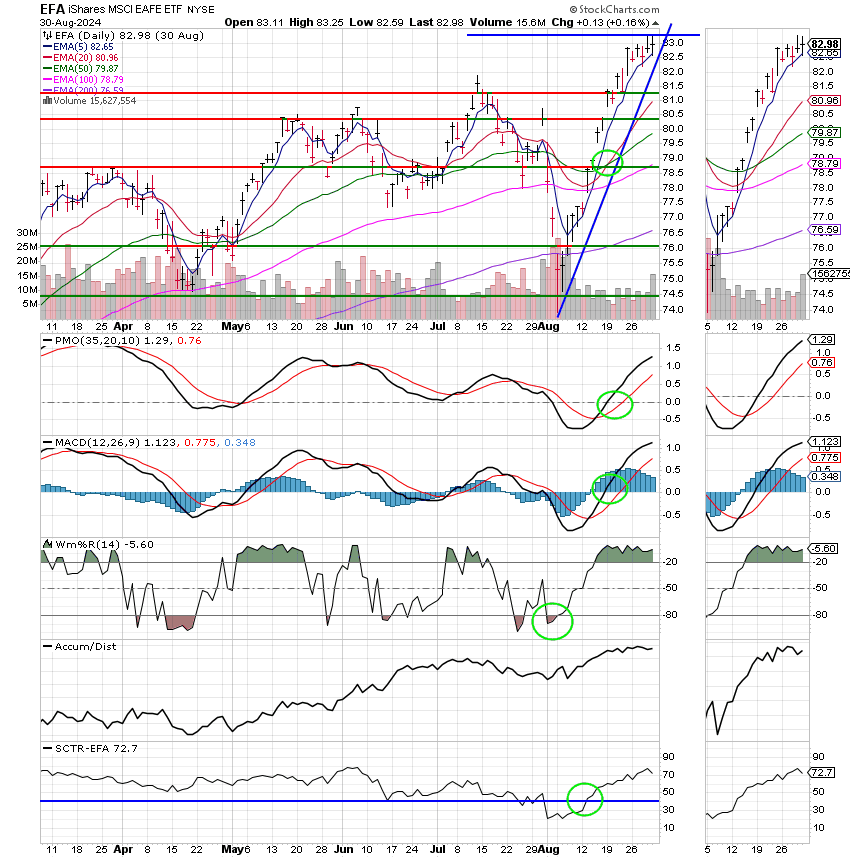

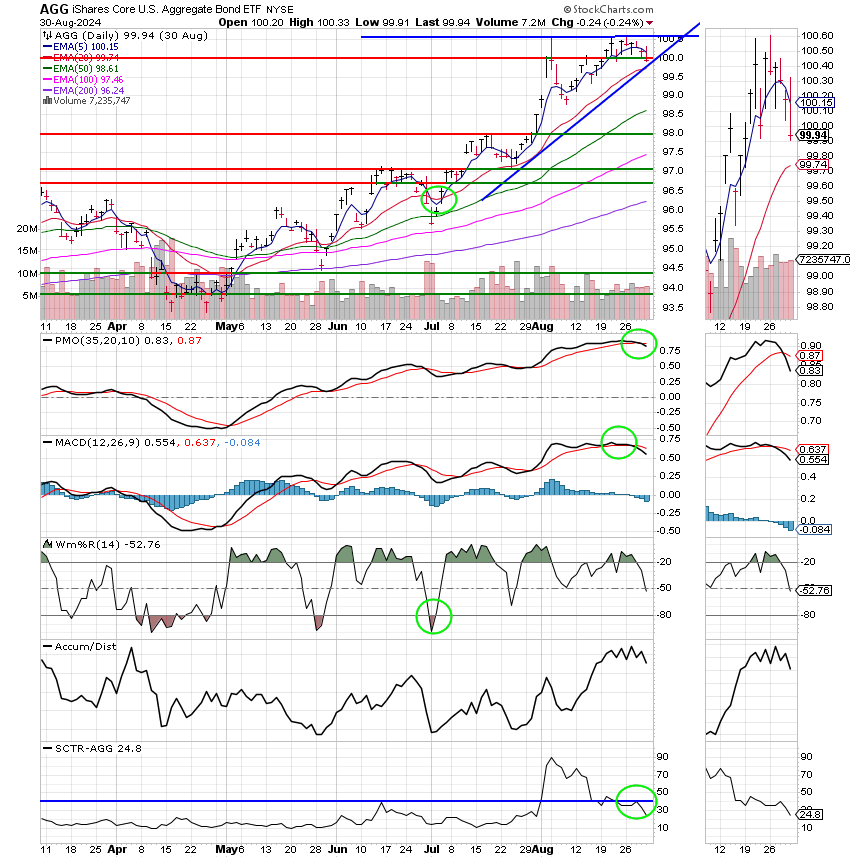

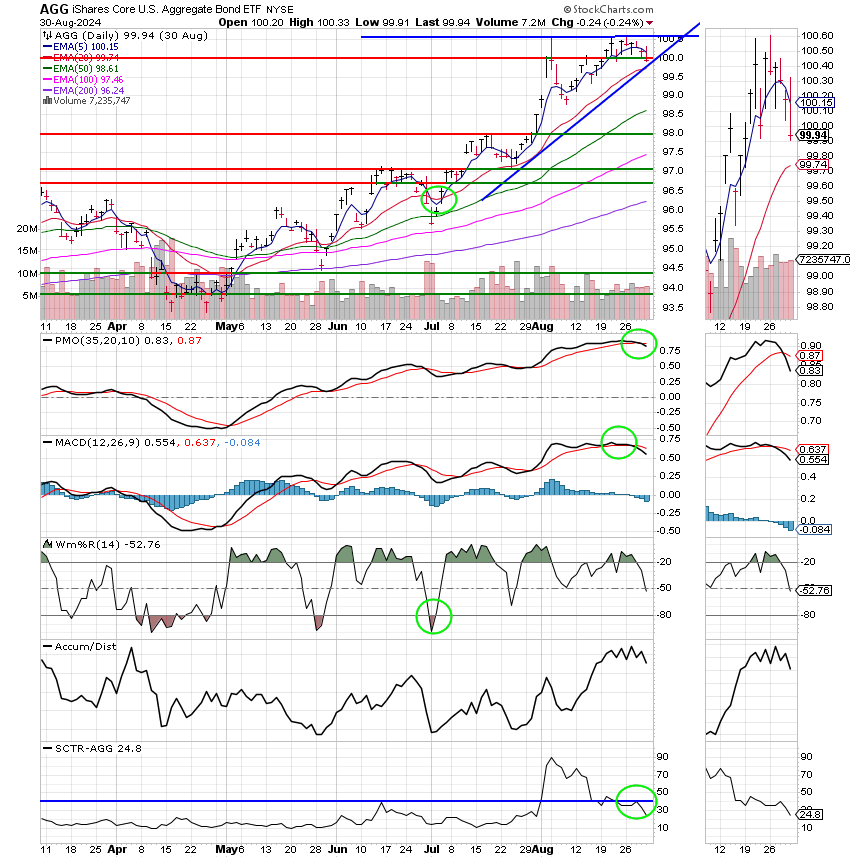

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

As I noted above, our performance so far this year is a respectable 10.34%. Could it be better. Yes. Absolutely! I just want to remind everyone that we didn’t get the new system in place until the first quarter was complete and to be perfectly honest with you we didn’t fully have a grasp on the new indicators until late July. So we pretty much made those gains in less than two quarters. Regrettably we gave up most of our July gains when the market sold off in the first week of August. Our timing on that sell was two days off. Several of our indicators told us to sell three days prior to when we actually sold. However, we chose to wait until all of our indicators agreed with the sell signal. Those two days cost us a little over 7% of our gains. At the time I made the decision, it was the first major test of the new indicators. So I waited for conformation. That cost us. Normally, the market would not drop that much in just two days, but in this case it did. We could have and should have kept more of those gains. All that said, I am thankful to God that we did get to keep a little of what we made and I am also thankful that we were able to gain more experience with the new system. It’s obvious that we have yet to unlock the full potential of our new indicators. We used our last system for well over twenty years and got better with it as time went on. We eventually were forced to go to the new system when market conditions changed following the pandemic. The longer we run this system the better our returns will get. I just wanted you all to know that we can do much better than this. That’s all for this week. Have a great afternoon and evening and may God continue to bless your trades!

God bless, Scott

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.