Good Day, The market continues to behave as we anticipated that it would. It responds with big swings to each news release concerning inflation or anything related to it. The theme has been and continues to be all things related to inflation. This especially includes the Feds efforts to control it through interest rate increases. How much will they raise rates vs how much investors anticipate that they should raise rates. Does a lesser increase mean that they see inflation as moderating? Does a larger increase signal that inflation is out of control and if that’s the case how will stocks respond to the increasing rates? Are stocks going lower to stay or in other words are they being repriced? Is their valuation being reset? How does this effect the supply chain? How does that effect inflation? As the Fed continues to work on reducing demand (the only part of the supply/ demand equation that they can control) will inflation continue to run rampant anyway due to ongoing supply issues? Will the energy crisis in Europe brought on by the war in the Ukraine make this worse? After all, the price of energy effects everything. Will all these issues combined cause a world wide recession? Each time the media release new report like these market players are asking where are we going now? Where does this take us? So then they do what they do. They buy or sell and what you are seeing in the market is the result. As of today we continue to trade in a wide range that befuddles and frustrates folks that have only been trading for the past dozen years. After all, they’ve never seen anything like this before. I tried to warn them!!! Some of them have quit trying to outperform the market. They are either staying put in the cash or the G Fund or holding in a conservative allocation such as 70/G, 20/C, 10/S. Well folks, right now the only thing that’s giving a positive performance is cash (cash is out performing the market) or as far as TSP goes the G Fund. The more you are have invested in the G Fund the better your allocation has and will perform in 2022. You know the problem with that?? It works and then it doesn’t. A lot of folks in our group have been doing this a long time and they will all tell you that nothing works 100% of the time. So if you are inflexible you will limit your performance. They will also tell you that they are so far ahead of where they would have been had they used that type of strategy that they consider themselves as playing with house money. They know in the end when their account dips that they will make back what they dropped and more. The moral of the story is that you need to stick with whatever system you used that has worked for you in the past and when the market cycle comes back around to you it will work again. The question you have to ask yourself is this. When that system was working did it outperform the market enough to justify it’s use. Did it build your account enough to sufficiently weather the down trend? In the end do you have more than you would have had if you’d held all the time or invested in an L-Fund?? These are questions that are answered over a period of time. Not in a few days or months but in years. It takes research to answer these questions. Where would your account be if you’d have done X, Y or Z the past five years vs. where you are now. Comparisons are a valid way to measure performance in this business. The idea is not to be compete with coworkers but to understand what works best for you over a period of time and understand that what works best for you may not necessarily be what works best for your neighbor. That has a lot to do with your goals and risk tolerance. For instance you may have some successful investments on the street and not need to push your thrift very much or on the flip side you may need your thrift to grow at a substantial rate as you need to build wealth in your account. After all not everyone has a rich uncle or a lot of investments (i.e. real estate) on the street. Your needs and goals determine what system you use. The thing you must understand that is vital to your success is that you do not need to change systems every time the wind blows. Determine what is best for you over time and stick with it!! Also, I would be amiss not to tell you to seek God’s guidance in this and all things you do. Concerning the market today our strategy remains the same. We are anticipating a retest of the June/July lows which are around 3620 for the S&P. If that support holds we will look for a good entry point back into equites. Of course the market my not cooperate and if that is the case we will react to whatever we see before us on our charts!!

The days trading is leaving us with the following results: Our TSP allotment is steady in the G Fund. For comparison, the Dow is currently off -0.75%, the Nasdaq -0.94%, and the S&P 500 -0.66%. All in all it’s a good day to be in the G.

Dow retreats Tuesday as robust service sector points to still higher interest rates

Recent action has generated the following signals: C-Sell, S-Sell, I-Sell, F-Sell. We are currently invested at 100/G. Our allocation is now -27.75% on the year not including the days results. Here are the latest posted results:

| 09/02/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.0175 | 18.6645 | 59.8765 | 63.7856 | 31.1915 |

| $ Change | 0.0016 | 0.0725 | -0.6453 | -0.3861 | 0.0203 |

| % Change day | +0.01% | +0.39% | -1.07% | -0.60% | +0.07% |

| % Change week | +0.06% | -1.03% | -3.23% | -4.51% | -3.02% |

| % Change month | +0.02% | -0.22% | -0.75% | -1.82% | -1.51% |

| % Change year | +1.68% | -10.64% | -16.78% | -23.56% | -20.92% |

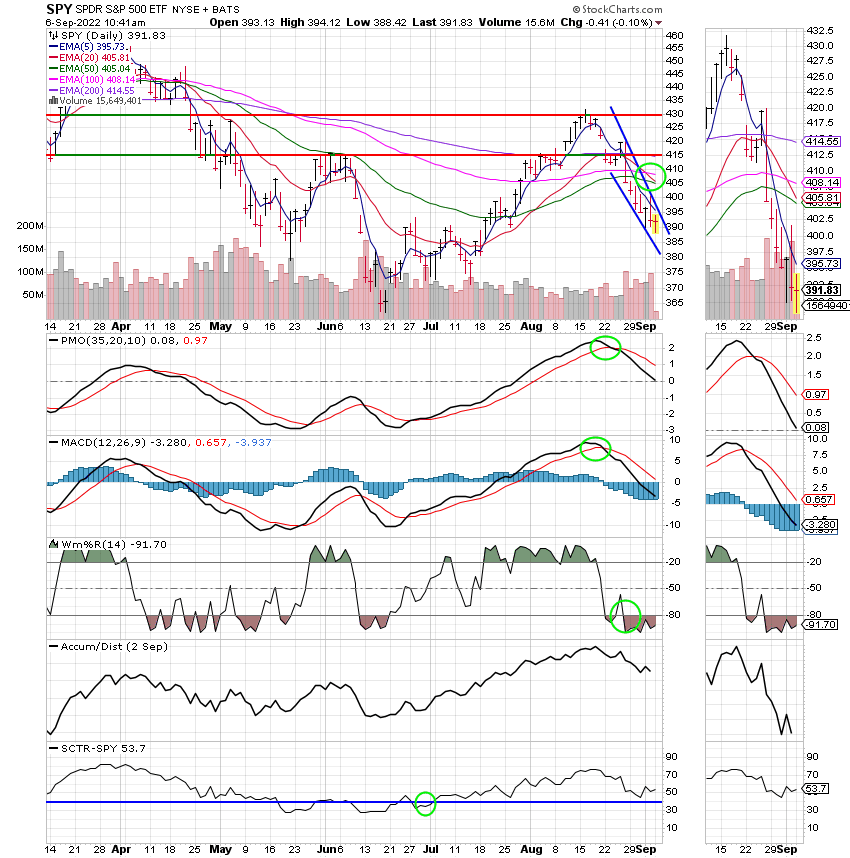

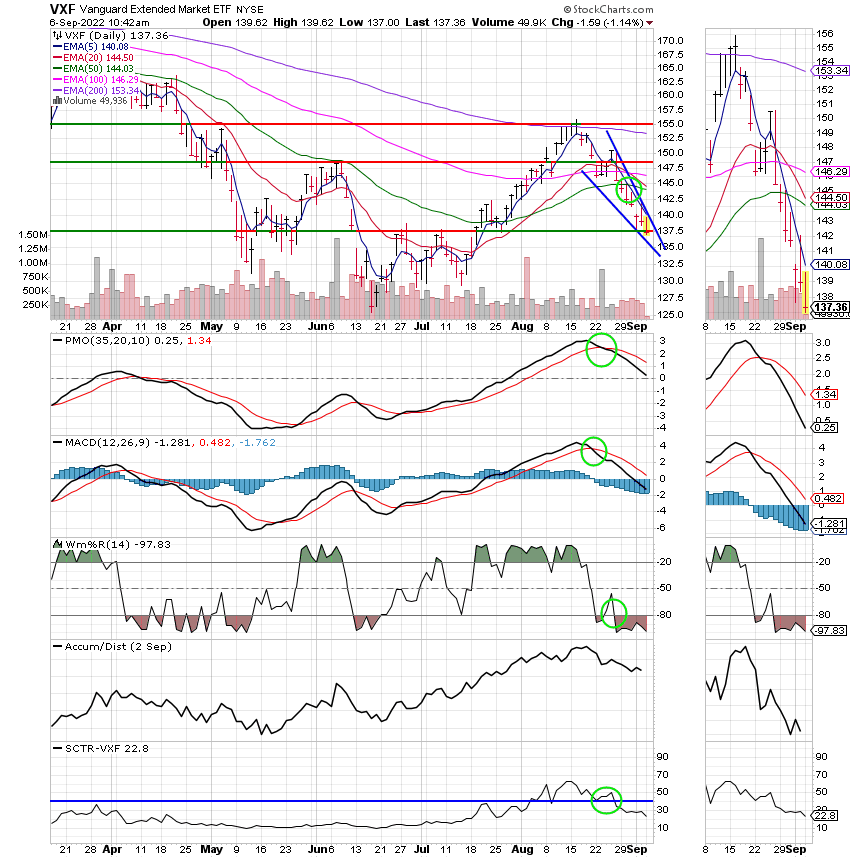

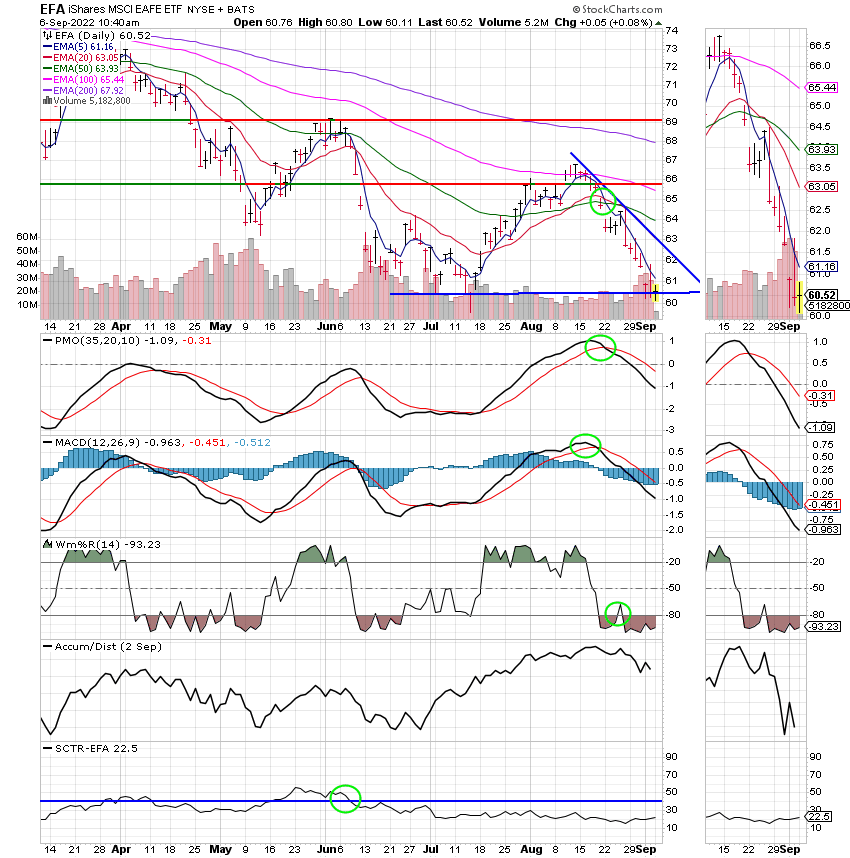

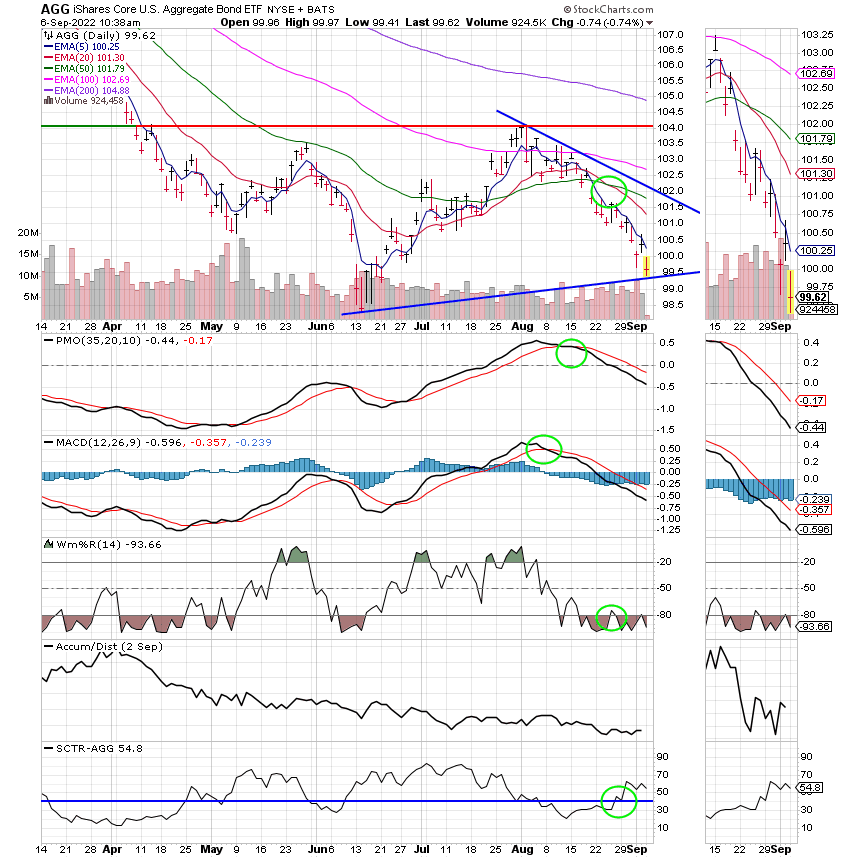

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

Folks, we need to pray for God to guide our group. Even if you don’t understand technical analysis just yet you can pray and as far as I’m concerned there is nothing more important that needs to be done! That’s all for today. Have a great afternoon and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.