Good Morning, This week is pretty cut and dried. The week, the month, and the year for that matter all lead up to this September meeting of the Federal Reserve. Unless, you have been on a long vacation in Antarctica or on some desert island with no cell service or internet you already know that they are widely expected to lower interest rates at tomorrows meeting. That would begin a cycle of rate cuts and signal the end of the fight against inflation. Just how big is this meeting. Let me put this in perspective. We have been waiting for this since well before the pandemic. Yes it’s that important. It will chart the foreseeable future for the stock market and as far as I’m concerned (don’t laugh) signal a formal end to the pandemic. The market has gone from quantitative easing to a cycle of tightening and back again now hopefully to easing. It has been a difficult time to maintain any consistency with regard to investing, but here we are at long last. There will be challenges but the old economic cycle will be behind us. What kind of challenges?? The main thing moving forward will be the markets anticipation of and reaction to the schedule and size of the forthcoming rate cuts. As we approach each Fed meeting market players will analyze news reports to determine what the Fed is thinking and what they will do. The results will likely be the same as they have been since the pandemic. This speculation will create volatility which is what indecision always creates in the market. I do not expect this volatility to be quite the same level as it was in the last 12 months but nonetheless it will be there. I believe it is a result of all the high speed trading so prevalent in todays market. However, that is a topic for another day. Make no mistake though, it will not be a totally smooth ride as some think it might. Investors will be looking for two things in particular in tomorrows meeting. They want to know if the anticipated rate decrease will be -0.05% or -0.25% or as they say a quarter or a half of a basis point. There are many folks who feel that the Fed is behind the curve in decreasing rates and that they need to go with a bigger decrease in this meeting in order to bring the economy in for a soft landing which simply means that there will not be a recession. There are a lot of dynamics in this decision and it is difficult to predict how the market will react. For instance, if the Fed decreases rates 0.50% will the market think they are pushing the panic button or will it be pleased with the decision. If they decrease rates by a 0.25% will the market think all is good and they are on schedule or will it think they haven’t done enough? Things like this are why the market is so unpredictable. Secondly, they will look particularly close for any signals as to what the rate of decreases will be. In other words how often do they plan on decreasing rates over the coming months or years? What will the market find acceptable? That my friends, is always hard to tell. Of course there will usually be a handful of fortune tellers that will get it right and have their moment in the sun. I say good for them. They will be right until…..they are not. Good luck predicting the next trend. That is the reason we use charts and let the price action determine what our next move will be. That is why we threw away our crystal ball years ago in favor of technical analysis.

This mornings trading so far has left us with the following results. Our TSP allotment is trading slightly higher at +0.08%. F0r comparison, the Dow is adding +0.63%, the Nasdaq is off -0.52%, and the S&P 500 is somewhat flat at -0.08%. Praise God for the current trend!

S&P 500 is flat ahead of Fed decision, Dow touches new record: Live updates

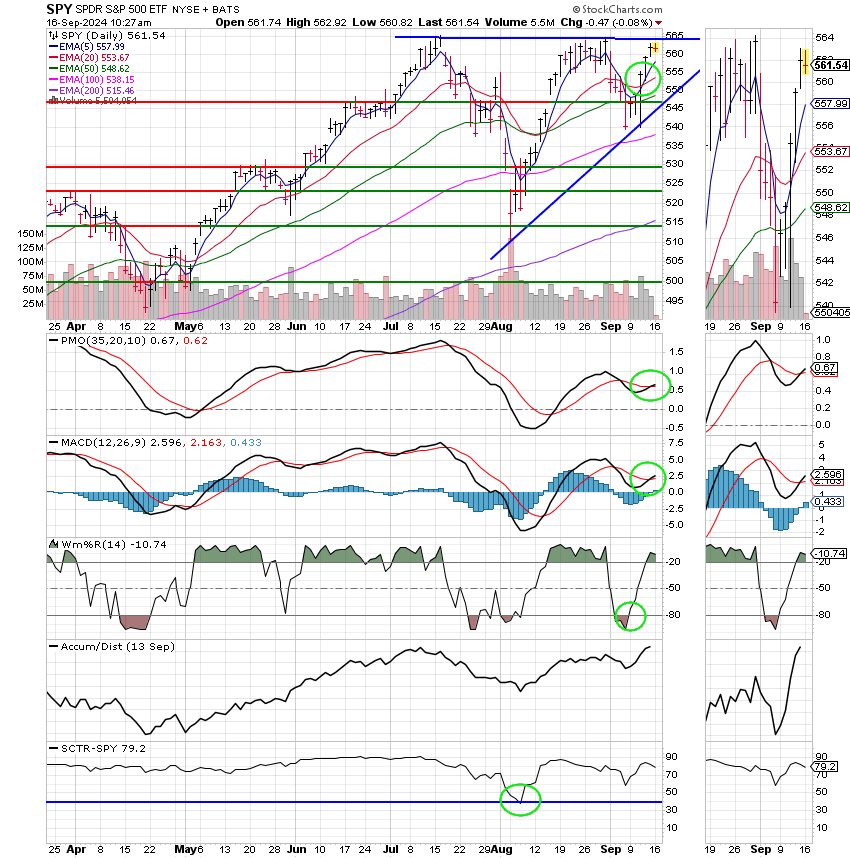

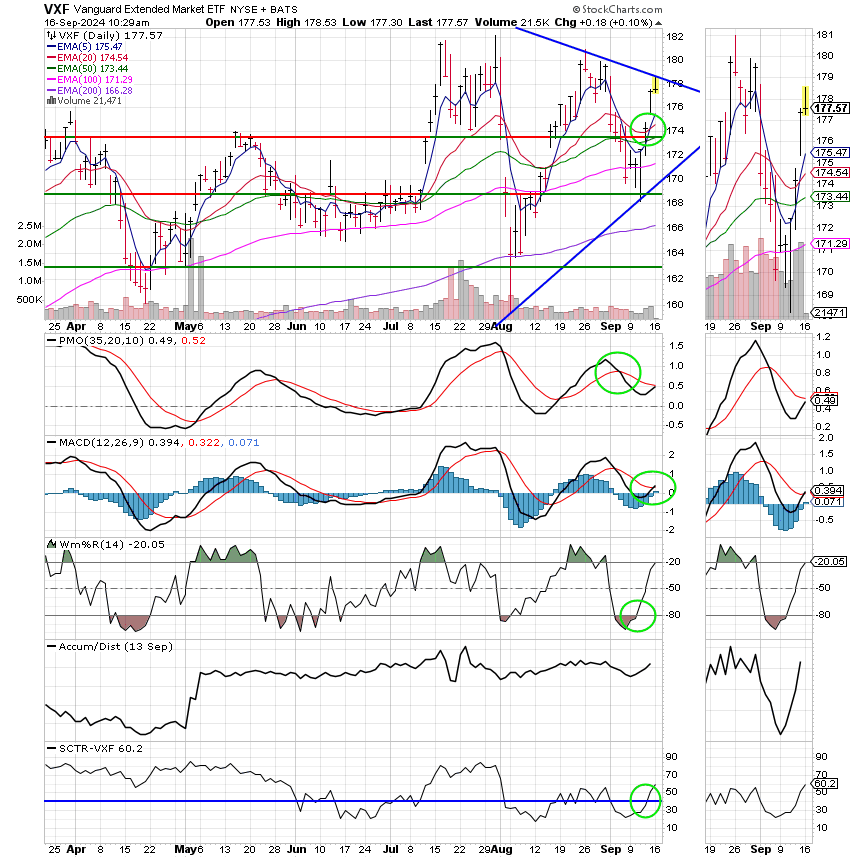

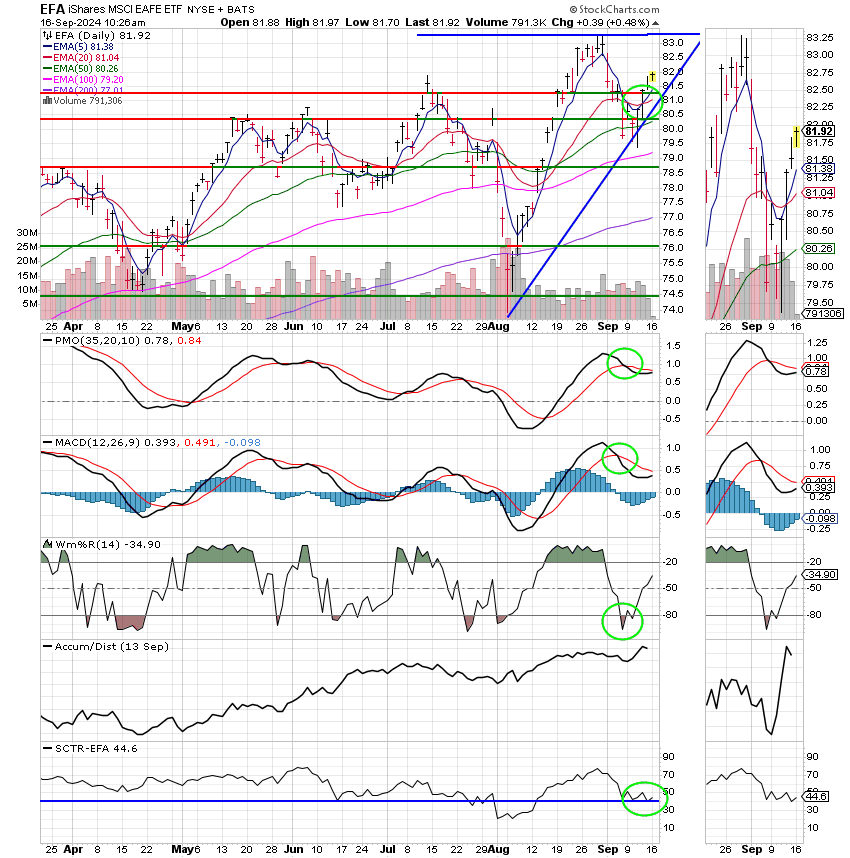

The most recent action has left us with the following signals: C-Buy, S-Buy, I-Buy, F-Buy. We are currently invested at 100/C. Our TSP allocation is now +8.55% for the year not including the days results. Here are the most recent posted results:

| 09/13/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.5229 | 20.1852 | 88.566 | 83.7028 | 44.3927 |

| $ Change | 0.0021 | 0.0403 | 0.4909 | 1.5320 | 0.1989 |

| % Change day | +0.01% | +0.20% | +0.56% | +1.86% | +0.45% |

| % Change week | +0.08% | +0.51% | +4.06% | +4.22% | +2.24% |

| % Change month | +0.14% | +1.81% | -0.33% | -1.29% | -1.62% |

| % Change year | +3.12% | +5.01% | +19.10% | +8.57% | +10.48% |

I Fund:

F Fund:

To me, this post pandemic market just doesn’t give you any rest. Again, I think it’s because everybody has a phone in their hand and is trading and the majority of the big firms have high speed computers doing their trading. Also, we have the new artificial intelligence factor playing into the action. I guess the bottom line is that computers have totally transformed the landscape of investing in the past 10 years. It’s not going back and it’s forever changed. This is it and I find it very hard to deal with but there is one thing that hasn’t changed and that is God. Scripture says that He is the same yesterday, today, and tomorrow. We must keep our focus on Him for He alone is able to guide us through this mess. Give Him all the praise for He and only He is worthy! That’s all for this week. Have a great day and may God continue to bless your trades.