Good Evening, As it has been for the last year plus so it is. It’s all about inflation and interest rates and everything that effects those two things. The most recent inputs to the equation are a hot Consumer Price index Report and a poor earnings report by Fed Ex. Not that these reports were not serious all on their own merit but they were even more so given that they were some of the last data that the Fed had to review before this weeks all important policy meeting. Everything in the short to medium term has been building up to this meeting. Investors are scrutinizing two things with regard to the Fed meeting. The first is how much they increase interest rates. There is no doubt by market players that they will raise rates again this time. That fact has been telegraphed in a crystal clear manner by the Fed since the last meeting. They still view inflation as being out of control and they will act to bring it under control regardless of whether or not it damages the economy. The Fed has a dual mandate which is to control inflation and to maintain employment. Right now the rate of employment is low and the rate of inflation remains too high at close to eight percent. As we have mentioned every week since the bear market started the Feds target for the rate of inflation is two percent. As long as it remains above that they will continue to raise rates. Most economists believe that rates will need to be raised to the 4 to 4.5% range in order to bring inflation under control although nobody really knows for sure. One has to only look back to the 1970’s to see a good example of that when the Fed raised rates high in the double digits to control rampant inflation. I’m not going to go back and check the figures for sure but I know that I personally remember interest rates in the 17 to 18% range and I’m not talking about just credit card interest here. I’m talking about house and car loans!! The dynamic that you must understand about what the Fed is trying to do is that the only thing they have control over is the demand end of the economy. They don’t have control over supply. So what they are trying to do is slow the economy down by decreasing demand which they do by making the money supply tighter. When you look at the whole picture that’s where it gets cloudy. In the 70’s the rate of inflation continued to increase despite what the Fed did and that was mainly due to the price of energy. At the time we had an energy shortage due to OPEC price increases and oil embargo’s. There where skyrocketing gas prices and long lines to fill up vehicles everywhere. You get the picture. Just for the record, as bad as it may seem to some of you younger folks now, it hasn’t even begun to get as bad yet as it was then and it is my fervent prayer that it will not. The thing that will help you understand the economy in general as well as how the Fed is attempting to manipulate it comes from your basic economics class. That is that the entire economy revolves around supply and demand. Let either one of those things get out of balance and bad things happen to the economy. We have discussed this a little on our Facebook page. If you haven’t visited it I would highly encourage it. You can stay up to date on a more day to day basis. So what are we looking at in tomorrows Fed rate increase?? My best guess is that there are three scenarios. The first is that the Fed increases rates at the expected 0.75% or 75 points. If that happens I expect the market to sell off at a moderate to low pace. If the Fed increases by more than that and moves the rate up by 1.00% or 100 points it will be Katy Bar the Door. There will be a huge sell off. Then there’s the best case scenario that I think will never happen and that would be if the Fed only increases the rate by 0.25% or 25 points and sends a signal that they are now ahead of the curve on controlling inflation. If that were to take place it would be rally on! I give that scenario almost no chance of happening. The second thing investors will be looking at will be the Fed statement with regard to future increases. There are many who feel that the FED is going to run the US economy into a recession. A lot of them are of the opinion that if the Fed doesn’t increase too much that a soft landing is possible meaning that inflation could be bought under control without the economy moving into a recession. There are also others who feel that a recession is impossible to avoid due to the fact that the bond yield curve has been inverted for most of the year. We have covered that subject before, but just to touch on it, that means that the rate of 2 year bonds has become higher than that of 10 year bonds which is considered by economists to be a strong predictor of an impending recession. So to tie if all up, investors are concerned about the rate of increases because of what they signal. Does the Fed have inflation under control or not? Secondly they are concerned that the Fed will increase rates too much and run the economy into a recession. Lastly there’s one more piece of the puzzle that we haven’t discussed yet and that’s the FedEx report. FedEx is considered a bellwether for the world economy. Last weeks earnings report indicated that there are still supply chain issues in Asia and that those issues could plunge the World economy into a recession. There is an increasing amount of investors that believe that if that happens that what the Fed is doing would become overkill and greatly damage the US economy plunging it deeply into a recession. They believe that the Fed should go ahead and increase the rate by .075% at this time and then wait and see if the warning from FedEx is valid before they increase rates again. They think the Fed should take the FedEx report seriously and take a wait and see attitude with regard to supply chain issues in Asia. Getting back to what I mentioned earlier. The Fed is adjusting the Demand side of the economic equation and investors are worried that the supply side of the equation may again become limited and have a synergistic effect on the Feds rate increases doing irreparable damage to the US economy. I find myself in this camp. The Fed must tread lightly before their next move as the whole game is in the balance. Keep praying that God will guide their hand!!

The days trading is producing the following results. Our TSP allotment is steady in the G Fund. For comparison, the Dow is currently off by -1.18%, the Nasdaq by -0.88%, and the S&P 500 by-1.14%. My guess if the selling will continue if the Fed enacts a significant rate increase at the close of their meeting tomorrow at 2:00PM. We will see.

Dow drops 300 points as Fed two-day policy meeting begins, rates surge

The days action is generating the following signals: C-Sell, S-Sell, I Sell, F-Sell. We are currently invested at 100/G. Our allocation is now -27.63% on the year not including the days results. Here are the latest posted results:

| 09/19/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.0445 | 18.3365 | 59.5478 | 64.1245 | 31.0793 |

| $ Change | 0.0048 | -0.0315 | 0.4063 | 0.4985 | 0.0870 |

| % Change day | +0.03% | -0.17% | +0.69% | +0.78% | +0.28% |

| % Change week | +0.03% | -0.17% | +0.69% | +0.78% | +0.28% |

| % Change month | +0.18% | -1.97% | -1.30% | -1.30% | -1.86% |

| % Change year | +1.84% | -12.21% | -17.23% | -23.15% | -21.20% |

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

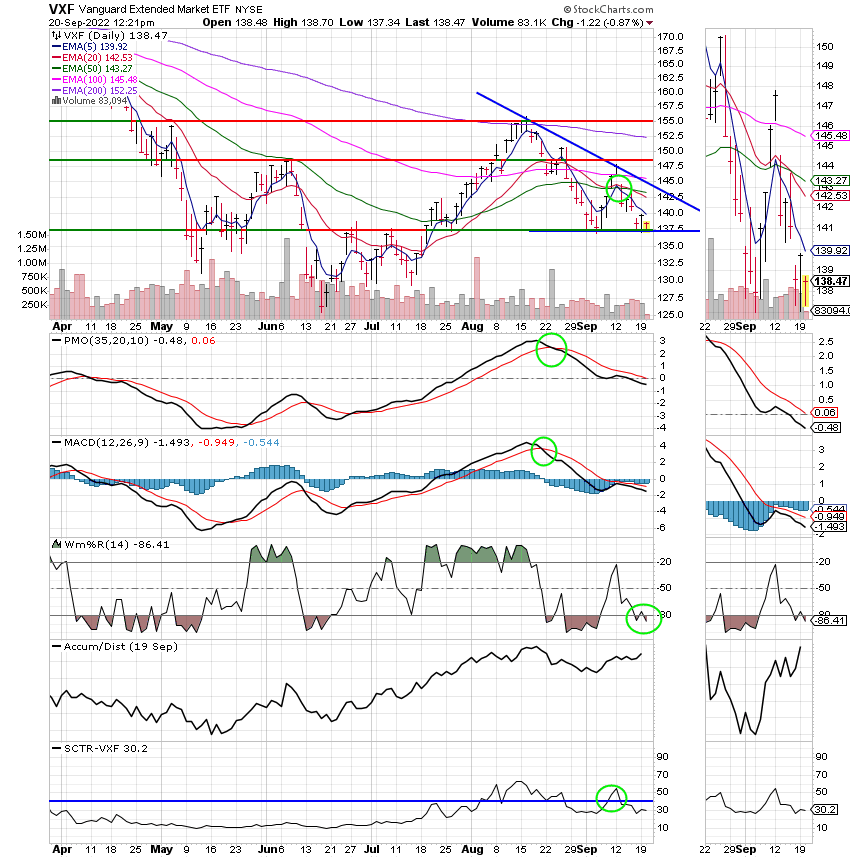

S Fund:

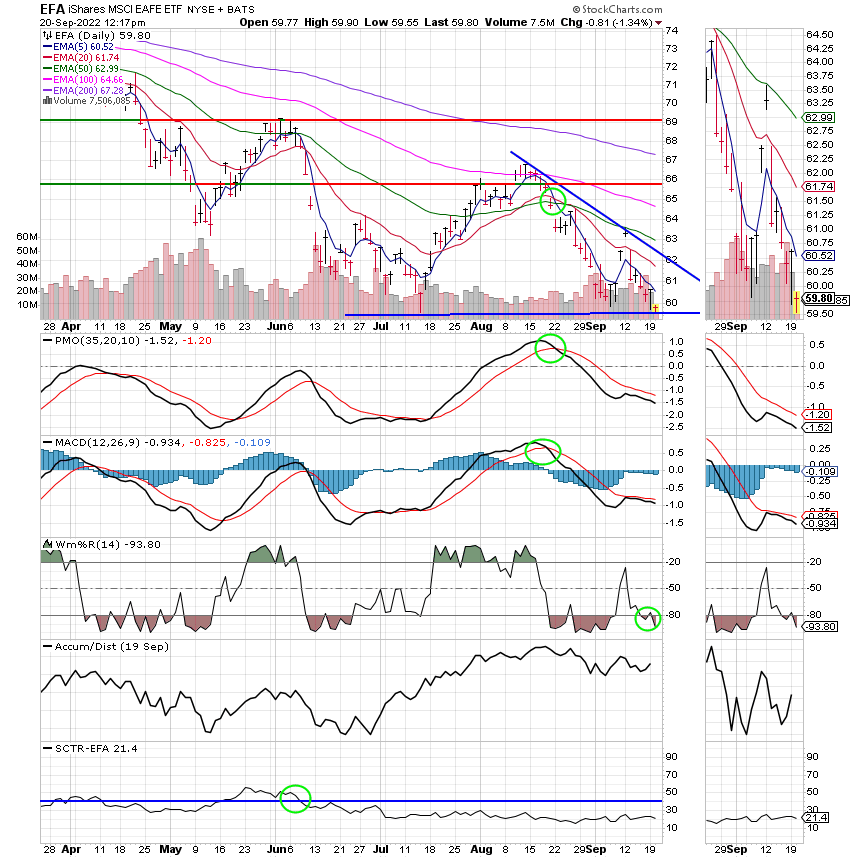

I Fund:

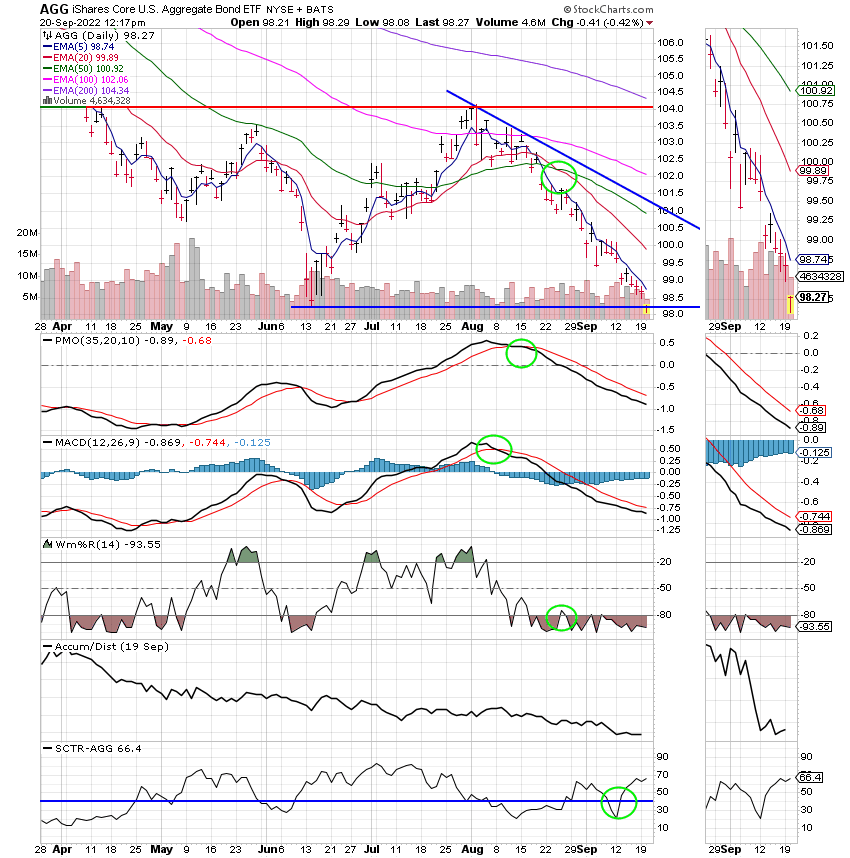

F Fund:

There’s just not anywhere to run but the G Fund right now. Keep watching the charts and keep praying!! That’s all for today. Have a nice afternoon and may God continue to bless your trades.

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.