Good Evening, There is so much going on that I could write a book tonight, but I don’t have time to write a book and you sure don’t have time to read one. So a blog will have to do! It’s just that sometimes it is really hard to condense all the stuff that is going on into one short blog and this is one of those times. All most of you see is a market that seems to be all over the place and you wonder what the heck is going on. You read the media and one says this and another says that and therein lies the problem. They are all partially correct but the problem is just that there are several issues affecting the market and it depends on whether they come to their full potential or not as to which direction the market moves. The media you see is fixated on prognostication. Accurately predicting the future is what sells so they endeavor to predict the future. In this they are no more than fortune tellers. Yeah sure they get it right occasionally and it always looks really good when they do. After all they can go straight back to the point at which they make their prediction and point to it and say “See there, I told you so”. Sure they did! However, let me ask you all one question. How many times do you see them pointing out the prediction they made that didn’t turn out to be correct. Yes Sir/Ma’am they never do that. When they don’t get it right they just forget about it and let it fade away. After all you entered the fair booth and paid your money and had your entertainment and isn’t that what they try to do? To entertain??? You betcha! Sometimes they get it right by making a bold prediction like the market is going to drop! Wow that’s right, sure! It will indeed eventually drop for sure or Have you ever seen this, they say a bottom is forming in the middle of a bear market and they are lauded is the one that got it right! An absolute hero! Oh yeah!! The problem is simply this, they predicted the bottom five times before that while the market continued lower, Never mind that the millions of investors that followed them lost half the portfolios waiting for that bottom to show up. Nevertheless, when they finally get it right they are a hero. Amazing!! You all get the picture. There is a big difference between someone that’s saying this or that is going to happen and someone that is saying this could happen. Sure we all try to guess the direction that the market will go and make contingency plans as to what we will do when it does. That’s called having a system! However, when someone tells you this or that is going to happen, they don’t know! When you see that run away as fast as you can run. They will make money off the adds they sell and you will lose money on the advice you take. OK, we hear you Scott but isn’t that what you do?? Nope, absolutely not. No way no how!! We talk about the current market conditions to help us explain what we see on our charts. It is a rare bird when we try to make a call on what we think will happen. But Scott, didn’t you just do that when you got out of the market is August? No Sir/Ma’am it is not! We got out to show caution as we got burned once before when the Fed brought up tapering so we decided better safe than sorry. If your scared say so and we did! The rest is history. We feared that the market would drop and it did not. I was 100% wrong. But you know what else. Had the market sold off at that time based on tapering our losses could have been catastrophic. The bottom line here is this. We didn’t get out of the market because we knew what it was going to do. No!!!! We got out because we didn’t know what it was going to do!! Given the same information again I would do it again ten times over! Let me say it one more way. We manage risk when we invest and when we feel that the risk is too much we move to safety. That is not and never will be fortune telling. Those people are to be avoided just like the false prophets mentioned in the bible. For the record! What we do is to follow the trend and move our money when the trend changes. We do this based on technical analysis and our balance always varies when the trend changes. As I have said many times. Our goal is to keep our balances near their highs not at their highs. That is impossible! Here’s another piece of investment advise absolutely for free. If someone tells you they can always keep your balance at it’s high and that you will never lose money with them then run away even faster than you did from the fortune tellers, but that’s another subject for another day. So what’s the market doing now? It’s bouncing all over the place as it is being in influenced by five issues. We’ve already talked about all of them but one. The first is obvious, seasonality. September is the worst month for the market on record since we have been keeping records. That said, there is over a 40% chance you can have success in the month and that’s why we stay invested. The second is one we haven’t discussed before. At least for me it’s relatively new. That is the struggling real estate developer China Evergrande Group which is teetering on the brink of default. There are fears that it’s failure could trigger market contagion much as Lehman Brothers did in the US back in 2008. Think you can tell the future (yeah I’m still stuck on that). Some experts are saying that they think the Chinese government will not let the company fail. Can you imagine the relief rally if they get bailed out? On one hand have the doom and gloom of a market contagion leading to bear market and on the other we have those predicting a massive relief rally if they get bailed out. You see why we follow the trend? For the record, I think it probably be a non-event and traders are just over reacting to it. We’ll just have to watch our charts and see. Third, we have this weeks Fed meeting and tomorrows news conference. You want to see the market move?? Just watch the ticker at 2:00PM eastern time tomorrow when J, Powell has his news conference. The direction the market goes will be determined by what the Fed decides to do with regard to tapering their monthly bond purchases and anything that might be said about future interest rate increases. Put on your seatbelts because it could be wild! The fourth issue and the one that I think is the elephant in the room is the Federal budget that is being debated in congress right now. I don’t have to tell you all as federal workers that a budget must be passed prior to the beginning of the new fiscal year on October 1st. There are so many things the market doesn’t like about this. The only absolutely perfect way this could be done to satisfy the market is if a budget is passed on time that doesn’t raise the debt ceiling for the federal government. Even if the a budget is passed the market will sell off if the budget raises the debt celling significantly. The market is obsessed with this and for good reason. You’d think our politicians would be obsessed with it too…..Folks, make no mistake. This one has the ability to take us into a bear market. Is anyone in congress listening? Does anyone really care?? We will see about this as well. The Fifth issue is one we all know too well. Covid 19. Will the delta variant continue to reek havoc? Will it slow down the world economy? Will it further impede on freedoms in the US causing even more political turmoil. That on is a loaded subject. Well there you have it. Take your best shot at predicting the future of the market if you dare. As for my family? We will continue to trust in the Lord our God who is a refuge in times of trouble!! Give Him all the praise because He and He alone is worthy!!!

The days trading left us with the following results: Our TSP allotment ended slightly in the red at -0.08%. For comparison, the Dow fell -0.15%, the Nasdaq bucked the trend at +0.22%, and the S&P 500 slipped -0.08%.

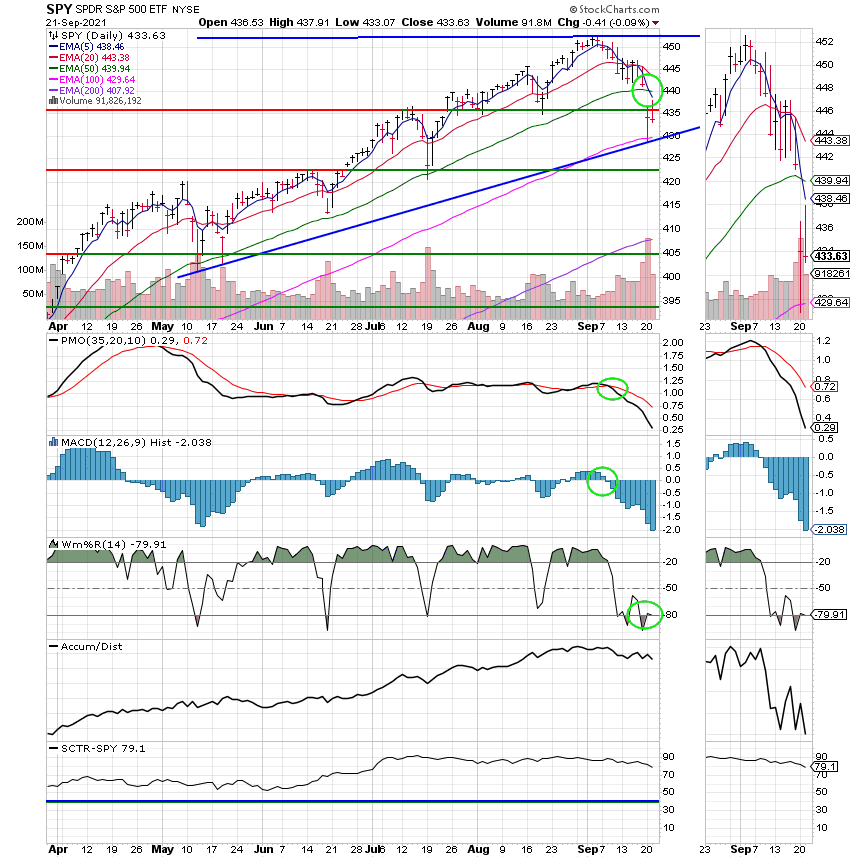

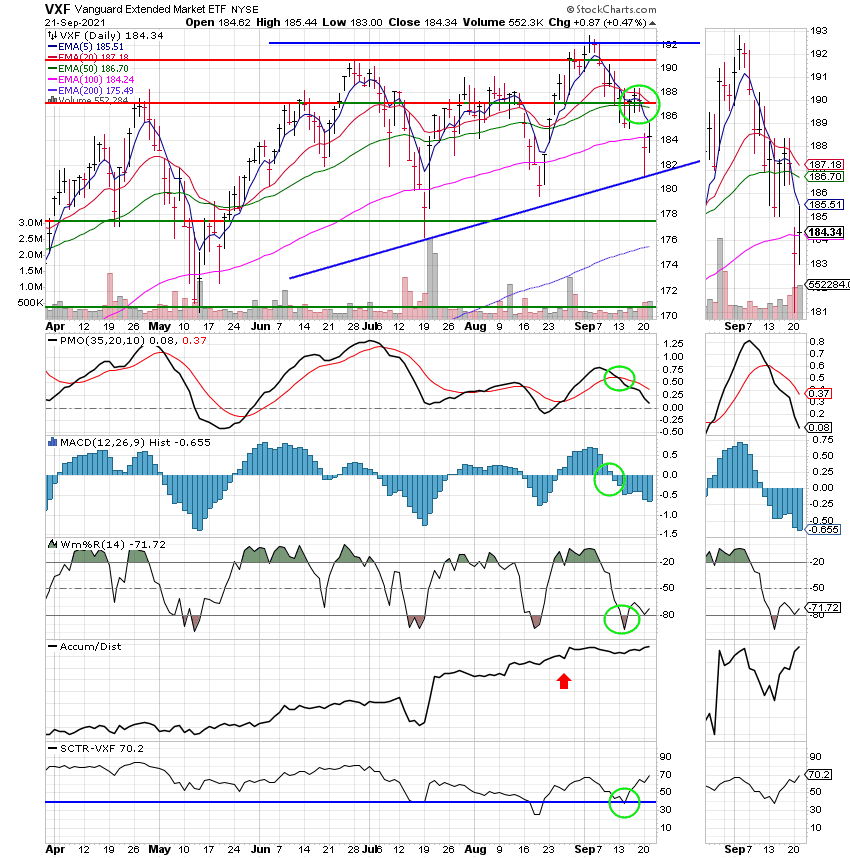

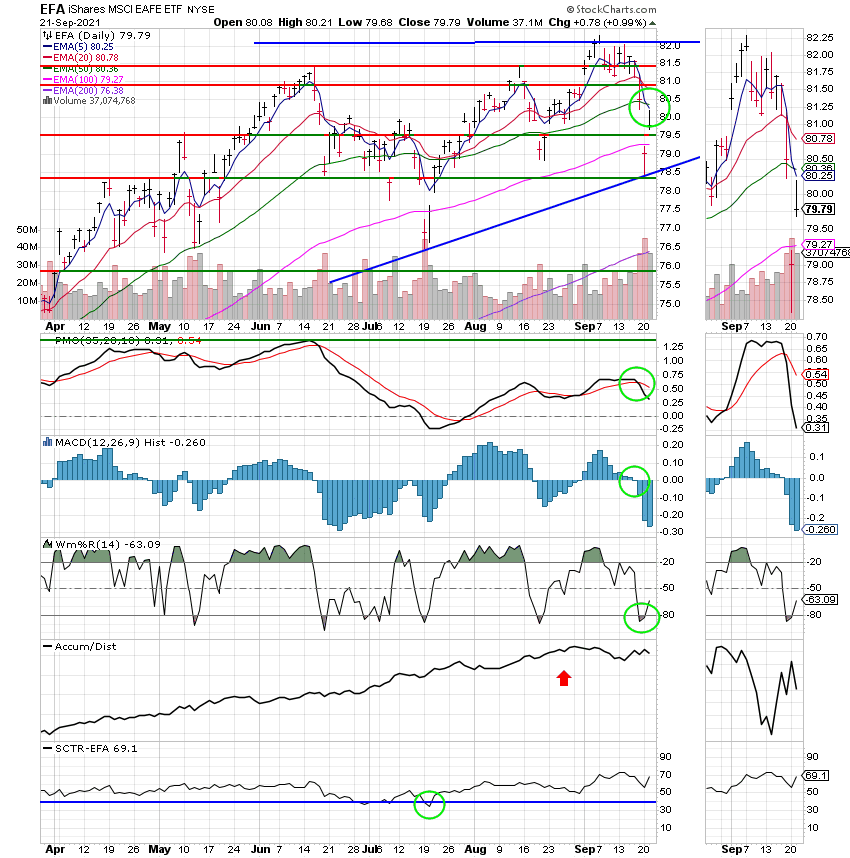

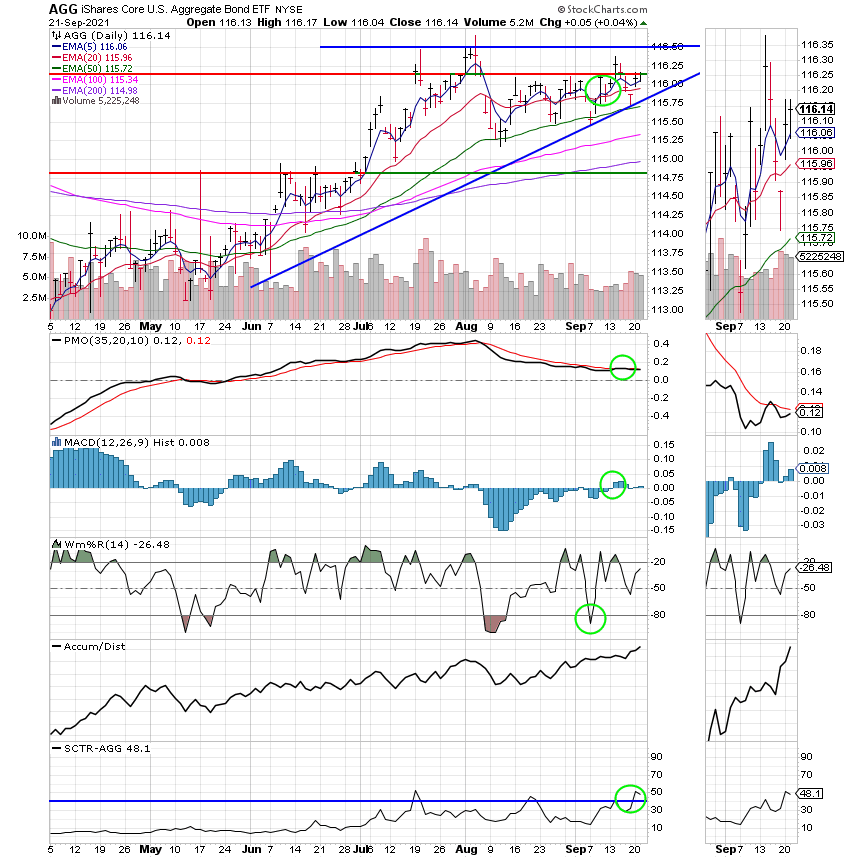

The days action left us with the following signals: C-Hold, S-Hold, I-Hold, F-Buy. We are currently invested at 100/C. Our allocation is now +12.23% for the year. Here are the latest posted results:

| 09/21/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.6669 | 21.1199 | 65.4863 | 83.5642 | 39.0943 |

| $ Change | 0.0006 | -0.0045 | -0.0500 | 0.3445 | 0.4106 |

| % Change day | +0.00% | -0.02% | -0.08% | +0.41% | +1.06% |

| % Change week | +0.01% | +0.25% | -1.77% | -1.79% | -0.89% |

| % Change month | +0.08% | +0.19% | -3.65% | -3.18% | -1.10% |

| % Change year | +0.96% | -0.36% | +17.12% | +12.62% | +10.47% |

I Fund:

F Fund:

There is definitely a lot of downward pressure out there right now. It requires a lot of patience but we must hang in there while the current trend is in tact. There is a good case for the market moving in either direction. We’ll just have to be vigilant, keeping a close eye on our charts and react to what we see when it finally makes it’s move. That’s all for tonight. Have a nice evening and may God continue to bless your trades!