Good Morning, Honestly, I don’t have much to say this morning that I haven’t already repeated many times. The inflection point for the market was last Wednesday’s Fed meeting where the Fed started a new policy cycle of rate cuts. Even though the discussion and debate is largely over the size of the rate cut which was 0.50% instead of the standard 0.25%, that is not the important issue. The most important thing is that the Fed ushered in a new economic cycle of loosening monetary policy. This signaled the end of the battle of inflation and put the focus squarely on the second part of the Fed’s dual mandate which is to maintain stable employment. Make no mistake, the decision to go with a half point instead of a quarter point increase had more to do with recent weakness in the labor market than it did with inflation. The Fed noted that the rate of inflation was coming closer to their target of two percent to be sure but what really caught their attention was the a weakening in the labor market. In order to insure that the economy comes in for a soft landing which is a term to describe inflation coming under control without a recession, the Fed must insure that employment remains stable. Thus, the half point decrease in the overnight lending rate. Now here’s the thing that injects a bit of uncertainty into the situation (remember uncertainty equals volatility where the market is concerned). Adjustments made by the Fed to the overnight lending rate don’t instantly get to the consumer. It actually takes around 8 months for an adjustment to reach the (money) market. That’s where all the uncertainty and volatility comes in. At least in theory, the current rate of inflation and unemployment are influenced by what the Fed did 8 months ago. So investors are now w0ndering out loud if the increase in rates 8 to 12 months ago will now push us into a recession. They wonder if the Fed went to far. They wonder if the Fed increased 1/2 a percent instead of a 1/4 percent because they realized that they went to far 8 months ago? They wonder if an increasing rate of unemployment will push is into a recession. So they will scrutinize each economic report and Fed statement through tinted glasses that ask ‘are we moving into a recession’. In other words they are extremely pessimistic in their views of where this economy is going and they will look for it one news release at a time. Personally, I am optimistic and think it’s all yet to be determined. Don’t forget we have an election and a lot of geopolitical stuff that will be factored into to our final destination. This week market players will be looking closely at speeches by Atlanta Fed President Raphael Bostic, Chicago Fed President Austan Goolsbee and Minneapolis Fed President Neel Kashkari for insights into what the central bank will do next. They will also be looking at multiple economic reports for hints as to how the economy is responding to recent and not so recent Fed policy. As usual, I write all this to give you a sense of where we might be at. I’m not trying to predict the future and I don’t make my investment decisions based on any of these observations. I threw out my crystal ball years ago. Trying to predict the future is like taking your money to Las Vegas. You might win and you might lose. As I state virtually every week. I base my investment decisions on good solid statistics. I trust the math not the opinionated news. Folks, the math never lies and it doesn’t have on opinion. It either is or it is not. Any error that is made with regard to the math on our charts is due to our interpretation and nothing else. That said, I would much rather try to interpret the math than the opinionated and in some cases fake news…… I trust in only two things. God and my charts. I react to what I hear from God and what I see with my eyes my charts.

This mornings trading has so far produced the following results: Our TSP allotment is currently up +0.25%. For comparison, the Dow is adding +0.15%, the Nasdaq +0.25%, and the S&P 500 +0.25%. The charts have weakened just a little over the past week. So we need to keep a very close eye on them at this point.

Dow futures rise slightly to start the week as index looks to add to record: Live updates

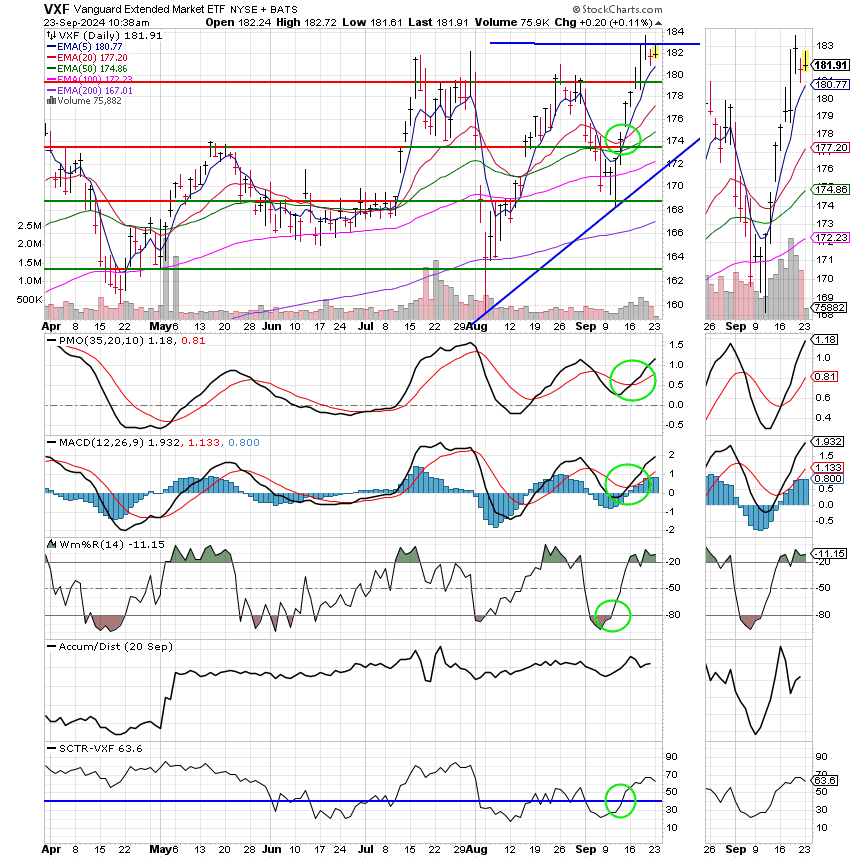

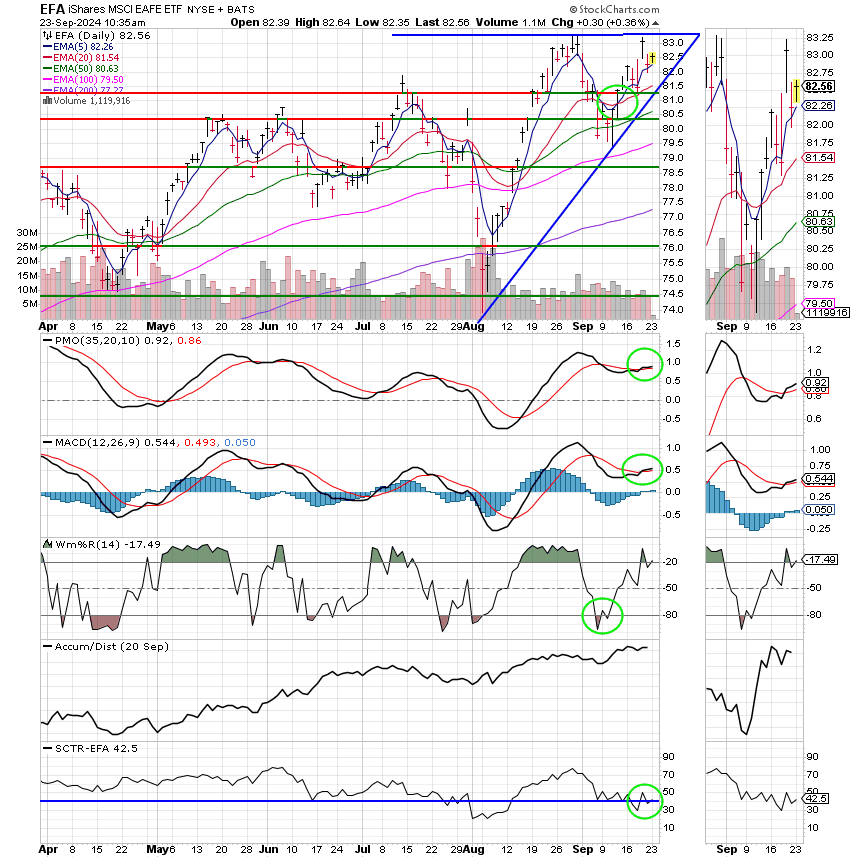

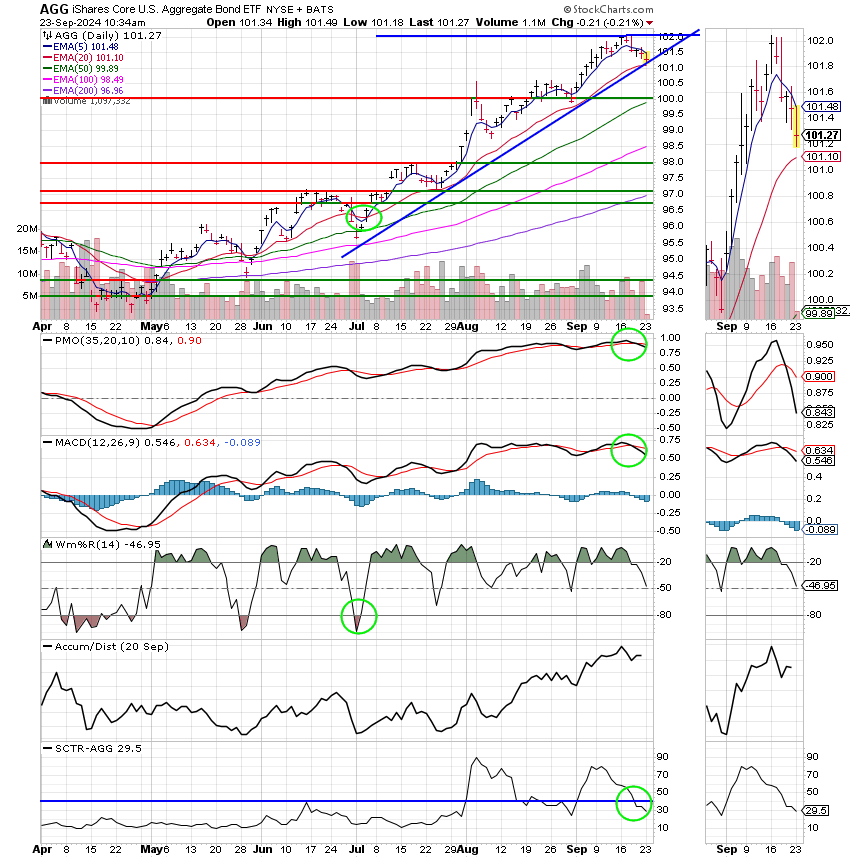

Recent action has generated the following signals: C-Buy, S-Buy, I-Buy, F-Sell. We are currently invested at 100/C. Our allocation is now +10.05% for the year not including the days results. Here are the latest posted results:

| 09/20/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.5371 | 20.1417 | 89.7959 | 85.7204 | 44.8402 |

| $ Change | 0.0020 | -0.0128 | -0.1742 | -0.6269 | -0.3037 |

| % Change day | +0.01% | -0.06% | -0.19% | -0.73% | -0.67% |

| % Change week | +0.08% | -0.22% | +1.39% | +2.41% | +1.01% |

| % Change month | +0.22% | +1.59% | +1.05% | +1.09% | -0.63% |

| % Change year | +3.20% | +4.78% | +20.75% | +11.19% | +11.59% |