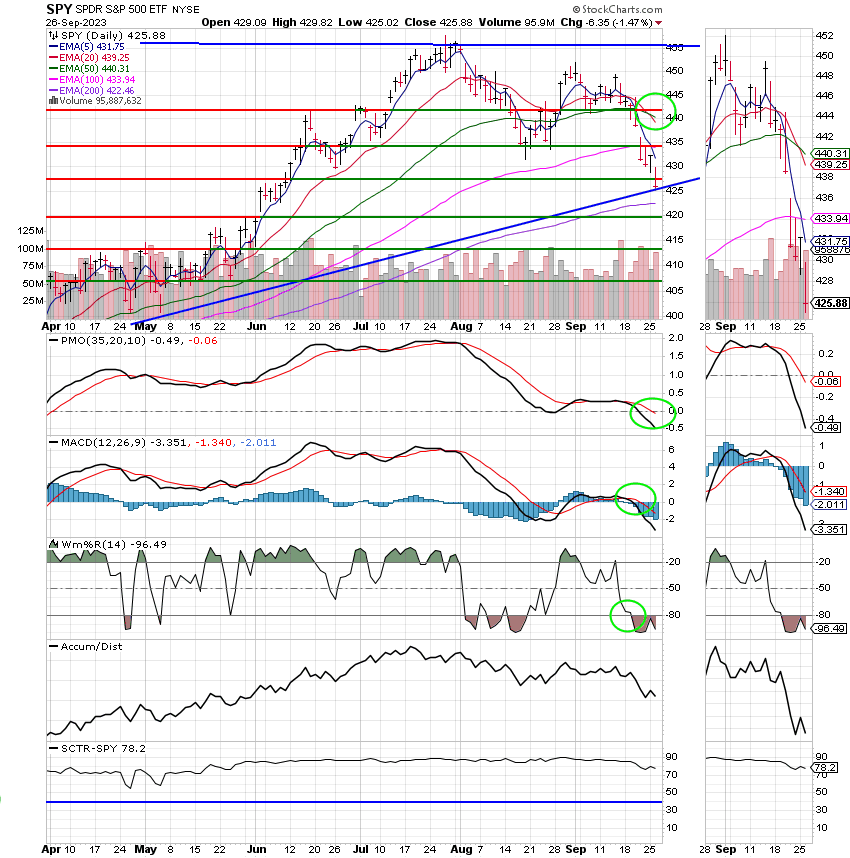

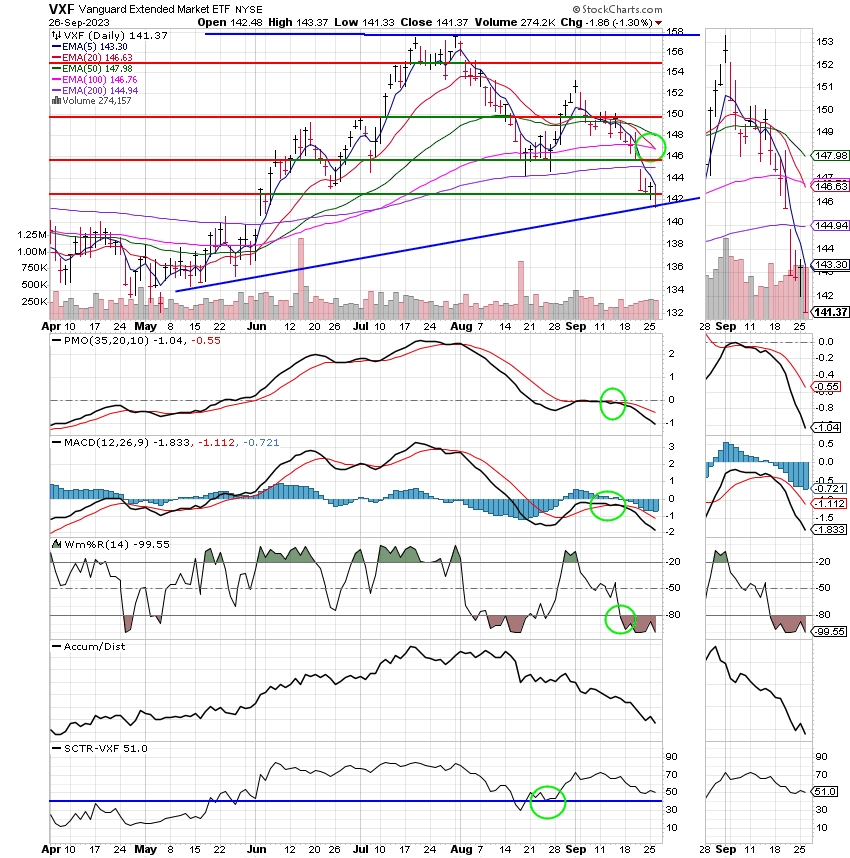

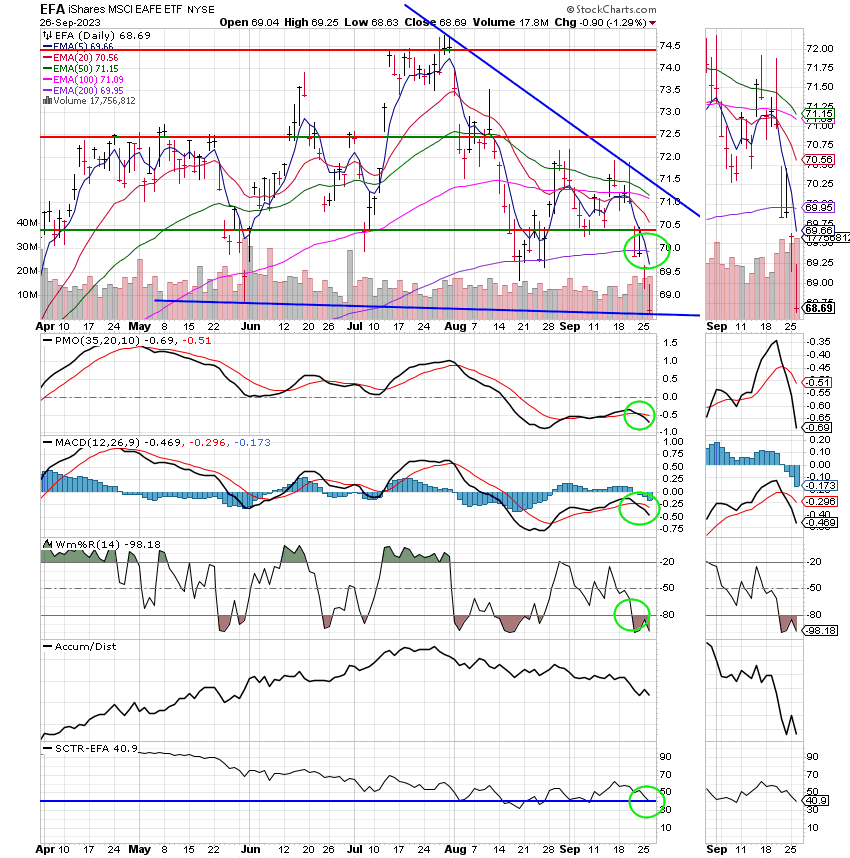

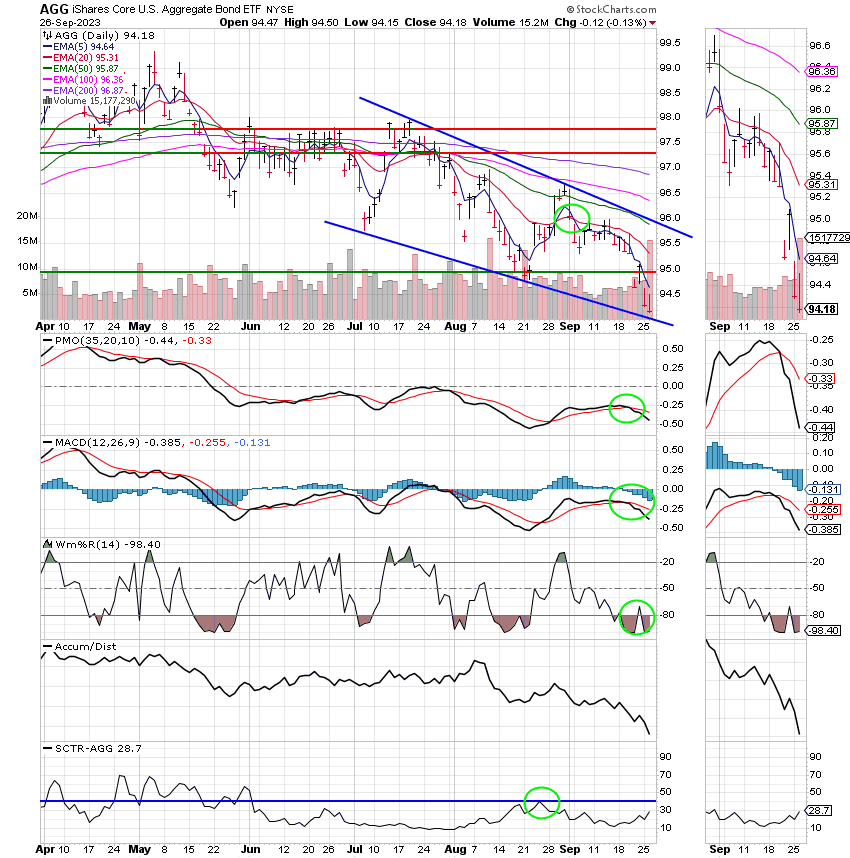

Good Evening, Let’s get one thing out of the way. We do have a sell signal in all our equity based funds and that of course includes the C Fund. However, price is not the only thing that we watch. We have several indicators such as the Williams %R, the RSI, and the KDJ to name a few that tell us how shallow or deep a selloff may be or when we might be getting close to a bottom. When we got the initial sell signal for the C Fund we also noted that our indicators were telling us that this would likely not be a deep pullback. So……. what does deep mean? After all this is pretty painful!! We would consider a deep pullback to be in the 10% range. Our initial inspection of our indicators showed us that this pullback would probably be in the 5-6% range. While that is painful when your going through it, it does not give us enough room to make a profit by shorting the market which is to say not enough time to get in and out and make money doing it. It has been my experience that you need a pullback to be at least in the 9 or 10 percent range for that strategy to work. So we decided to hold the C Fund through this sell off which is what we have done. One word of caution with this plan of action or should I say inaction? Our overbought oversold indicators have been pretty good to us over the years. However, the current budget negotiations going on in congress could be landmine. The budget process with such a polarized congress definitely has a negative effect on the market and that has the ability to push our indicators past their normal limits. An easy way of saying this is that the ongoing budget negotiations raise the level of risk with regard to technical analysis. A budget impasse will cause selling regardless of what our indicators say. When they talk about a government shutdown you can pretty well throw everything else out the window. That said, I am still staying invested because I do not believe the politicians will allow the government to shut down with an election year so close. I’m also sticking with my indicators that this selloff is near or at the bottom. Given that assumption, I do not believe it would be prudent or profitable to sell at this time. My recommendation is to buy if you are currently out of the market and to hold of you are already in it.

So what caused the selling today? The bad news that was good is now bad again. If you don’t like the news one day just stick around, it will change. New Home sales, the consumer confidence index, and some comments from Jamie Dimon shot us down today. August new home sales missed expectations. Homes under contract totaled 675,000 for the month, down 8.7% from July, according to the Commerce Department. Economists polled by Dow Jones anticipated a total of 695,000, which would have represented a 2.7% fall from unrevised July totals. The Conference Board’s consumer confidence index fell to 103 in September, down from 108.7 in August. Economists were anticipating 105.5, according to consensus estimates from Dow Jones. The expectations index tumbled to 73.7, below the level that observers associate with recessions. JPMorgan Chase CEO Jamie Dimon warned interest rates may need to rise further to tamp down inflation, comments that added to bearish sentiment Tuesday. Also, don’t forget the sour taste that the market has from the Fed Statement that said that they would have to leave rates higher for longer to control inflation. Remember what we said about inflation returning to two percent???? Come on! How could you forget? The bottom line is that if you can stomach all this, the market will most likely rally into the holidays when congress passes either a continuing resolution or a permanent budget. When it all comes down to it we need congress to do their job. Folks, keep praying for our nation!!!

The days trading left us with the following results (You may want to take the kids out of the room. It’s ugly!): Our TSP allotment dropped -1,47%. For comparison, the Dow fell -1.16%, the Nasdaq -1.14%, and the S&P 500 -1.47%. Just an encouraging note. The C Fund is in the green in afterhours trading. Remember! Bottoming is a process that includes both higher and lower prices moving mostly in a sideways direction and it can last a week or for weeks. Once it begins there will always be a fluctuation in prices with sideways movement. So if you are holding you must be patient. The market will come to you!

Dow sheds nearly 400 points in worst day since March as economic worries return: Live updates

The days action left us with the following signals: C-Sell, S-Sell, I-Sell, F-Sell. We are currently invested at 100/C. Our allocation is now -5.30%, not including the days results. Our monthly return currently sits at -3.70%. Here are the latest posted results:

| 09/25/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.7386 | 18.0669 | 67.3407 | 66.6921 | 36.5989 |

| $ Change | 0.0062 | -0.1268 | 0.2710 | 0.2304 | -0.2206 |

| % Change day | +0.03% | -0.70% | +0.40% | +0.35% | -0.60% |

| % Change week | +0.03% | -0.70% | +0.40% | +0.35% | -0.60% |

| % Change month | +0.29% | -2.27% | -3.70% | -5.30% | -2.71% |

| % Change year | +2.92% | -0.77% | +14.32% | +8.39% | +7.83% |