Good Evening, A report showed that manufacturing retracted for the first time in several months and the market responded in kind. However, a rally in tech drove the market off it’s lows with the major indexes finishing flat for the day. Of course I always include a link for the latest news and market fundamentals with each blog. No use in reinventing the wheel so to speak.

The days trading left us with the following signals: Our TSP allotment gained +0.09%. For comparison, the Dow added +0.10%, the Nasdaq +0.27%, and the S&P 500 was -0.00%. For those that don’t understand why the S&P has a negative sign in front of zeros, that shows that the S&P 500 finished slightly in the negative but greater than -0.01%.

Wall Street flat as tech offsets manufacturing data

The days action left us with the following signals: C-neutral, S-Neutral, I-Neutral, F-Neutral. We are currently invested at 100/F. Our allocation is now +1.78% on the year not including the days results. Here are the latest posted results.

| 09/01/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 15.093 | 17.9783 | 29.7252 | 38.494 | 24.5971 |

| $ Change | 15.0930 | 17.9783 | 29.7252 | 38.4940 | 24.5971 |

| % Change day | +0.00% | -0.02% | +0.00% | +0.11% | +0.53% |

| % Change week | +0.02% | +0.31% | +0.13% | +0.41% | +0.36% |

| % Change month | +0.00% | -0.02% | +0.00% | +0.11% | +0.53% |

| % Change year | +1.19% | +6.04% | +7.85% | +9.25% | +2.08% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 18.2433 | 24.1178 | 26.3039 | 28.0248 | 15.9068 |

| $ Change | 18.2433 | 24.1178 | 26.3039 | 28.0248 | 15.9068 |

| % Change day | +0.04% | +0.08% | +0.11% | +0.13% | +0.15% |

| % Change week | +0.09% | +0.14% | +0.18% | +0.21% | +0.23% |

| % Change month | +0.04% | +0.08% | +0.11% | +0.13% | +0.15% |

| % Change year | +2.64% | +3.92% | +4.95% | +5.47% | +5.86% |

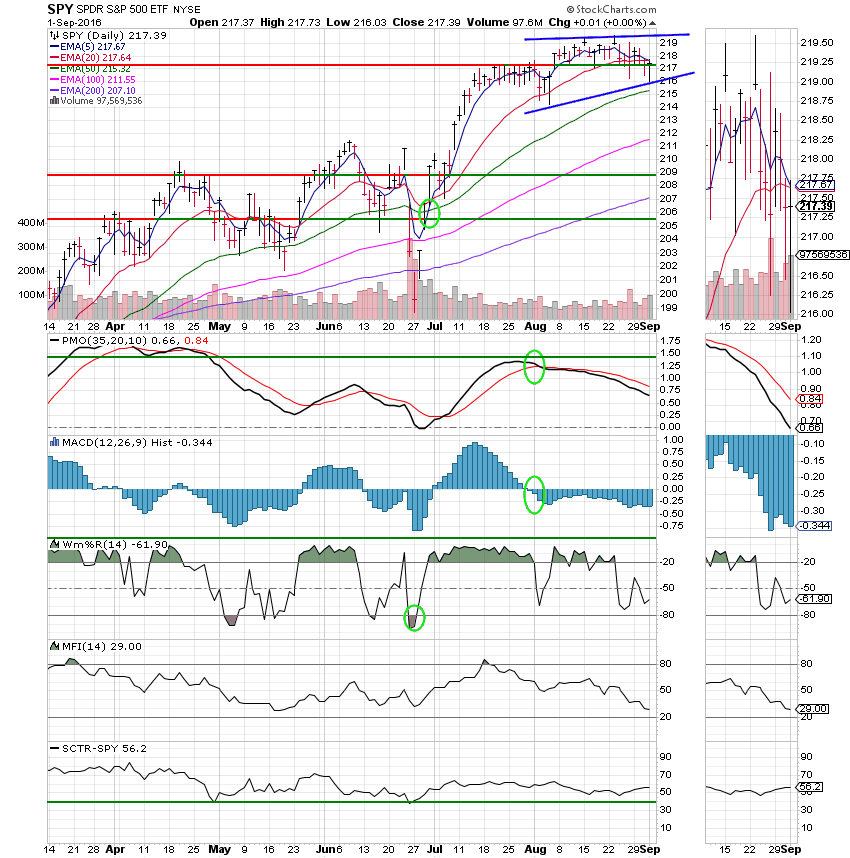

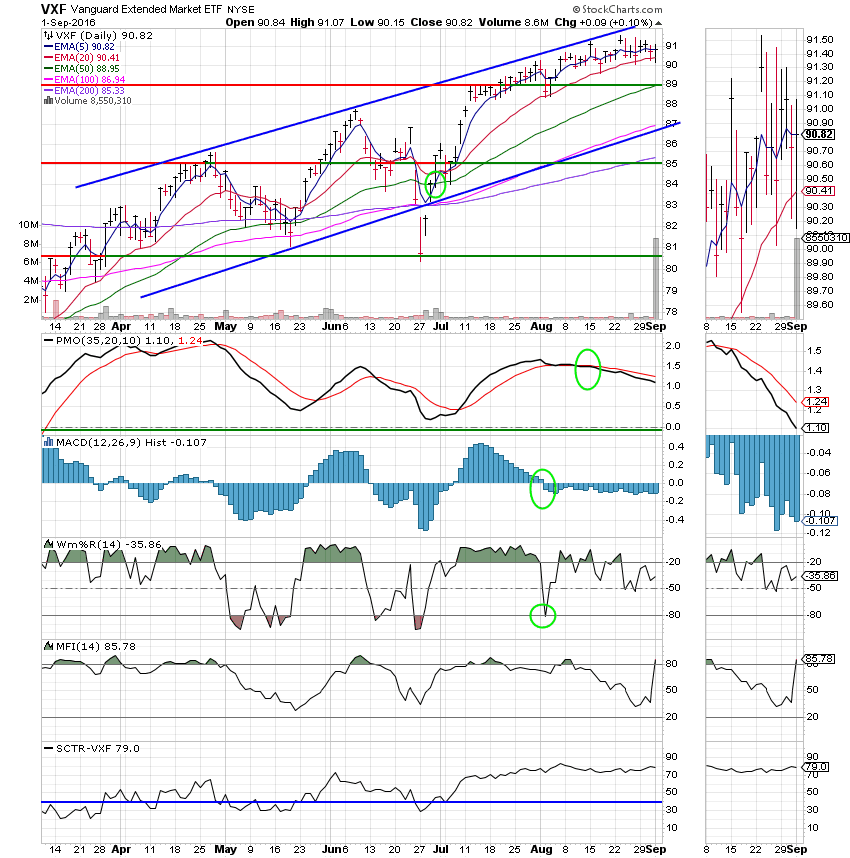

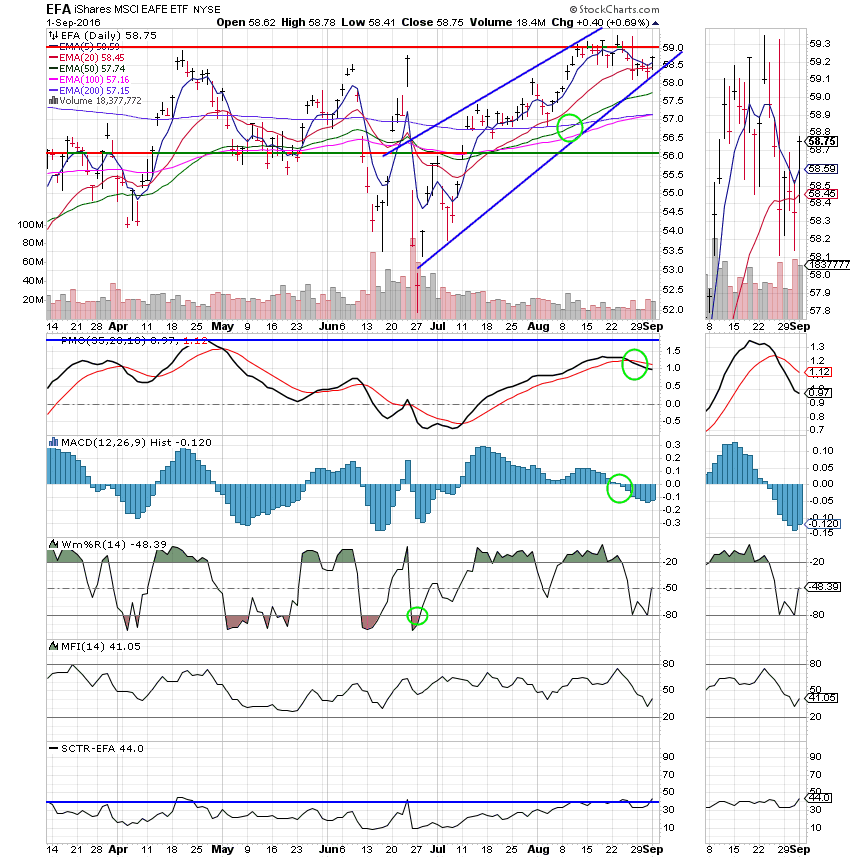

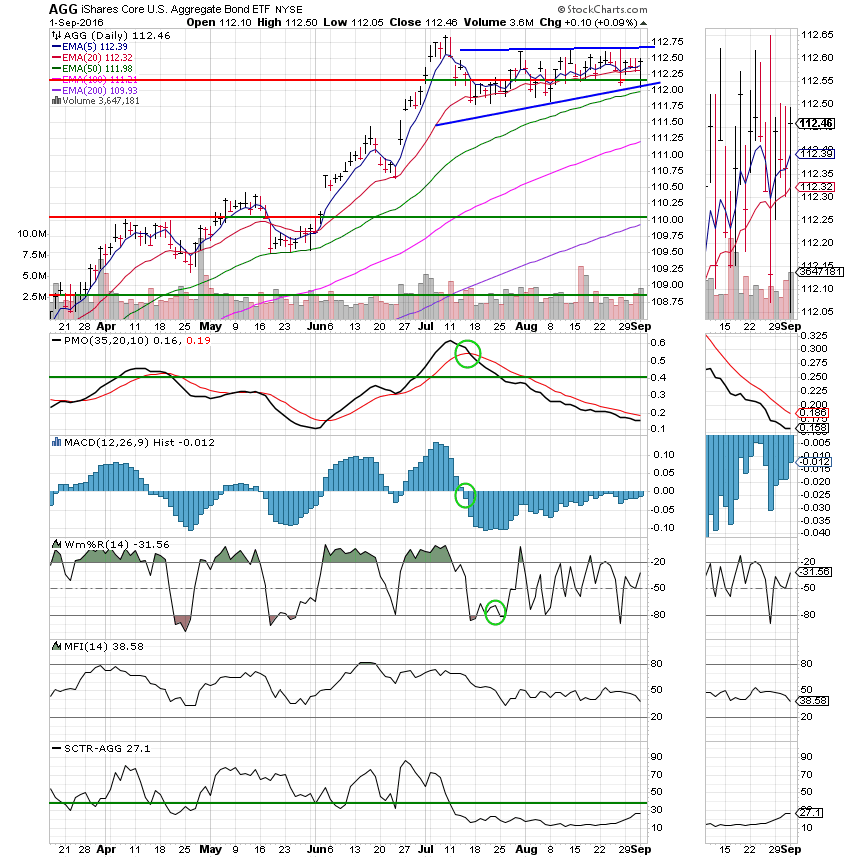

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund:

S Fund:

I Fund:

F Fund:

As you can see, everything was a little flat today. Our task now is to monitor the charts for the first hint of a change in the current character of this market. That would mean a break either way from the tight trading range that we have been in since July. My expectation is for more of the same type of trading we are currently experiencing through September and into October. That’s all for tonight. Have a great evening and may God continue to bless your trades.