Good Evening,

Well it’s September. It looks like we’ve gone from everything working to almost nothing working. However, the important thing to remember is that one day does not a trend make. When you have a bad day like this and most of your charts are still trading above their respective 20 Exponential Moving Averages, there is no reason to be overly concerned. At least, not at this point. TSP came in mixed today as small caps out performed with the Dow and S&P showing losses. The defensive sector from bonds to precious metals tanked. Could this signal a change in character? It’s too early to tell, but we must monitor our charts carefully for signs that the market winds could be changing. An exit from defensive investments could definitely bode well for our TSP allocation!

09/02/14 7:41 AM: Morning Thoughts“With the end of summer and the start of school the first of September always has the feel that we are starting a new chapter in the market adventure. Unfortunately that new chapter is often difficult as September is, historically, the worst performing month of the year. That has not been the case 4 of the last 5 years but 2008 was hard to forgot.The bears continue to believe that the market is on the brink of a major top. That is nothing new but what is interesting is how a more hawkish Fed and international events like the crisis in Ukraine are being totally ignored. There just isn’t any real worry about big picture matters right now. In fact the major positive right now is that the economy is still so weak in Europe that the ECB is likely to come up with some sort of stimulus plan. Central bankers have been the key to the market for years and they still are the only thing that matters.Last week we saw some traditional ‘holiday trading’. Volume was extremely light but there were pockets of speculation and traders did quite well with individual stock picking. There was strong underlying support and the race to put money to work continued. The fear of being left out as an extended market goes even higher is trumping fear of being caught in a reversal.If you want to find a negative it is easy to point to the complacency. There just doesn’t seem to be any real fear or worry out there. Ukraine is being totally ignored and what seems to cause the greatest anxiety is worry about not having sufficient long exposure. This has been the theme for a very long time and it never seems to end as the bears keep wishing and hoping and praying that the doom they have been predicting is about to hit.What works best in this market is some of the very old and tired clichés like ‘don’t’ fight the Fed’ and ‘the trend is your friend’. If you stuck with the wisdom of those aphorisms you are on the right side of the market.For many people it is impossible to forego the market timing game. They desperate want to be the hero that nails the exact minute the market rolls over and makes a top. They have been consistently been wrong but that doesn’t stop them. They are convinced that this time it really is going to be different but it’s not.You can be certain that the bears are going to be talking about the poor seasonality of September and October and the fact that the market is extended on light volume but the smart move has been to not anticipate. If you have a bearish bias you need to wait and react to negative price action rather than anticipate it. Strong markets are sticky to the upside and this has definitely been a strong market.It is always tough to be trusting of the gap-up opens to start the week but the tendency is for support to kick in quickly if there is a pullback. We haven’t seen many quick reversals at all as the dip buyers are watching and waiting to do their thing.AAPL and TSLA have some target increases this morning that is helping the mood and Europe is strong as well. Buckle up and have a little extra caffeine this morning. It is time to go to work.Long AAPL”

| 09/02/14 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.5128 | 16.5312 | 26.2361 | 36.0285 | 26.2822 |

| $ Change | 0.0019 | -0.0512 | -0.0130 | 0.1298 | -0.0140 |

| % Change day | +0.01% | -0.31% | -0.05% | +0.36% | -0.05% |

| % Change week | +0.01% | -0.31% | -0.05% | +0.36% | -0.05% |

| % Change month | +0.01% | -0.31% | -0.05% | +0.36% | -0.05% |

| % Change year | +1.58% | +5.02% | +9.89% | +7.00% | +2.81% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.3275 | 22.8447 | 24.7842 | 26.3786 | 14.9995 |

| $ Change | -0.0012 | -0.0004 | 0.0011 | 0.0038 | 0.0033 |

| % Change day | -0.01% | +0.00% | +0.00% | +0.01% | +0.02% |

| % Change week | -0.01% | +0.00% | +0.00% | +0.01% | +0.02% |

| % Change month | -0.01% | +0.00% | +0.00% | +0.01% | +0.02% |

| % Change year | +3.04% | +4.81% | +5.65% | +6.22% | +6.66% |

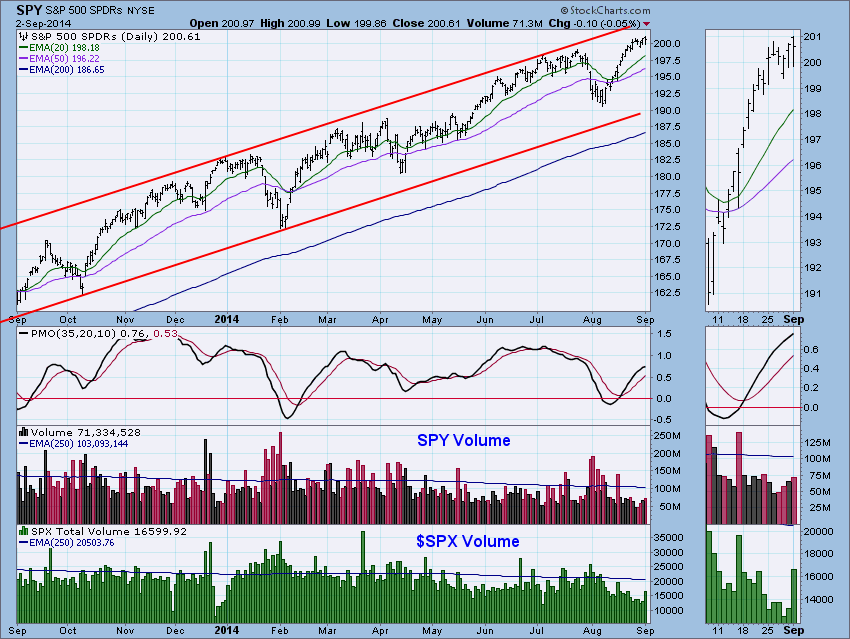

“Price has basically been consolidating since closing above 2000 with a slightly positive bias. The PMO is nearing overbought territory and appears to be flattening out a bit. For post-holiday trading, there was a decent amount of volume.”

“Conclusion: Summarizing the indicators, the most important time frame is the intermediate-term and these indicators are bullish and have been for some time. Short-term indicators are looking bearish again, while ultra-short-term indicators are in neutral. It looks like we should expect price to back down or continue to consolidate in the short-term but ultimately the market should continue the rally because intermediate-term indicators are telling us a rally above all-time highs can be expected.”