Good Evening, Bad news is good was the theme again today as dip buyers stepped in to bring the market back into the green after a report showed that the services sector posted a weaker than expected reading in August. This results from the fact that traders are focused on whether the Fed will raise interest rates this fall and if so how soon. Barring a catastrophic market moving even all issues will be viewed through “Fed Rate Increase” glasses.

The days trading left us with the following results: Our TSP allotment added +0.21%. For comparison the Dow gained +0.25%, the Nasdaq +0.50%, and the S&P 500 +0.30%.

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Neutral. We are currently invested at 100/F. Our allocation is now + 1.65% on the year not including the days results. Here are the latest posted results:

| 09/02/16 |

|

|

|

Prior Prices |

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

15.0936 |

17.9557 |

29.8518 |

38.85 |

24.8224 |

| $ Change |

0.0006 |

-0.0226 |

0.1266 |

0.3560 |

0.2253 |

| % Change day |

+0.00% |

-0.13% |

+0.43% |

+0.92% |

+0.92% |

| % Change week |

+0.03% |

+0.18% |

+0.56% |

+1.34% |

+1.28% |

| % Change month |

+0.01% |

-0.14% |

+0.42% |

+1.03% |

+1.45% |

| % Change year |

+1.19% |

+5.90% |

+8.31% |

+10.26% |

+3.02% |

| |

L INC |

L 2020 |

L 2030 |

L 2040 |

L 2050 |

| Price |

18.266 |

24.1853 |

26.4112 |

28.1591 |

15.9944 |

| $ Change |

0.0227 |

0.0675 |

0.1073 |

0.1343 |

0.0876 |

| % Change day |

+0.12% |

+0.28% |

+0.41% |

+0.48% |

+0.55% |

| % Change week |

+0.21% |

+0.42% |

+0.59% |

+0.69% |

+0.78% |

| % Change month |

+0.16% |

+0.36% |

+0.52% |

+0.61% |

+0.70% |

| % Change year |

+2.77% |

+4.21% |

+5.38% |

+5.97% |

+6.44% |

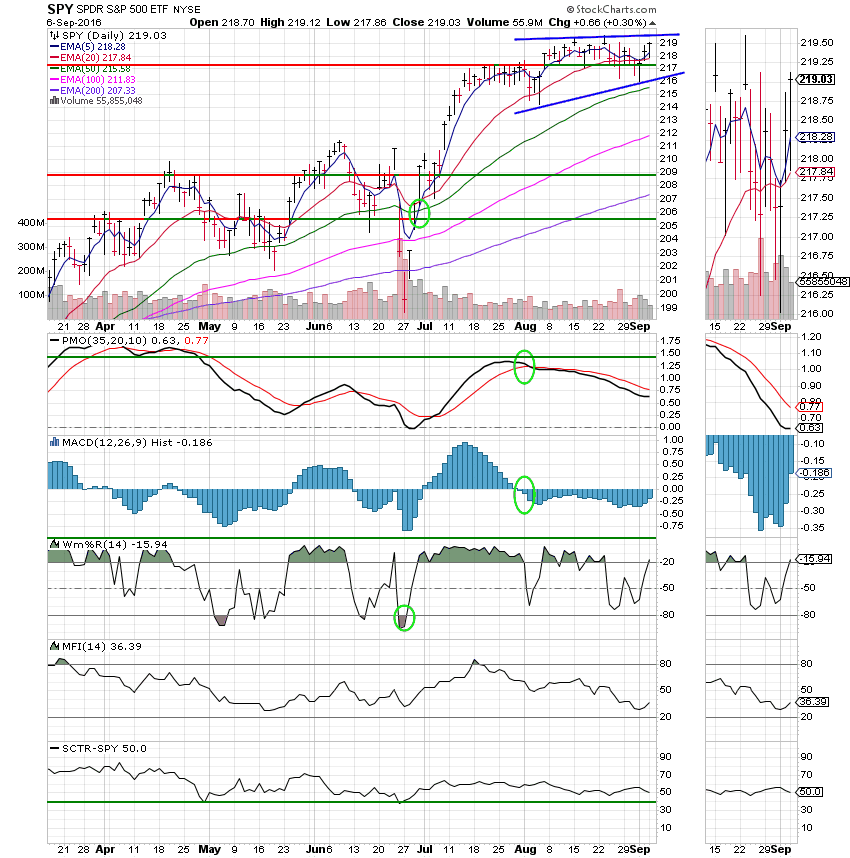

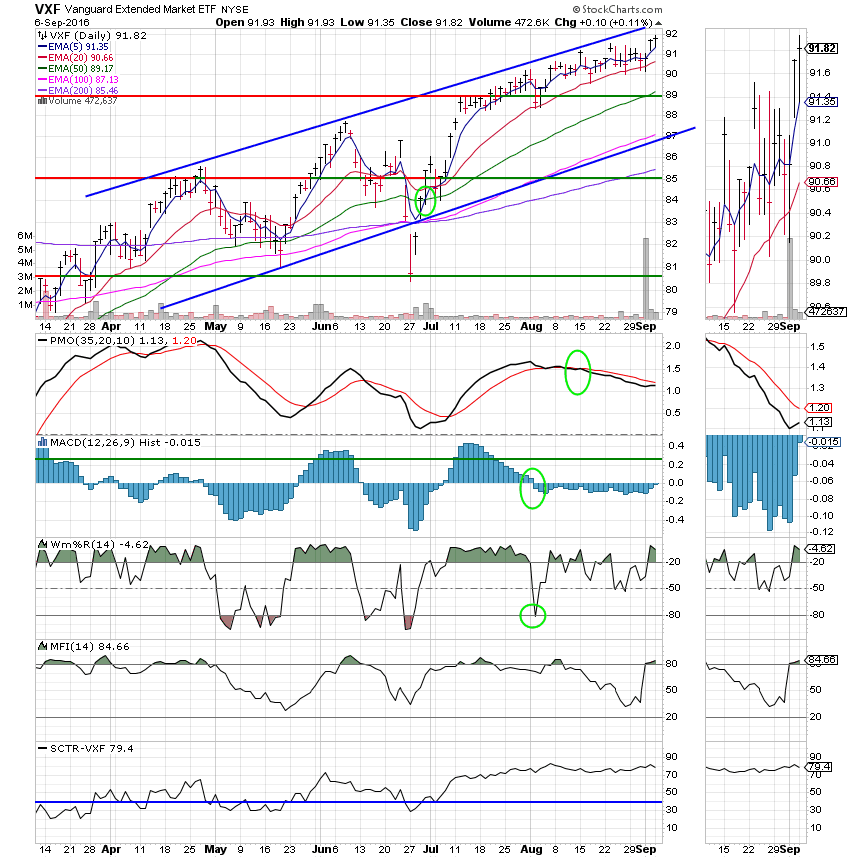

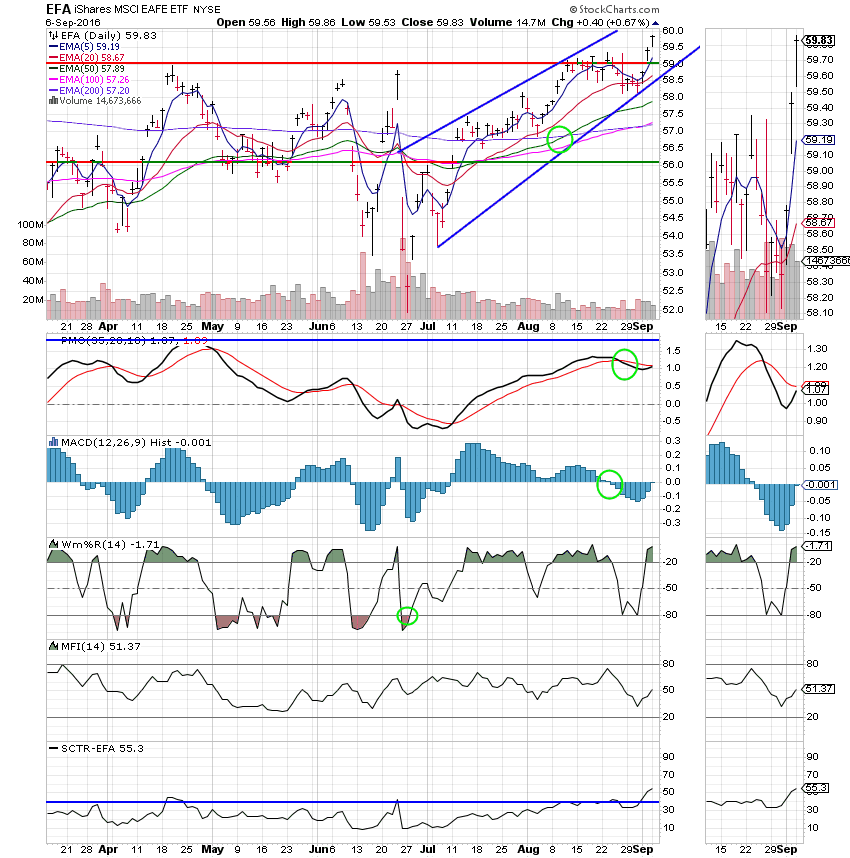

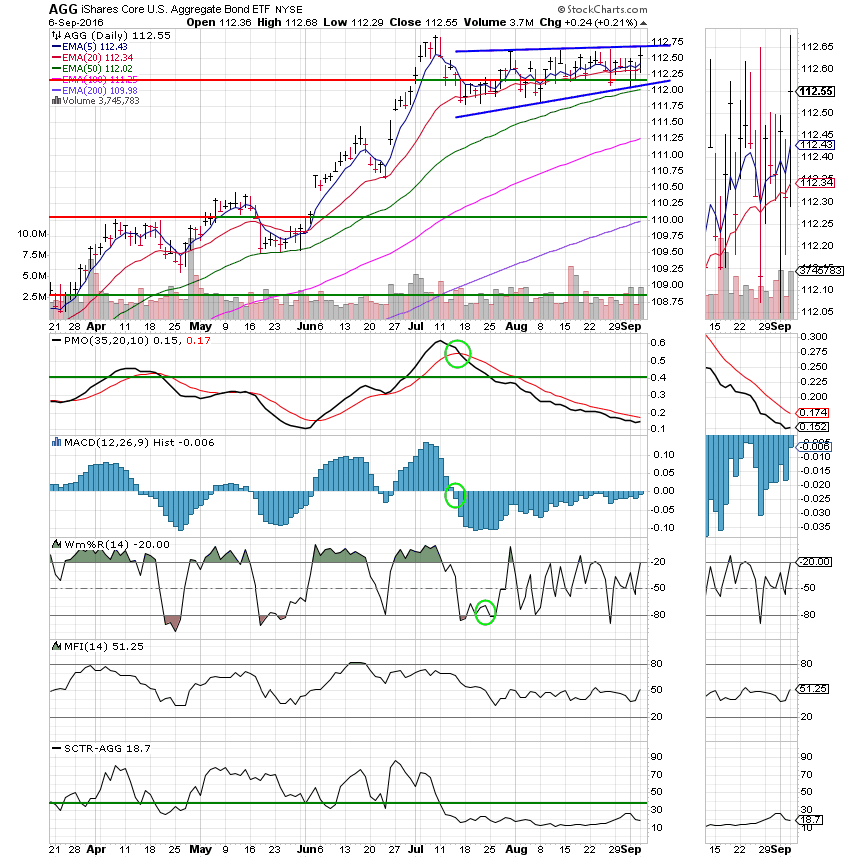

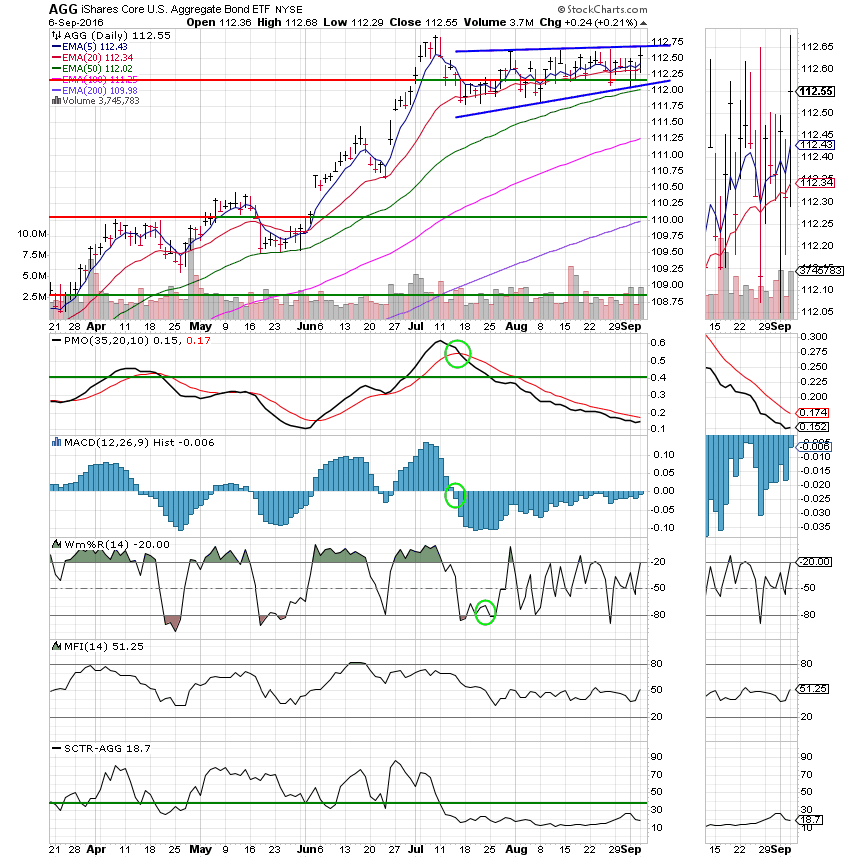

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund: Price continues to trade sideways. None of the other indicators are even hinting that will change. The SCTR shows this lack of strength at 50.0.

S Fund: The S Fund continues to perform well with price hanging out near the upper trend line. The SCTR is healthy at 79.4. That is currently the best of our TSP funds. Although, the fund is moving up fast at 55.3. If I had to buy one of these today it would be the S Fund. Why am I not buying? I’ll address that at the end….

I Fund: Price is improving as we said if would if it broke resistance at 59.0. That resistance is now support. The Money Flow index and SCTR are both improving showing that their is probably more upside here.

F Fund: Price continues to move ever so slightly higher in a bullish ascending wedge. This pattern as well as the PMO. MACD, WMS%R, and MFI all hint that a break higher could come soon.

So now to the big question. Why am I staying in bonds while equities are leaving me in the dust? The answer to that question is simple. Given that August and September are the poorest months for the major indices in records going back to the early 1900’s coupled with the fact that they are all within a few percent of record highs (The Nasdaq actually set a new record today) our view is and has been that we are due for a pullback. Our strategy has been to position our funds in the relative safety of bonds while we wait for this pullback to occur and present us with a good entry point into equities. Our system has always been predicated on outperforming the market by taking advantage of the pullbacks that have occurred regularly throughout the history of the market. That is until now when the market is in a protracted uptrend with only a few mild pullbacks that is unprecedented in history. There are many reasons for this that we have discussed in detail in the past. So what about now? I considered moving back into equities and chasing the current strength of the S and I Funds. However, September has traditionally been the worst month for the market and second half of September consisting of the period from September 15th to October 1st has been dismal. With that in mind I have decided not to chase at this time and to wait until October 1st to see if we get our pullback. If that does not occur, I intend to buy into equities at that time. I would be amiss not to add that this is an election year which could throw a wildcard into the mix. That said, my strategy is to maintain my discipline and stick to our initial plan and trust that God will guide our hand as He has always done in the past. That’s all for tonight. Have a nice evening!

God bless, Scott

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.