Good Evening, The market was flat again today as investors continue to assess whether or not the Fed will raise rates this month. Also on their minds is the European Central Bank which will announce their decision tomorrow. The ECB announcement has the ability to move the market, but not like the Fed which meets later this month.

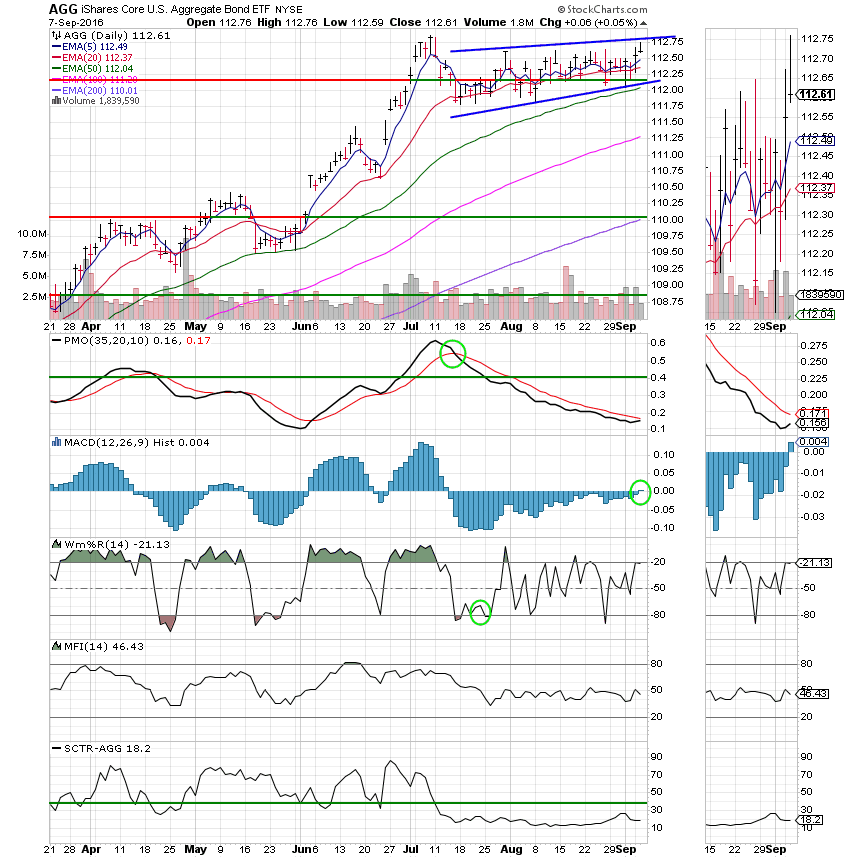

The days trading left us with the following results: Our TSP allotment gained +0.05%. For comparison, the Dow fell back -0.06%, the Nasdaq added +0.15%, and the S&P was flat at -0.01%. I thank God that our bonds did about as well as anything else today.

Wall Street ends flat as investors assess U.S. rates outlook

The days action left us with the following signals: C-Neutral, S-Buy, I-Buy, F-Buy. We are currently invested at 100/F. Our allocation is now +1.95% on the year not including the days results. Here are the latest posted results:

| 09/06/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 15.0963 | 18.0083 | 29.9415 | 38.9038 | 25.1074 |

| $ Change | 0.0027 | 0.0526 | 0.0897 | 0.0538 | 0.2850 |

| % Change day | +0.02% | +0.29% | +0.30% | +0.14% | +1.15% |

| % Change week | +0.02% | +0.29% | +0.30% | +0.14% | +1.15% |

| % Change month | +0.03% | +0.15% | +0.72% | +1.17% | +2.62% |

| % Change year | +1.21% | +6.21% | +8.63% | +10.41% | +4.20% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 18.2912 | 24.2483 | 26.5062 | 28.2751 | 16.0674 |

| $ Change | 0.0252 | 0.0630 | 0.0950 | 0.1160 | 0.0730 |

| % Change day | +0.14% | +0.26% | +0.36% | +0.41% | +0.46% |

| % Change week | +0.14% | +0.26% | +0.36% | +0.41% | +0.46% |

| % Change month | +0.30% | +0.62% | +0.88% | +1.02% | +1.16% |

| % Change year | +2.91% | +4.48% | +5.76% | +6.41% | +6.93% |

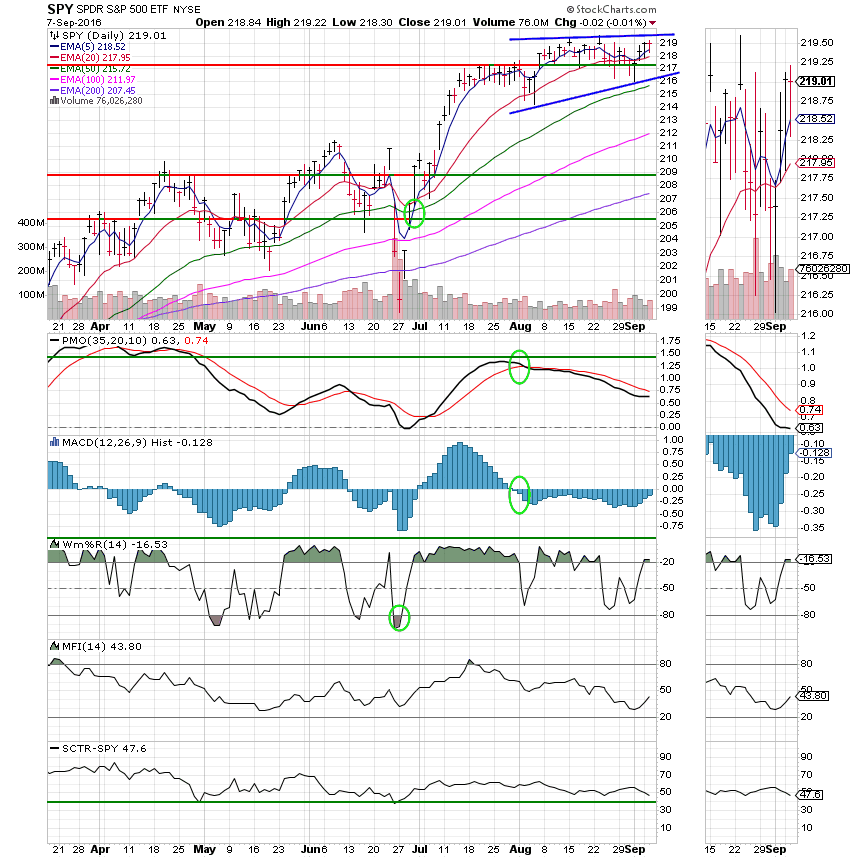

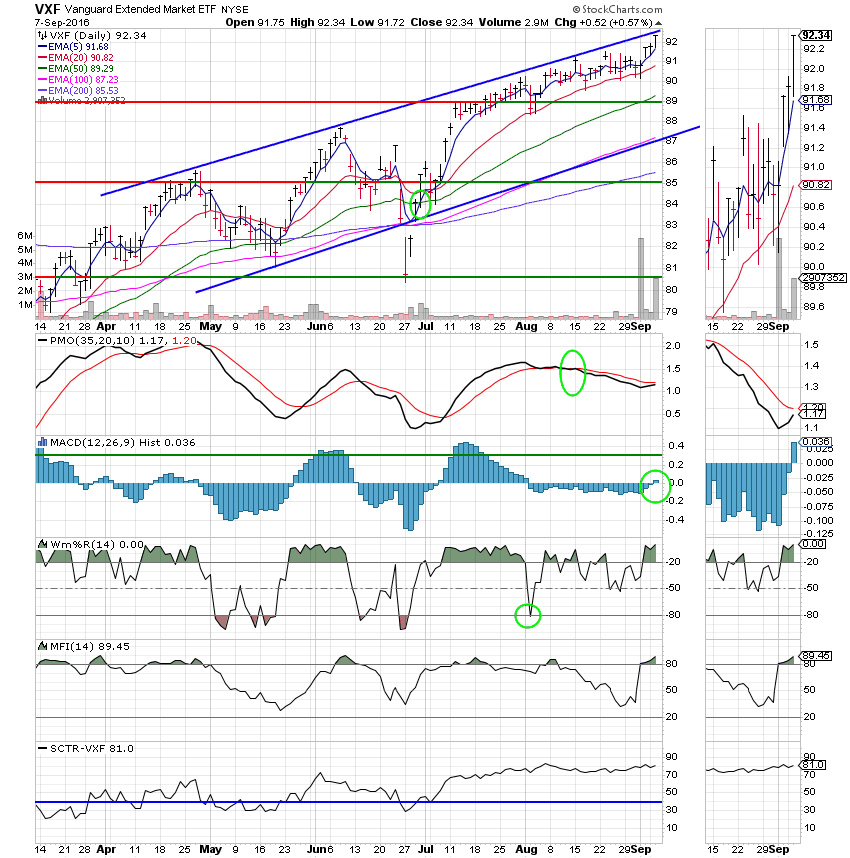

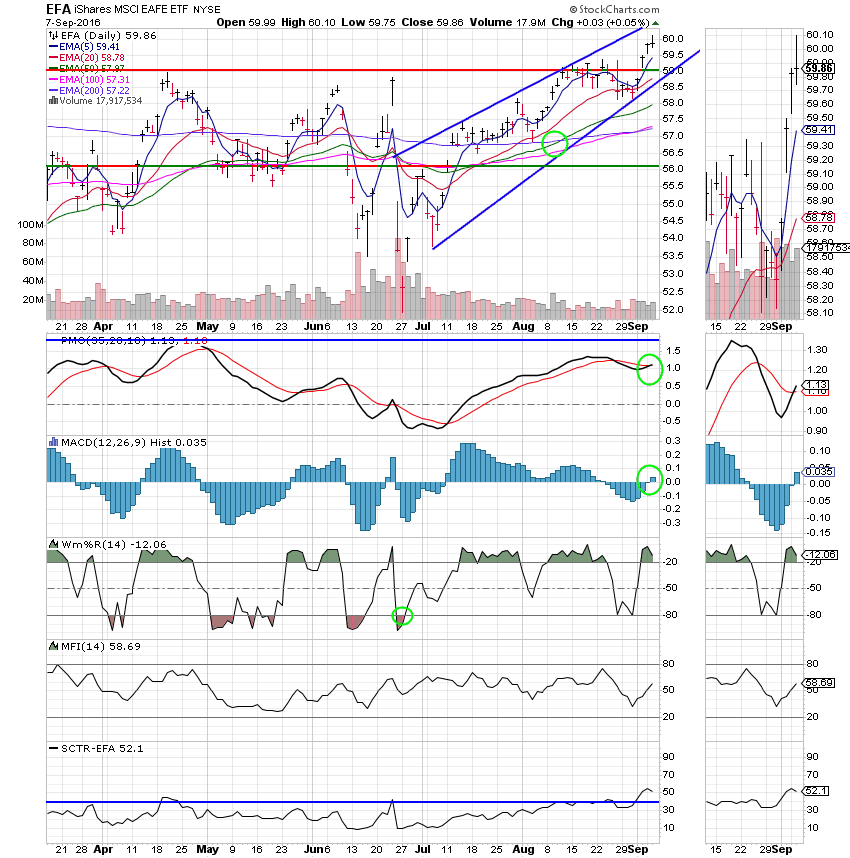

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund:

S Fund:

I Fund:

F Fund:

We got a few buy signals today in the S,I, and F Funds, but what we’re really waiting for right now is the Fed meeting and the end of this month. While I must admit that things are looking a little better, there is still a strong possibility that we will experience some type of meaningful pullback before the end of the month. If not,then I guess we’ll be forced to jump on a speeding train. That’s all for tonight. Have a great evening!