Good Evening,

The market returned to its winning ways today. Stocks rose while bonds continued to slide as the concern of possible rising interest rates caused investors to sell. Dropping bond prices cause bond yields to rise which in turn helps push the dollar higher as higher bond yields make the domestic market more attractive to foreign investors. I might add that, in the long run, this is good for stocks as well! That is, stocks that do a lot of business in the US. As we have already discussed, the higher dollar is hard on companies that rely heavily on imports because their goods become high priced and uncompetitive in foreign markets. Nevertheless, the aforementioned conditions favor the market as a whole. It’s really a whole lot more complicated than that, but for these purposes, the short explanation will do. Everything is intertwined and right now the rising dollar is effecting many things. Our TSP allotment posted a small to moderate gain today and the AMP program also put the skids on a three day decline with a small gain as well. Here’s what happened in today’s trading:

US stocks edge higher as unemployment rate drops

| 09/09/14 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.5186 | 16.481 | 26.0685 | 35.5422 | 26.06 |

| $ Change | 0.0008 | -0.0254 | -0.1709 | -0.3392 | -0.1570 |

| % Change day | +0.01% | -0.15% | -0.65% | -0.95% | -0.60% |

| % Change week | +0.02% | -0.16% | -0.94% | -0.93% | -1.03% |

| % Change month | +0.05% | -0.61% | -0.69% | -0.99% | -0.90% |

| % Change year | +1.62% | +4.70% | +9.19% | +5.56% | +1.94% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.2967 | 22.7386 | 24.637 | 26.1983 | 14.8861 |

| $ Change | -0.0244 | -0.0815 | -0.1145 | -0.1418 | -0.0906 |

| % Change day | -0.14% | -0.36% | -0.46% | -0.54% | -0.60% |

| % Change week | -0.18% | -0.50% | -0.64% | -0.74% | -0.83% |

| % Change month | -0.18% | -0.47% | -0.59% | -0.67% | -0.73% |

| % Change year | +2.85% | +4.33% | +5.02% | +5.49% | +5.85% |

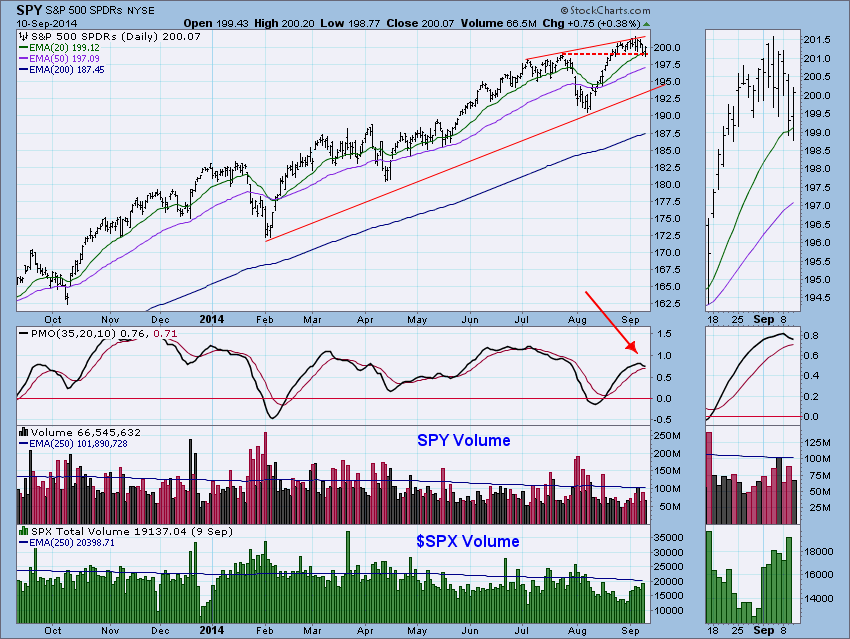

“Price declined in the morning just enough to move below support once again. However, after support was tested, price moved back up. I’m not able to annotate the thumbnail, but you can see how the past week price has been in an ulta-short-term declining trend channel. Momentum is still negative as the PMO is preparing for a negative crossover its EMA. Volume was higher on a positive day, so that can be considered bullish.”

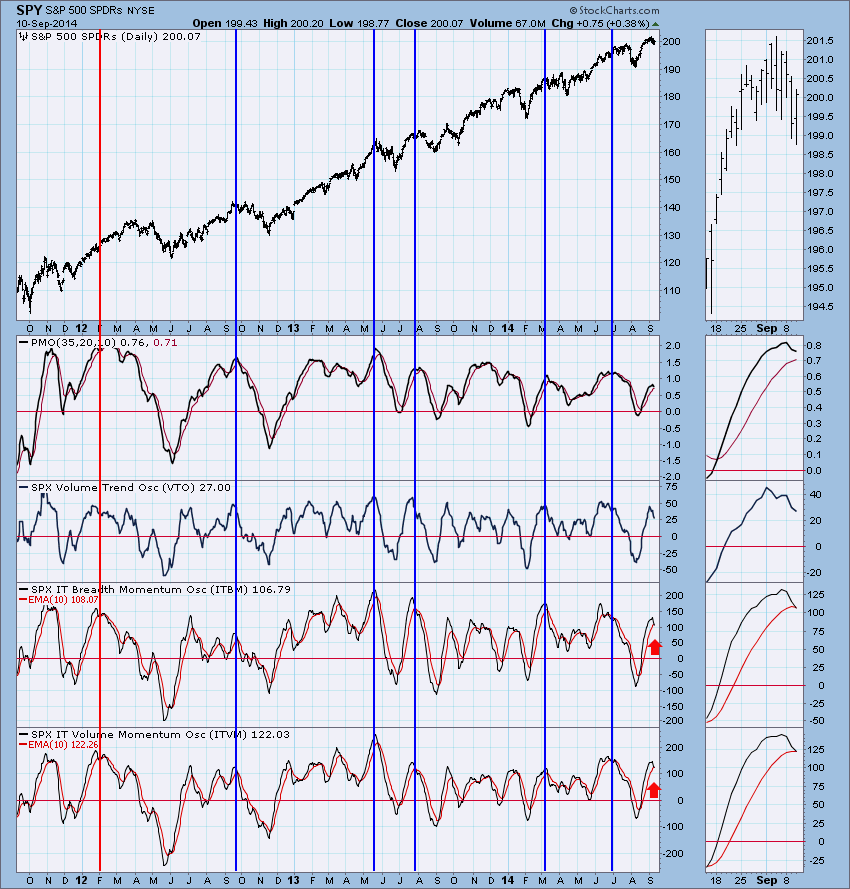

“Intermediate-Term Indicators: The ITBM and ITVM have both crossed below their EMAs. This is very bearish. Note that the majority of these negative crossovers have come before declines. The tops were in overbought territory and coincided with tops in the PMO and VTO. However, the red vertical line shows you that it isn’t a “sure thing”. “

“Conclusion: Short- and intermediate-term indicators are bearish. Price has been in a declining trend since the last all-time high was hit. So the environment is quite negative, but price still is holding above horizontal support. The market has tested that support twice and it has held. Let’s see if it can hold a third time… indicators suggest it won’t.”

I’m still looking for that pullback. What we’ve had so far doesn’t fit the bill. We’ll stay invested for now and wait for the charts to make up their minds. Right now everything is still good. That’s all for tonight. Keep praying and God will keep blessing. May He continue to guide our hand and bless our trades! Have a nice evening.