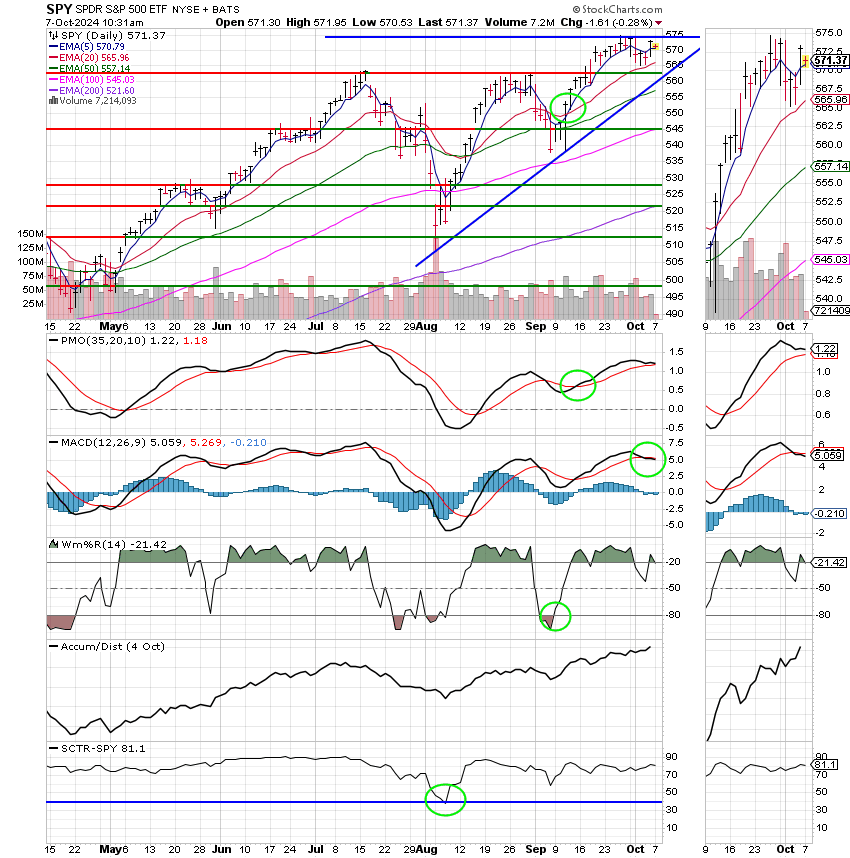

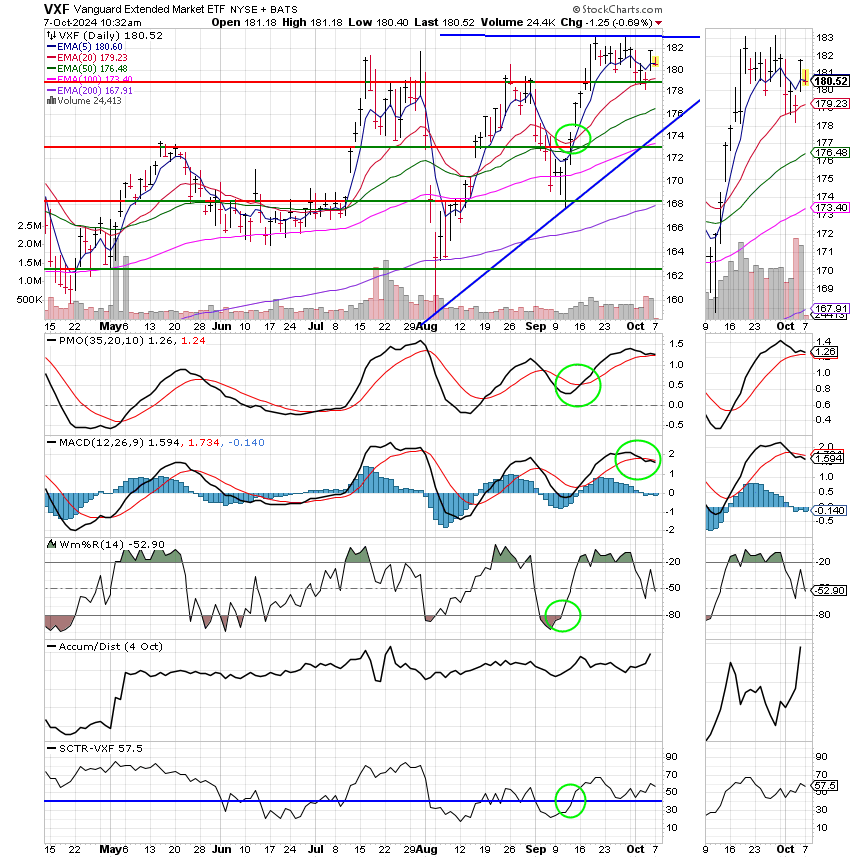

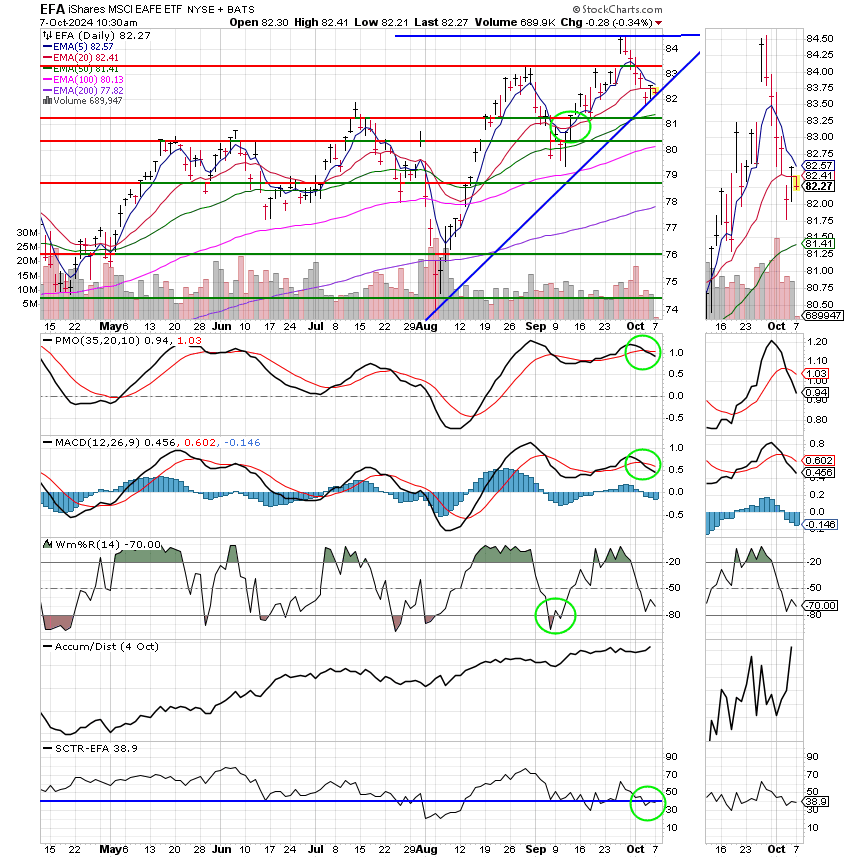

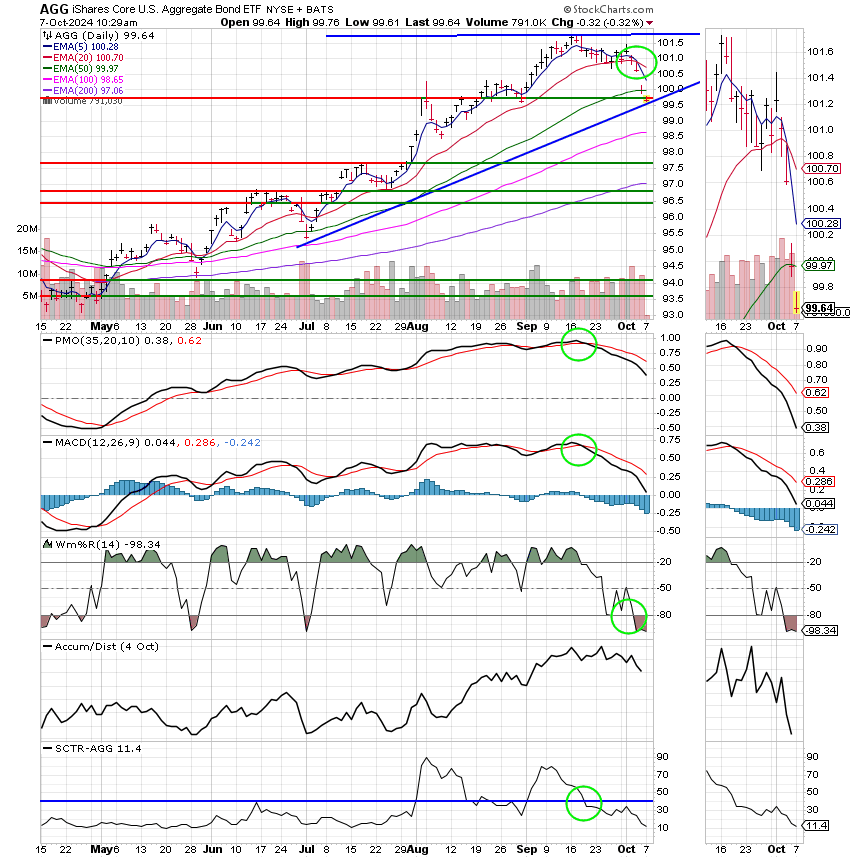

Good Morning, Where do I start? The charts where under pressure most of last week. Given all the current geo political stuff going on we decided to move a day two earlier than we normally would and put in an interfund transfer request to reallocate our funds to 100% G Fund. We anticipated and got a nice rally from Friday’s jobs report which allowed us to exit the trade with a nice profit which brings us to today. The nice rally on Friday took a lot of pressure off the charts and kind of left them in no mans land leaving us with the question of if we moved too early. Let me point our a few things here. The first is our guiding principle. The one we lost track of in all the pandemic related turmoil. It’s not what you make that’s important, it’s what you keep! Folks we made a nice profit in September and that’s a rare occurrence. So….why get greedy. The second thing I want to point out is that the market has become increasingly unstable in October. We have an escalating conflict in the middle east and it’s resulting in higher oil prices. There are two issues with regard to this conflict. The most obvious is the possibility of the conflict spilling out of the middle east. Think world war three here. We’re already at odds with Russia over Ukraine. Now add this to the mix. Of a more immediate nature is the fact that Israel was attacked by Iran and will surely retaliate. We didn’t feel like holding equities over the weekend with the risk of an Israeli attack on Iran was good risk management. Second unto all this is the fact that the conflict is driving oil prices higher. High oil prices are bad for two reasons. It increases corporate expense and makes the companies in the NYSE less profitable and then there’s the big elephant in the room which is it’s effect on the US economy. Investors are just now getting back to the idea that the Fed has avoided a recession. Forget that interest rates are high right now as a result of the Feds battle with inflation. High oil prices alone can create a recession! Think not? Then you’d better think again. All you need to do is look at the seventies going into the eighties. High oil prices from the Arab Oil Embargo left us with a recession that resulted in 14.5% inflation and 21% interest rates. You think inflation was bad last year? Surely you jest……. Oh yes…..and one more thing. We got so tied up in discussing Armageddon that we almost forgot the election. Normally, that would be the headliner here. Folks, this is not just any election as far as the market is concerned. No Sir/Ma’am, there are a sizeable group of politicians that want to take us hard to the left and that has never been good for a free market society. Like a said a week or two ago, socialism and capitalism don’t mix. Let me be totally clear. The market does not like socialism. So until this uncertainty is settled at the ballot box the resulting confusion will continue to create volatility. There you have it. We decided not to hold over the weekend and to sit back and watch a few days before we decided to reenter equities. Quite simply, we just weren’t comfortable with the risk/reward ratio…… 100/G for now but stay tuned. We could move any day…..or not.

The days trading so far has produced the following results: Our TSP allotment is steady in the G Fund. For comparison, the Dow is -0.15%, the Nasdaq -0,44%, and the S&P 500 -0.27%. So far our trade has benefitted us. We will see how it goes……

Stocks open lower, pressured by higher rates and rising oil prices: Live updates

Recent action has left us with the following signals: C-Hold, S-Sell, I-Sell, F-Sell. We are currently invested at 100/G. Our allocation is now +11.04% for the year not including the days results. Here are the latest posted results:

| 10/04/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.5654 | 19.8906 | 90.603 | 86.0157 | 44.8806 |

| $ Change | 0.0020 | -0.1442 | 0.8247 | 1.2223 | 0.2154 |

| % Change day | +0.01% | -0.72% | +0.92% | +1.44% | +0.48% |

| % Change week | +0.08% | -1.23% | +0.26% | +0.01% | -1.90% |

| % Change month | +0.04% | -1.00% | -0.17% | -0.10% | -1.30% |

| % Change year | +3.35% | +3.48% | +21.84% | +11.57% | +11.69% |