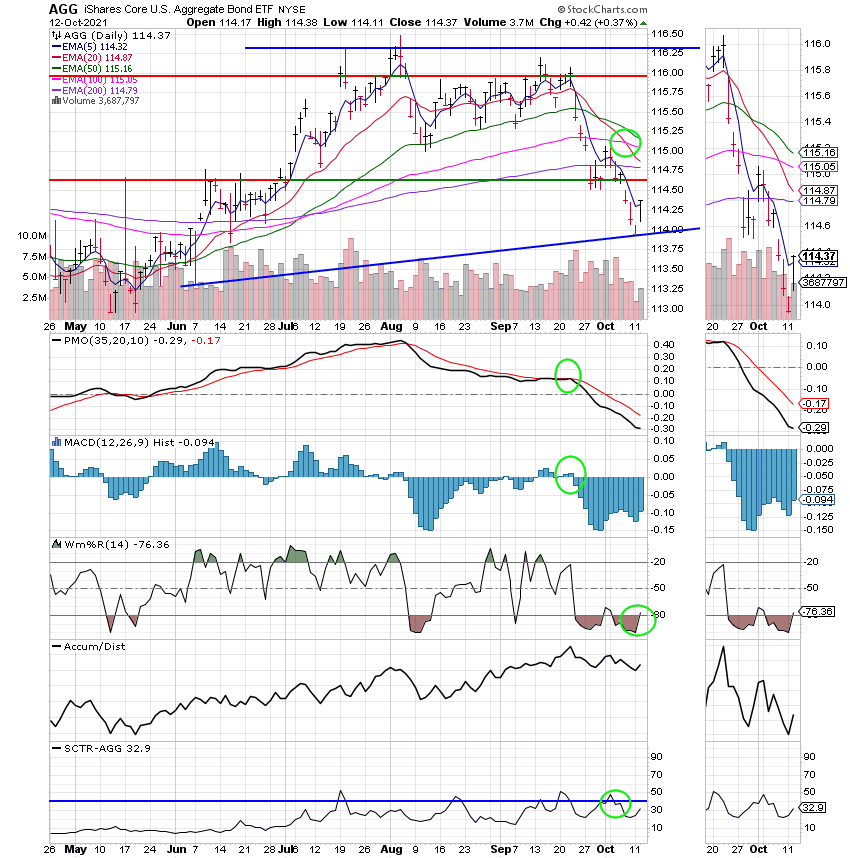

Good Evening, I’ll keep it short and sweet tonight as I’m on the road again. Mrs. Grimes insisted that I take her to the Shilo Battlefield. You see she actually did retire and would like to do such things every now and then. She’s the genealogist in our family so I have to take her to study history, visit cemeteries and things like that! So on to the market. As we anticipated the choppiness continues. There are currently three things influencing the action and their all interrelated. Inflation, earnings, and the Fed. The all important CPI report is due out tomorrow. Make no mistake it is a market mover. The Consumer Price Index is one of the main things that the FOMC (The Fed) watches to keep tabs on inflation. It definitely effects their decisions on monetary policy with regard to interest rates. Next we have earnings season which starts in earnest tomorrow with the big banks such as Bank of America and Morgan Stanley as well as several other major players issuing their quarterly reports. Investors will be watching the earnings reports with and eagle eye to make sure the economic recovery is still on track. Most importantly they will be watching the forward guidance given by companies to determine that it is going to stay on track. A major player could give a good report and even beat guidance but issue a poor outlook for future and still trigger a sell off! Finally you have the FED which will release the minutes from their last meeting and you can bet that market players will be pouring through the transcript looking for clues as to when the Fed might start tapering their monthly bond purchases. I said it before and I’ll say it again, the market is addicted to all this cheap money! So there will be a few withdrawal symptoms when it is taken away. The main idea here is that the economy should be able to stand on it’s own without all this fiscal stimulus. We will see…..

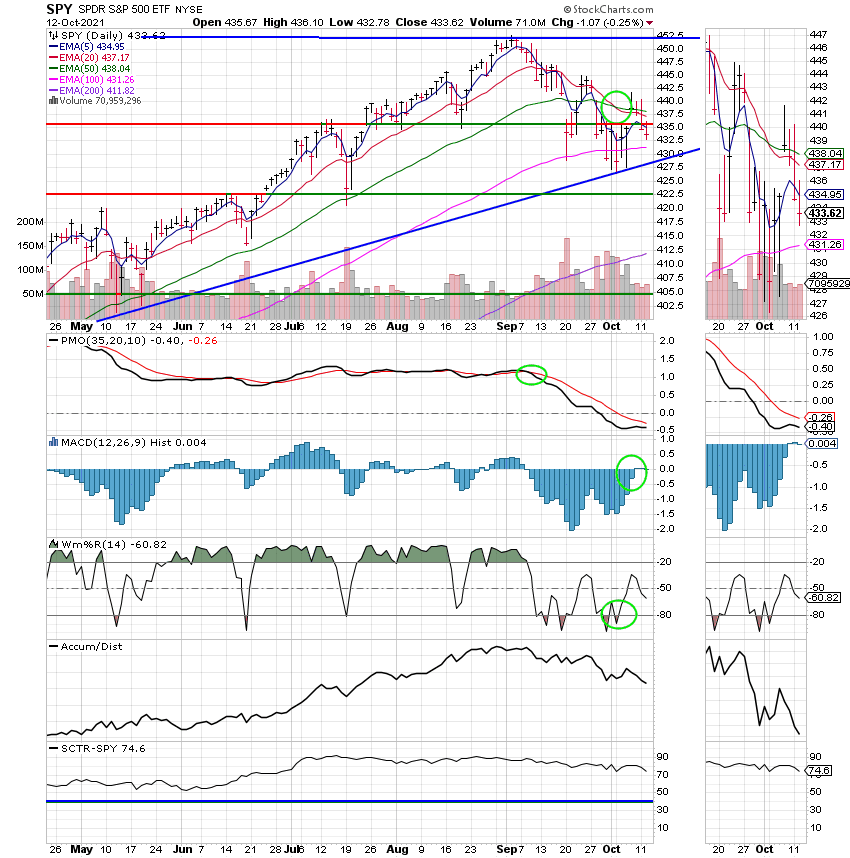

The days trading left us with the following results: Our TSP allotment slipped -0.24%. For comparison, the Dow dropped -0.34%, the Nasdaq -0.14%, and the S&P 500 -0.24%.

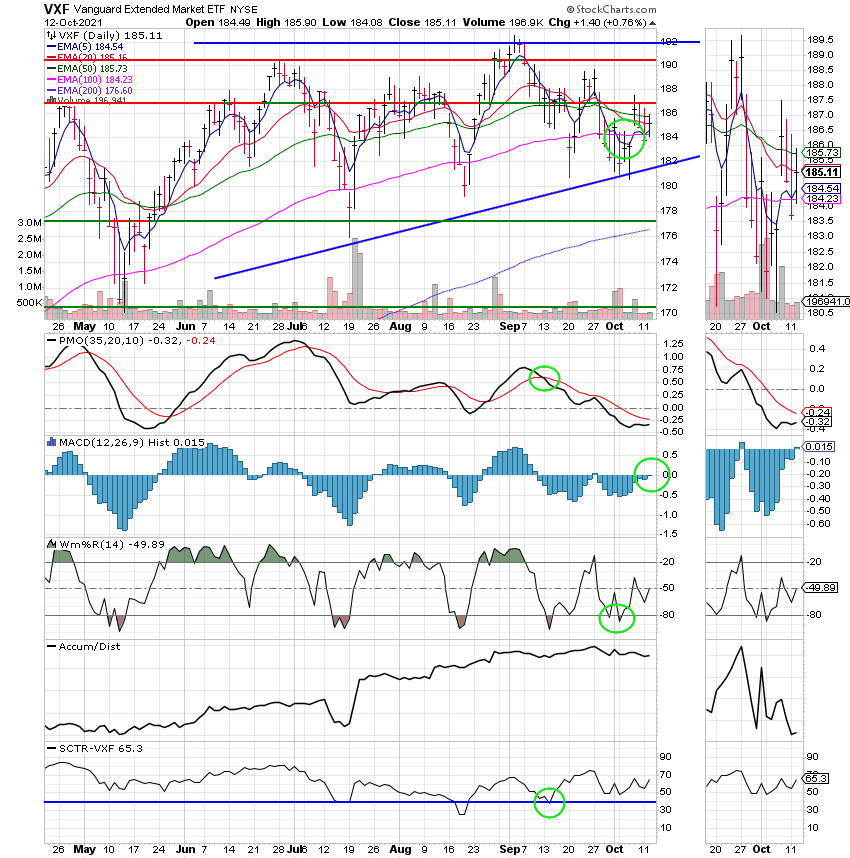

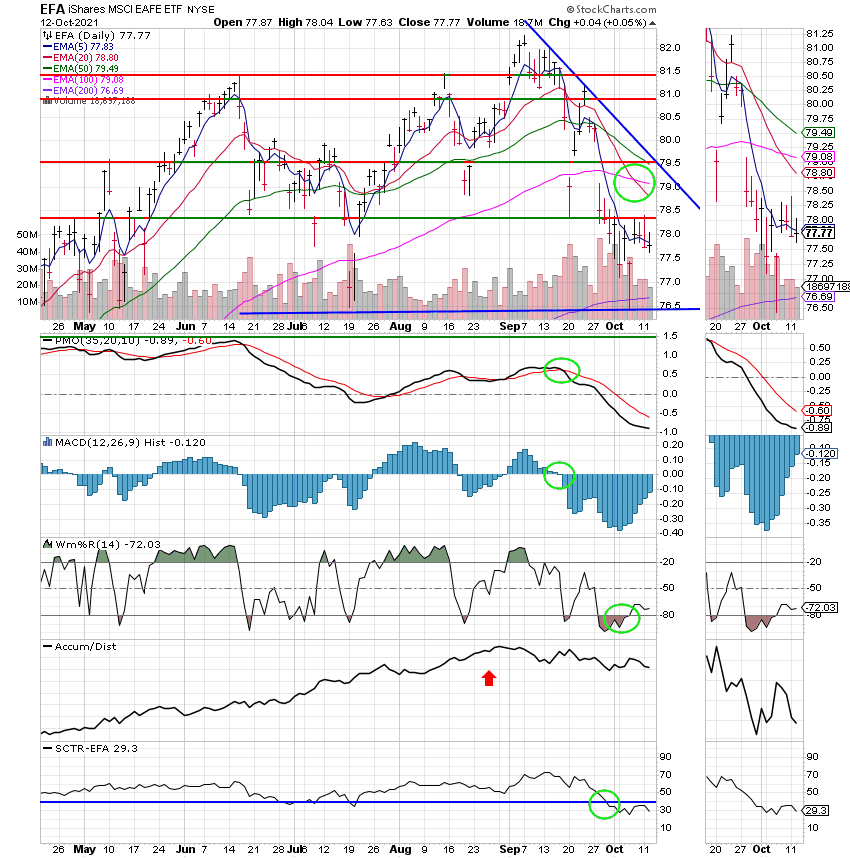

The days action left us with the following signals: C-Hold, S-Hold, I-Sell, F-Sell. We are currently invested at 100/C. Our allocation is now +12.22% on the year. Here are the latest posted results:

| 10/12/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.6806 | 20.8374 | 65.48 | 84.172 | 38.1562 |

| $ Change | 0.0027 | 0.0426 | -0.6126 | 0.1834 | -0.0805 |

| % Change day | +0.02% | +0.20% | -0.93% | +0.22% | -0.21% |

| % Change week | +0.02% | +0.20% | -0.93% | +0.22% | -0.21% |

| % Change month | +0.05% | -0.30% | +1.04% | +1.59% | -0.68% |

| % Change year | +1.04% | -1.69% | +17.11% | +13.44% | +7.82% |