Good Evening, The market continues to be moved by the same issues, Covid-19, the election, and the economy. Although, the latter has seemed to take a back seat with all the political drama on Capital Hill. Today the market was primarily focused a delay in Johnson and Johnson’s Covid 19 vaccine trials and a lack of progress on stimulus legislation in congress. Specifically, Johnson and Johnson delayed their Phase three vaccine trials due to an unknown illness and stimulus legislation was impeded again when House Speaker Nancy Pelosi rejected the White Houses 1.8 Trillion Dollar Economic Stimulus Package saying that it doesn’t do enough for the pandemic or economic recovery. One thing to bear in mind. While the market did react negatively to today’s news with regard to the stimulus package it seems to be pricing in the that a stimulus package will be passed after the election. It also seems to be assuming that there will now be a clear cut winner to the election with Democrat Joe Biden leading by 11 points in the polls. Remember what I said, the market hates uncertainty, but also don’t forget that second unto the that it hates disappointment and the possibility for disappointment always exists when the market prices in future events. I too believe there will be a stimulus package passed after the election but you never know for sure and a disappointment with either one of these issues would most definitely trigger a sell off which makes them worth noting. Of course as always, we will watch our charts and react to what we see. In actuality we could probably make our investment decisions better without any interference or distraction from the news! Fundamental investing (which should never be totally ignored) is an inexact method at best……

The days trading left us with the following results: Our TSP allotment posted fell back slightly at -0.06%. For comparison, the Dow fell -0.55%, the Nasdaq -0.10%, and the S&P 500 -0.63%.

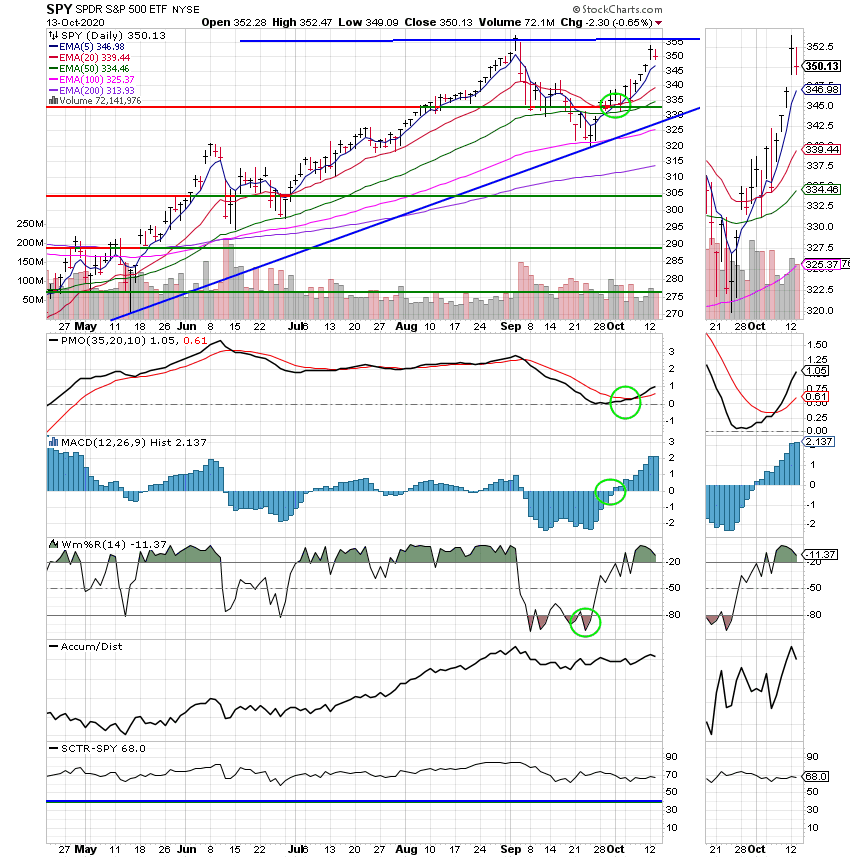

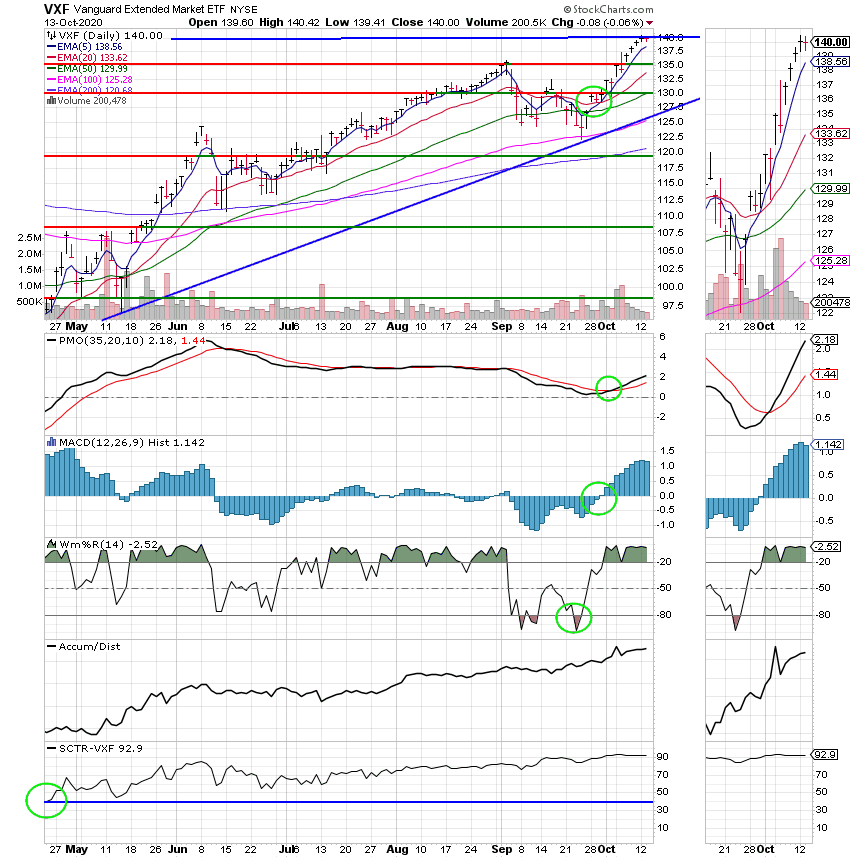

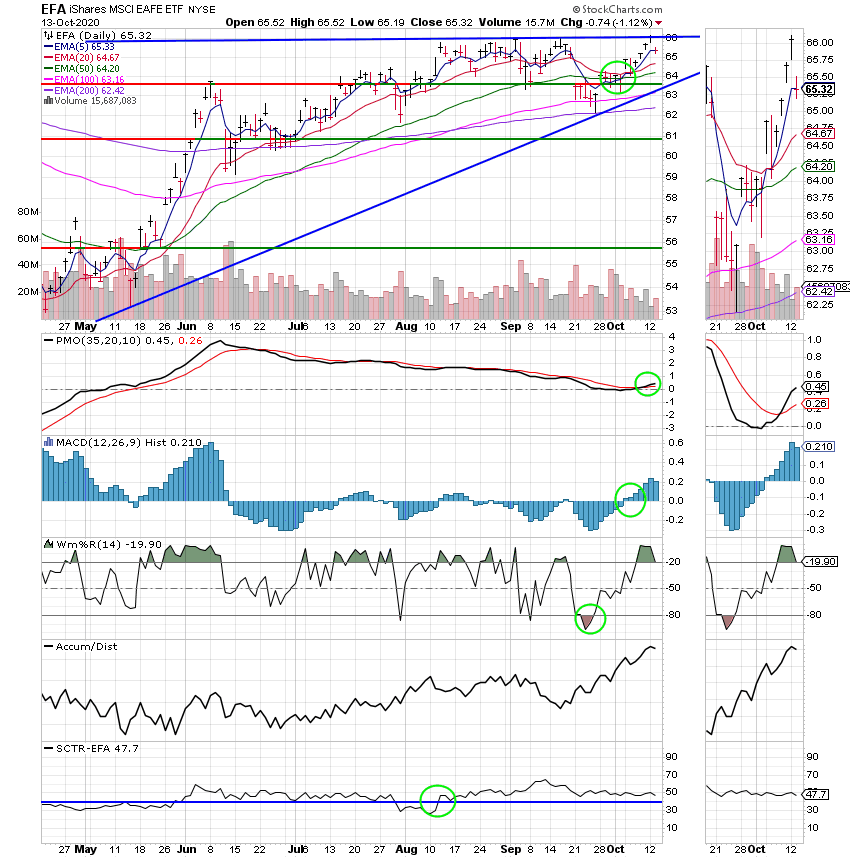

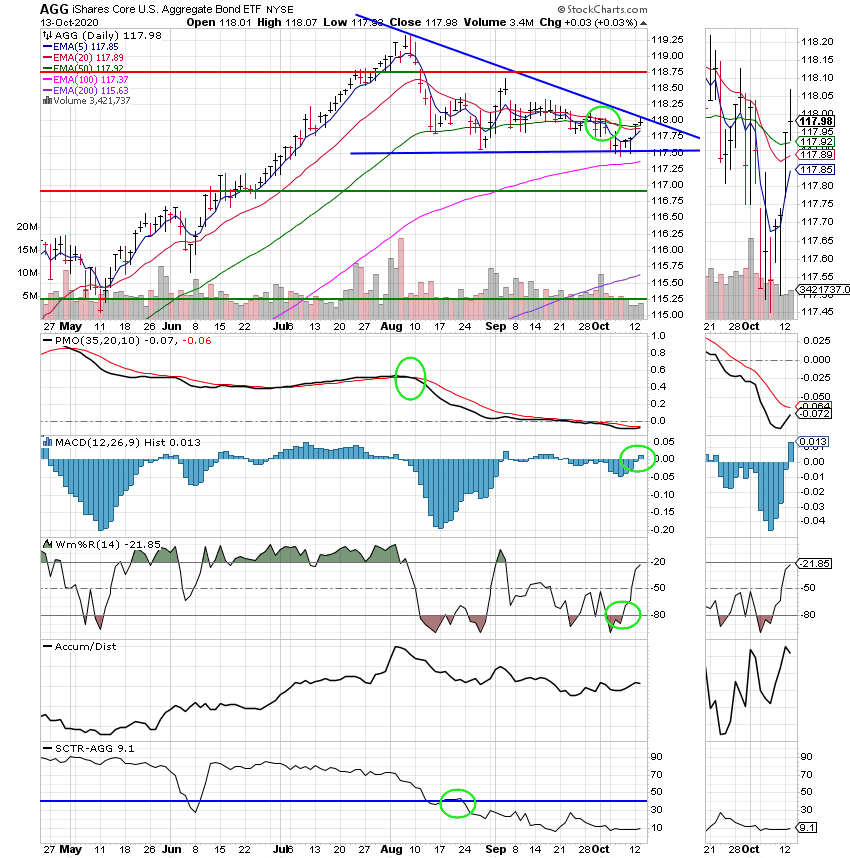

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Neutral. We are currently invested at 100/S. Our allocation is now +24.52% on the year not including the days results. Here are the latest posted results:

| 10/09/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.4778 | 21.0032 | 51.5806 | 62.4719 | 31.3947 |

| $ Change | 0.0003 | -0.0041 | 0.4508 | 0.4782 | 0.2236 |

| % Change day | +0.00% | -0.02% | +0.88% | +0.77% | +0.72% |

| % Change week | +0.01% | -0.17% | +3.89% | +5.48% | +2.99% |

| % Change month | +0.02% | -0.21% | +3.46% | +7.31% | +3.00% |

| % Change year | +0.78% | +6.52% | +9.14% | +11.01% | -4.04% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 21.703 | 10.5668 | 36.2749 | 10.754 | 40.1684 |

| $ Change | 0.0393 | 0.0417 | 0.1758 | 0.0571 | 0.2316 |

| % Change day | +0.18% | +0.40% | +0.49% | +0.53% | +0.58% |

| % Change week | +0.83% | +1.83% | +2.26% | +2.48% | +2.71% |

| % Change month | +0.83% | +1.84% | +2.28% | +2.51% | +2.74% |

| % Change year | +2.44% | +5.67% | +4.08% | +7.54% | +4.53% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 10.8815 | 23.5731 | 11.1394 | 11.1395 | 11.1396 |

| $ Change | 0.0670 | 0.1544 | 0.0882 | 0.0883 | 0.0883 |

| % Change day | +0.62% | +0.66% | +0.80% | +0.80% | +0.80% |

| % Change week | +2.91% | +3.10% | +3.78% | +3.78% | +3.78% |

| % Change month | +2.95% | +3.16% | +3.86% | +3.86% | +3.86% |

| % Change year | +8.82% | +4.85% | +11.39% | +11.40% | +11.40% |